Georgia Property Tax Appeal Form

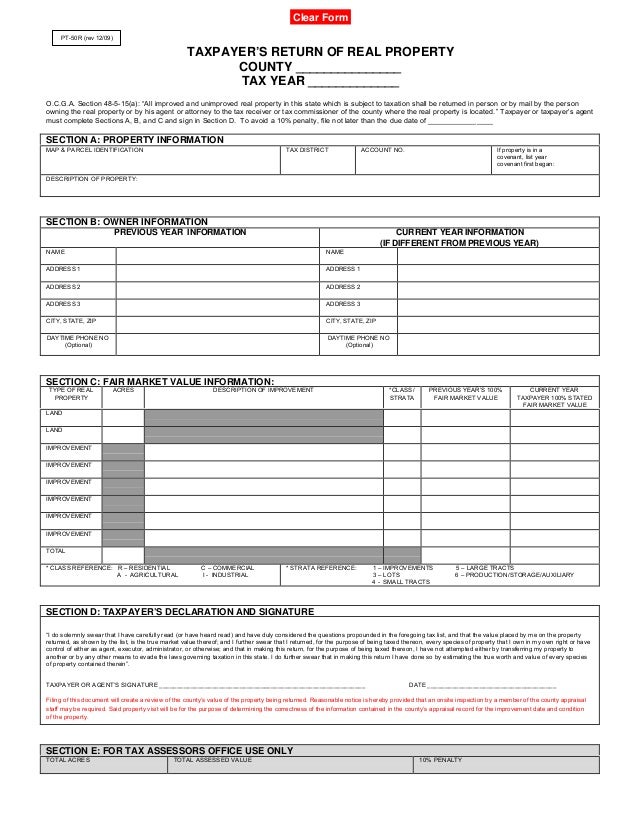

Georgia Property Tax Appeal Form - This form is to filed with your county board of tax assessors within 45 days of the date of the notice. _____________ name address address city state home phone work phone email address zip property / appeal type (check one) real property id number property description specify grounds for appeal: The deadline for appealing an assessment is exactly 45 days after the notice of assessment was mailed by the county tax commissioner. Web how to appeal a property tax assessment in georgia. Web the state of georgia provides a uniform appeal form for use by property owners. Web while we encourage online filing, if you wish to file an appeal manually, click the link below to access an appeal form. Georgia law provides a procedure for filing property tax returns and property tax appeals at the county level. Can i research the values of property in my county online? Here's the really confusing part. Web the document shown below is the standard georgia department of revenue tax appeal form designated for use by all georgia counties.

Web how do i appeal an annual notice of assessment of my property? Web the document shown below is the standard georgia department of revenue tax appeal form designated for use by all georgia counties. Web the state of georgia provides a uniform appeal form for use by property owners. Taxpayers may file a property tax return (declaration of value) in one of two ways: Web while we encourage online filing, if you wish to file an appeal manually, click the link below to access an appeal form. Can i get a copy of my property tax bill? The deadline for appealing an assessment is exactly 45 days after the notice of assessment was mailed by the county tax commissioner. How do i figure the tax on my home? To protest by mail : By paying taxes in the prior year on their property the value which was the basis for tax.

The deadline for appealing an assessment is exactly 45 days after the notice of assessment was mailed by the county tax commissioner. Can i research the values of property in my county online? This form is to filed with your county board of tax assessors within 45 days of the date of the notice. Personal motor vehicle manufactured home. Georgia law provides a procedure for filing property tax returns and property tax appeals at the county level. Log on to the georgia tax center. Web how to appeal a property tax assessment in georgia. How do i figure the tax on my home? By paying taxes in the prior year on their property the value which was the basis for tax. Can i get a copy of my property tax bill?

Property Tax Appeals in a Nutshell by Jon M. Ripans

Personal motor vehicle manufactured home. The deadline for appealing an assessment is exactly 45 days after the notice of assessment was mailed by the county tax commissioner. Taxpayers may file a property tax return (declaration of value) in one of two ways: When are property taxes due? By paying taxes in the prior year on their property the value which.

ad valorem tax family member Onerous Ejournal Image Database

How do i figure the tax on my home? Web how do i appeal an annual notice of assessment of my property? In the initial written dispute, property owners must indicate their preferred method of appeal. Here's the really confusing part. Web how to appeal a property tax assessment in georgia.

How to Appeal Excessive Property Tax Assessments YouTube

_____________ name address address city state home phone work phone email address zip property / appeal type (check one) real property id number property description specify grounds for appeal: Can i get a copy of my property tax bill? Web how do i appeal an annual notice of assessment of my property? How do i figure the tax on my.

