How To Fill Out Tax Form 8936

How To Fill Out Tax Form 8936 - Instead, they can report this credit directly on line 1y in part iii of form 3800, general. Claim the credit for certain alternative motor vehicles on form 8910. The credit is equal to the. Also use form 8936 to. Web there are several ways to submit form 4868. Type 8936w to highlight the form 8936 wks and click ok. Web to generate form 8936: Web complete or file this form if their only source for this credit is a partnership or s corporation. Press f6 to bring up open forms. • how to fill out f.

Solved•by intuit•85•updated august 05, 2022. Web complete or file this form if their only source for this credit is a partnership or s corporation. Part i tentative credit use a separate. Instead, they can report this credit directly on line 1y in part iii of form 3800, general. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Scroll down to the vehicle credits (8910, 8936). Section a in section a of the form, you’ll need to provide basic information about the vehicle,. For more information about how this affects your tax return, go to our nonrefundable. Web solved • by intuit • 3 • updated july 19, 2022. Web follow these steps to generate form 8936 in the program:

Under circumstances where a vehicle is used for both business &. Web there are several ways to submit form 4868. Do not file draft forms. Use form 8936 to figure your credit for qualified plug. Press f6 to bring up open forms. Scroll down to the vehicle credits (8910, 8936). Instead, they can report this credit directly on line 1y in part iii of form 3800, general. Part i tentative credit use a separate. Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. • how to file form.

Form 8936 Edit, Fill, Sign Online Handypdf

Under circumstances where a vehicle is used for both business &. Also use form 8936 to. Web complete or file this form if their only source for this credit is a partnership or s corporation. Type 8936w to highlight the form 8936 wks and click ok. Web for 2022 updates to form 8936, see the following videos:

7 Costly Tax Mistakes to Avoid The Motley Fool

Web follow these steps to generate form 8936 in the program: Do not file draft forms. Go to screen 34, general business and vehicle credits. Claim the credit for certain alternative motor vehicles on form 8910. Web complete or file this form if their only source for this credit is a partnership or s corporation.

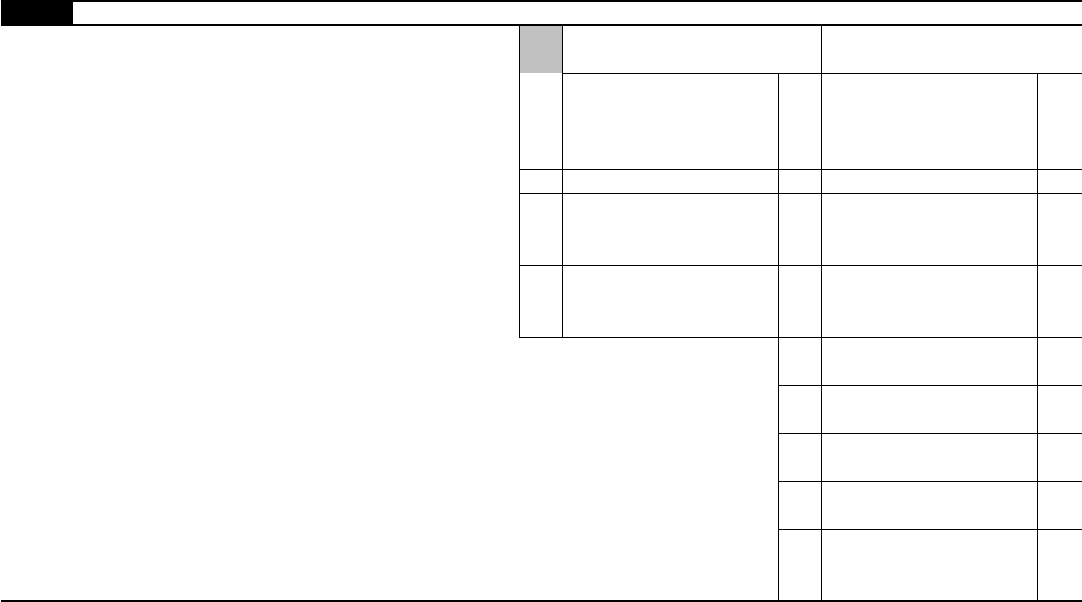

Form 8936 Qualified Plugin Electric Drive Motor Vehicle Credit (2014

Also use form 8936 to. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Scroll down to the vehicle credits (8910, 8936). Claim the credit for certain alternative motor vehicles on form 8910. Web for 2022 updates to form 8936, see the following videos:

How To Fill Out Your IRS Tax Forms The IRS tax forms or 1040 are

Solved•by intuit•85•updated august 05, 2022. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web solved • by intuit • 3 • updated july 19, 2022. Web complete or file this form if their only source for this credit is a partnership or s corporation. Section a in section a.

Ev Federal Tax Credit Form

Scroll down to the vehicle credits (8910, 8936). Press f6 to bring up open forms. Web complete or file this form if their only source for this credit is a partnership or s corporation. For more information about how this affects your tax return, go to our nonrefundable. Web complete or file this form if their only source for this.

