Form 990 Schedule F

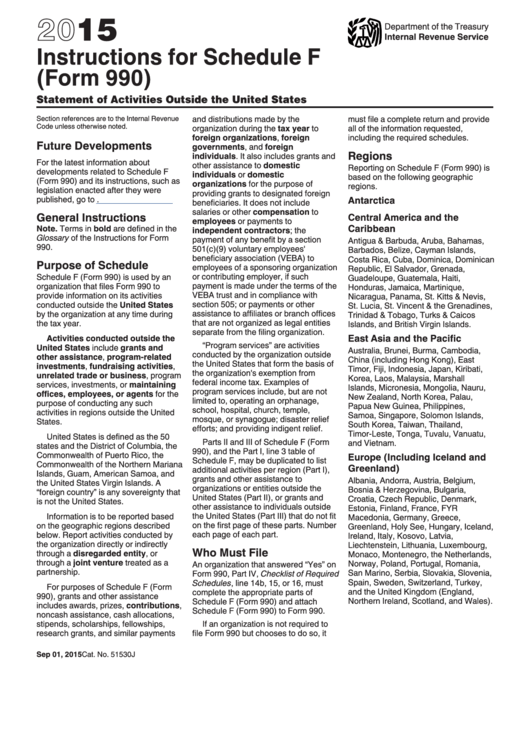

Form 990 Schedule F - Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Complete if the organization answered “yes” on form 990, part iv, line 16. Part iii can be duplicated if additional space is needed. For schedule f purposes, activities typically reported are: Web an organization that is required to file form 990 may be required to disclose information regarding its foreign activities on schedule f. A form 990 filer must complete: Web organizations that file form 990 use schedule f (form 990) to provide information on their activities conducted outside the united states at any time during the tax year. Web form 990 schedule f is used by organizations to provide the irs with information regarding the activities they have conducted outside the united states during the corresponding tax year. Instructions for schedule f (form 990) Instructions for these schedules are combined with the schedules.

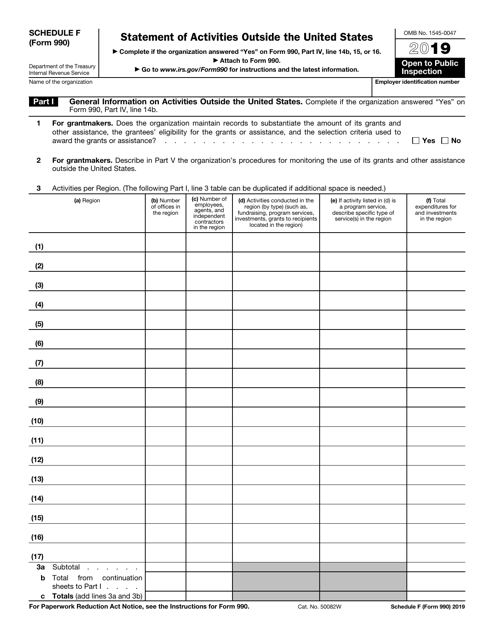

Part iii can be duplicated if additional space is needed. Web purpose of schedule. Program service activities grants and other assistance, and fundraising activities Web schedule f pdf requires the reporting of activities outside of the united states or foreign investments valued at $100,000 or more. A form 990 filer must complete: Web schedule f (form 990) is used by an organization that files form 990 to provide information on its activities conducted outside the united states by the organization during the tax year. Web organizations that file form 990 use schedule f (form 990) to provide information on their activities conducted outside the united states at any time during the tax year. Schedule f, part i if it had aggregate revenues or expenses of more than $10,000 during the tax year from grantmaking, fundraising, business (including investments), and program service activities outside the united states; Instructions for these schedules are combined with the schedules. Web schedule f (form 990) 2022 part iii grants and other assistance to individuals outside the united states.

Instructions for these schedules are combined with the schedules. Complete if the organization answered “yes” on form 990, part iv, line 16. Schedule f, part i if it had aggregate revenues or expenses of more than $10,000 during the tax year from grantmaking, fundraising, business (including investments), and program service activities outside the united states; Web what is the threshold for reporting on schedule f? Questions have arisen regarding the new foreign activity reporting requirements, including how passive and related organization investments should be reported on schedule f. Web schedule f pdf requires the reporting of activities outside of the united states or foreign investments valued at $100,000 or more. Web schedule f (form 990) 2022 part iii grants and other assistance to individuals outside the united states. Web schedule f (form 990) is used by an organization that files form 990 to provide information on its activities conducted outside the united states by the organization during the tax year. A form 990 filer must complete: Web organizations that file form 990 use schedule f (form 990) to provide information on their activities conducted outside the united states at any time during the tax year.

Form 990 Instructions For Schedule F (2015) printable pdf download

Schedule f (form 990) 2022 schedule f (form 990) 2022 part v supplemental information Web what is the threshold for reporting on schedule f? Web an organization that is required to file form 990 may be required to disclose information regarding its foreign activities on schedule f. Web schedule f (form 990) 2022 part iii grants and other assistance to.

IRS Form 990 Schedule F Download Fillable PDF or Fill Online Statement

Part iii can be duplicated if additional space is needed. Web what is the threshold for reporting on schedule f? A form 990 filer must complete: Program service activities grants and other assistance, and fundraising activities Web an organization that is required to file form 990 may be required to disclose information regarding its foreign activities on schedule f.

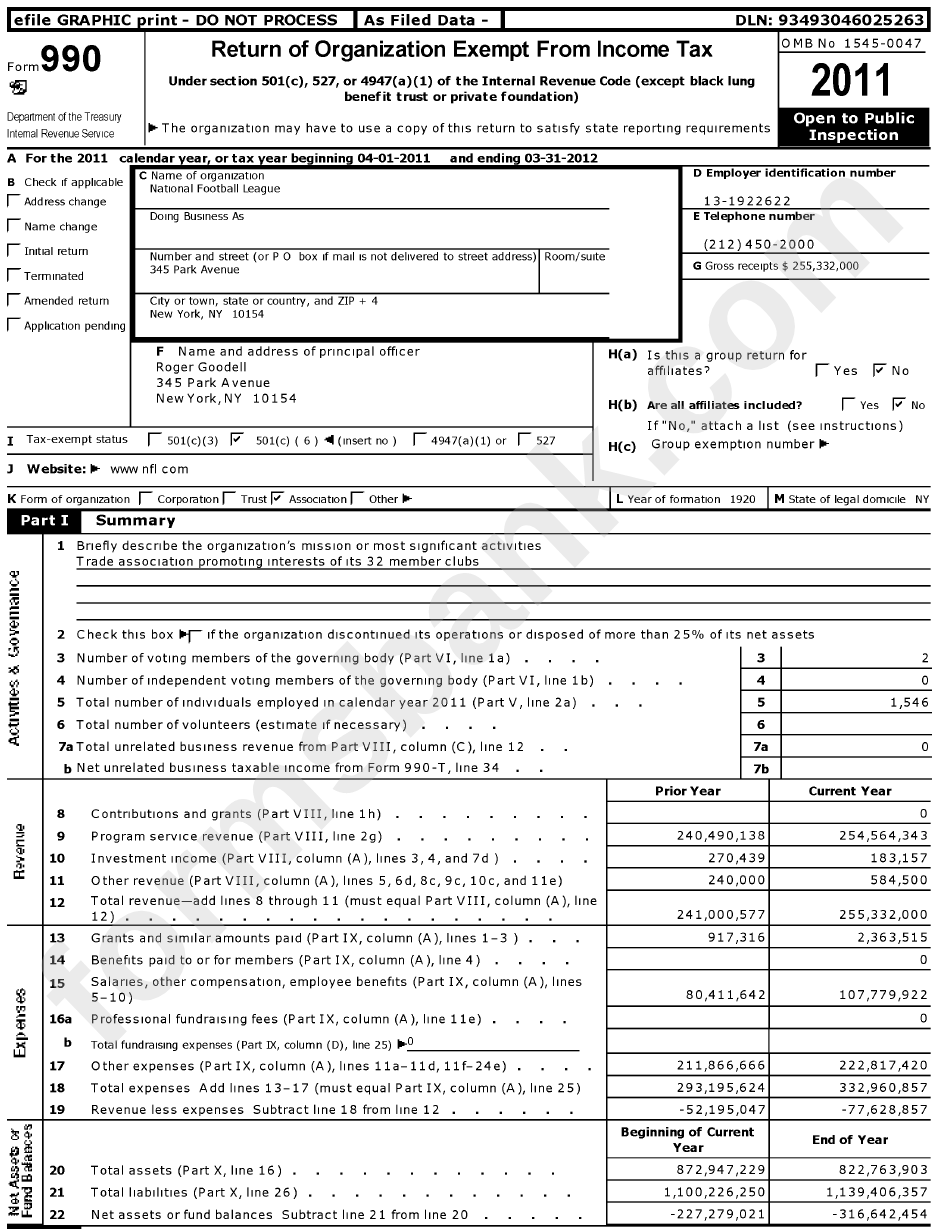

Form 990 2011 Sample printable pdf download

Schedule f, part i if it had aggregate revenues or expenses of more than $10,000 during the tax year from grantmaking, fundraising, business (including investments), and program service activities outside the united states; Web purpose of schedule. Schedule f (form 990) 2022 schedule f (form 990) 2022 part v supplemental information A form 990 filer must complete: Questions have arisen.

IRS Form 990 Schedule B 2018 2019 Printable & Fillable Sample in PDF

For schedule f purposes, activities typically reported are: A form 990 filer must complete: Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web an organization that is required to file form 990 may be required to disclose information regarding its foreign activities on schedule f. Instructions for schedule f.

Schedule F Form 990 instructions Fill online, Printable, Fillable Blank

Program service activities grants and other assistance, and fundraising activities Schedule f (form 990) 2022 schedule f (form 990) 2022 part v supplemental information Complete if the organization answered “yes” on form 990, part iv, line 16. Web purpose of schedule. A form 990 filer must complete:

Fill Free fillable Form 990 schedule F Statement of Activities

Web schedule f (form 990) is used by an organization that files form 990 to provide information on its activities conducted outside the united states by the organization during the tax year. Part iii can be duplicated if additional space is needed. Schedule f (form 990) is used by an organization that files form 990, return of organization exempt from.

Fill Free fillable Form 990 schedule F Statement of Activities

Web what is the threshold for reporting on schedule f? Complete if the organization answered “yes” on form 990, part iv, line 16. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web organizations that file form 990 use schedule f (form 990) to provide information on their activities conducted.

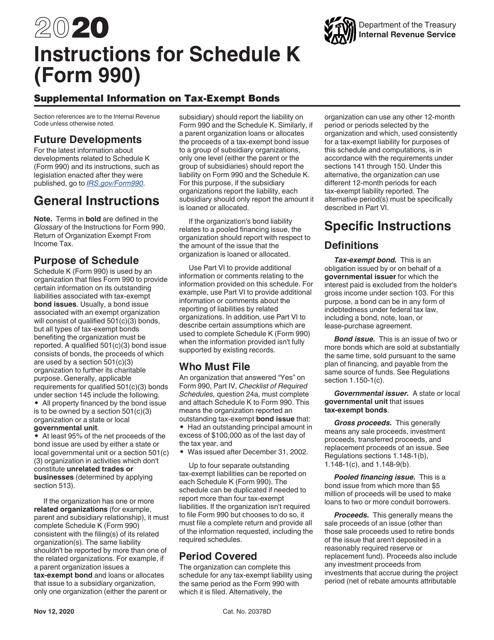

Download Instructions for IRS Form 990 Schedule K Supplemental

Instructions for these schedules are combined with the schedules. Web organizations that file form 990 use schedule f (form 990) to provide information on their activities conducted outside the united states at any time during the tax year. Complete if the organization answered “yes” on form 990, part iv, line 16. Web purpose of schedule. Web the following schedules to.

