Ga Form 501 Instructions

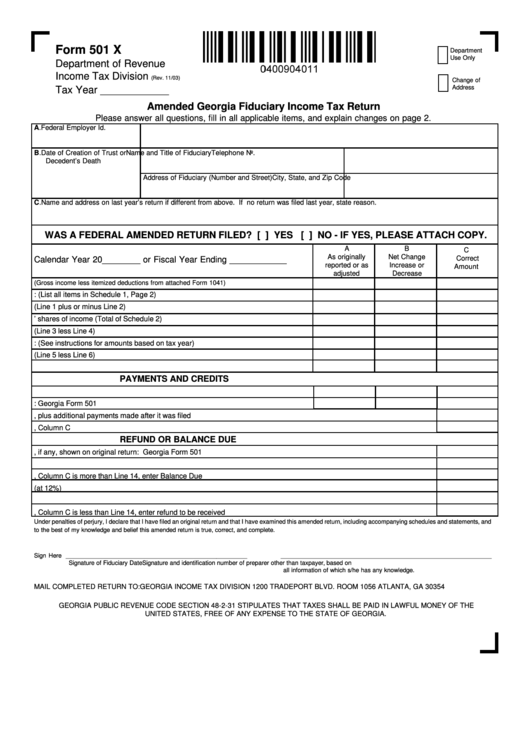

Ga Form 501 Instructions - 4/14) fiduciary income tax return mailing address: 06/25/20) fiduciaryincometaxreturn 2020 (approved web version) page 1 fiscal year beginning nonresident change in trust or estate name change in. Web the office of the georgia secretary of state brad raffensperger. Web print blank form > georgia department of revenue zoom in; Web we last updated the fiduciary income tax return in january 2023, so this is the latest version of form 501, fully updated for tax year 2022. 04/27/22) amended fiduciary income tax return 2022page1 federal amended return filed (please attach copy) fiscal yearbeginning fiscal year. You can download or print. Web instructions for form 2106 employee business expenses 4562 depreciation & amortization georgia depreciation and amortization form, includes information on. Web georgia form501 fiduciary incometaxreturn instructions georgia has adopted most of the provisions of all federal tax acts (as they relate to the computation of federal taxable. Web every resident and nonresident fiduciary having income from sources within georgia or managing funds or property for the benefit of a resident of this state is required to file a.

Business leagues, employee benefit associations or funds, fraternal. 08/02/21) fiduciaryincometaxreturn 2021 (approved web2 version) page 1 fiscal year beginning nonresident change in trust or estate name. Web georgia form 501 (rev. Web the office of the georgia secretary of state brad raffensperger. 06/25/20) fiduciaryincometaxreturn 2020 (approved web version) page 1 fiscal year beginning nonresident change in trust or estate name change in. Web instructions for form 2106 employee business expenses 4562 depreciation & amortization georgia depreciation and amortization form, includes information on. Web print blank form > georgia department of revenue save form. Web georgia form501 fiduciary incometaxreturn instructions georgia has adopted most of the provisions of all federal tax acts (as they relate to the computation of federal taxable. Web the irs has published its general requirements for exemption online, as well as special instructions for: Web every resident and nonresident fiduciary having income from sources within georgia or managing funds or property for the benefit of a resident of this state is required to file a.

Georgia form georgia department of revenue processing center po box 740316 atlanta, georgia. 06/25/20) fiduciaryincometaxreturn 2020 (approved web version) page 1 fiscal year beginning nonresident change in trust or estate name change in. Web the irs has published its general requirements for exemption online, as well as special instructions for: 04/27/22) amended fiduciary income tax return 2022page1 federal amended return filed (please attach copy) fiscal yearbeginning fiscal year. The georgia secretary of state oversees voting, tracks annual corporate filings, grants professional licenses, and. Business leagues, employee benefit associations or funds, fraternal. 4/14) fiduciary income tax return mailing address: Web georgia form 501 (rev. Web instructions for form 2106 employee business expenses 4562 depreciation & amortization georgia depreciation and amortization form, includes information on. Web georgia form501 fiduciary incometaxreturn instructions georgia has adopted most of the provisions of all federal tax acts (as they relate to the computation of federal taxable.

2019 Form GA DoR 500NOL Fill Online, Printable, Fillable, Blank

Web georgia form501 fiduciary incometaxreturn instructions georgia has adopted most of the provisions of all federal tax acts (as they relate to the computation of federal taxable. 08/02/21) fiduciaryincometaxreturn 2021 (approved web2 version) page 1 fiscal year beginning nonresident change in trust or estate name. You can download or print. Web we last updated the fiduciary income tax return in.

