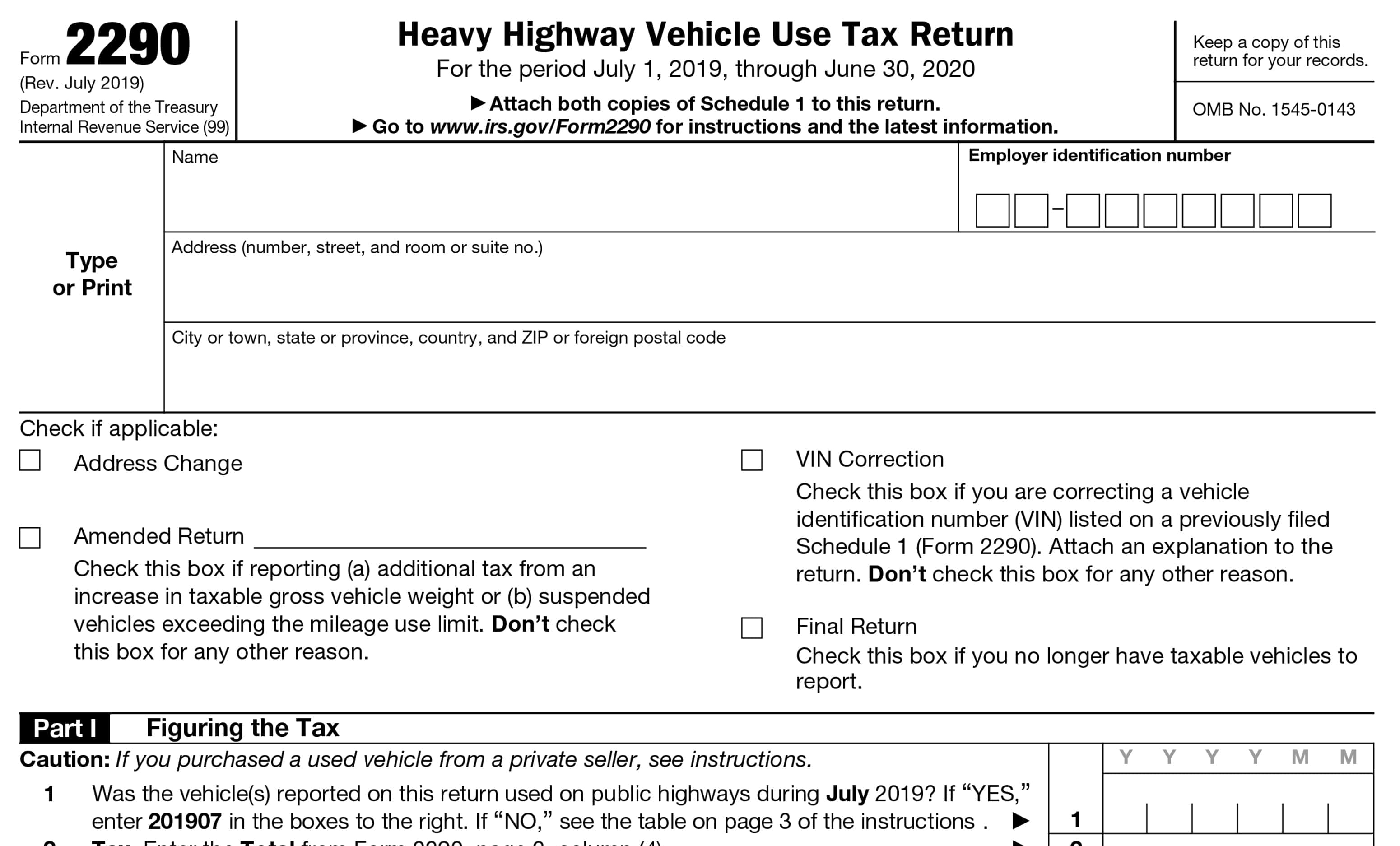

How To Fill Out 2290 Form

How To Fill Out 2290 Form - Easy, fast, secure & free to try. Web steps to file form 2290 step 1: Web how to complete a form 2290 (step by step) to complete a form 2290, you need to provide the following information: Current customers can simply log in to access their account and start filing. Includes step by step instructions. The fundamentals basically, filing this return is a must for any individual, llc, cooperation, or any other type of entity with heavy vehicles registered. See when to file form 2290 for more details. Deadline to file hvut return 4. In this article, we will be. Use the table below to determine your.

