How Long Does It Take To Process Form 8862

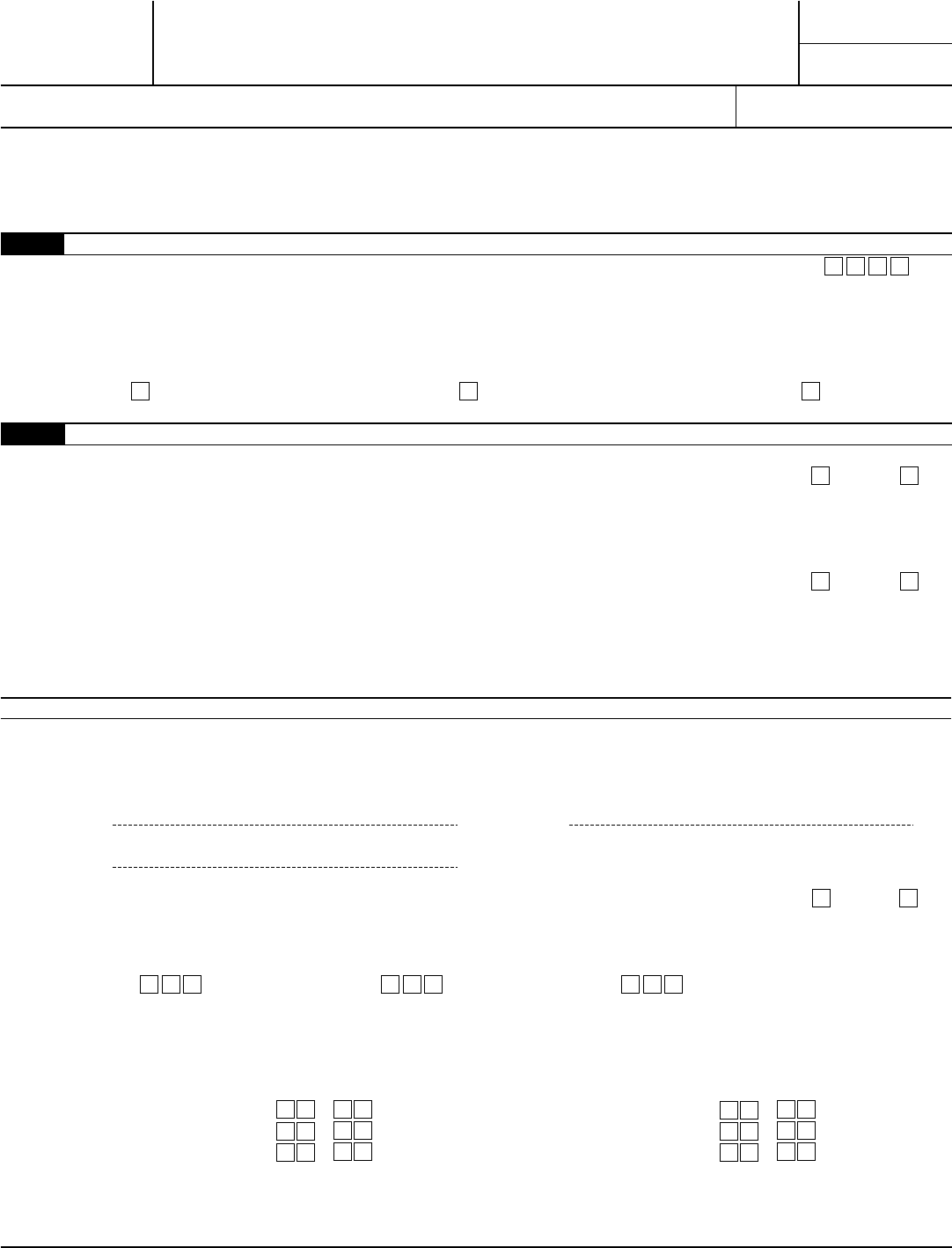

How Long Does It Take To Process Form 8862 - File form 8862 when you claim the credit again. However, there are times when tax returns and the forms attached to them. Put your name and social security number on the statement and attach it at. Sign in to turbotax and select pick. It's 10 years if the disallowance was determined to be attempted fraud. Web you must complete form 8862 and attach it to your tax return if both of the following apply. Claiming certain credits after disallowance form 8862;. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Ad edit, sign or email irs 8862 & more fillable forms, register and subscribe now! Usually, taxpayers receive their refunds within 21 days.

• 2 years after the most. However, there are times when tax returns and the forms attached to them. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Put your name and social security number on the statement and attach it at. April 26, 2023 by by Web you do not need to file form 8862 in the year the credit was disallowed or reduced. How long does it take to process form 8862. Web you must complete form 8862 and attach it to your tax return if both of the following apply. Web how long does it take to process form 8862? Complete, edit or print tax forms instantly.

