How To Amend A 1099 Form

How To Amend A 1099 Form - Employment authorization document issued by the department of homeland. Web type x in the 1099 form's void box. Delete or void the incorrect form first. Depending on the additional amount and type of income, the following may be. Still in the process of creating your. Mention the correct information for 1099 you have mentioned wrongly. Web you can submit a 1099 amendment or corrected form to the irs. Use these irs instructions to work with them for the. Web starting tax year 2023, if you have 10 or more information returns, you must file them electronically. Use form 1096 to let the irs know that a correction has been made to a 1099, you need to send them an updated copy.

Web starting tax year 2023, if you have 10 or more information returns, you must file them electronically. Web you can file the amended form by following the steps below: Web when you have made corrections to one or more 1099 forms, complete a new 1099 form for each recipient. Mail copy a and the corrected transmission form (form. Web you can submit a 1099 amendment or corrected form to the irs. Employment authorization document issued by the department of homeland. Use form 1096 to let the irs know that a correction has been made to a 1099, you need to send them an updated copy. Find out the incorrect return that is transmitted to the irs. If the voided form was for an independent contractor, enter the. Web type x in the 1099 form's void box.

Use these irs instructions to work with them for the. Mention the correct information for 1099 you have mentioned wrongly. Find out the incorrect return that is transmitted to the irs. Individual income tax return, and follow the instructions. Web you can file the amended form by following the steps below: Depending on the additional amount and type of income, the following may be. Web when you have made corrections to one or more 1099 forms, complete a new 1099 form for each recipient. Use form 1096 to let the irs know that a correction has been made to a 1099, you need to send them an updated copy. Mail copy a and the corrected transmission form (form. If you received a form 1099 after submitting your return, you might need to amend it.