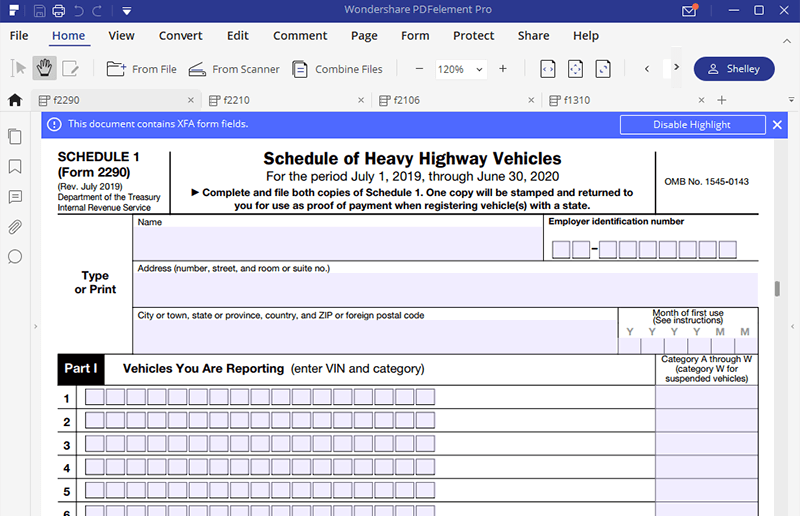

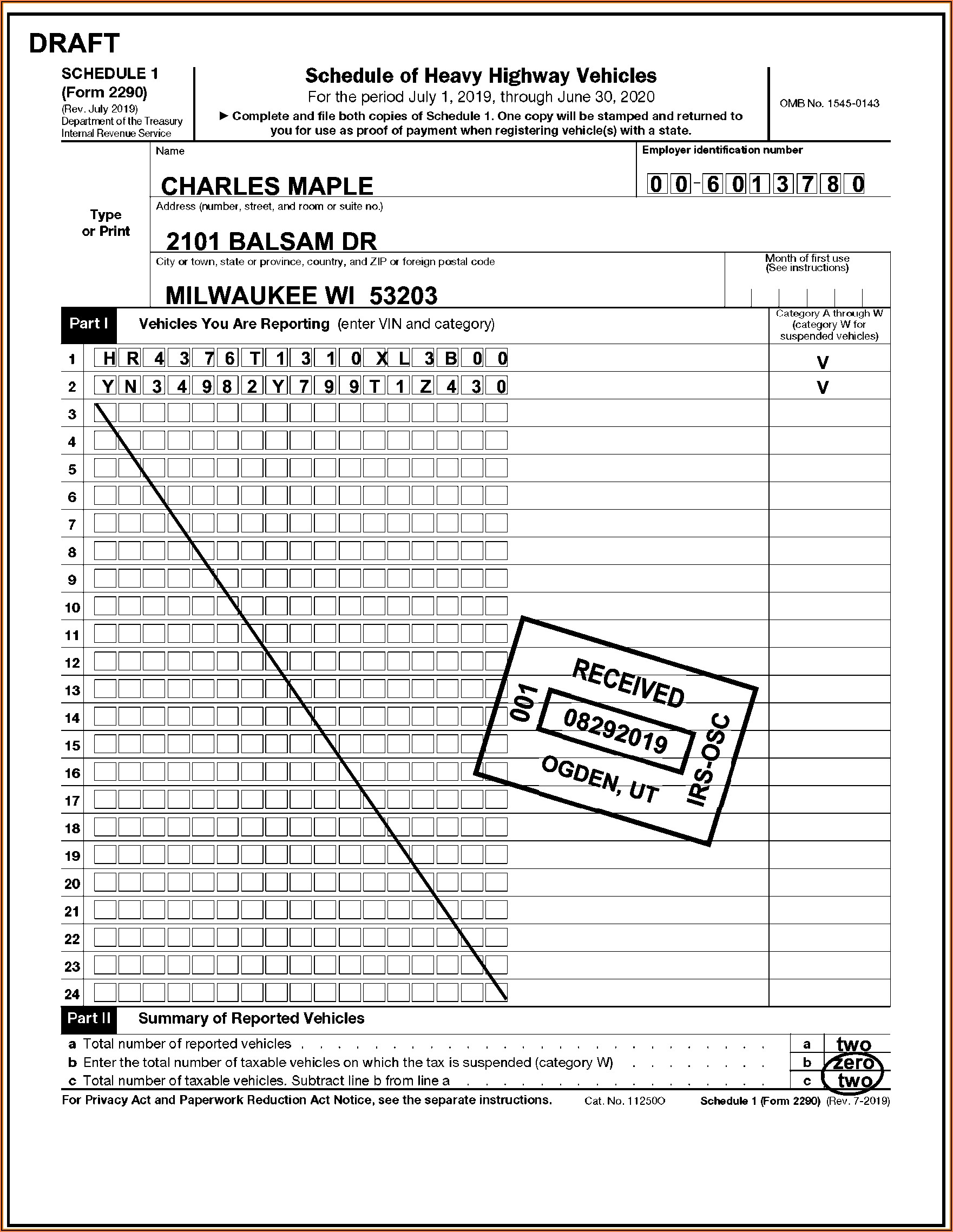

Web form 2290 filers must enter the month of first use in schedule 1 to indicate when the vehicles included in schedule 1 were first used during the tax period. Web you should file your 2290 form online if you fulfill the below criteria: Web how to start filling out the 2290? If you need to pay the 2290 form, you need to inform the irs of your intention to file for the tax year in which you’re going to do it. Enter the date for the month of first use in this field. The first section of the form 2290 asks for basic information about your business including. Web about form 2290, heavy highway vehicle use tax return. Who has to file form 2290? New customers will create an account and. In this article, we will be.

Web how to fill out a 2290 form: Web form 2290 is the heavy highway vehicle use tax return. Web you must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. See when to file form 2290 for more details. Web you should file your 2290 form online if you fulfill the below criteria: Ad file form 2290 for vehicles weighing 55,000 pounds or more. If you need to pay the 2290 form, you need to inform the irs of your intention to file for the tax year in which you’re going to do it. Web file form 2290 by the last day of the month following the month in which you first used the vehicle on a public highway. The first section of the form 2290 asks for basic information about your business including. Application for family member to use transferred benefits.

How To Fill Form 2290 Form Resume Examples 1ZV8oNKY3X

Create an account or log in. Web how to fill out a 2290 form: New customers will create an account and. File your 2290 online & get schedule 1 in minutes. The fundamentals basically, filing this return is a must for any individual, llc, cooperation, or any other type of entity with heavy vehicles registered.