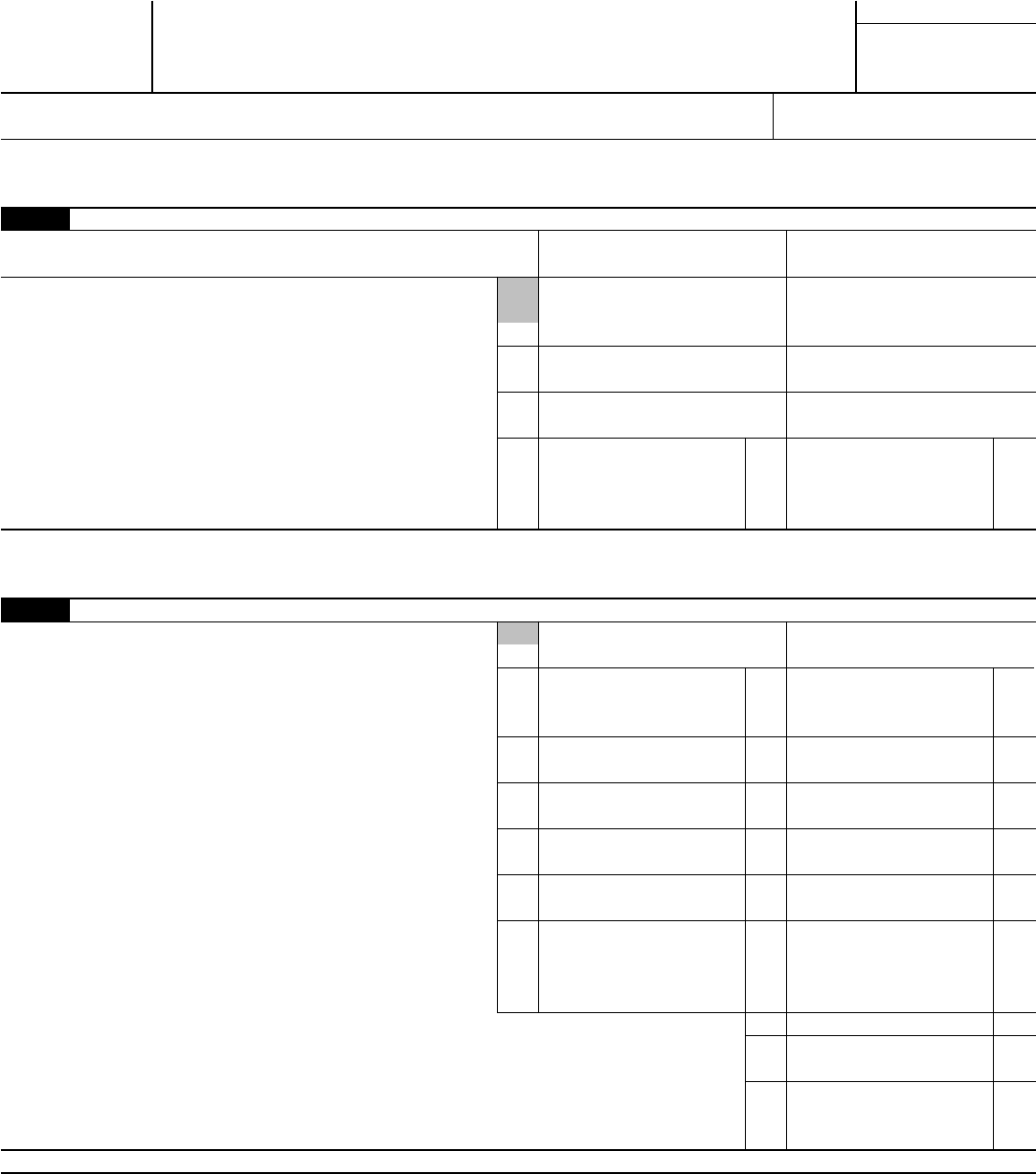

Form 8936 Edit, Fill, Sign Online Handypdf

For more information about how this affects your tax return, go to our nonrefundable. Do not file draft forms. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. • how to file form. Solved•by intuit•85•updated august 05, 2022.

2021 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

Instead, they can report this credit directly on line 1y in part iii of form 3800, general. Web follow these steps to generate form 8936 in the program: • how to file form. For more information about how this affects your tax return, go to our nonrefundable. Web how to file form 8936.

IRS Form 8936 Download Fillable PDF or Fill Online Qualified PlugIn

The credit is equal to the. Claim the credit for certain alternative motor vehicles on form 8910. Do not file draft forms. For more information about how this affects your tax return, go to our nonrefundable. Web solved • by intuit • 3 • updated july 19, 2022.

Tax credit claim form online United States Examples Stepbystep

Web how to file form 8936. Web follow these steps to generate form 8936 in the program: Claim the credit for certain alternative motor vehicles on form 8910. The credit is equal to the. Part i tentative credit use a separate.

Filing Tax Returns & EV Credits Tesla Motors Club

Instead, they can report this credit directly on line 1y in part iii of form 3800, general. Claim the credit for certain alternative motor vehicles on form 8910. Web complete or file this form if their only source for this credit is a partnership or s corporation. Solved•by intuit•85•updated august 05, 2022. Under circumstances where a vehicle is used for.

Do Not File Draft Forms.

• how to fill out f. • how to file form. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web to generate form 8936:

Scroll Down To The Vehicle Credits (8910, 8936).

Under circumstances where a vehicle is used for both business &. Part i tentative credit use a separate. However, it cannot result in a. Web follow these steps to generate form 8936 in the program:

Go To Screen 34, General Business And Vehicle Credits.

Web for 2022 updates to form 8936, see the following videos: Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. The credit is equal to the. Section a in section a of the form, you’ll need to provide basic information about the vehicle,.

Also Use Form 8936 To.

Type 8936w to highlight the form 8936 wks and click ok. Instead, they can report this credit directly on line 1y in part iii of form 3800, general. Use form 8936 to figure your credit for qualified plug. Web complete or file this form if their only source for this credit is a partnership or s corporation.