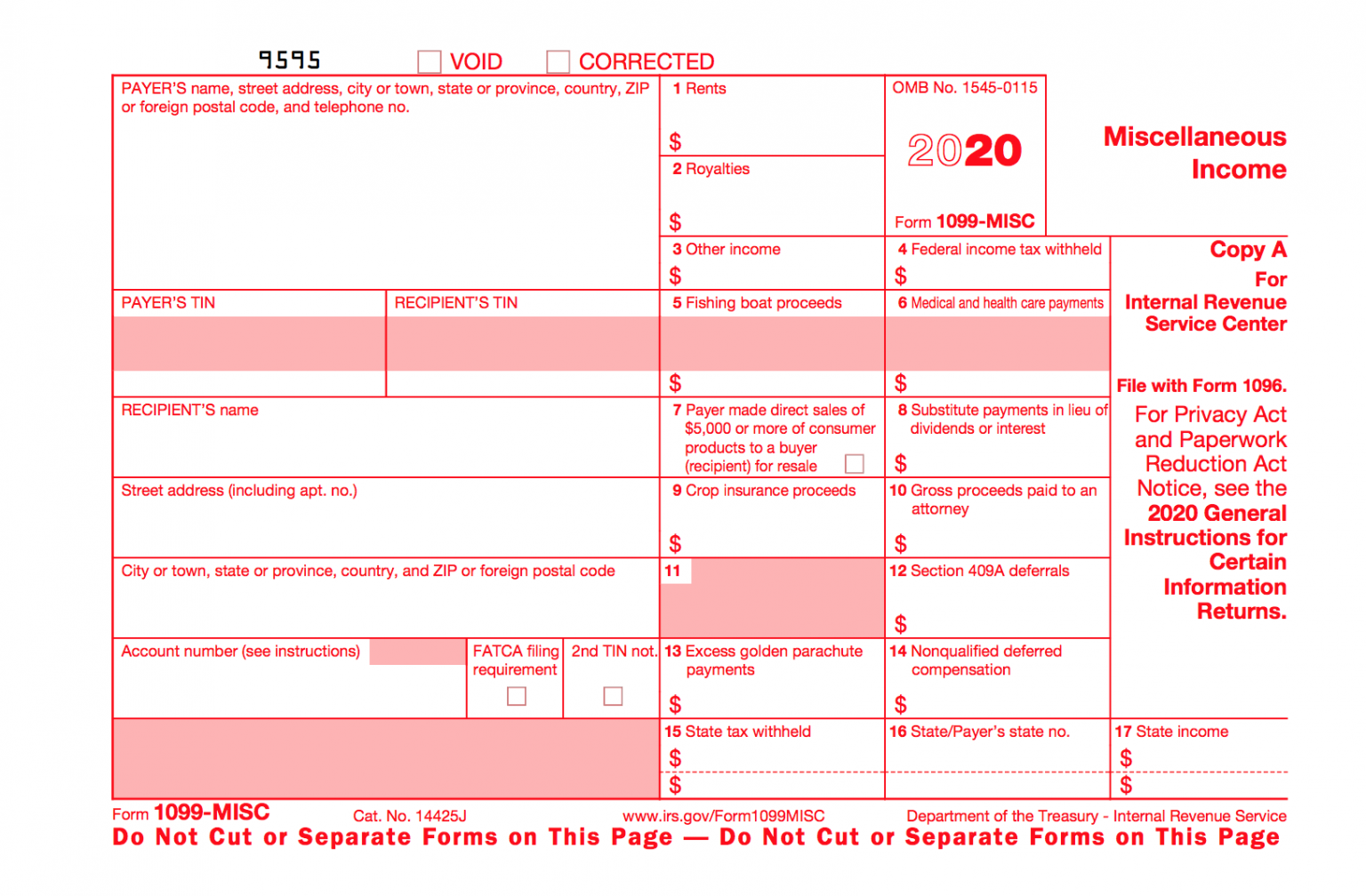

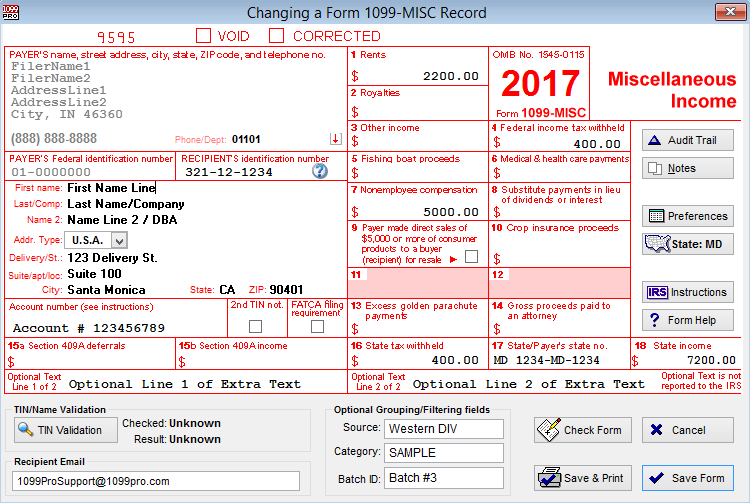

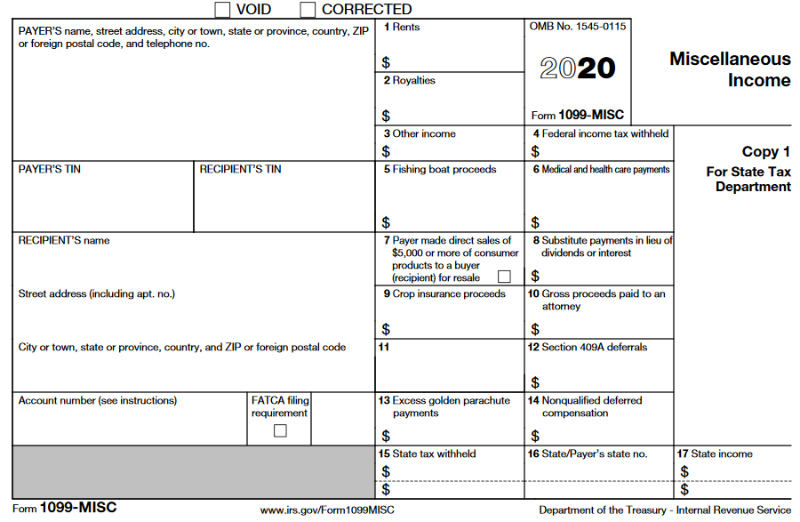

9 1099 Misc Template For Preprinted Forms Template Guru

Web before the irs breaks down your door, go to tax1099.com > forms > new form. If you received a form 1099 after submitting your return, you might need to amend it. Web when you have made corrections to one or more 1099 forms, complete a new 1099 form for each recipient. Use form 1096 to let the irs know.