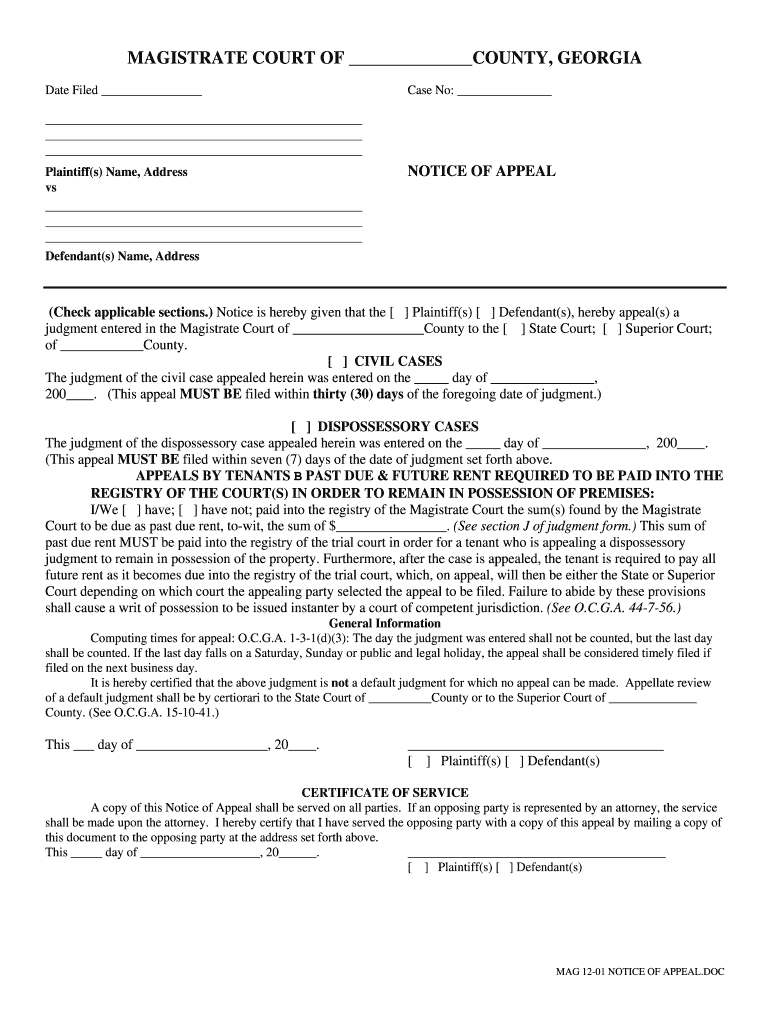

Notice Of Appeal Sample Fill Out and Sign Printable PDF

When are property taxes due? Personal motor vehicle manufactured home. Can i research the values of property in my county online? Web how do i appeal an annual notice of assessment of my property? For even more information, visit the georgia tax center website.

Part 2 how to appeal your property taxes Michelle Hatch Realtor

Taxpayers may file a property tax return (declaration of value) in one of two ways: In the initial written dispute, property owners must indicate their preferred method of appeal. For even more information, visit the georgia tax center website. Web while we encourage online filing, if you wish to file an appeal manually, click the link below to access an.

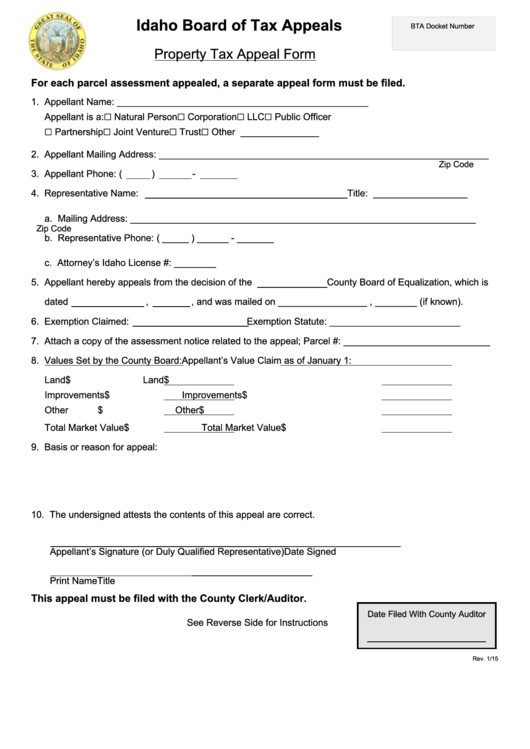

Fillable Property Tax Appeal Form Idaho Board Of Tax Appeals

The state of georgia provides a uniform appeal form for use by property owners. Web you may not appeal a proposed assessment with the georgia tax tribunal. In the initial written dispute, property owners must indicate their preferred method of appeal. Web while we encourage online filing, if you wish to file an appeal manually, click the link below to.

