How To Fill Out A Payment To Avoid Garnishment Form

How To Fill Out A Payment To Avoid Garnishment Form - Web if the creditor does get a judgment against you, within 15 days of receiving the “notice of court proceedings to collect debt have your employer complete the payment to avoid garnishment form and returning it to my creditor with the monthly payment due. Fill out the payment form. This must be done within 15 days of receiving the “notice of court proceedings to collect debt,” a trustee is a person who will collect the portion of your wages that will be garnished and divide it between your creditors until your debts are paid off. Web the notice should include a form titled payment to avoid garnishment. if you intend to use this method to stop wage garnishment, you must complete the form and return it to the creditor within 15 days of the date on the letter or notice to which the form was attached. Challenge the wage garnishment in court. Web you fill out a claim of exemption form stating why you believe that exemption applies to you and file it with the court issuing the order allowing the garnishment. Web whenever the creditor does get an judgment negative you, within 15 days of welcome the “notice by legal proceedings to collect debt have your employer complete the payment to avoid garnishment form and refund it to your creditor with the monthly payment due. Reach out to a nonprofit to ask for financial assistance. If you do, the garnishment amount will be reduced or eliminated, depending on state law. The judge will determine if you qualify for that particular exemption.

Challenge the wage garnishment in court. Try to negotiate a payment plan with your creditor (s) or settle your debt. Fill out the payment form. Web if some or all of your income — such as social security — is exempt from garnishment, if you already paid the debt or if it was discharged in a bankruptcy, you’ll have to back up your claim with. If paid monthly, enter one hundred thirty(130) times the current fede. Web the notice should include a form titled payment to avoid garnishment. if you intend to use this method to stop wage garnishment, you must complete the form and return it to the creditor within 15 days of the date on the letter or notice to which the form was attached. Web you fill out a claim of exemption form stating why you believe that exemption applies to you and file it with the court issuing the order allowing the garnishment. Web to avoid garnishment, apply to your local municipal court for the appointment of a trustee. This must be done within 15 days of receiving the “notice of court proceedings to collect debt,” a trustee is a person who will collect the portion of your wages that will be garnished and divide it between your creditors until your debts are paid off. Web if the creditor does get a judgment against you, within 15 days of receiving the “notice of court proceedings to collect debt have your employer complete the payment to avoid garnishment form and returning it to my creditor with the monthly payment due.

Fill out the payment form. Web if some or all of your income — such as social security — is exempt from garnishment, if you already paid the debt or if it was discharged in a bankruptcy, you’ll have to back up your claim with. Web whenever the creditor does get an judgment negative you, within 15 days of welcome the “notice by legal proceedings to collect debt have your employer complete the payment to avoid garnishment form and refund it to your creditor with the monthly payment due. Try to negotiate a payment plan with your creditor (s) or settle your debt. This must be done within 15 days of receiving the “notice of court proceedings to collect debt,” a trustee is a person who will collect the portion of your wages that will be garnished and divide it between your creditors until your debts are paid off. The judge will determine if you qualify for that particular exemption. Challenge the wage garnishment in court. Web if the creditor does get a judgment against you, within 15 days of receiving the “notice of court proceedings to collect debt have your employer complete the payment to avoid garnishment form and returning it to my creditor with the monthly payment due. If you do, the garnishment amount will be reduced or eliminated, depending on state law. Reach out to a nonprofit to ask for financial assistance.

Pin on Budgeting 101

Web to avoid garnishment, apply to your local municipal court for the appointment of a trustee. Challenge the wage garnishment in court. If you do, the garnishment amount will be reduced or eliminated, depending on state law. The judge will determine if you qualify for that particular exemption. Try to negotiate a payment plan with your creditor (s) or settle.

