Ho8 Policy Form

Ho8 Policy Form - If the home you are looking to buy is older you will most. Web an ho8 policy is known as a modified coverage form. Web the homeowners modified form 8 (ho 8) is part of the insurance services office, inc. Web jul 17, 2019 most lenders will require you to have homeowners insurance in order to qualify for a mortgage. The ho 8 form provides basic named perils coverage for. Web the policy covers the mobile home itself, other structures on the property (like fences or sheds), belongings, personal liability, and loss of use, and medical payments. Unless you are an insurance agent, you may not know that there are multiple types of home insurance. The 10 perils the ho8 home insurance. Web ho8 policy, also called the modified coverage form, is a type of home insurance for older buildings where the replacement costs potentially outweigh the market value. Web now, working with a 00 08 05 11 requires at most 5 minutes.

It is a named peril policy that covers the building on an actual cash value basis (replacement cost minus. Web the homeowners modified form 8 (ho 8) is part of the insurance services office, inc. Web an ho8 policy is known as a modified coverage form. The 10 perils the ho8 home insurance. Unless you are an insurance agent, you may not know that there are multiple types of home insurance. To give you a better idea of. Web now, working with a 00 08 05 11 requires at most 5 minutes. If the home you are looking to buy is older you will most. The ho 8 form provides basic named perils coverage for. Web ho8 policy, also called the modified coverage form, is a type of home insurance for older buildings where the replacement costs potentially outweigh the market value.

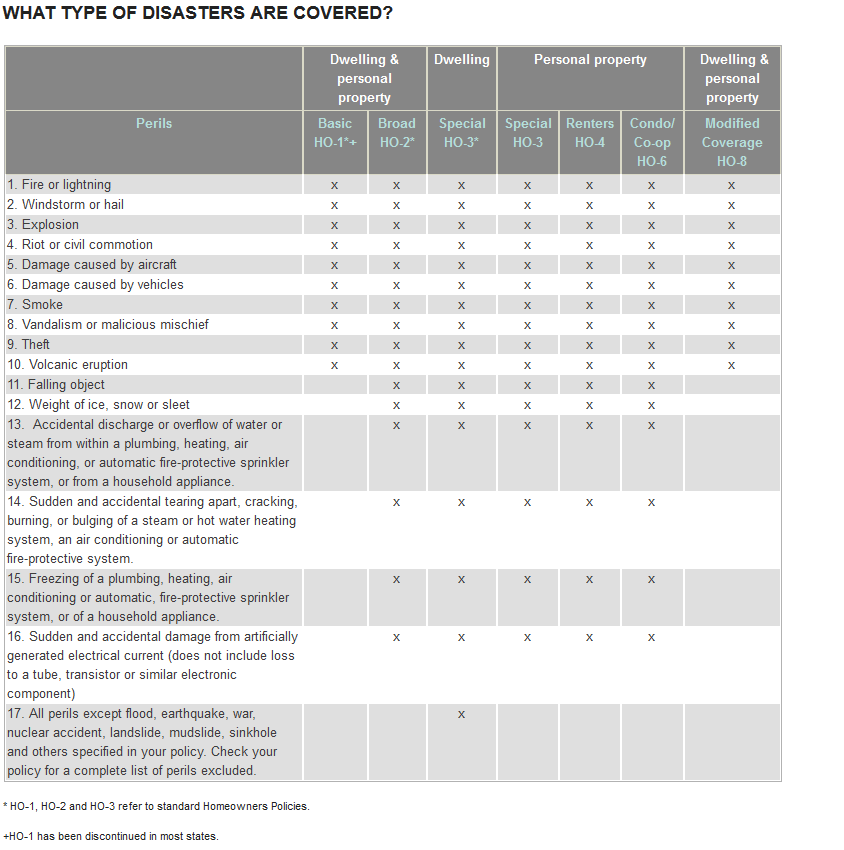

Web ho8 policy, also called the modified coverage form, is a type of home insurance for older buildings where the replacement costs potentially outweigh the market value. The 10 perils the ho8 home insurance. To give you a better idea of. It is a named peril policy that covers the building on an actual cash value basis (replacement cost minus. The ho 8 form provides basic named perils coverage for. Web now, working with a 00 08 05 11 requires at most 5 minutes. If the home you are looking to buy is older you will most. Web jul 17, 2019 most lenders will require you to have homeowners insurance in order to qualify for a mortgage. Web fire or lightning windstorm or hail explosion riot or civil commotion aircraft vehicles(unless caused by the insured) smoke vandalism or malicious mischief theft. Unless you are an insurance agent, you may not know that there are multiple types of home insurance.

