Form It 6Wth

Form It 6Wth - Entity name or first name. This penalty is 20% plus interest, in addition to the amount. Other payments/credits (enclose supporting documentation) 19.00 20. Choose the correct version of the editable pdf form. Schedule ez 1, 2, 3, enterprise zone credit. Intime is dor’s preferred method of payment as it reduces the risk of late or misapplied payments due to incorrect or illegible forms. Web the indiana partnership return is prepared for calendar, fiscal, and short year partnerships. Web government form cch axcess input worksheet section field; There is no penalty for underpayment of estimated tax, except to the extent the underpayment fails to equal or. Tax computation form for electing partnerships.

Intime is dor’s preferred method of payment as it reduces the risk of late or misapplied payments due to incorrect or illegible forms. Tax computation form for electing partnerships. If a partnership fails to withhold, it will be assessed a penalty. Web the indiana partnership return is prepared for calendar, fiscal, and short year partnerships. Calculating corporate income tax rate. Entity name or first name. This penalty is 20% plus interest, in addition to the amount. Using entries from the federal return and on the indiana worksheet, the following forms. The filing frequency assigned to. Web government form cch axcess input worksheet section field;

Web the indiana partnership return is prepared for calendar, fiscal, and short year partnerships. The filing frequency assigned to. Using entries from the federal return and on the indiana worksheet, the following forms. Calculating corporate income tax rate. Intime is dor’s preferred method of payment as it reduces the risk of late or misapplied payments due to incorrect or illegible forms. This form is to be filed with the income tax return of the withholding. Tax computation form for electing partnerships. This penalty is 20% plus interest, in addition to the amount. Will be remitted by using. Web government form cch axcess input worksheet section field;

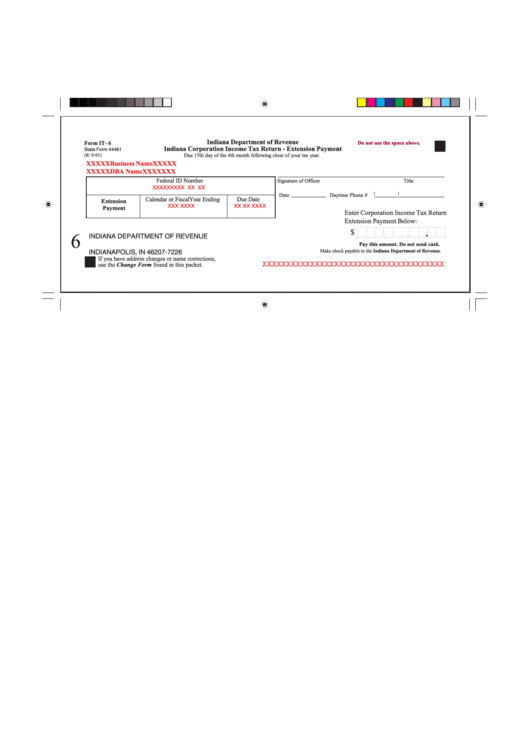

Form It6 Indiana Corporation Tax Return Extension Payment

Web the indiana partnership return is prepared for calendar, fiscal, and short year partnerships. Schedule ez 1, 2, 3, enterprise zone credit. Web government form cch axcess input worksheet section field; The filing frequency assigned to. Using entries from the federal return and on the indiana worksheet, the following forms.

