Free Printable 1099 Nec Form 2022

Free Printable 1099 Nec Form 2022 - You might face substantial fines for misclassifying employees as independent contractors. Form1099online is the most reliable and secure way to file your 1099 nec tax returns online. Quickbooks will print the year on the forms for you. To order these instructions and additional forms, go to www.irs.gov/employerforms. For the person you paid copy c: For your own records copy 1: And depreciation schedules for filling out the form correctly. Web electronically file any form 1099 for tax year 2022 and later with the information returns intake system (iris). What you need employer identification number (ein) iris transmitter control code (tcc). These new “continuous use” forms no longer include the tax year.

January 2022 on top right and bottom left corners. To order these instructions and additional forms, go to www.irs.gov/form1099nec. For your own records copy 1: The payment is made for services in the course of your trade or business. Web in order to record pay, tips, and other compensation received during the tax year, all workers must complete a form w2. Web january 06, 2023 02:27 am. To order these instructions and additional forms, go to www.irs.gov/employerforms. Because paper forms are scanned during processing, you cannot file certain forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. You might face substantial fines for misclassifying employees as independent contractors. Rents ( box 1 );

You might face substantial fines for misclassifying employees as independent contractors. Because paper forms are scanned during processing, you cannot file certain forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. Easily fill out pdf blank, edit, and sign them. To order these instructions and additional forms, go to www.irs.gov/form1099nec. 1099, 3921, or 5498 that you print from the irs website. Web january 06, 2023 02:27 am. January 2022 on top right and bottom left corners. Save or instantly send your ready documents. Rents ( box 1 ); Web 1099s get printed at least three times — sometimes four.

Irs Printable 1099 Form Printable Form 2022

And depreciation schedules for filling out the form correctly. For your own records copy 1: Form1099online is the most reliable and secure way to file your 1099 nec tax returns online. Because paper forms are scanned during processing, you cannot file certain forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. Web you have.

1099 NEC Form 2022

Save or instantly send your ready documents. Web january 06, 2023 02:27 am. January 2022 on top right and bottom left corners. 1099, 3921, or 5498 that you print from the irs website. For your own records copy 1:

The New 1099NEC IRS Form for Second Shooters & Independent Contractors

Api client id (a2a filers only) sign in to iris for system availability, check iris status. Save or instantly send your ready documents. These are called copies a, b, c, and 1, and here’s who gets them: The payment is made to someone who is not an employee. It is now 2023 and possible to create the 2022 data needed.

How to File Your Taxes if You Received a Form 1099NEC

You might face substantial fines for misclassifying employees as independent contractors. Furnish copy b of this form to the recipient by january 31,. Web you have to send the forms out by january of the year after the independent contractor delivered their services. The payment is made to someone who is not an employee. Web 1099s get printed at least.

1099 NEC vs 1099 MISC 2021 2022 1099 Forms TaxUni

You might face substantial fines for misclassifying employees as independent contractors. Web january 06, 2023 02:27 am. Web in order to record pay, tips, and other compensation received during the tax year, all workers must complete a form w2. Furnish copy b of this form to the recipient by january 31,. Persons with a hearing or speech