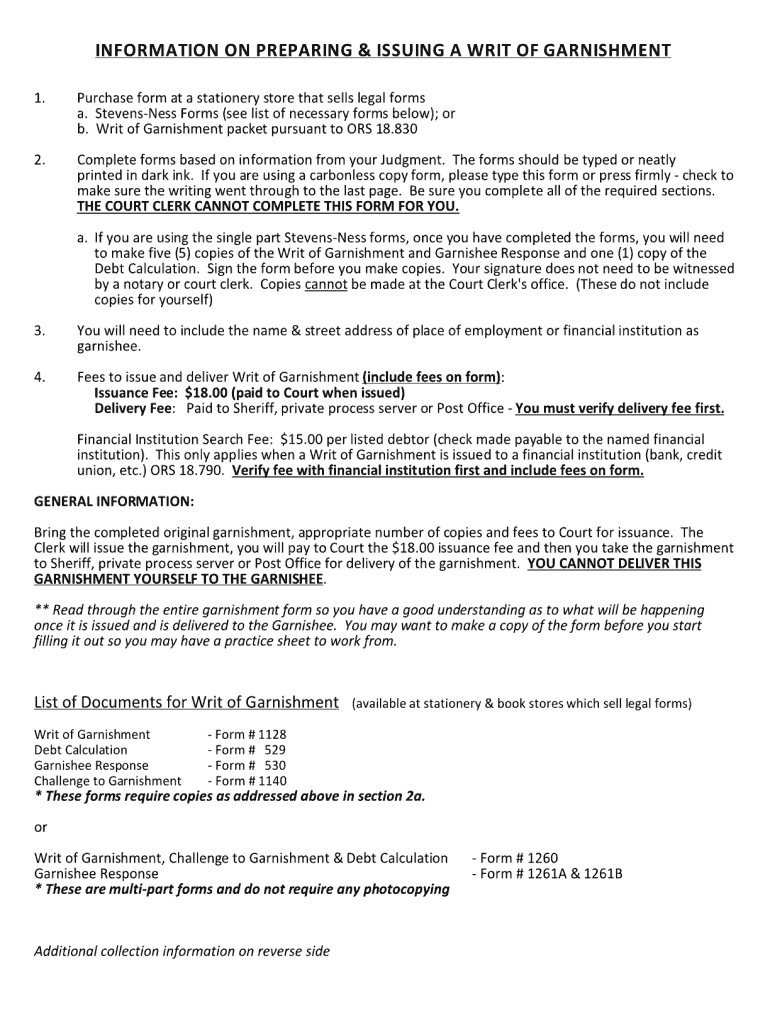

Garnishment Oregon Fill Out and Sign Printable PDF Template signNow

Reach out to a nonprofit to ask for financial assistance. Web if you are paid weekly, enter thirty (30) times the current federal minimum hourly wage; This must be done within 15 days of receiving the “notice of court proceedings to collect debt,” a trustee is a person who will collect the portion of your wages that will be garnished.

3 Ways to Avoid Wage Garnishment wikiHow

Web whenever the creditor does get an judgment negative you, within 15 days of welcome the “notice by legal proceedings to collect debt have your employer complete the payment to avoid garnishment form and refund it to your creditor with the monthly payment due. Reach out to a nonprofit to ask for financial assistance. Web the notice should include a.

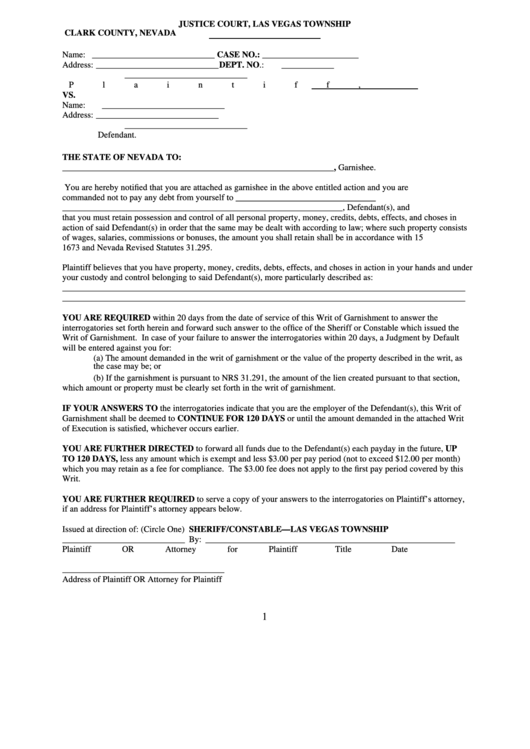

Fillable Writ Of Garnishment printable pdf download

Challenge the wage garnishment in court. Web wage garnishment is a legal procedure in which a person's earnings are required by court order to be withheld by an employer for the payment of a debt such as child support. Fill out the payment form. Web if you are paid weekly, enter thirty (30) times the current federal minimum hourly wage;.

Youtube How To Fill Out Paper Work To Garnish Wedge Oh Fill Out and

Web you fill out a claim of exemption form stating why you believe that exemption applies to you and file it with the court issuing the order allowing the garnishment. Web if some or all of your income — such as social security — is exempt from garnishment, if you already paid the debt or if it was discharged in.

Earnings Writ Fill Out and Sign Printable PDF Template signNow

If paid monthly, enter one hundred thirty(130) times the current fede. Web you fill out a claim of exemption form stating why you believe that exemption applies to you and file it with the court issuing the order allowing the garnishment. Web if the creditor does get a judgment against you, within 15 days of receiving the “notice of court.