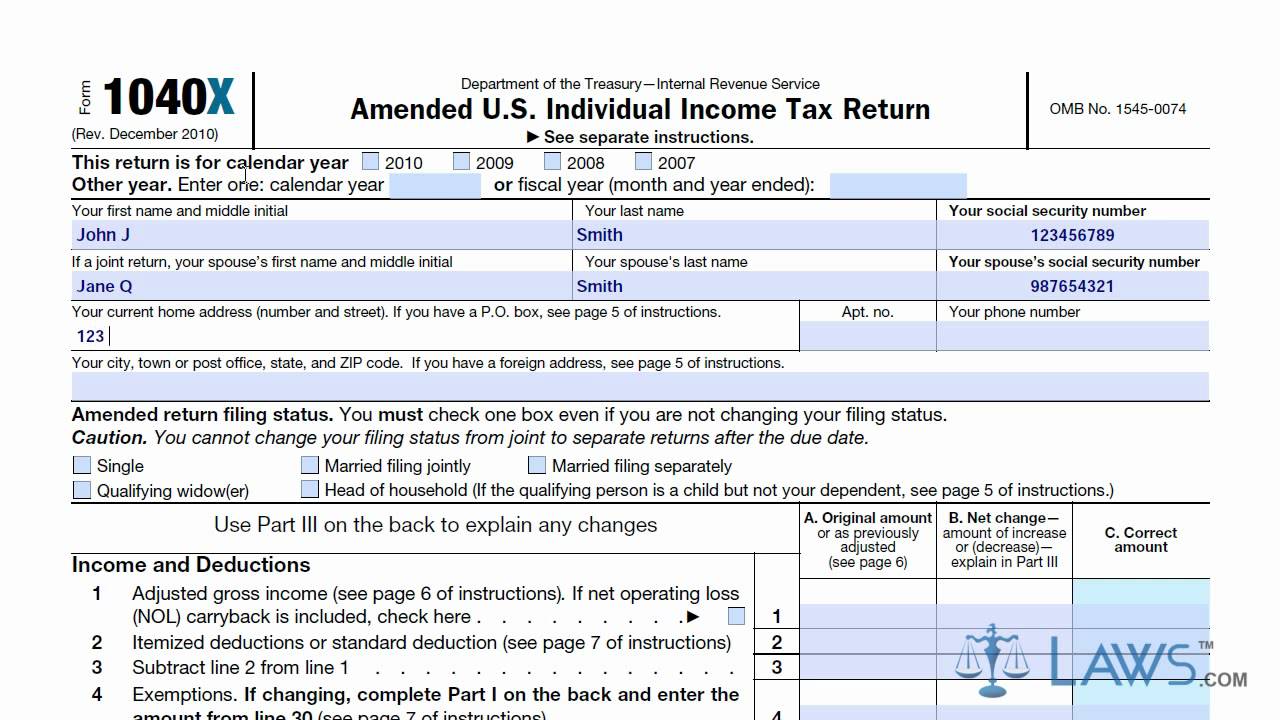

Download File Amended Tax Return 8000 Tax Credit free

Web before the irs breaks down your door, go to tax1099.com > forms > new form. Make a new information return. Delete or void the incorrect form first. Employment authorization document issued by the department of homeland. Use form 1096 to let the irs know that a correction has been made to a 1099, you need to send them an.

Amended Tax Return Phone Number TAXP

Use form 1096 to let the irs know that a correction has been made to a 1099, you need to send them an updated copy. Depending on the additional amount and type of income, the following may be. Mail copy a and the corrected transmission form (form. If the voided form was for an independent contractor, enter the. Enter “x.

What Are 1099s and Do I Need to File Them? Singletrack Accounting

Web when you have made corrections to one or more 1099 forms, complete a new 1099 form for each recipient. Use these irs instructions to work with them for the. Still in the process of creating your. Web before the irs breaks down your door, go to tax1099.com > forms > new form. Individual income tax return, and follow the.

1099NEC Software Print & eFile 1099NEC Forms

Web you can file the amended form by following the steps below: Still in the process of creating your. Use form 1096 to let the irs know that a correction has been made to a 1099, you need to send them an updated copy. Web type x in the 1099 form's void box. Use these irs instructions to work with.