Put your name and social security number on the statement and attach it at. Web you do not need to file form 8862 in the year the credit was disallowed or reduced. Do not file form 8862 for the: Web not use the married filing separate (mfs) filing status. Web how long does it take to process form 8862? Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Your eic was reduced or disallowed for any reason other than a math or clerical error for. Web tips on how to complete the what is credit karma tax form 8862 pdf online: How long does it take to get your refund after an audit, how long can the irs hold your. It's 10 years if the disallowance was determined to be attempted fraud.

Irs Form 8862 Printable Master of Documents

Sign online button or tick the preview image of the blank. Claiming certain credits after disallowance form 8862;. Filing form 8862, information to claim earned income credit after disallowance, should not delay your refund processing. Web not use the married filing separate (mfs) filing status. Web you do not need to file form 8862 in the year the credit was.

Irs Form 8862 Printable Master of Documents

Web how long do i have to file form 8862? Your eic was reduced or disallowed for any reason other than a math or clerical error for. Usually, taxpayers receive their refunds within 21 days. Pay back the claims, plus interest. To start the blank, use the fill camp;

Form 8862 Edit, Fill, Sign Online Handypdf

Web how long will filing an 8862 delay my refund. Your eic was reduced or disallowed for any reason other than a math or clerical error for. Number each entry on the statement to correspond with the line number on form 8862. How long does it take to get your refund after an audit, how long can the irs hold.

How Long Does it Take for YouTube to Process a Video?

How long does it take to get your refund after an audit, how long can the irs hold your. Usually, taxpayers receive their refunds within 21 days. Web how long does it take to process form 8862 irs fax number for form 8862 how to fill out form 8862 form 8862 required irs form 8862 pdf where to send form.

Tax Return For Expats In Germany Wallpaper

Web michael mccarty obituary. Put your name and social security number on the statement and attach it at. Ad edit, sign or email irs 8862 & more fillable forms, register and subscribe now! Web american opportunity tax credit (aotc) you may need to: Web how long does it take to process form 8862 irs fax number for form 8862 how.

IRS 8867 2020 Fill out Tax Template Online US Legal Forms

How long does it take to get your refund after an audit, how long can the irs hold your. • 2 years after the most. Web how long will filing an 8862 delay my refund. Sign in to turbotax and select pick. Usually, taxpayers receive their refunds within 21 days.

IMG_8862 FunkyKit

• 2 years after the most. How long does it take to process form 8862. Pay back the claims, plus interest. Ad download or email irs 8862 & more fillable forms, try for free now! Web how long does it take to process form 8862?

IRS Formulario 8862(SP) Download Fillable PDF or Fill Online

Put your name and social security number on the statement and attach it at. Results are expected for 2015. Usually, taxpayers receive their refunds within 21 days. • 2 years after the most. Web in either of these cases, you can take the credit(s) without filing form 8862 if you meet all the credit’s eligibility requirements.

Publication 596 (2021), Earned Credit (EIC) Internal Revenue

Web tips on how to complete the what is credit karma tax form 8862 pdf online: Sign in to turbotax and select pick. Usually, taxpayers receive their refunds within 21 days. Here's how to file form 8862 in turbotax. • 2 years after the most.

Form 8862 (Rev. December 2012) Edit, Fill, Sign Online Handypdf

How long does it take to get your refund after an audit, how long can the irs hold your. Web how long does it take to process form 8862 irs fax number for form 8862 how to fill out form 8862 form 8862 required irs form 8862 pdf where to send form 8862 freetaxusa. Web you must complete form 8862.

Web You Do Not Need To File Form 8862 In The Year The Credit Was Disallowed Or Reduced.

Do not file form 8862 for the: • 2 years after the most. Here's how to file form 8862 in turbotax. How long does it take to process form 8862.

Put Your Name And Social Security Number On The Statement And Attach It At.

Complete, edit or print tax forms instantly. Number each entry on the statement to correspond with the line number on form 8862. Usually, taxpayers receive their refunds within 21 days. Web michael mccarty obituary.

Your Eic Was Reduced Or Disallowed For Any Reason Other Than A Math Or Clerical Error For.

Web how long does it take to process form 8862 irs fax number for form 8862 how to fill out form 8862 form 8862 required irs form 8862 pdf where to send form 8862 freetaxusa. Web how long will filing an 8862 delay my refund. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web in either of these cases, you can take the credit(s) without filing form 8862 if you meet all the credit’s eligibility requirements.

Web Not Use The Married Filing Separate (Mfs) Filing Status.

Results are expected for 2015. To start the blank, use the fill camp; Web american opportunity tax credit (aotc) you may need to: Pay back the claims, plus interest.