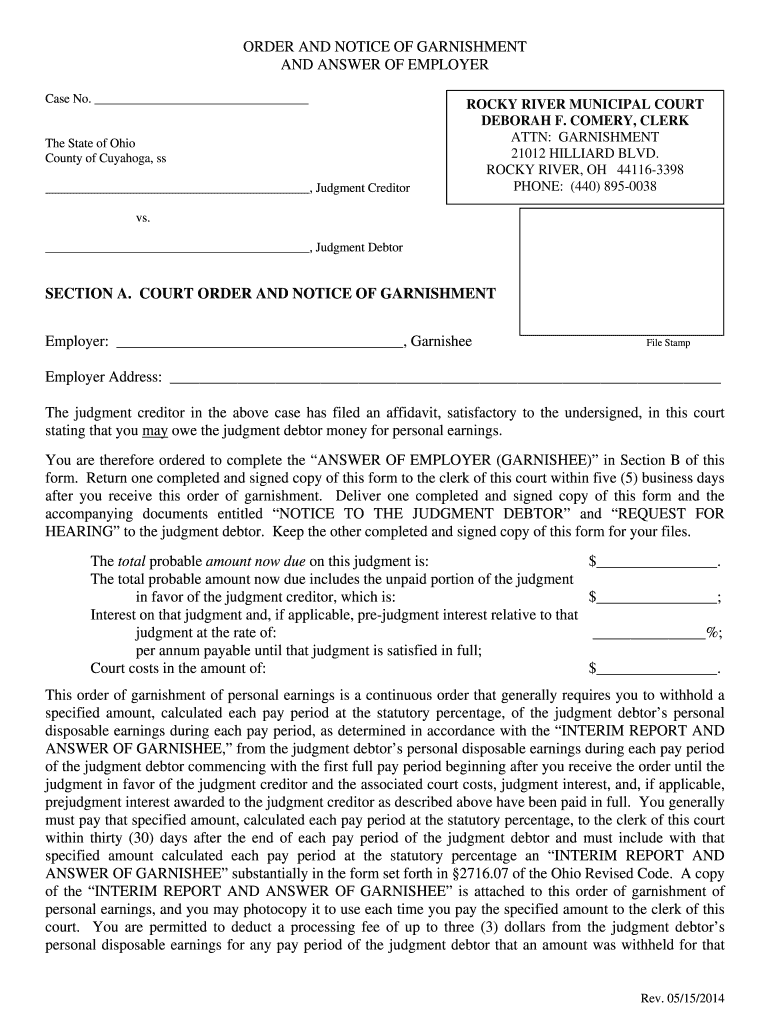

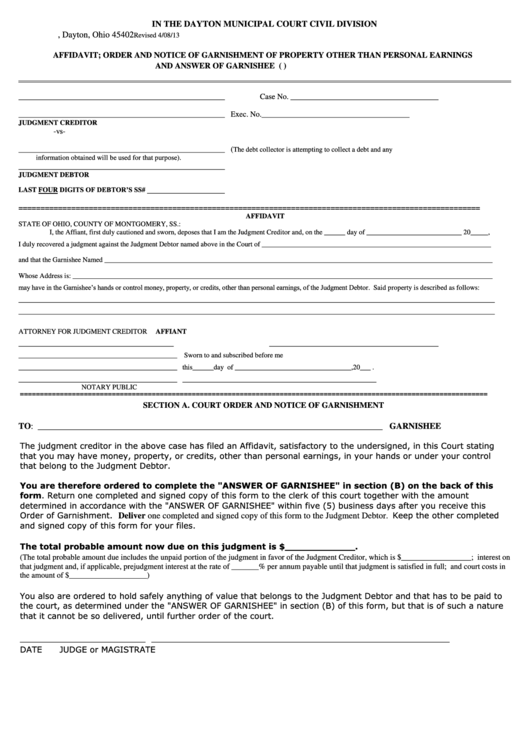

Order And Notice Of Garnishment Of Property Other Form (2013) printable

Web if you are paid weekly, enter thirty (30) times the current federal minimum hourly wage; File for bankruptcy to stop the garnishment fast. Web to avoid garnishment, apply to your local municipal court for the appointment of a trustee. Try to negotiate a payment plan with your creditor (s) or settle your debt. Web there are four direct ways.