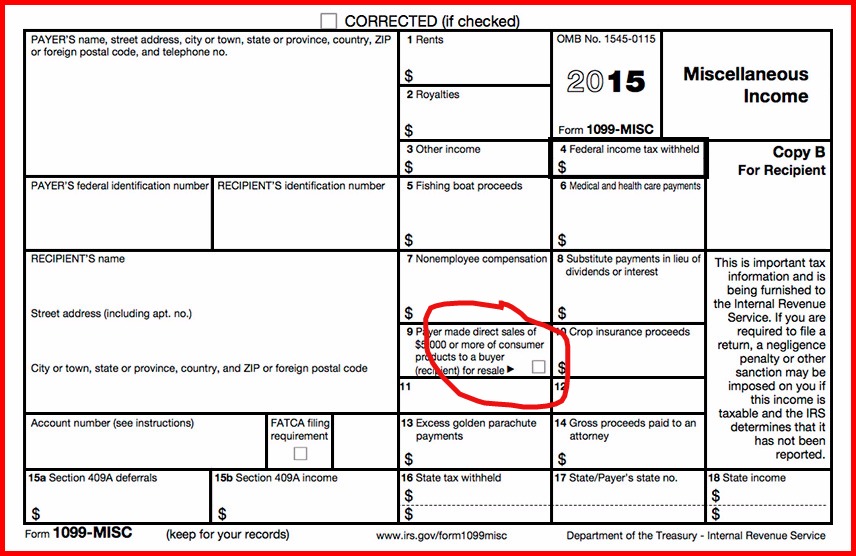

The One Box On Your 1099 That May Hurt You Steve Spangenberg

Use form 1096 to let the irs know that a correction has been made to a 1099, you need to send them an updated copy. Web type x in the 1099 form's void box. Web you need to manually file the amendment to make corrections to the 1099 forms that were already reported. Web you can submit a 1099 amendment.

What Is a 1099 Form, and How Do I Fill It Out? Bench Accounting

If the voided form was for an independent contractor, enter the. Mail copy a and the corrected transmission form (form. Use form 1096 to let the irs know that a correction has been made to a 1099, you need to send them an updated copy. Web type x in the 1099 form's void box. Employment authorization document issued by the.

Free Printable 1099 Misc Forms Free Printable

If the voided form was for an independent contractor, enter the. Find out the incorrect return that is transmitted to the irs. Enter “x ” in the “corrected” box at the top of the form. Use these irs instructions to work with them for the. Web you can submit a 1099 amendment or corrected form to the irs.

How To File A Corrected Form 1099misc Leah Beachum's Template

Make a new information return. Employment authorization document issued by the department of homeland. If the voided form was for an independent contractor, enter the. Web you can submit a 1099 amendment or corrected form to the irs. It's not possible to change the form type directly.

Florida 1099 Form Online Universal Network

Web you need to manually file the amendment to make corrections to the 1099 forms that were already reported. Make a new information return. Delete or void the incorrect form first. Web before the irs breaks down your door, go to tax1099.com > forms > new form. If the voided form was for an independent contractor, enter the.

If The Voided Form Was For An Independent Contractor, Enter The.

If you received a form 1099 after submitting your return, you might need to amend it. Web before the irs breaks down your door, go to tax1099.com > forms > new form. Still in the process of creating your. You should amend your return if you reported certain items incorrectly.

Web Type X In The 1099 Form's Void Box.

Depending on the additional amount and type of income, the following may be. Web you can file the amended form by following the steps below: It's not possible to change the form type directly. Use these irs instructions to work with them for the.

Enter “X ” In The “Corrected” Box At The Top Of The Form.

Web you can submit a 1099 amendment or corrected form to the irs. Individual income tax return, and follow the instructions. Use form 1096 to let the irs know that a correction has been made to a 1099, you need to send them an updated copy. Make a new information return.

Employment Authorization Document Issued By The Department Of Homeland.

Mail copy a and the corrected transmission form (form. Web you need to manually file the amendment to make corrections to the 1099 forms that were already reported. Mention the correct information for 1099 you have mentioned wrongly. Delete or void the incorrect form first.