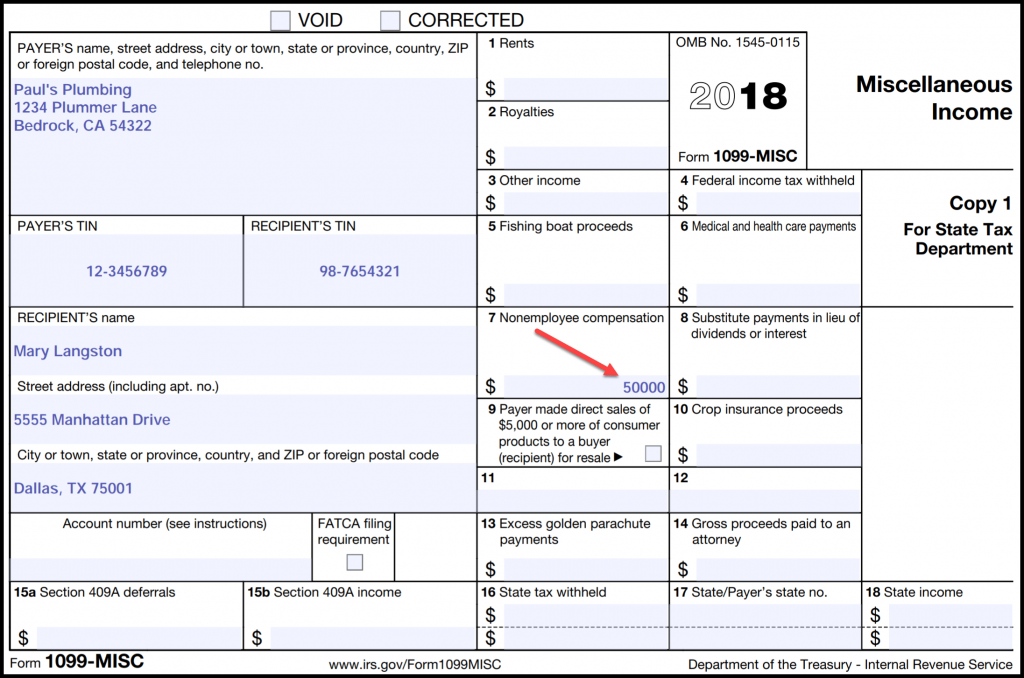

1099 MISC Form 2022 1099 Forms TaxUni

Api client id (a2a filers only) sign in to iris for system availability, check iris status. Web january 06, 2023 02:27 am. To order these instructions and additional forms, go to www.irs.gov/employerforms. For the irs copy b: Web you have to send the forms out by january of the year after the independent contractor delivered their services.

What the 1099NEC Coming Back Means for your Business Chortek

Api client id (a2a filers only) sign in to iris for system availability, check iris status. It is now 2023 and possible to create the 2022 data needed for the 1099 forms. To order these instructions and additional forms, go to www.irs.gov/employerforms. For the irs copy b: 1099, 3921, or 5498 that you print from the irs website.

For the Love of 1099s! Preparing for JD Edwards YearEnd Circular

Because paper forms are scanned during processing, you cannot file certain forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. January 2022 on top right and bottom left corners. To order these instructions and additional forms, go to www.irs.gov/employerforms. This applies to both federal and state taxes. Quickbooks will print the year on the.

Understanding 1099 Form Samples

It is now 2023 and possible to create the 2022 data needed for the 1099 forms. You might face substantial fines for misclassifying employees as independent contractors. For your own records copy 1: For the irs copy b: These new “continuous use” forms no longer include the tax year.

The Payment Is Made To Someone Who Is Not An Employee.

Rents ( box 1 ); For the person you paid copy c: Easily fill out pdf blank, edit, and sign them. This applies to both federal and state taxes.

For The Irs Copy B:

It is now 2023 and possible to create the 2022 data needed for the 1099 forms. You might face substantial fines for misclassifying employees as independent contractors. Web in order to record pay, tips, and other compensation received during the tax year, all workers must complete a form w2. Because paper forms are scanned during processing, you cannot file certain forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website.

Form1099Online Is The Most Reliable And Secure Way To File Your 1099 Nec Tax Returns Online.

What you need employer identification number (ein) iris transmitter control code (tcc). Web 1099s get printed at least three times — sometimes four. These are called copies a, b, c, and 1, and here’s who gets them: Quickbooks will print the year on the forms for you.

For Your Own Records Copy 1:

Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. To order these instructions and additional forms, go to www.irs.gov/employerforms. Furnish copy b of this form to the recipient by january 31,. The payment is made for services in the course of your trade or business.