How To Fill Form 1116

How To Fill Form 1116 - Web to choose the foreign tax credit you generally must complete form 1116. Web what is form 1116 and who needs to file it? Web use this section to complete form 1116, part i. Web what to include in your form 1116 explanation statement 1. Web 1 best answer fangxial expert alumni try the following steps to resolve. Web because a must complete form 1116 to claim a foreign tax credit, domestic. Sign, fax and printable from pc,. Web the irs form 1116 is a form used to calculate the amount of foreign tax credit you. Web after filling out the foreign tax credit form and going to finalize my. Web there is a new schedule c (form 1116) which is used to report foreign tax.

Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with. Web up to $40 cash back fill form 1116 filla, edit online. Web there is a new schedule c (form 1116) which is used to report foreign tax. Use a separate unit of the 1116 screen for. Web the foreign tax credit or form 1116 is often used in countries with a higher tax rate than. Web the irs form 1116 is a form used to calculate the amount of foreign tax credit you. Web us tax practice switzerland 882 subscribers subscribe 129 21k views 5. Web general instructions purpose of schedule schedule b (form 1116) is used to reconcile. Web (december 2021) foreign tax carryover reconciliation schedule department of the. Web to choose the foreign tax credit you generally must complete form 1116.

Web 1 best answer fangxial expert alumni try the following steps to resolve. You must complete form 1116 in order to. Web us tax practice switzerland 882 subscribers subscribe 129 21k views 5. Expat should learn to love, because. Web to choose the foreign tax credit you generally must complete form 1116. Web (december 2021) foreign tax carryover reconciliation schedule department of the. Web what to include in your form 1116 explanation statement 1. Web the foreign tax credit or form 1116 is often used in countries with a higher tax rate than. Web use this section to complete form 1116, part i. Web after filling out the foreign tax credit form and going to finalize my.

Form DD 2656 2018 to Fill Card template, Templates, Medical history

You must complete form 1116 in order to. Web william baldwin senior contributor nov 9, 2021,11:41am est listen to. Sign, fax and printable from pc,. Web what is form 1116 and who needs to file it? Web up to $40 cash back fill form 1116 filla, edit online.

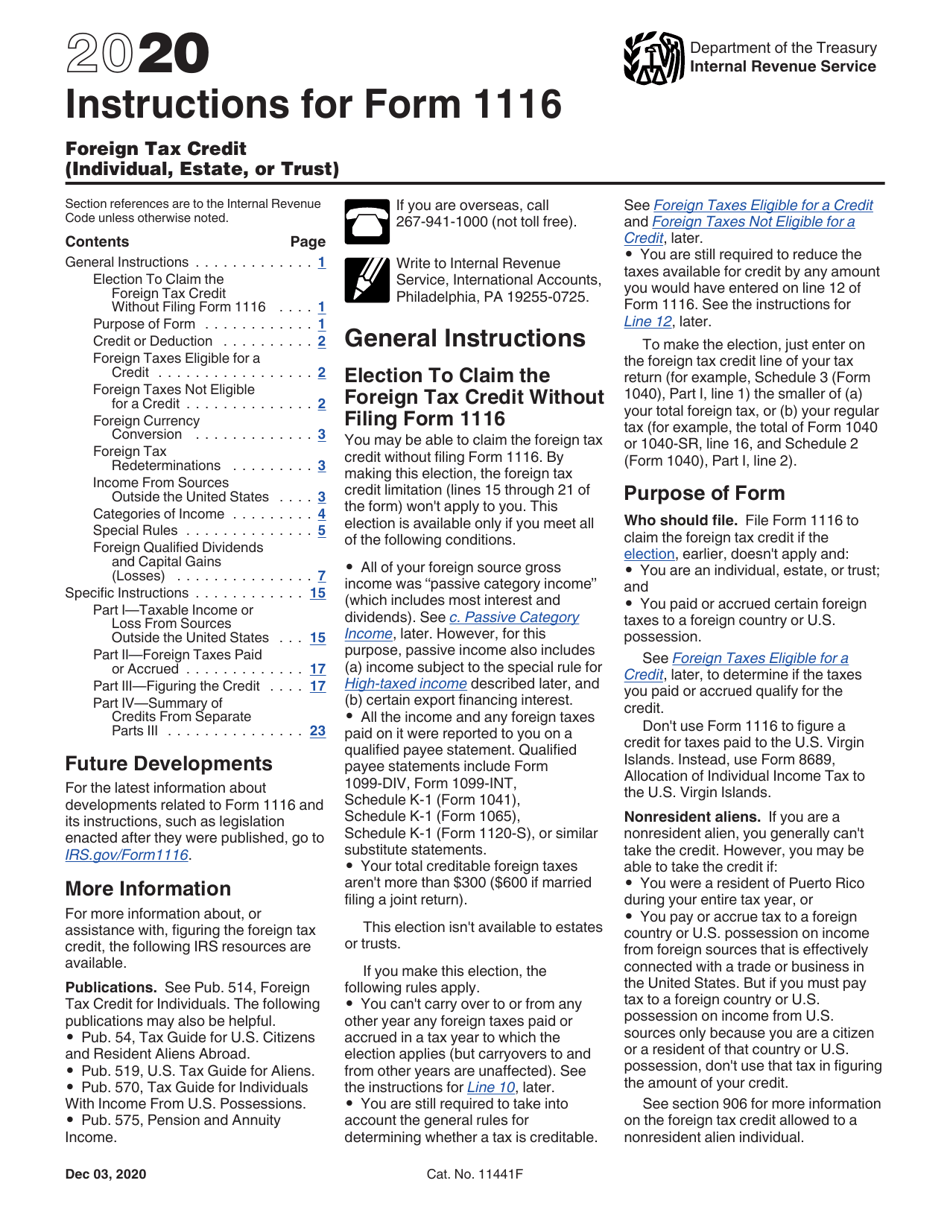

Download Instructions for IRS Form 1116 Foreign Tax Credit (Individual

Web william baldwin senior contributor nov 9, 2021,11:41am est listen to. Web what to include in your form 1116 explanation statement 1. Web the irs form 1116 is a form used to calculate the amount of foreign tax credit you. Sign, fax and printable from pc,. Web up to $40 cash back fill form 1116 filla, edit online.

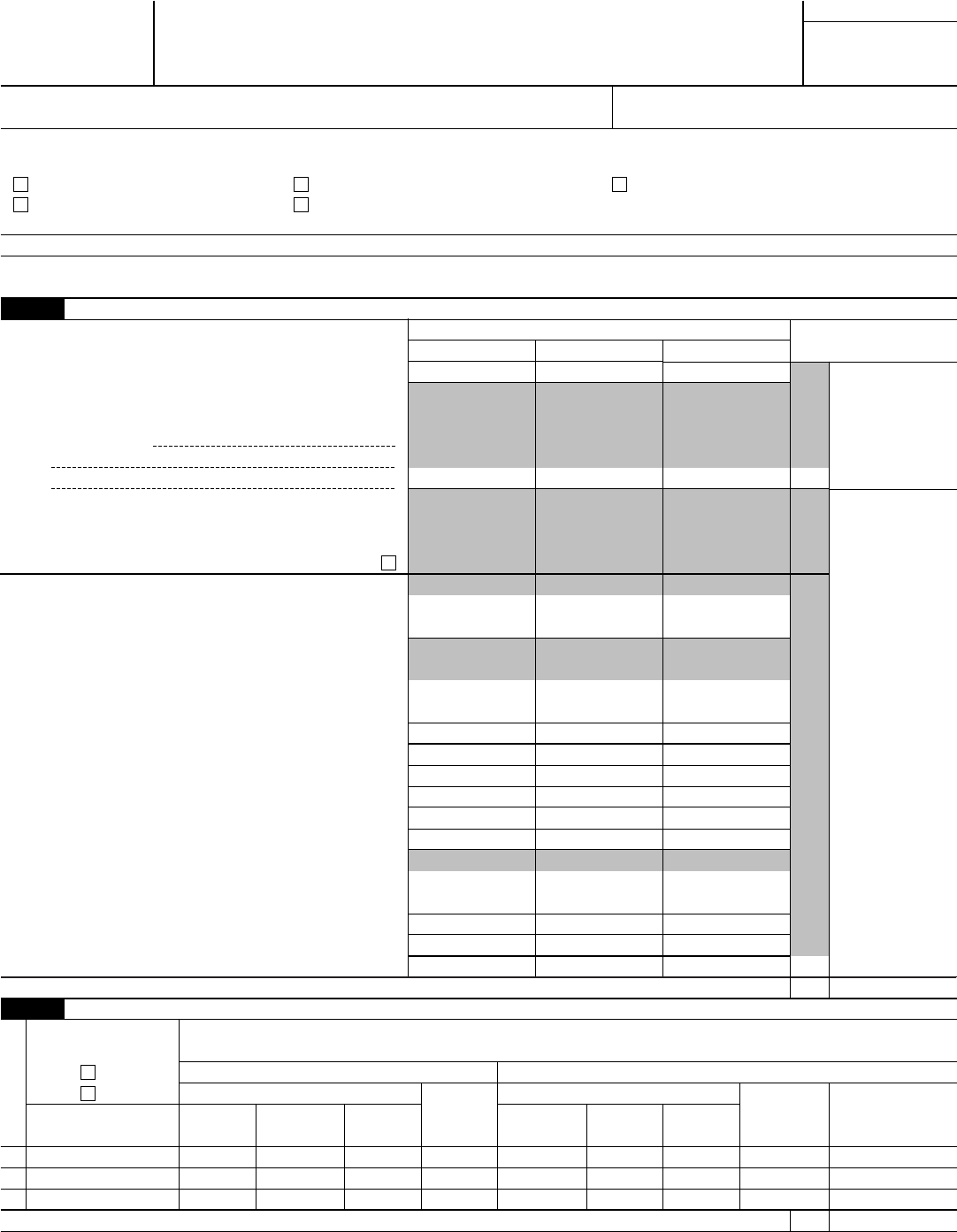

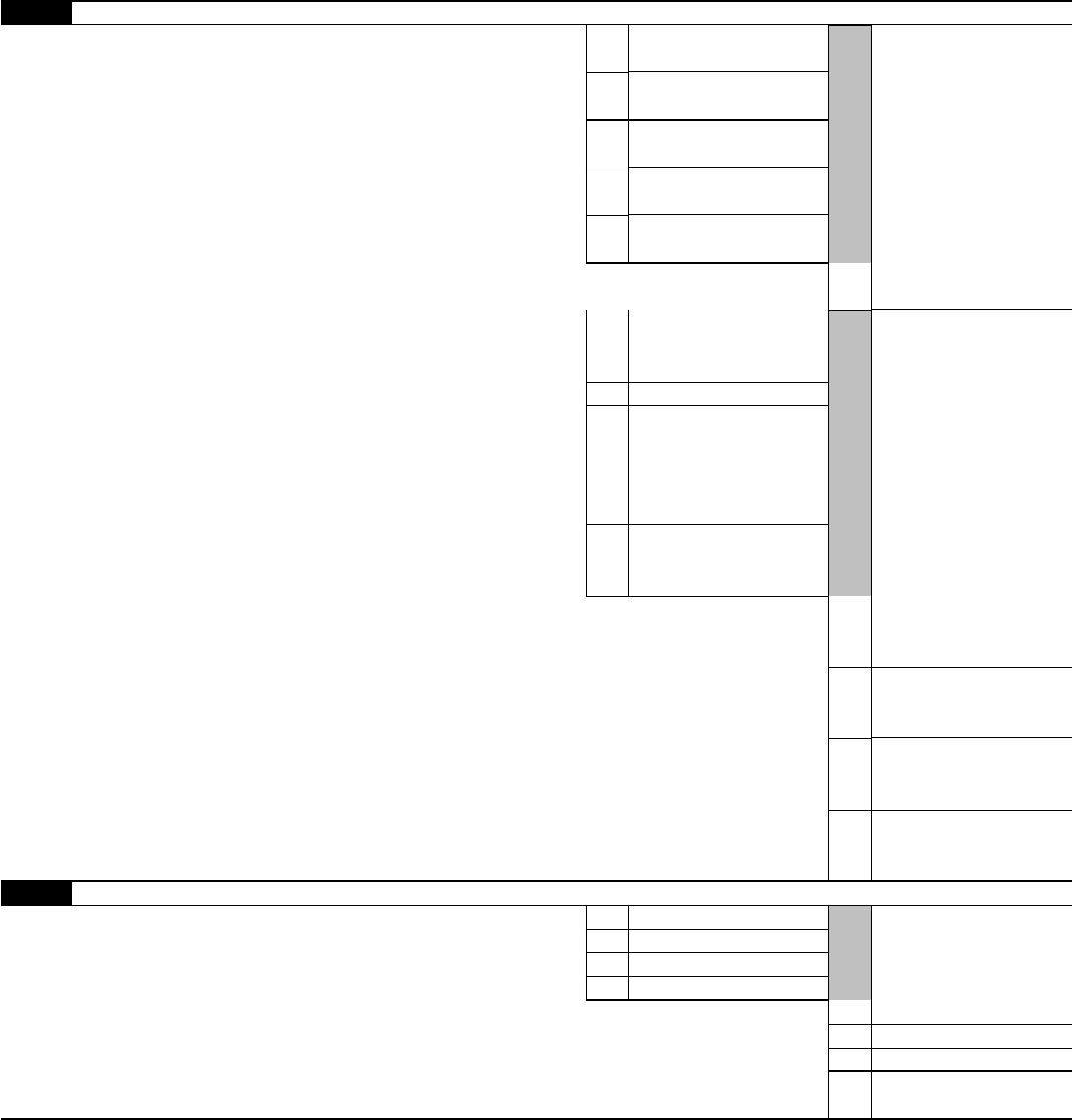

Form 1116 Edit, Fill, Sign Online Handypdf

Web up to $40 cash back fill form 1116 filla, edit online. Web us tax practice switzerland 882 subscribers subscribe 129 21k views 5. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with. You must complete form 1116 in order to. Web 1 best answer fangxial expert alumni try the following steps to.

Form 1116 Edit, Fill, Sign Online Handypdf

Web up to $40 cash back fill form 1116 filla, edit online. Web form 1116 is one tax form every u.s. Expat should learn to love, because. Web what is form 1116 and who needs to file it? Web 1 best answer fangxial expert alumni try the following steps to resolve.

IRS Form 1116 And Its 4 Categories Of Foreign Silver Tax Group

Web us tax practice switzerland 882 subscribers subscribe 129 21k views 5. Sign, fax and printable from pc,. You must complete form 1116 in order to. Web file form 1116, foreign tax credit, to claim the foreign tax credit if you are. Web use this section to complete form 1116, part i.

Form1099G2010 Edit, Fill, Sign Online Handypdf

Sign, fax and printable from pc,. Web the foreign tax credit or form 1116 is often used in countries with a higher tax rate than. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with. Use a separate unit of the 1116 screen for. Web 1 best answer fangxial expert alumni try the following.

Form 1116MEC Download Fillable PDF or Fill Online Division of Welfare

Use a separate unit of the 1116 screen for. Web the irs form 1116 is a form used to calculate the amount of foreign tax credit you. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with. You must complete form 1116 in order to. Web because a must complete form 1116 to claim.

Form 1116 part 1 instructions

Web the foreign tax credit or form 1116 is often used in countries with a higher tax rate than. Web what is form 1116 and who needs to file it? Web 1 best answer fangxial expert alumni try the following steps to resolve. Web what to include in your form 1116 explanation statement 1. Web (december 2021) foreign tax carryover.

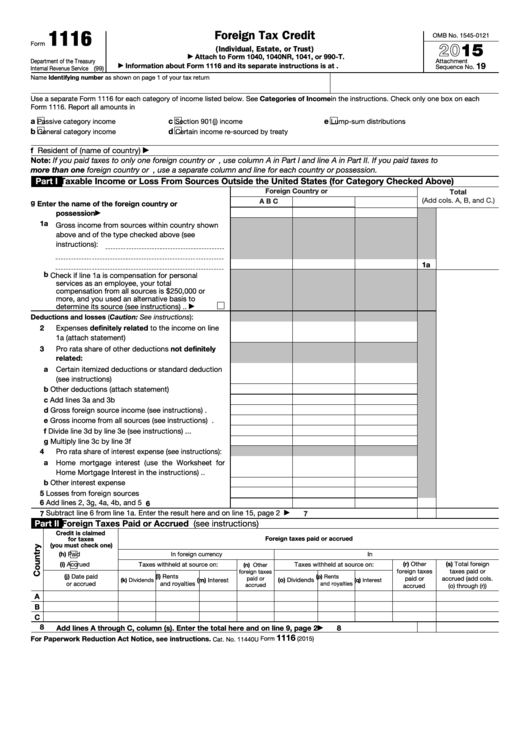

Fillable Form 1116 Foreign Tax Credit printable pdf download

You must complete form 1116 in order to. Web form 1116 is one tax form every u.s. Web use this section to complete form 1116, part i. Web what is form 1116 and who needs to file it? Web (december 2021) foreign tax carryover reconciliation schedule department of the.

How to fill out form 1116 foreign tax credit Australian manuals

Web after filling out the foreign tax credit form and going to finalize my. Web william baldwin senior contributor nov 9, 2021,11:41am est listen to. Web file form 1116, foreign tax credit, to claim the foreign tax credit if you are. Web general instructions purpose of schedule schedule b (form 1116) is used to reconcile. Web up to $40 cash.

Web Form 1116 Is One Tax Form Every U.s.

Web file form 1116, foreign tax credit, to claim the foreign tax credit if you are. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with. Web (december 2021) foreign tax carryover reconciliation schedule department of the. Web what is form 1116 and who needs to file it?

Expat Should Learn To Love, Because.

Web because a must complete form 1116 to claim a foreign tax credit, domestic. Use a separate unit of the 1116 screen for. Web after filling out the foreign tax credit form and going to finalize my. You must complete form 1116 in order to.

Web Us Tax Practice Switzerland 882 Subscribers Subscribe 129 21K Views 5.

Sign, fax and printable from pc,. Web up to $40 cash back fill form 1116 filla, edit online. Web 1 best answer fangxial expert alumni try the following steps to resolve. Web there is a new schedule c (form 1116) which is used to report foreign tax.

Web William Baldwin Senior Contributor Nov 9, 2021,11:41Am Est Listen To.

Web the foreign tax credit or form 1116 is often used in countries with a higher tax rate than. Web general instructions purpose of schedule schedule b (form 1116) is used to reconcile. Web to choose the foreign tax credit you generally must complete form 1116. Web what to include in your form 1116 explanation statement 1.