Form 990 Instructions

Form 990 Instructions - Complete if the organization is a section 501(c)(3) organization or a section 4947(a)(1) nonexempt charitable trust. Information relevant to paper filing. Web form 990 must be filed by an organization exempt from income tax under section 501(a) (including an organization that hasn't applied for recognition of exemption) if it has either (1) gross receipts greater than or equal to $200,000, or (2) total assets greater than or equal to $500,000 at the end of the tax year (with exceptions described. Supplemental information to form 990 (instructions included in schedule) schedule r pdf. Go to www.irs.aov/form990 for instructions and the latest information. Related organizations and unrelated partnerships pdf. Liquidation, termination, dissolution, or significant disposition of assets (instructions included in schedule) schedule o pdf. Web form 990 return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form as it may be made public. Schedule g (form 990) 2022 omb no. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes:

Related organizations and unrelated partnerships pdf. Schedule g (form 990) 2022 omb no. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Liquidation, termination, dissolution, or significant disposition of assets (instructions included in schedule) schedule o pdf. Go to www.irs.aov/form990 for instructions and the latest information. Web form 990 return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form as it may be made public. Web for paperwork reduction act notice, see instructions. Supplemental information to form 990 (instructions included in schedule) schedule r pdf. Information relevant to paper filing. Web form 990 must be filed by an organization exempt from income tax under section 501(a) (including an organization that hasn't applied for recognition of exemption) if it has either (1) gross receipts greater than or equal to $200,000, or (2) total assets greater than or equal to $500,000 at the end of the tax year (with exceptions described.

Complete if the organization is a section 501(c)(3) organization or a section 4947(a)(1) nonexempt charitable trust. Go to www.irs.aov/form990 for instructions and the latest information. Related organizations and unrelated partnerships pdf. Information relevant to paper filing. Web form 990 must be filed by an organization exempt from income tax under section 501(a) (including an organization that hasn't applied for recognition of exemption) if it has either (1) gross receipts greater than or equal to $200,000, or (2) total assets greater than or equal to $500,000 at the end of the tax year (with exceptions described. Web form 990 return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form as it may be made public. Schedule g (form 990) 2022 omb no. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Liquidation, termination, dissolution, or significant disposition of assets (instructions included in schedule) schedule o pdf. Supplemental information to form 990 (instructions included in schedule) schedule r pdf.

IRS Instructions 990 2018 2019 Printable & Fillable Sample in PDF

Web form 990 return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form as it may be made public. Go to www.irs.aov/form990 for instructions and the latest information. Supplemental information to form 990 (instructions included in schedule) schedule r pdf..

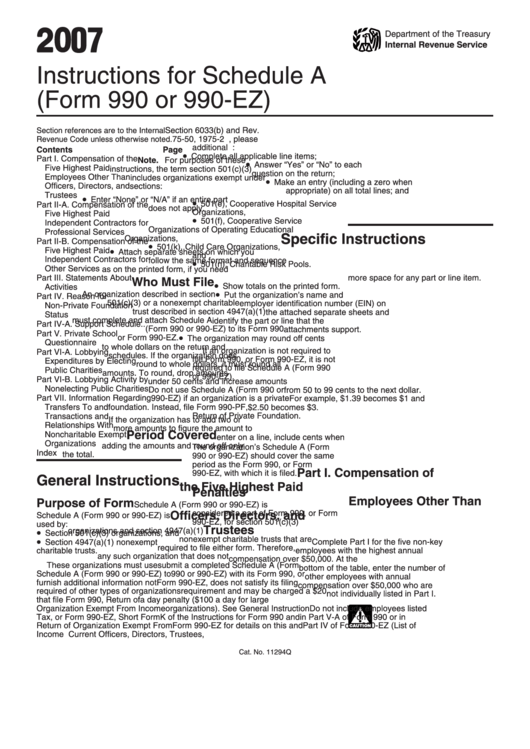

Instructions For Schedule A (Form 990 Or 990Ez) 2007 printable pdf

Web for paperwork reduction act notice, see instructions. Web form 990 must be filed by an organization exempt from income tax under section 501(a) (including an organization that hasn't applied for recognition of exemption) if it has either (1) gross receipts greater than or equal to $200,000, or (2) total assets greater than or equal to $500,000 at the end.