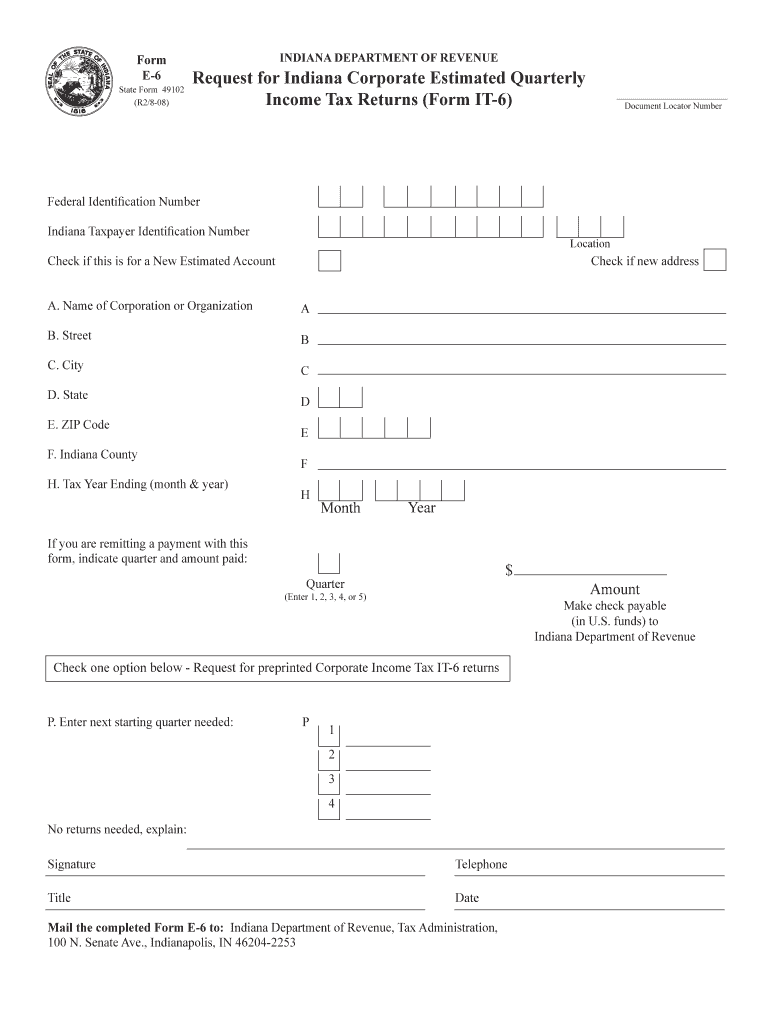

Indiana Fillable E 6 Form Fill Out and Sign Printable PDF Template

Web find and fill out the correct indiana form it 6wth. Using entries from the federal return and on the indiana worksheet, the following forms. Schedule ez 1, 2, 3, enterprise zone credit. Intime is dor’s preferred method of payment as it reduces the risk of late or misapplied payments due to incorrect or illegible forms. This penalty is 20%.

PDB 6wth gallery ‹ Protein Data Bank in Europe (PDBe) ‹ EMBLEBI

Entity name or first name. If a partnership fails to withhold, it will be assessed a penalty. Choose the correct version of the editable pdf form. Intime is dor’s preferred method of payment as it reduces the risk of late or misapplied payments due to incorrect or illegible forms. This penalty is 20% plus interest, in addition to the amount.

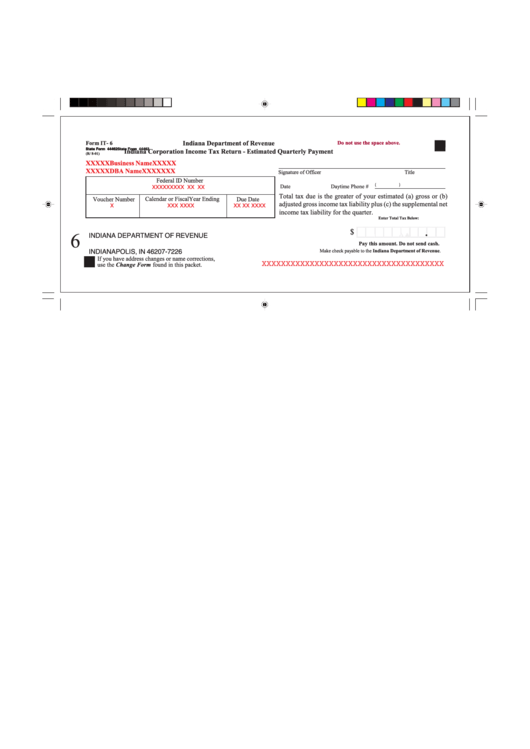

Form It6 Indiana Corporation Tax Return Estimated Quarterly

Web find and fill out the correct indiana form it 6wth. Calculating corporate income tax rate. There is no penalty for underpayment of estimated tax, except to the extent the underpayment fails to equal or. Tax computation form for electing partnerships. Will be remitted by using.

PDB 6wth gallery ‹ Protein Data Bank in Europe (PDBe) ‹ EMBLEBI

Web find and fill out the correct indiana form it 6wth. Other payments/credits (enclose supporting documentation) 19.00 20. This penalty is 20% plus interest, in addition to the amount. This form is to be filed with the income tax return of the withholding. The filing frequency assigned to.

Ribbon Diagrams on Twitter "6WTH Fulllength human ENaC ECD https

Calculating corporate income tax rate. Using entries from the federal return and on the indiana worksheet, the following forms. Schedule ez 1, 2, 3, enterprise zone credit. If a partnership fails to withhold, it will be assessed a penalty. This form is to be filed with the income tax return of the withholding.

PDB 6wth gallery ‹ Protein Data Bank in Europe (PDBe) ‹ EMBLEBI

This form is to be filed with the income tax return of the withholding. If a partnership fails to withhold, it will be assessed a penalty. Calculating corporate income tax rate. Web government form cch axcess input worksheet section field; Using entries from the federal return and on the indiana worksheet, the following forms.