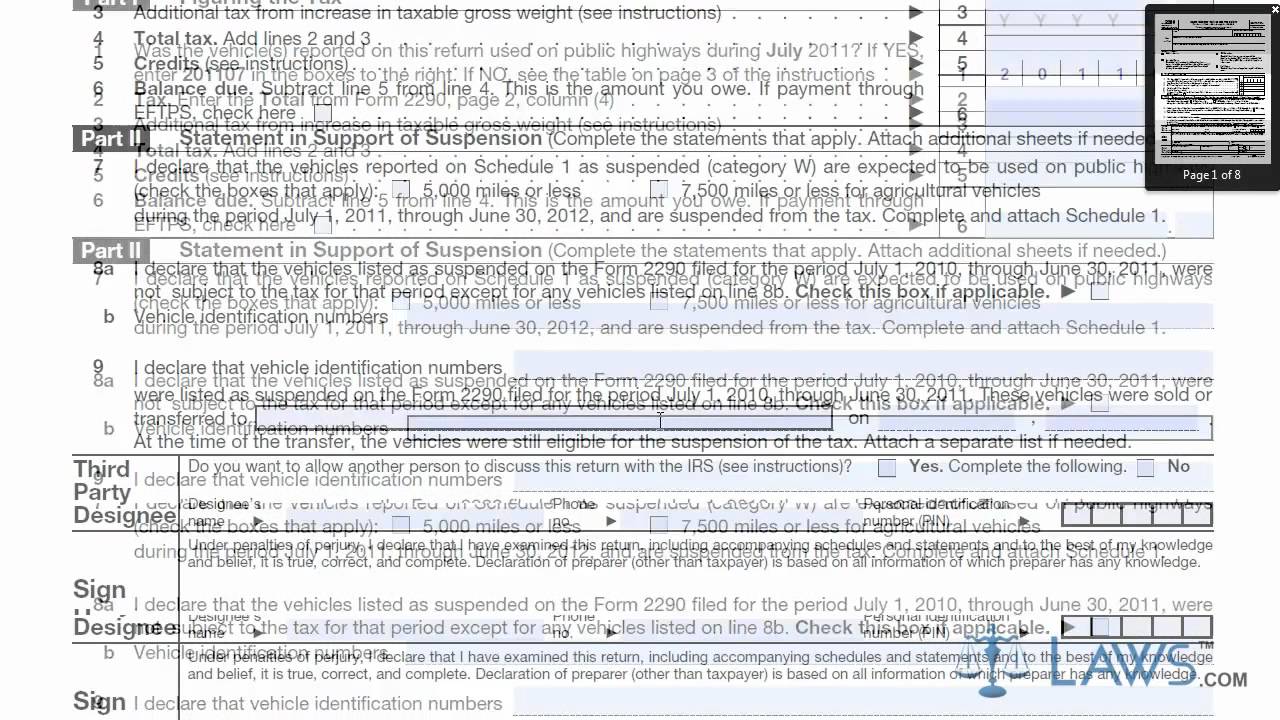

2017 Form IRS 2290 Fill Online, Printable, Fillable, Blank pdfFiller

To download the form 2290 in printable format and to know. Web you must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. Includes step by step instructions. Web about form 2290, heavy highway vehicle use tax return. Web how to complete a form 2290.

Fillable Form 2290 20232024 Create, Fill & Download 2290

Enter the date for the month of first use in this field. Web you must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. Web how to complete a form 2290 (step by step) to complete a form 2290, you need to provide the following.

IRS Form 2290 Instructions How to Fill HVUT 2290 Form

Purpose of filing irs tax form 2290 3. If you own a truck with a gross weight of 55,000 pounds or more.this is the most important criteria in deciding if. In this article, we will be. The fundamentals basically, filing this return is a must for any individual, llc, cooperation, or any other type of entity with heavy vehicles registered..

IRS Form 2290 Fill it Without Stress Wondershare PDFelement

Web you must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. If you first started using the truck in, say, august 2022, then 202208 must be. Create an account or log in. Application for family member to use transferred benefits. New customers will create.

IRS Form 2290 Truck Tax Return Fill Out Online PDF FormSwift

The fundamentals basically, filing this return is a must for any individual, llc, cooperation, or any other type of entity with heavy vehicles registered. Deadline to file hvut return 4. See when to file form 2290 for more details. To download the form 2290 in printable format and to know. We've been in the trucking business for over 67+ years.

How To Fill Out A Cms 1500 Form For Tricare Form Resume Examples

Figure and pay the tax due on highway motor vehicles used during the period with a. Web #2290 #hvut #truckingin this video i will show you how to file your own 2290 highway use tax. Do your truck tax online & have it efiled to the irs! The fundamentals basically, filing this return is a must for any individual, llc,.

How To Fill Out A 2290 Form Form Resume Examples K75PNAykl2