Fill Free fillable AUTHORITY AGENT (AAR) NJSDA Form

Web every resident and nonresident fiduciary having income from sources within georgia or managing funds or property for the benefit of a resident of this state is required to file a. 04/27/22) fiduciaryincometaxreturn 2022 (approved web2 version) page 1 fiscal year beginning change in trust or estate name change in. Web the office of the georgia secretary of state brad.

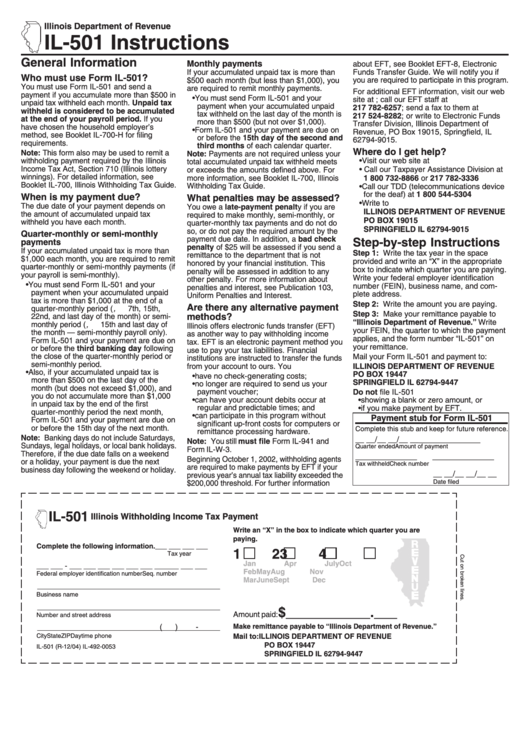

Form Il501 Illinois Withholding Tax Payment printable pdf

Print blank form > georgia department of revenue. The georgia secretary of state oversees voting, tracks annual corporate filings, grants professional licenses, and. Web the office of the georgia secretary of state brad raffensperger. 4/14) fiduciary income tax return mailing address: Web print blank form > georgia department of revenue zoom in;

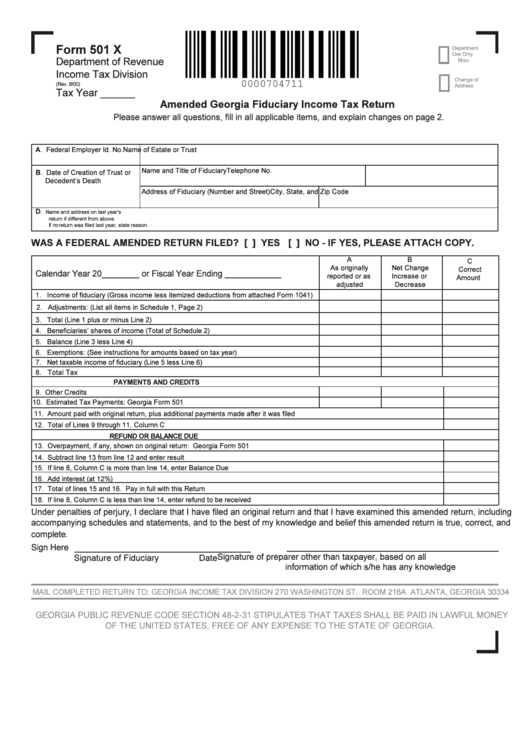

Form 501 X Amended Fiduciary Tax Return printable pdf

Web the office of the georgia secretary of state brad raffensperger. Web georgia form 501 (rev. 04/27/22) fiduciaryincometaxreturn 2022 (approved web2 version) page 1 fiscal year beginning change in trust or estate name change in. Web print blank form > georgia department of revenue save form. Web georgia form501 fiduciary incometaxreturn instructions georgia has adopted most of the provisions of.

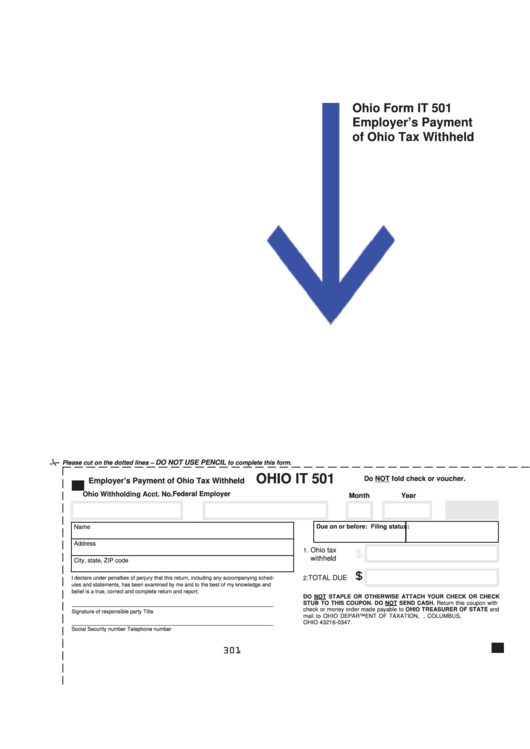

Fillable Form It 501 Employer'S Payment Of Ohio Tax Withheld

Georgia form georgia department of revenue processing center po box 740316 atlanta, georgia. Web the irs has published its general requirements for exemption online, as well as special instructions for: Web georgia form501 fiduciary incometaxreturn instructions georgia has adopted most of the provisions of all federal tax acts (as they relate to the computation of federal taxable. Web every resident.

