Form 990Ez Instructions

Form 990Ez Instructions - Complete, edit or print tax forms instantly. • organizations that are described in section. As required by section 3101 of the taxpayer first. Organizations under section 501 (c), 527, or 4947 (a) (1) of the (irc). Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social. The instructions include a reminder that form. Ad get ready for tax season deadlines by completing any required tax forms today. Web short form return of organization exempt from income tax. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Luckily, the irs has defined the qualities that.

• organizations that are described in section. Complete, edit or print tax forms instantly. Ad get ready for tax season deadlines by completing any required tax forms today. Luckily, the irs has defined the qualities that. Ad download or email irs 990ez & more fillable forms, register and subscribe now! Complete if the organization is a section 501(c)(3). The instructions include a reminder that form. The organizations with gross receipts less. Form 990 must be used to file a group return, not. Organizations under section 501 (c), 527, or 4947 (a) (1) of the (irc).

The organizations with gross receipts less. Organizations under section 501 (c), 527, or 4947 (a) (1) of the (irc). Web short form return of organization exempt from income tax. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social. Form 990 must be used to file a group return, not. As required by section 3101 of the taxpayer first. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Complete if the organization is a section 501(c)(3). Complete, edit or print tax forms instantly. Luckily, the irs has defined the qualities that.

2009 form 990ez

Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Web short form return of organization exempt from income tax. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social. The instructions include a reminder that form. Ad get ready for tax season.

Form 990 or 990EZ (Sch N) Liquidation, Termination, Dissolution, or

Complete if the organization is a section 501(c)(3). Organizations under section 501 (c), 527, or 4947 (a) (1) of the (irc). Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Ad get ready for tax season deadlines by completing any required tax forms today. Under section 501(c), 527, or 4947(a)(1).

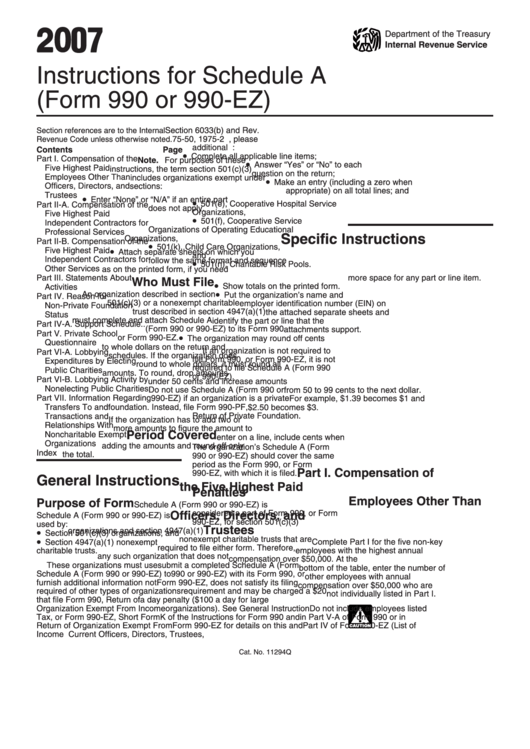

Instructions for IRS Form 990ez Short Form Return of Organization

The instructions include a reminder that form. Web short form return of organization exempt from income tax. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social. Organizations under section 501 (c), 527, or 4947 (a) (1) of the (irc). As required by section 3101 of the taxpayer first.

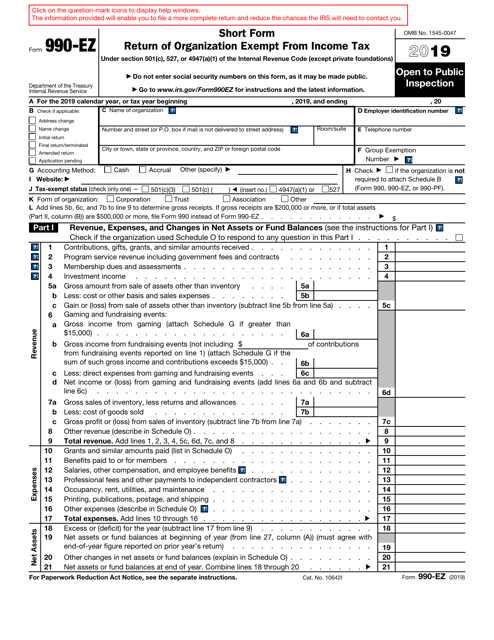

Printable Form 990ez 2019 Printable Word Searches

Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Complete, edit or print tax forms instantly. Ad download or email irs 990ez & more fillable forms, register and subscribe now! • organizations that are described in section. Organizations under section 501 (c), 527, or 4947 (a) (1) of the (irc).