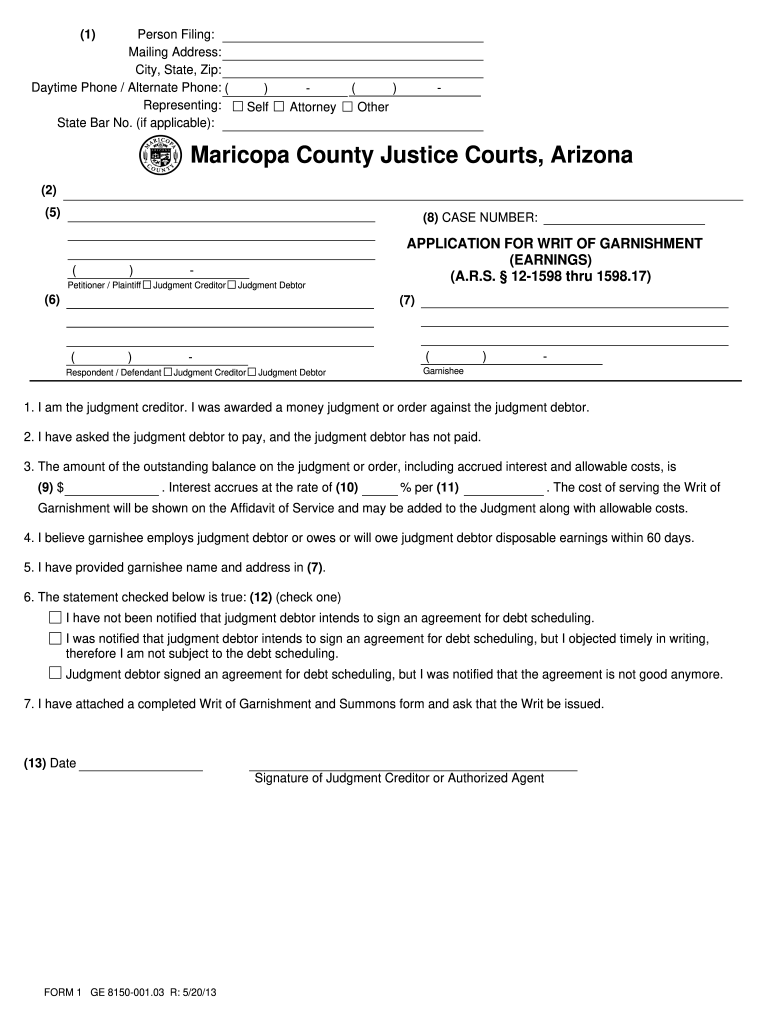

Fillable Online azcourts wage garnishment answers forms Fax Email Print

Web the notice should include a form titled payment to avoid garnishment. if you intend to use this method to stop wage garnishment, you must complete the form and return it to the creditor within 15 days of the date on the letter or notice to which the form was attached. Fill out the payment form. Web wage garnishment is.

Garnishment Letter Fill Online, Printable, Fillable, Blank pdfFiller

If you do, the garnishment amount will be reduced or eliminated, depending on state law. Web there are four direct ways you can take action to stop a wage garnishment: Reach out to a nonprofit to ask for financial assistance. If paid monthly, enter one hundred thirty(130) times the current fede. Try to negotiate a payment plan with your creditor.