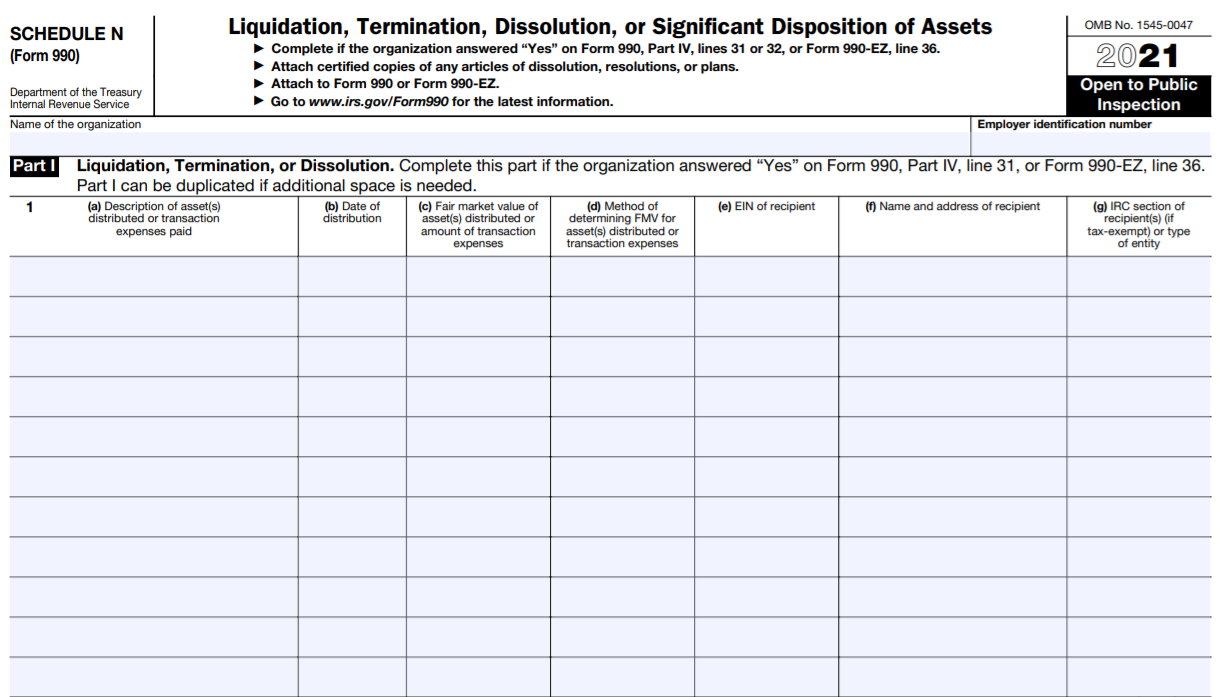

IRS Form 990/990EZ Schedule N Instructions Liquidation, Termination

Web what is the threshold for reporting on schedule f? A form 990 filer must complete: Schedule f (form 990) 2022 schedule f (form 990) 2022 part v supplemental information Web form 990 schedule f is used by organizations to provide the irs with information regarding the activities they have conducted outside the united states during the corresponding tax year..

Form 990 (Schedule F) Statement of Activities outside the United

Schedule f (form 990) pdf. Web form 990 schedule f is used by organizations to provide the irs with information regarding the activities they have conducted outside the united states during the corresponding tax year. Questions have arisen regarding the new foreign activity reporting requirements, including how passive and related organization investments should be reported on schedule f. Web an.

Schedule F, Part I If It Had Aggregate Revenues Or Expenses Of More Than $10,000 During The Tax Year From Grantmaking, Fundraising, Business (Including Investments), And Program Service Activities Outside The United States;

Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Schedule f (form 990) pdf. Instructions for schedule f (form 990) Questions have arisen regarding the new foreign activity reporting requirements, including how passive and related organization investments should be reported on schedule f.

Instructions For These Schedules Are Combined With The Schedules.

Web schedule f pdf requires the reporting of activities outside of the united states or foreign investments valued at $100,000 or more. Complete if the organization answered “yes” on form 990, part iv, line 16. Schedule f (form 990) 2022 schedule f (form 990) 2022 part v supplemental information Web what is the threshold for reporting on schedule f?

Web An Organization That Is Required To File Form 990 May Be Required To Disclose Information Regarding Its Foreign Activities On Schedule F.

For schedule f purposes, activities typically reported are: Web organizations that file form 990 use schedule f (form 990) to provide information on their activities conducted outside the united states at any time during the tax year. Part iii can be duplicated if additional space is needed. Web form 990 schedule f is used by organizations to provide the irs with information regarding the activities they have conducted outside the united states during the corresponding tax year.

Schedule F (Form 990) Is Used By An Organization That Files Form 990, Return Of Organization Exempt From Income Tax, To Provide Information On Its Activities Conducted Outside The United States By The Organization At.

Web purpose of schedule. A form 990 filer must complete: Program service activities grants and other assistance, and fundraising activities Web schedule f (form 990) is used by an organization that files form 990 to provide information on its activities conducted outside the united states by the organization during the tax year.