2009 form 990ez

As required by section 3101 of the taxpayer first. Complete if the organization is a section 501(c)(3). Ad download or email irs 990ez & more fillable forms, register and subscribe now! Luckily, the irs has defined the qualities that. Form 990 must be used to file a group return, not.

Form 990EZ Short Form Return of Organization Exempt from Tax

Ad download or email irs 990ez & more fillable forms, register and subscribe now! • organizations that are described in section. Complete if the organization is a section 501(c)(3). Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Complete, edit or print tax forms instantly.

Fillable IRS Form 990EZ Free Printable PDF Sample FormSwift

Organizations under section 501 (c), 527, or 4947 (a) (1) of the (irc). Luckily, the irs has defined the qualities that. The organizations with gross receipts less. Web short form return of organization exempt from income tax. Form 990 must be used to file a group return, not.

Instructions For Schedule A (Form 990 Or 990Ez) 2007 printable pdf

Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Luckily, the irs has defined the qualities that. Complete, edit or print tax forms instantly. Web short form return of organization exempt from income tax. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not.

form 990 ez 2022 Fill Online, Printable, Fillable Blank form990ez

Ad get ready for tax season deadlines by completing any required tax forms today. Organizations under section 501 (c), 527, or 4947 (a) (1) of the (irc). The organizations with gross receipts less. Complete, edit or print tax forms instantly. Complete if the organization is a section 501(c)(3).

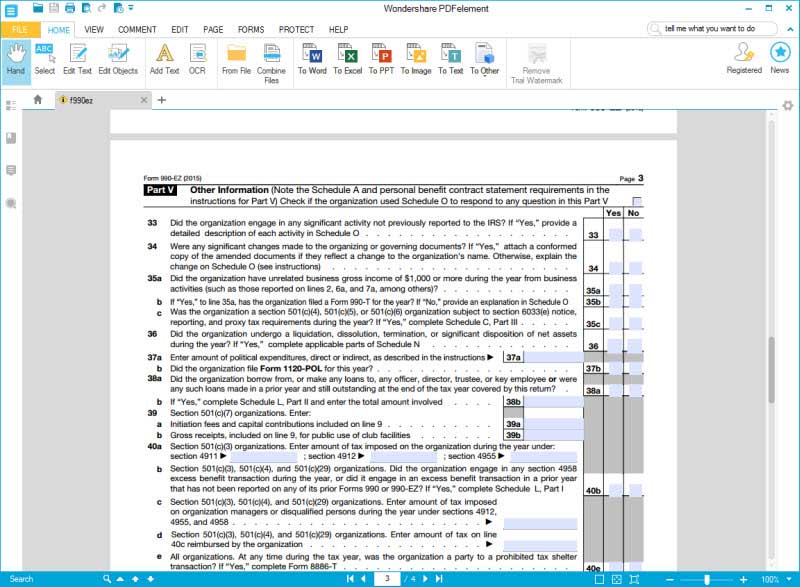

IRS Form 990EZ Filling Instructions before Working on it

• organizations that are described in section. Luckily, the irs has defined the qualities that. Web short form return of organization exempt from income tax. Complete if the organization is a section 501(c)(3). Ad download or email irs 990ez & more fillable forms, register and subscribe now!

The Organizations With Gross Receipts Less.

Complete, edit or print tax forms instantly. Luckily, the irs has defined the qualities that. Form 990 must be used to file a group return, not. The instructions include a reminder that form.

• Organizations That Are Described In Section.

Ad get ready for tax season deadlines by completing any required tax forms today. Organizations under section 501 (c), 527, or 4947 (a) (1) of the (irc). Web short form return of organization exempt from income tax. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes:

Under Section 501(C), 527, Or 4947(A)(1) Of The Internal Revenue Code (Except Private Foundations) Do Not Enter Social.

Complete if the organization is a section 501(c)(3). As required by section 3101 of the taxpayer first. Ad download or email irs 990ez & more fillable forms, register and subscribe now!