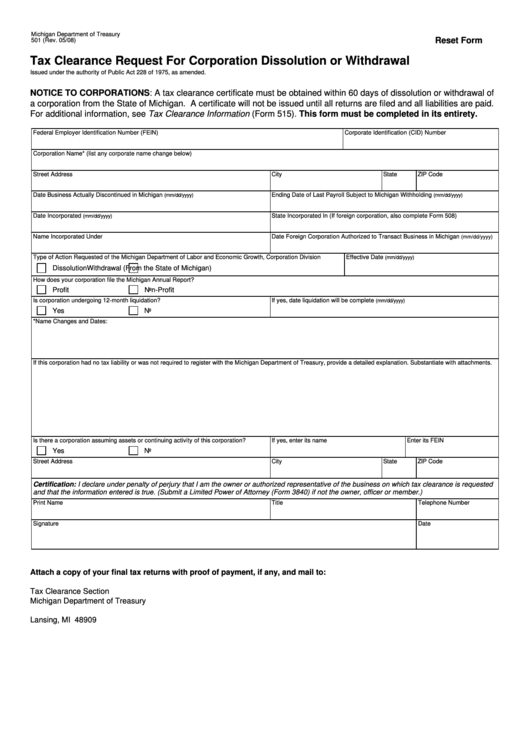

Fillable Form 501 Tax Clearance Request For Corporation Dissolution

Web georgia form 501 (rev. Business leagues, employee benefit associations or funds, fraternal. Web georgia form 501 (rev. 04/27/22) fiduciaryincometaxreturn 2022 (approved web2 version) page 1 fiscal year beginning change in trust or estate name change in. 06/25/20) fiduciaryincometaxreturn 2020 (approved web version) page 1 fiscal year beginning nonresident change in trust or estate name change in.

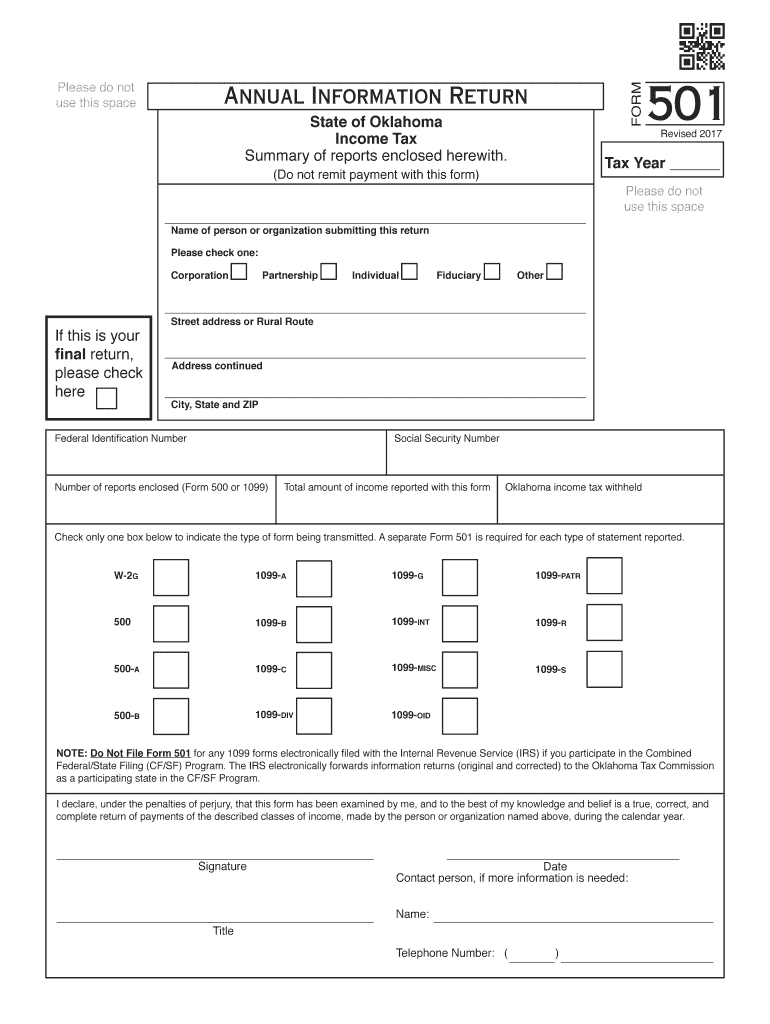

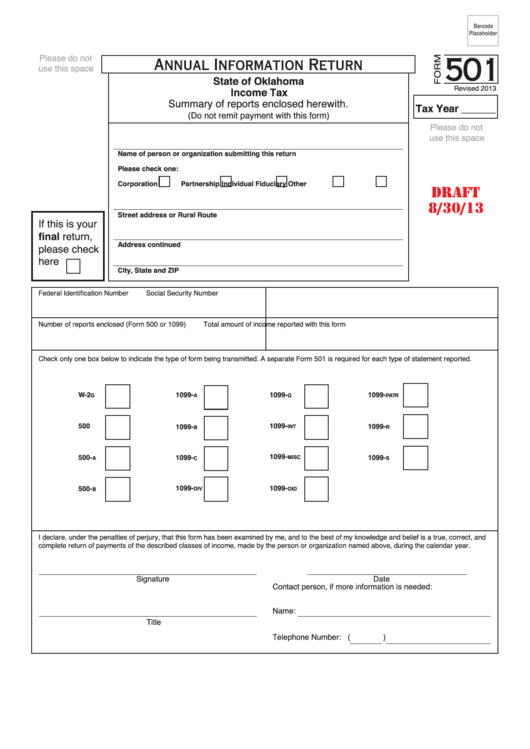

20172020 OK Form 501 Fill Online, Printable, Fillable, Blank pdfFiller

Web georgia form 501 (rev. Business leagues, employee benefit associations or funds, fraternal. Web print blank form > georgia department of revenue save form. 04/27/22) amended fiduciary income tax return 2022page1 federal amended return filed (please attach copy) fiscal yearbeginning fiscal year. Web georgia form 501 (rev.

Form 501 X Amended Fiduciary Tax Return printable pdf

Web georgia form 501 (rev. 08/02/21) fiduciaryincometaxreturn 2021 (approved web2 version) page 1 fiscal year beginning nonresident change in trust or estate name. Web the irs has published its general requirements for exemption online, as well as special instructions for: 04/27/22) fiduciaryincometaxreturn 2022 (approved web2 version) page 1 fiscal year beginning change in trust or estate name change in. Web.

GA Form 500 20182022 Fill out Tax Template Online US Legal Forms

Georgia form georgia department of revenue processing center po box 740316 atlanta, georgia. Web we last updated georgia form 501 in january 2023 from the georgia department of revenue. 06/25/20) fiduciaryincometaxreturn 2020 (approved web version) page 1 fiscal year beginning nonresident change in trust or estate name change in. 4/14) fiduciary income tax return mailing address: Web print blank form.

Form 501 Draft Annual Information Return State Of Oklahoma

4/14) fiduciary income tax return mailing address: Print blank form > georgia department of revenue. 04/27/22) fiduciaryincometaxreturn 2022 (approved web2 version) page 1 fiscal year beginning change in trust or estate name change in. You can download or print. The georgia secretary of state oversees voting, tracks annual corporate filings, grants professional licenses, and.

Web Instructions For Form 2106 Employee Business Expenses 4562 Depreciation & Amortization Georgia Depreciation And Amortization Form, Includes Information On.

Business leagues, employee benefit associations or funds, fraternal. Web georgia form501 fiduciary incometaxreturn instructions georgia has adopted most of the provisions of all federal tax acts (as they relate to the computation of federal taxable. Web we last updated the fiduciary income tax return in january 2023, so this is the latest version of form 501, fully updated for tax year 2022. You can download or print.

Web The Office Of The Georgia Secretary Of State Brad Raffensperger.

Web print blank form > georgia department of revenue zoom in; Web every resident and nonresident fiduciary having income from sources within georgia or managing funds or property for the benefit of a resident of this state is required to file a. 04/27/22) amended fiduciary income tax return 2022page1 federal amended return filed (please attach copy) fiscal yearbeginning fiscal year. The georgia secretary of state oversees voting, tracks annual corporate filings, grants professional licenses, and.

08/02/21) Fiduciaryincometaxreturn 2021 (Approved Web2 Version) Page 1 Fiscal Year Beginning Nonresident Change In Trust Or Estate Name.

Web georgia form 501 (rev. Georgia form georgia department of revenue processing center po box 740316 atlanta, georgia. Web georgia form 501 (rev. 06/25/20) fiduciaryincometaxreturn 2020 (approved web version) page 1 fiscal year beginning nonresident change in trust or estate name change in.

Print Blank Form > Georgia Department Of Revenue.

Web print blank form > georgia department of revenue save form. Web the irs has published its general requirements for exemption online, as well as special instructions for: Web we last updated georgia form 501 in january 2023 from the georgia department of revenue. 4/14) fiduciary income tax return mailing address: