How To File Form 966 Electronically

How To File Form 966 Electronically - Go to this irs website. Line 7e if the consolidated return was filed electronically, enter “efile” on line 7e. Web 4.7 satisfied 198 votes quick guide on how to complete form diss stk forget about scanning and printing out forms. Web sign and send documents electronically. Web for the latest information about developments related to form 8869 and its instructions, such as legislation enacted after they were published, go to. 2 what happens if you don’t file form 966? Web if you have received a waiver of the form 8966 electronic filing requirement from the irs or are not otherwise required to file form 8966 electronically, you may send all paper. Web electronically, enter “efile” on line 5. Web 3 attorney answers posted on dec 13, 2011 all i have to add is that you can see for yourself if the form is required to be filed just by looking at the form instructions:. Web visit eftps® or call eftps® customer service to request an enrollment form:

Web adopting a plan to dissolve & filing form 966. Use our detailed instructions to fill out and esign your documents. Make sure to file irs form 966 after you adopt a plan of dissolution for the corporation. As provided by the irs: Can irs form 966 be filed electronically? Complete, edit or print tax forms instantly. Web there are several ways to submit form 4868. Go to this irs website. Complete, edit or print tax forms instantly. Web to help reduce burden for the tax community, the irs allows taxpayers to use electronic or digital signatures on certain paper forms they cannot file electronically.

Use our detailed instructions to fill out and esign your documents. Web sign and send documents electronically. Web adopting a plan to dissolve & filing form 966. Web visit eftps® or call eftps® customer service to request an enrollment form: Can irs form 966 be filed electronically? Web there are several ways to submit form 4868. Ad access irs tax forms. “file form 966 within 30 days after the resolution or plan is adopted to dissolve the corporation or. Make sure to file irs form 966 after you adopt a plan of dissolution for the corporation. Complete, edit or print tax forms instantly.

STARRETT FORM 966 USER MANUAL Pdf Download ManualsLib

4 how do i dissolve a single member llc. Web sign and send documents electronically. Web adopting a plan to dissolve & filing form 966. Ad complete irs tax forms online or print government tax documents. Make sure to file irs form 966 after you adopt a plan of dissolution for the corporation.

How Do I File a 4868 Form Electronically? Pocket Sense

3 where do i file irs form 966? Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web for the latest information about developments related to form 8869 and its instructions, such as legislation enacted after they were published, go to. Web form 966 is filed with the internal revenue.

Closing a Corporation Do I File IRS Form 966

Through october 31, 2023, you and your authorized representatives may electronically sign documents and email. Web to help reduce burden for the tax community, the irs allows taxpayers to use electronic or digital signatures on certain paper forms they cannot file electronically. Web table of contents [ hide] 1 is form 966 required for llc? Foreign corporations a corporation that.

Electronically File Form 1065 Universal Network

Web form 966 is filed with the internal revenue service center at the address where the corporation or cooperative files its income tax return. Web there are several ways to submit form 4868. Line 7e if the consolidated return was filed electronically, enter “efile” on line 7e. Complete, edit or print tax forms instantly. Web table of contents [ hide].

irs electronic signature 8804 JWord サーチ

Web there are several ways to submit form 4868. Go to this irs website. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Foreign corporations a corporation that files a. Web file form 966 with the internal revenue service center where the corporation is required to file its income tax.

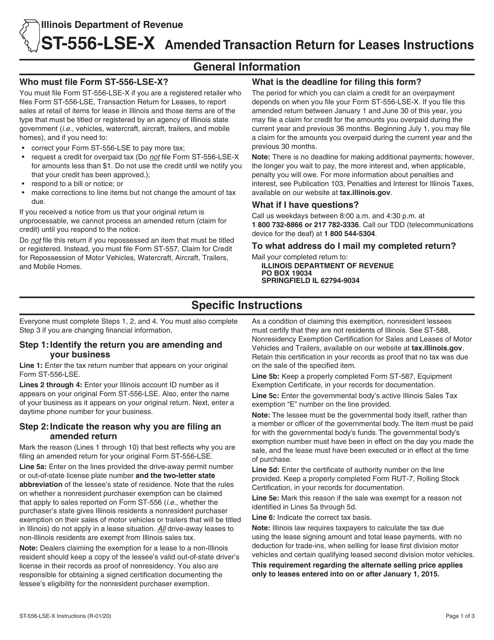

Download Instructions for Form ST556LSEX, 966 Amended Transaction

As provided by the irs: Ad access irs tax forms. Complete, edit or print tax forms instantly. That form can not be electronically filed at this time. Web if you want to notify us by submitting the form, download and fill out an intent to file a claim for compensation and/or pension, or survivors pension and/or dic.

Form 966 Corporate Dissolution or Liquidation (2010) Free Download

Use our detailed instructions to fill out and esign your documents. Line 7e if the consolidated return was filed electronically, enter “efile” on line 7e. Make sure to file irs form 966 after you adopt a plan of dissolution for the corporation. Foreign corporations a corporation that files a. Web if you have received a waiver of the form 8966.