How to Fill Out Tax Appeal Form (GA PT311A) YouTube

The deadline for appealing an assessment is exactly 45 days after the notice of assessment was mailed by the county tax commissioner. Web the document shown below is the standard georgia department of revenue tax appeal form designated for use by all georgia counties. In the initial written dispute, property owners must indicate their preferred method of appeal. How do.

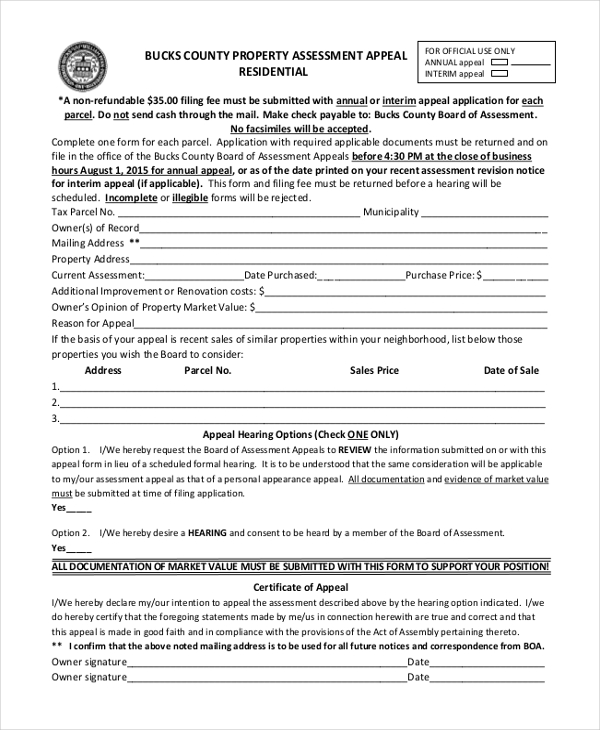

FREE 9+ Sample Property Assessment Forms in PDF MS Word

Here's the really confusing part. Web while we encourage online filing, if you wish to file an appeal manually, click the link below to access an appeal form. How do i figure the tax on my home? Web the state of georgia provides a uniform appeal form for use by property owners. Can i get a copy of my property.

Here's how to appeal property tax assessments

Georgia law provides a procedure for filing property tax returns and property tax appeals at the county level. Can i research the values of property in my county online? Here's the really confusing part. Log on to the georgia tax center. By paying taxes in the prior year on their property the value which was the basis for tax.

Http Dor Gov Documents Property Tax Appeal Assessment Form

Web how to appeal a property tax assessment in georgia. By paying taxes in the prior year on their property the value which was the basis for tax. Personal motor vehicle manufactured home. Web you may not appeal a proposed assessment with the georgia tax tribunal. Web while we encourage online filing, if you wish to file an appeal manually,.

When Are Property Taxes Due?

By paying taxes in the prior year on their property the value which was the basis for tax. Web the state of georgia provides a uniform appeal form for use by property owners. Personal motor vehicle manufactured home. Web how do i appeal an annual notice of assessment of my property?

How Do I Figure The Tax On My Home?

Web you may not appeal a proposed assessment with the georgia tax tribunal. This form is to filed with your county board of tax assessors within 45 days of the date of the notice. Taxpayers may file a property tax return (declaration of value) in one of two ways: In the initial written dispute, property owners must indicate their preferred method of appeal.

The Property Owner Must Declare Their Chosen Method Of Appeal.

To protest by mail : Web the document shown below is the standard georgia department of revenue tax appeal form designated for use by all georgia counties. Can i research the values of property in my county online? Here's the really confusing part.

Web While We Encourage Online Filing, If You Wish To File An Appeal Manually, Click The Link Below To Access An Appeal Form.

The deadline for appealing an assessment is exactly 45 days after the notice of assessment was mailed by the county tax commissioner. Web how to appeal a property tax assessment in georgia. The state of georgia provides a uniform appeal form for use by property owners. _____________ name address address city state home phone work phone email address zip property / appeal type (check one) real property id number property description specify grounds for appeal: