Form 990 Vs 990 Ez

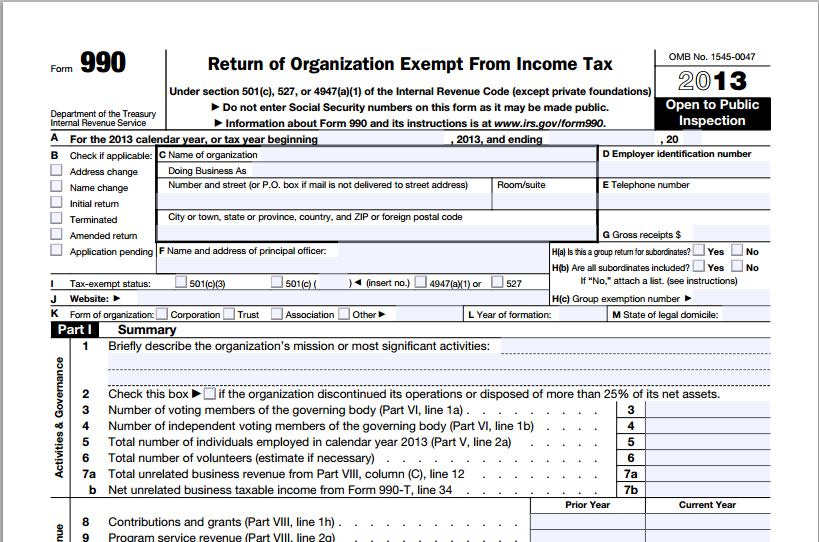

Form 990 Vs 990 Ez - Upload, modify or create forms. How can i learn about using them? The application does not provide unique input screens for. Try it for free now! Web blog 990n vs. • the gross revenues of the organization for the past year are less than $200,000; Exempt organizations must file a tax return called a form 990 with the irs each year to comply. The following are examples when form 990 must be utilized. Web the form 990ez requires all of above information, as well as fiscal year financial activity for the organization to include: Organizations exempt from income tax under section 501 (a).

• the gross revenues of the organization for the past year are less than $200,000; A supporting organization described in section 509 (a) (3) is required to file form 990 (or. Exempt organizations must file a tax return called a form 990 with the irs each year to comply. Simplify your 1099 reporting with the irs and the state by importing your 1099 data from xero into. The information provided will enable you to file a more complete return and reduce the. Web blog 990n vs. Upload, modify or create forms. 990ez | a compact (yet complete!) guide as we wrap up. The application does not provide unique input screens for. How can i learn about using them?

Try it for free now! A supporting organization described in section 509 (a) (3) is required to file form 990 (or. • the assets of the organization are less than. The application does not provide unique input screens for. 990ez | a compact (yet complete!) guide published on 15 mar 2022 by auctria 990n vs. Organizations exempt from income tax under section 501 (a). Simplify your 1099 reporting with the irs and the state by importing your 1099 data from xero into. Exempt organizations must file a tax return called a form 990 with the irs each year to comply. The following are examples when form 990 must be utilized. Web blog 990n vs.

Pdf 2020 990 N Fill Out Fillable and Editable PDF Template

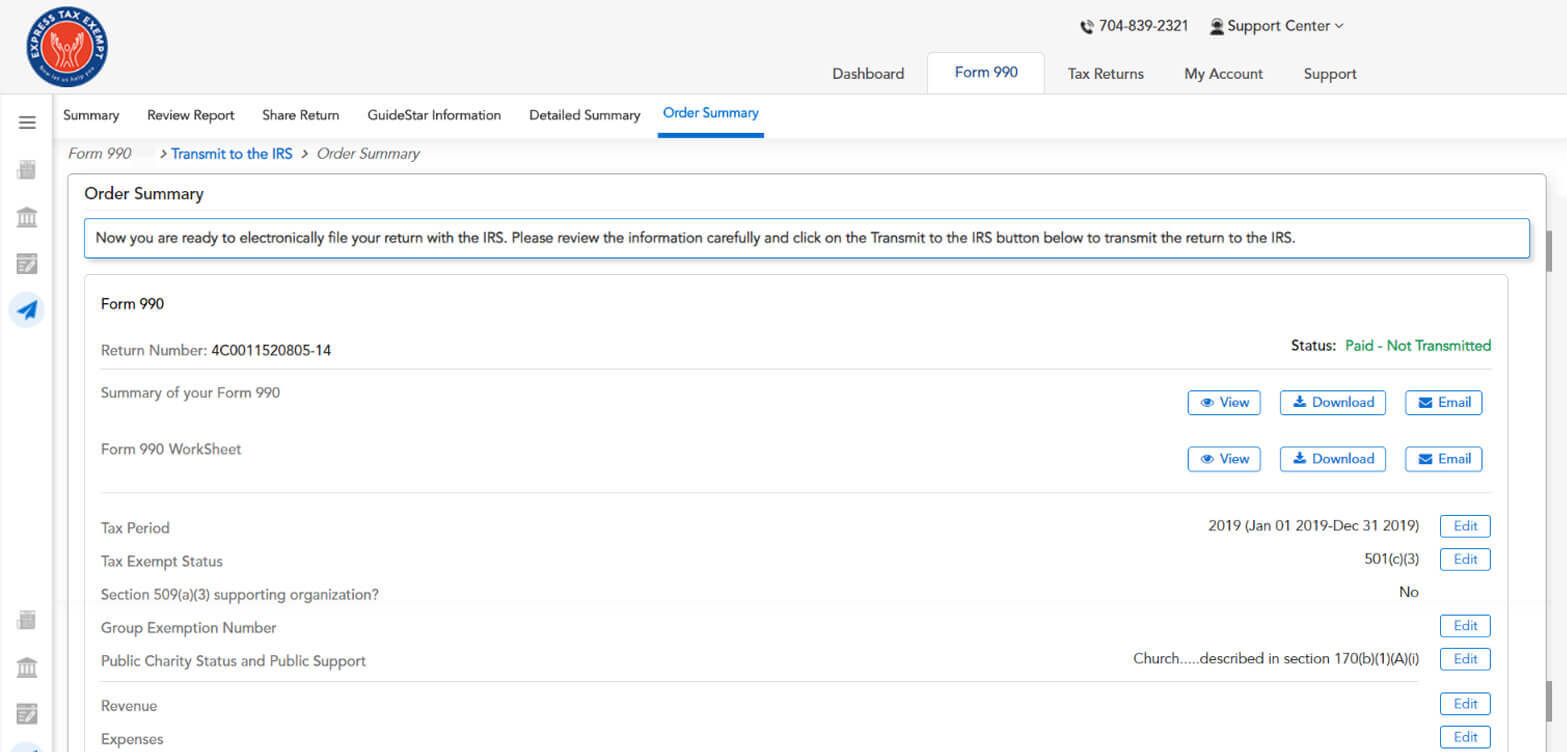

990ez | a compact (yet complete!) guide as we wrap up. The information provided will enable you to file a more complete return and reduce the. 990ez | a compact (yet complete!) guide published on 15 mar 2022 by auctria 990n vs. Exempt organizations must file a tax return called a form 990 with the irs each year to comply..

Form 990 or 990EZ (Sch C) Political Campaign and Lobbying Activities

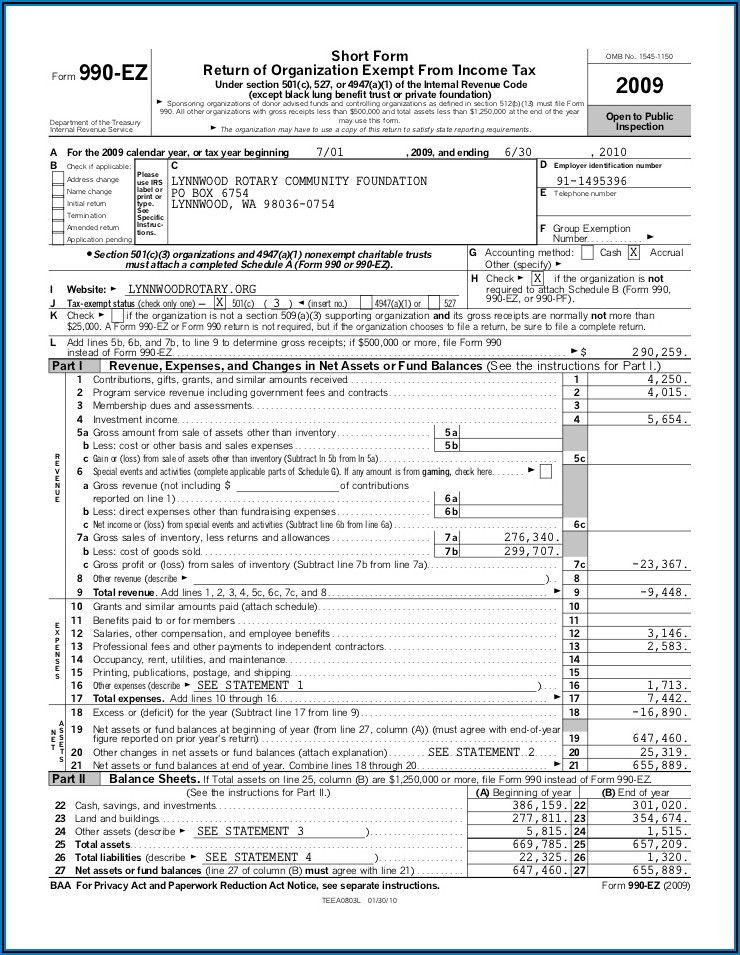

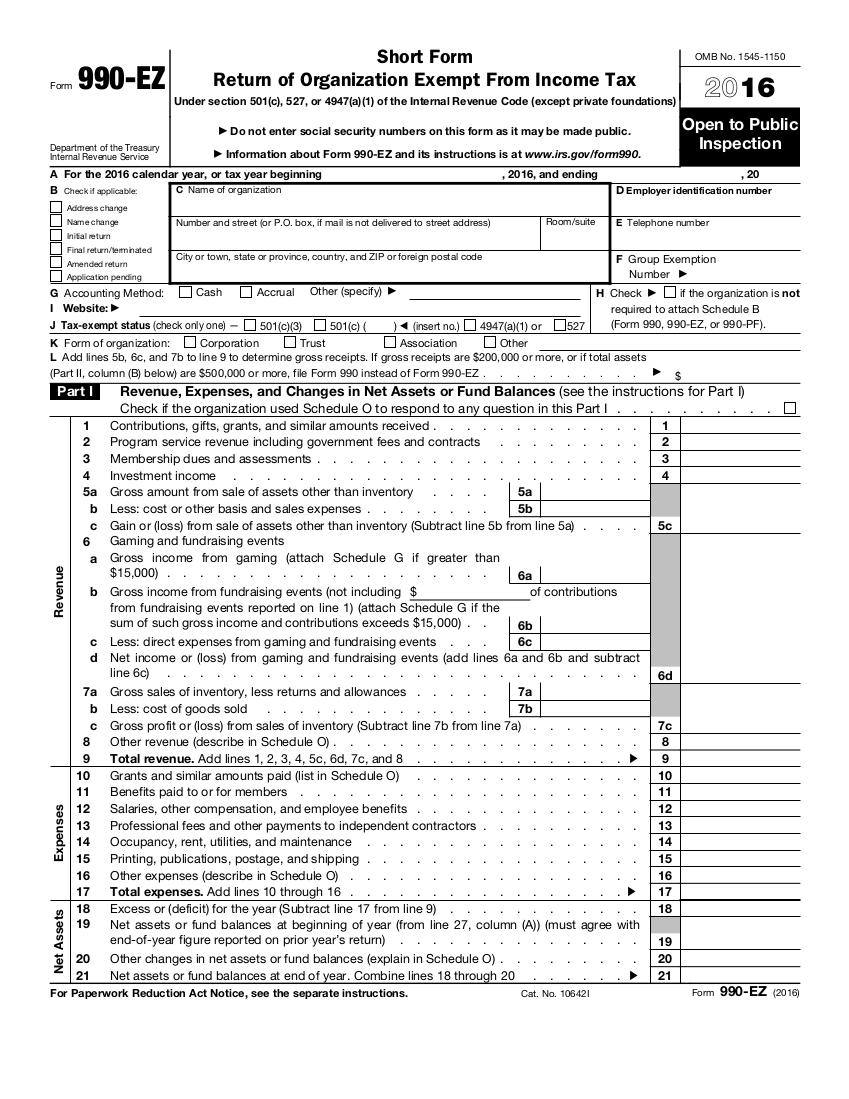

Web the form 990ez requires all of above information, as well as fiscal year financial activity for the organization to include: 990ez | a compact (yet complete!) guide published on 15 mar 2022 by auctria 990n vs. Opening asset and liability balances, income and expenses. Was the organization controlled directly or indirectly at any time during the tax year by.

990N vs. 990EZ What is the difference?

A supporting organization described in section 509 (a) (3) is required to file form 990 (or. Upload, modify or create forms. • the assets of the organization are less than. 990ez | a compact (yet complete!) guide published on 15 mar 2022 by auctria 990n vs. How can i learn about using them?

Federal Tax Form 990 Ez Instructions Form Resume Examples 0g27lBAx9P

Upload, modify or create forms. Opening asset and liability balances, income and expenses. 990ez | a compact (yet complete!) guide published on 15 mar 2022 by auctria 990n vs. Exempt organizations must file a tax return called a form 990 with the irs each year to comply. How can i learn about using them?

Form 990 Preparation Service 501(c)(3) Tax Services in Tampa

990ez | a compact (yet complete!) guide as we wrap up. • the assets of the organization are less than. The following are examples when form 990 must be utilized. The information provided will enable you to file a more complete return and reduce the. How can i learn about using them?

File Form 990 Online Efile 990 990 Filing Deadline 2021

For tax years beginning on or after july 2, 2019, section 3101 of p.l. A supporting organization described in section 509 (a) (3) is required to file form 990 (or. Try it for free now! The information provided will enable you to file a more complete return and reduce the. The application does not provide unique input screens for.

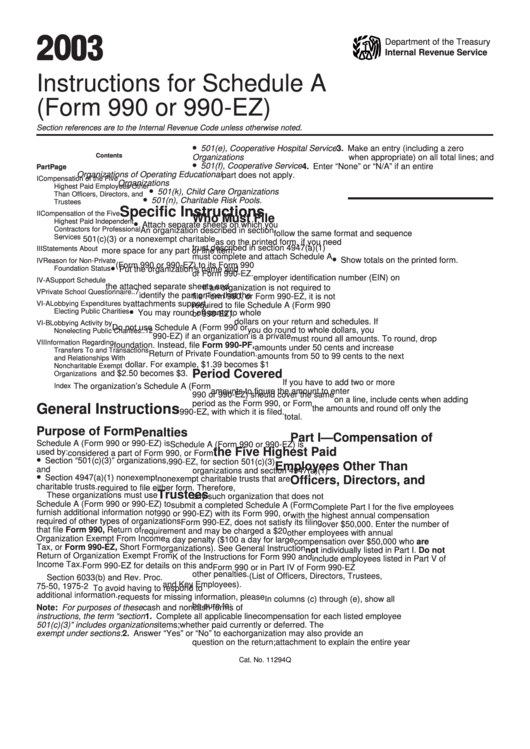

Instructions For Schedule A (Form 990 Or 990Ez) 2003 printable pdf

Was the organization controlled directly or indirectly at any time during the tax year by one or more disqualified. Mail your recipients paper copies of their forms. Ad download or email irs 990ez & more fillable forms, register and subscribe now! Web the form 990ez requires all of above information, as well as fiscal year financial activity for the organization.

990EZ (2016) Edit Forms Online PDFFormPro

• the gross revenues of the organization for the past year are less than $200,000; How can i learn about using them? 990ez | a compact (yet complete!) guide as we wrap up. 990ez | a compact (yet complete!) guide published on 15 mar 2022 by auctria 990n vs. The information provided will enable you to file a more complete.

Where Should I Mail My Form 990EZ?

Mail your recipients paper copies of their forms. A supporting organization described in section 509 (a) (3) is required to file form 990 (or. The following are examples when form 990 must be utilized. Exempt organizations must file a tax return called a form 990 with the irs each year to comply. • the assets of the organization are less.

Form 990EZ for nonprofits updated Accounting Today

Exempt organizations must file a tax return called a form 990 with the irs each year to comply. 990ez | a compact (yet complete!) guide as we wrap up. Mail your recipients paper copies of their forms. Organizations exempt from income tax under section 501 (a). Try it for free now!

Exempt Organizations Must File A Tax Return Called A Form 990 With The Irs Each Year To Comply.

Opening asset and liability balances, income and expenses. Simplify your 1099 reporting with the irs and the state by importing your 1099 data from xero into. Organizations exempt from income tax under section 501 (a). Ad download or email irs 990ez & more fillable forms, register and subscribe now!

The Information Provided Will Enable You To File A More Complete Return And Reduce The.

For tax years beginning on or after july 2, 2019, section 3101 of p.l. 990ez | a compact (yet complete!) guide published on 15 mar 2022 by auctria 990n vs. • the gross revenues of the organization for the past year are less than $200,000; The application does not provide unique input screens for.

Mail Your Recipients Paper Copies Of Their Forms.

Web blog 990n vs. Try it for free now! How can i learn about using them? 990ez | a compact (yet complete!) guide as we wrap up.

Was The Organization Controlled Directly Or Indirectly At Any Time During The Tax Year By One Or More Disqualified.

Upload, modify or create forms. The following are examples when form 990 must be utilized. • the assets of the organization are less than. A supporting organization described in section 509 (a) (3) is required to file form 990 (or.