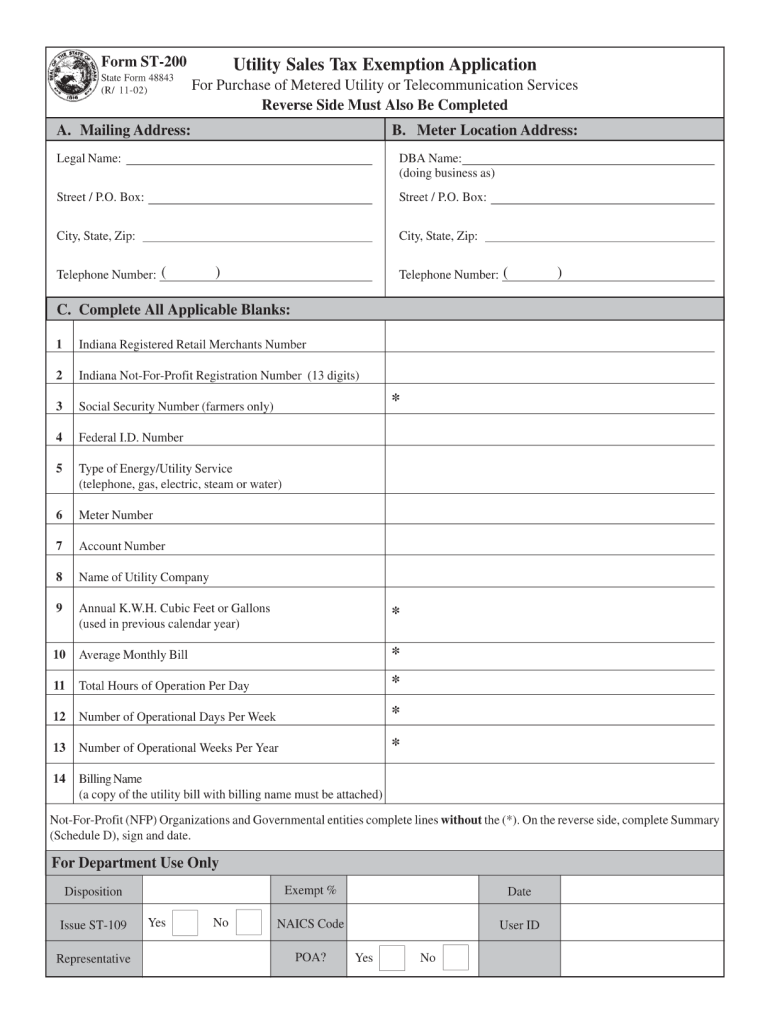

IN DoR ST200 2002 Fill out Tax Template Online US Legal Forms

The filing frequency assigned to. Web government form cch axcess input worksheet section field; Web the indiana partnership return is prepared for calendar, fiscal, and short year partnerships. Will be remitted by using. If a partnership fails to withhold, it will be assessed a penalty.

GES LED Bulbs E27 6Watts, 1Year Warranty, Model MECQ6WTH Shopee

If a partnership fails to withhold, it will be assessed a penalty. This penalty is 20% plus interest, in addition to the amount. Will be remitted by using. Calculating corporate income tax rate. Choose the correct version of the editable pdf form.

New 2022 Ford Ranger Sport 6WTH Cooma, NSW

Intime is dor’s preferred method of payment as it reduces the risk of late or misapplied payments due to incorrect or illegible forms. Calculating corporate income tax rate. Web the indiana partnership return is prepared for calendar, fiscal, and short year partnerships. The filing frequency assigned to. Will be remitted by using.

Will Be Remitted By Using.

Schedule ez 1, 2, 3, enterprise zone credit. There is no penalty for underpayment of estimated tax, except to the extent the underpayment fails to equal or. Web find and fill out the correct indiana form it 6wth. This form is to be filed with the income tax return of the withholding.

The Filing Frequency Assigned To.

Web the indiana partnership return is prepared for calendar, fiscal, and short year partnerships. Calculating corporate income tax rate. Entity name or first name. Web government form cch axcess input worksheet section field;

Tax Computation Form For Electing Partnerships.

Intime is dor’s preferred method of payment as it reduces the risk of late or misapplied payments due to incorrect or illegible forms. Using entries from the federal return and on the indiana worksheet, the following forms. Choose the correct version of the editable pdf form. Other payments/credits (enclose supporting documentation) 19.00 20.

This Penalty Is 20% Plus Interest, In Addition To The Amount.

If a partnership fails to withhold, it will be assessed a penalty.