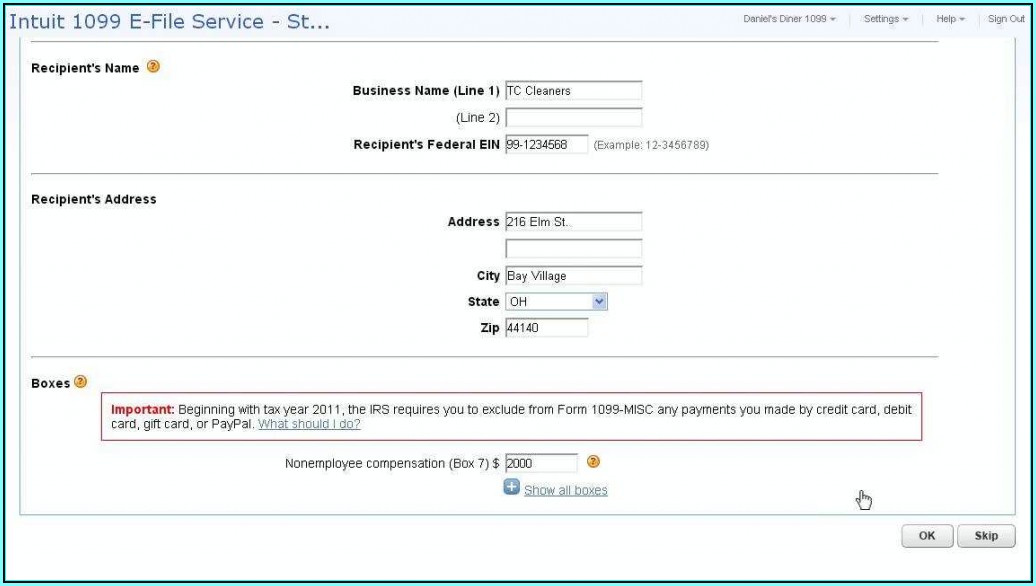

Electronically File Form 1099 Misc With The Irs Form Resume

Web there are several ways to submit form 4868. Web file form 966 with the internal revenue service center at the address where the corporation (or cooperative) files its income tax return. Complete, edit or print tax forms instantly. 3 where do i file irs form 966? 2 what happens if you don’t file form 966?

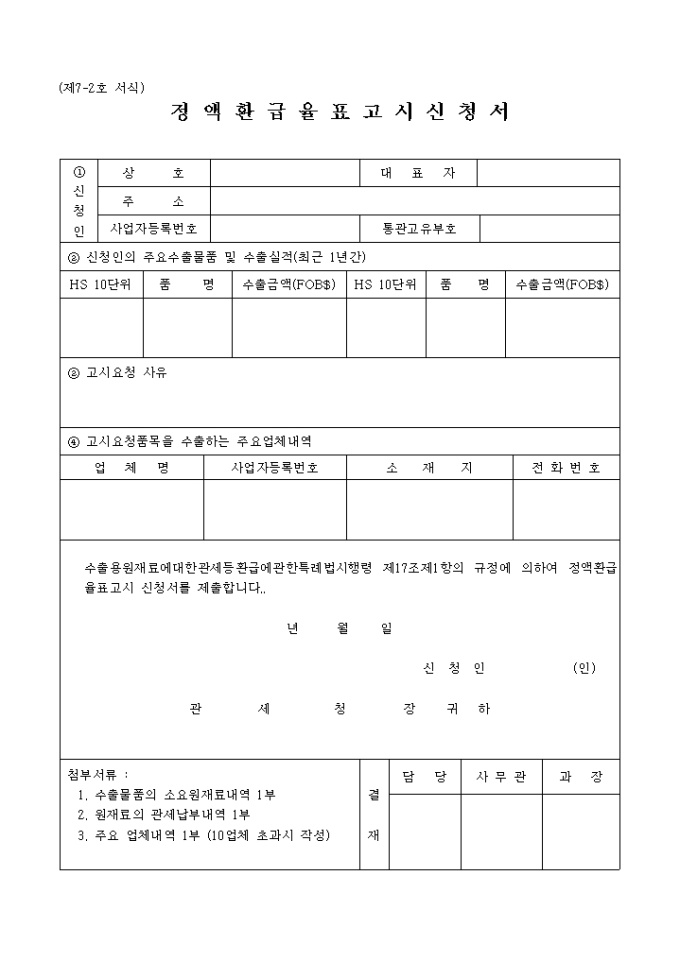

정액환급율표고시 신청서 샘플, 양식 다운로드

Complete, edit or print tax forms instantly. Who must file corporation (or a cooperative filing. Through october 31, 2023, you and your authorized representatives may electronically sign documents and email. Ad access irs tax forms. Web for the latest information about developments related to form 8869 and its instructions, such as legislation enacted after they were published, go to.

Form 966 (Rev PDF Tax Return (United States) S Corporation

Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web if you have received a waiver of the form 8966 electronic filing requirement from the irs or are not otherwise required to file form 8966 electronically, you may send all paper. Web are you going to dissolve your corporation during.

2 What Happens If You Don’t File Form 966?

Make sure to file irs form 966 after you adopt a plan of dissolution for the corporation. Web 3 attorney answers posted on dec 13, 2011 all i have to add is that you can see for yourself if the form is required to be filed just by looking at the form instructions:. As provided by the irs: Web 4.7 satisfied 198 votes quick guide on how to complete form diss stk forget about scanning and printing out forms.

“File Form 966 Within 30 Days After The Resolution Or Plan Is Adopted To Dissolve The Corporation Or.

That form can not be electronically filed at this time. 3 where do i file irs form 966? Go to this irs website. 4 how do i dissolve a single member llc.

Web If You Have Received A Waiver Of The Form 8966 Electronic Filing Requirement From The Irs Or Are Not Otherwise Required To File Form 8966 Electronically, You May Send All Paper.

Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web are you going to dissolve your corporation during the tax year? Web to help reduce burden for the tax community, the irs allows taxpayers to use electronic or digital signatures on certain paper forms they cannot file electronically. Web electronically, enter “efile” on line 5.

Web Adopting A Plan To Dissolve & Filing Form 966.

Always free federal, $14.99 state Foreign corporations a corporation that files a. Who must file corporation (or a cooperative filing. Line 7e if the consolidated return was filed electronically, enter “efile” on line 7e.