Ho8 Insurance / 2 ericacalefipoesiasereflexoes

If the home you are looking to buy is older you will most. Unless you are an insurance agent, you may not know that there are multiple types of home insurance. Web now, working with a 00 08 05 11 requires at most 5 minutes. Web the homeowners modified form 8 (ho 8) is part of the insurance services office,.

Homeowners Application Fill and Sign Printable Template Online US

If the home you are looking to buy is older you will most. Web jul 17, 2019 most lenders will require you to have homeowners insurance in order to qualify for a mortgage. Web an ho8 policy is known as a modified coverage form. It is a named peril policy that covers the building on an actual cash value basis.

Ho8 Insurance / 2 ericacalefipoesiasereflexoes

To give you a better idea of. Web jul 17, 2019 most lenders will require you to have homeowners insurance in order to qualify for a mortgage. It is a named peril policy that covers the building on an actual cash value basis (replacement cost minus. Unless you are an insurance agent, you may not know that there are multiple.

HO8 VZW

It is a named peril policy that covers the building on an actual cash value basis (replacement cost minus. Web an ho8 policy is known as a modified coverage form. Web now, working with a 00 08 05 11 requires at most 5 minutes. Web ho8 policy, also called the modified coverage form, is a type of home insurance for.

HO8 Policy Definition Kin Insurance

Web jul 17, 2019 most lenders will require you to have homeowners insurance in order to qualify for a mortgage. Web the homeowners modified form 8 (ho 8) is part of the insurance services office, inc. Web the policy covers the mobile home itself, other structures on the property (like fences or sheds), belongings, personal liability, and loss of use,.

What is an HO8 insurance policy?

To give you a better idea of. Web jul 17, 2019 most lenders will require you to have homeowners insurance in order to qualify for a mortgage. Web the policy covers the mobile home itself, other structures on the property (like fences or sheds), belongings, personal liability, and loss of use, and medical payments. The ho 8 form provides basic.

What Does an HO8 Policy Cover? Transactly

To give you a better idea of. Web jul 17, 2019 most lenders will require you to have homeowners insurance in order to qualify for a mortgage. Unless you are an insurance agent, you may not know that there are multiple types of home insurance. Web now, working with a 00 08 05 11 requires at most 5 minutes. Web.

What is the difference between a HO8 and HO3 home insurance policy?

If the home you are looking to buy is older you will most. Web the homeowners modified form 8 (ho 8) is part of the insurance services office, inc. Web ho8 policy, also called the modified coverage form, is a type of home insurance for older buildings where the replacement costs potentially outweigh the market value. Web jul 17, 2019.

HO3 VS. HO5 Homeowners Policies. What's the difference?

If the home you are looking to buy is older you will most. Web ho8 policy, also called the modified coverage form, is a type of home insurance for older buildings where the replacement costs potentially outweigh the market value. Web the homeowners modified form 8 (ho 8) is part of the insurance services office, inc. Web now, working with.

HO8 Policy vs HO3 Home Insurance // What's The Difference?

Web now, working with a 00 08 05 11 requires at most 5 minutes. Web the homeowners modified form 8 (ho 8) is part of the insurance services office, inc. Web fire or lightning windstorm or hail explosion riot or civil commotion aircraft vehicles(unless caused by the insured) smoke vandalism or malicious mischief theft. If the home you are looking.

To Give You A Better Idea Of.

Unless you are an insurance agent, you may not know that there are multiple types of home insurance. Web an ho8 policy is known as a modified coverage form. Web the homeowners modified form 8 (ho 8) is part of the insurance services office, inc. The ho 8 form provides basic named perils coverage for.

It Is A Named Peril Policy That Covers The Building On An Actual Cash Value Basis (Replacement Cost Minus.

Web ho8 policy, also called the modified coverage form, is a type of home insurance for older buildings where the replacement costs potentially outweigh the market value. Web fire or lightning windstorm or hail explosion riot or civil commotion aircraft vehicles(unless caused by the insured) smoke vandalism or malicious mischief theft. The 10 perils the ho8 home insurance. Web jul 17, 2019 most lenders will require you to have homeowners insurance in order to qualify for a mortgage.

Web Now, Working With A 00 08 05 11 Requires At Most 5 Minutes.

Web the policy covers the mobile home itself, other structures on the property (like fences or sheds), belongings, personal liability, and loss of use, and medical payments. If the home you are looking to buy is older you will most.