Create an account or log in. Web form 2290 is the heavy highway vehicle use tax return. Web learn how to fill the form 2290 internal revenue service tax. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Web about form 2290, heavy highway vehicle use tax return.

Learn How to Fill the Form 2290 Internal Revenue Service Tax YouTube

Figure and pay the tax due on highway motor vehicles used during the period with a. Web you should file your 2290 form online if you fulfill the below criteria: Ad online 2290 tax filing in minutes. If you need to pay the 2290 form, you need to inform the irs of your intention to file for the tax year.

Form W2c Fill In Version Download Form Resume Examples G28BpLkKgE

If you need to pay the 2290 form, you need to inform the irs of your intention to file for the tax year in which you’re going to do it. Web there are two ways you can file your irs form 2290: Who has to file form 2290? New customers will create an account and. Web form 2290 filers must.

Purpose Of Filing Irs Tax Form 2290 3.

Web how to complete a form 2290 (step by step) to complete a form 2290, you need to provide the following information: Web you must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. Web how to fill out a 2290 form: If you use our online.

Web Learn How To Fill The Form 2290 Internal Revenue Service Tax.

If you need to pay the 2290 form, you need to inform the irs of your intention to file for the tax year in which you’re going to do it. If you first started using the truck in, say, august 2022, then 202208 must be. Web form 2290 is the heavy highway vehicle use tax return. Enter the date for the month of first use in this field.

Use The Table Below To Determine Your.

The first section of the form 2290 asks for basic information about your business including. In this article, we will be. Easy, fast, secure & free to try. Any person operating a vehicle weighing more than 55,000 pounds is required to file this return.

File Your 2290 Online & Get Schedule 1 In Minutes.

Application for family member to use transferred benefits. Who has to file form 2290? Includes step by step instructions. If you own a truck with a gross weight of 55,000 pounds or more.this is the most important criteria in deciding if.