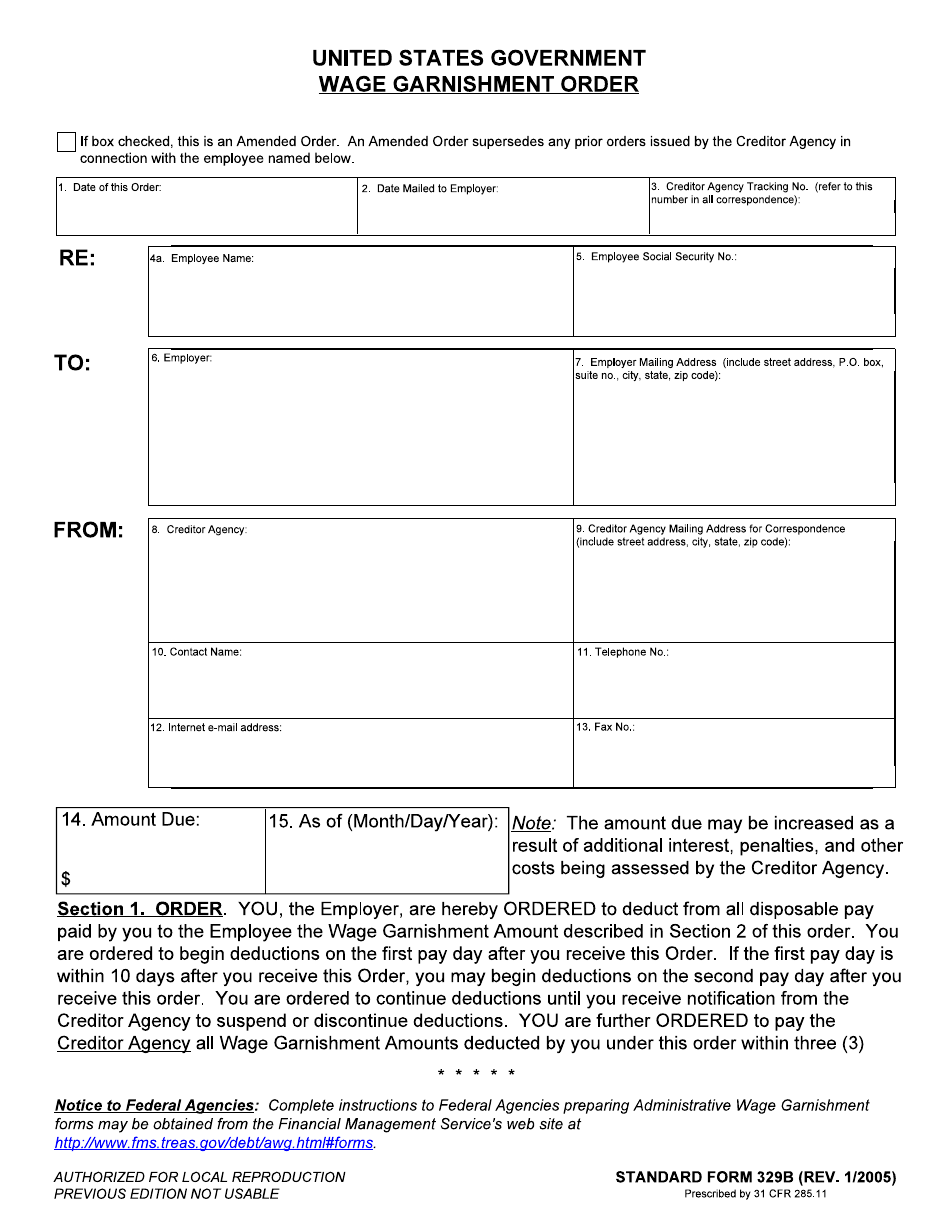

Form SF329B Download Fillable PDF or Fill Online Wage Garnishment

Challenge the wage garnishment in court. Web you fill out a claim of exemption form stating why you believe that exemption applies to you and file it with the court issuing the order allowing the garnishment. Web whenever the creditor does get an judgment negative you, within 15 days of welcome the “notice by legal proceedings to collect debt have.

Web The Notice Should Include A Form Titled Payment To Avoid Garnishment. If You Intend To Use This Method To Stop Wage Garnishment, You Must Complete The Form And Return It To The Creditor Within 15 Days Of The Date On The Letter Or Notice To Which The Form Was Attached.

Web if the creditor does get a judgment against you, within 15 days of receiving the “notice of court proceedings to collect debt have your employer complete the payment to avoid garnishment form and returning it to my creditor with the monthly payment due. Challenge the wage garnishment in court. Web whenever the creditor does get an judgment negative you, within 15 days of welcome the “notice by legal proceedings to collect debt have your employer complete the payment to avoid garnishment form and refund it to your creditor with the monthly payment due. The judge will determine if you qualify for that particular exemption.

This Must Be Done Within 15 Days Of Receiving The “Notice Of Court Proceedings To Collect Debt,” A Trustee Is A Person Who Will Collect The Portion Of Your Wages That Will Be Garnished And Divide It Between Your Creditors Until Your Debts Are Paid Off.

If you do, the garnishment amount will be reduced or eliminated, depending on state law. Web to avoid garnishment, apply to your local municipal court for the appointment of a trustee. Web if some or all of your income — such as social security — is exempt from garnishment, if you already paid the debt or if it was discharged in a bankruptcy, you’ll have to back up your claim with. Fill out the payment form.

Web You Fill Out A Claim Of Exemption Form Stating Why You Believe That Exemption Applies To You And File It With The Court Issuing The Order Allowing The Garnishment.

Try to negotiate a payment plan with your creditor (s) or settle your debt. File for bankruptcy to stop the garnishment fast. Web wage garnishment is a legal procedure in which a person's earnings are required by court order to be withheld by an employer for the payment of a debt such as child support. Web if you are paid weekly, enter thirty (30) times the current federal minimum hourly wage;

Web There Are Four Direct Ways You Can Take Action To Stop A Wage Garnishment:

Reach out to a nonprofit to ask for financial assistance. If paid monthly, enter one hundred thirty(130) times the current fede.