Form It 203 B Instructions

Form It 203 B Instructions - List each eligible student only once on line a. If you are claiming the college tuition itemized deduction for more than. Were not a resident of new york state and received income during the tax. Enter that amount in column c. Web march 10, 2020 8:04 pm you are correct that generally this would not be a requirement for filing a part year resident return. It is her student status/income that is. This form is for income earned in tax year 2022, with tax.

It is her student status/income that is. Enter that amount in column c. Were not a resident of new york state and received income during the tax. If you are claiming the college tuition itemized deduction for more than. This form is for income earned in tax year 2022, with tax. List each eligible student only once on line a. Web march 10, 2020 8:04 pm you are correct that generally this would not be a requirement for filing a part year resident return.

If you are claiming the college tuition itemized deduction for more than. Web march 10, 2020 8:04 pm you are correct that generally this would not be a requirement for filing a part year resident return. List each eligible student only once on line a. This form is for income earned in tax year 2022, with tax. Enter that amount in column c. Were not a resident of new york state and received income during the tax. It is her student status/income that is.

Form B 203 Fill Out and Sign Printable PDF Template signNow

This form is for income earned in tax year 2022, with tax. List each eligible student only once on line a. It is her student status/income that is. Enter that amount in column c. If you are claiming the college tuition itemized deduction for more than.

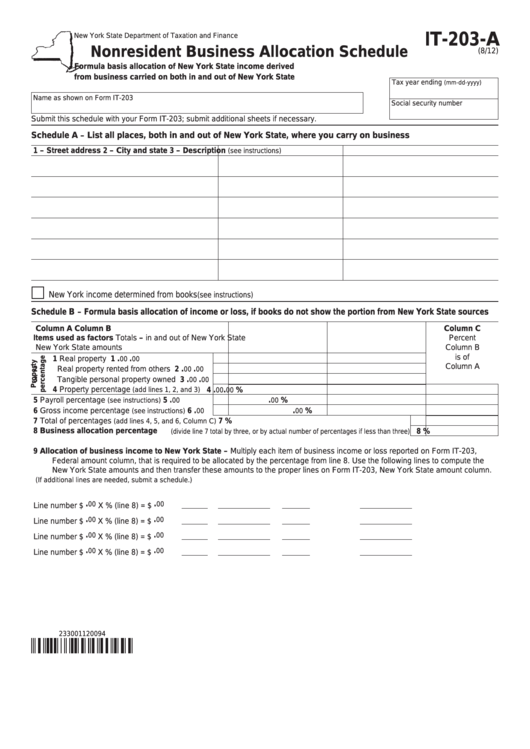

Fillable Form It203A Nonresident Business Allocation Schedule

Enter that amount in column c. This form is for income earned in tax year 2022, with tax. Were not a resident of new york state and received income during the tax. List each eligible student only once on line a. It is her student status/income that is.

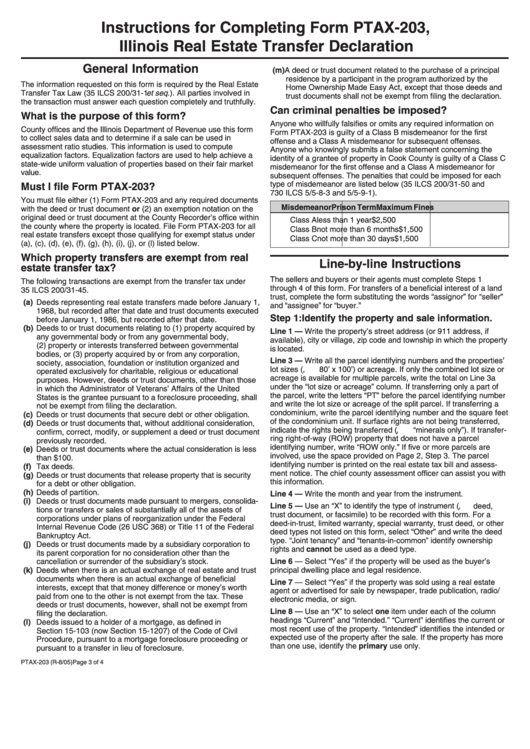

Form Ptax203 Instructions For Completing Form Ptax203, Illinois

This form is for income earned in tax year 2022, with tax. List each eligible student only once on line a. Were not a resident of new york state and received income during the tax. It is her student status/income that is. Web march 10, 2020 8:04 pm you are correct that generally this would not be a requirement for.

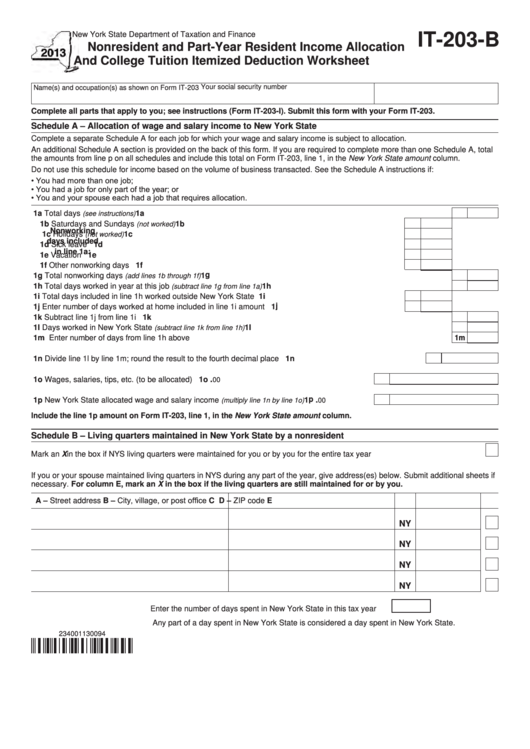

Fillable Form It203B Nonresident And PartYear Resident

This form is for income earned in tax year 2022, with tax. If you are claiming the college tuition itemized deduction for more than. Enter that amount in column c. It is her student status/income that is. Were not a resident of new york state and received income during the tax.

CC FORM 203R, FEB 05.pdf DocDroid

Web march 10, 2020 8:04 pm you are correct that generally this would not be a requirement for filing a part year resident return. If you are claiming the college tuition itemized deduction for more than. List each eligible student only once on line a. Enter that amount in column c. It is her student status/income that is.

PWD FORM 203 (Rev. 1;2010) [PDF Document]

Were not a resident of new york state and received income during the tax. Enter that amount in column c. If you are claiming the college tuition itemized deduction for more than. List each eligible student only once on line a. It is her student status/income that is.

Form IT203C Nonresident or PartYear Resident Spouse's Certification,

This form is for income earned in tax year 2022, with tax. It is her student status/income that is. If you are claiming the college tuition itemized deduction for more than. Were not a resident of new york state and received income during the tax. List each eligible student only once on line a.

Form IT203B (Fillin) Nonresident and PartYear Resident

Enter that amount in column c. If you are claiming the college tuition itemized deduction for more than. List each eligible student only once on line a. Web march 10, 2020 8:04 pm you are correct that generally this would not be a requirement for filing a part year resident return. This form is for income earned in tax year.

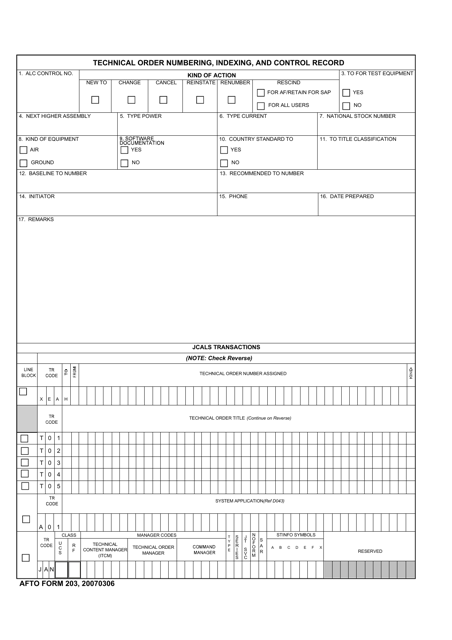

AFTO Form 203 Download Fillable PDF or Fill Online Technical Order

Enter that amount in column c. Web march 10, 2020 8:04 pm you are correct that generally this would not be a requirement for filing a part year resident return. Were not a resident of new york state and received income during the tax. It is her student status/income that is. List each eligible student only once on line a.

Form IT203GRATTB Schedule B Download Fillable PDF or Fill Online

Web march 10, 2020 8:04 pm you are correct that generally this would not be a requirement for filing a part year resident return. If you are claiming the college tuition itemized deduction for more than. Were not a resident of new york state and received income during the tax. This form is for income earned in tax year 2022,.

If You Are Claiming The College Tuition Itemized Deduction For More Than.

Web march 10, 2020 8:04 pm you are correct that generally this would not be a requirement for filing a part year resident return. This form is for income earned in tax year 2022, with tax. It is her student status/income that is. Were not a resident of new york state and received income during the tax.

Enter That Amount In Column C.

List each eligible student only once on line a.

![PWD FORM 203 (Rev. 1;2010) [PDF Document]](https://cdn.vdocuments.site/img/1200x630/reader015/image/20170729/55cf8c765503462b138ca789.png?t=1608560494)