2010 Form IRS 990 Schedule A Fill Online, Printable, Fillable, Blank

Go to www.irs.aov/form990 for instructions and the latest information. Schedule g (form 990) 2022 omb no. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Web for paperwork reduction act notice, see instructions. Related organizations and unrelated partnerships pdf.

2010 FORM 990 INSTRUCTIONS 2010 FORM 990 INSTRUCTIONS

Liquidation, termination, dissolution, or significant disposition of assets (instructions included in schedule) schedule o pdf. Web form 990 must be filed by an organization exempt from income tax under section 501(a) (including an organization that hasn't applied for recognition of exemption) if it has either (1) gross receipts greater than or equal to $200,000, or (2) total assets greater than.

form 990 instructions Fill Online, Printable, Fillable Blank form

Complete if the organization is a section 501(c)(3) organization or a section 4947(a)(1) nonexempt charitable trust. Supplemental information to form 990 (instructions included in schedule) schedule r pdf. Web for paperwork reduction act notice, see instructions. Liquidation, termination, dissolution, or significant disposition of assets (instructions included in schedule) schedule o pdf. Information relevant to paper filing.

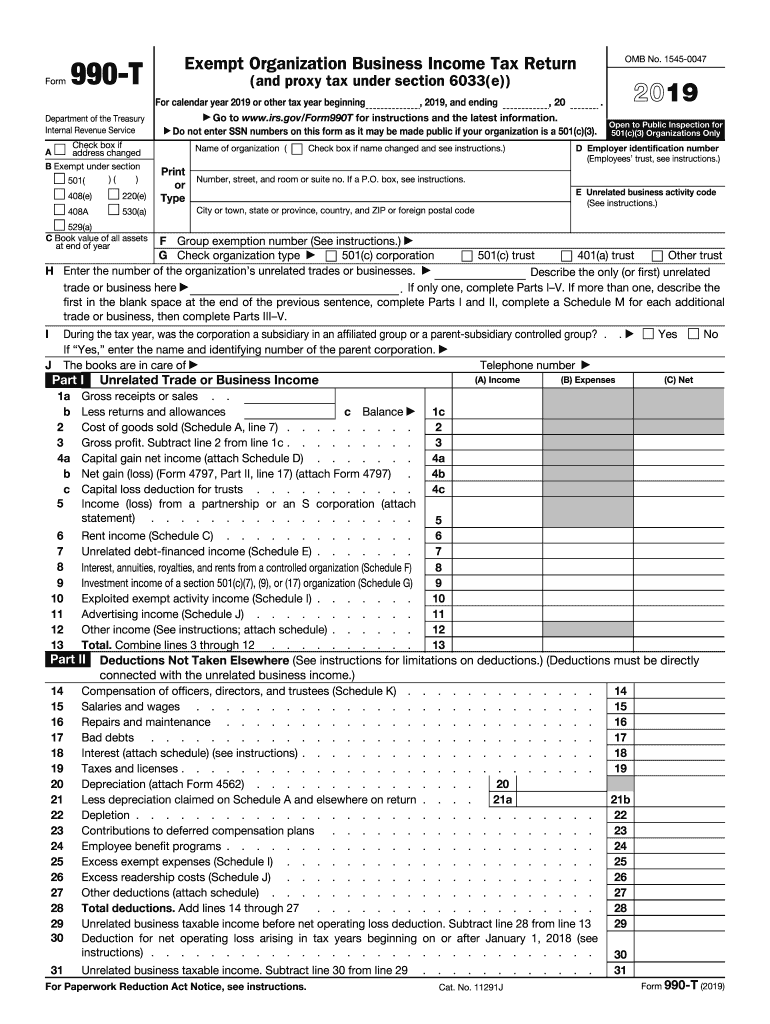

990 T Fill Out and Sign Printable PDF Template signNow

Liquidation, termination, dissolution, or significant disposition of assets (instructions included in schedule) schedule o pdf. Web form 990 return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form as it may be made public. Schedule g (form 990) 2022 omb.

Irs Form 990 Ez Schedule A Instructions Form Resume Examples

Schedule g (form 990) 2022 omb no. Web form 990 return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form as it may be made public. Related organizations and unrelated partnerships pdf. Liquidation, termination, dissolution, or significant disposition of assets.

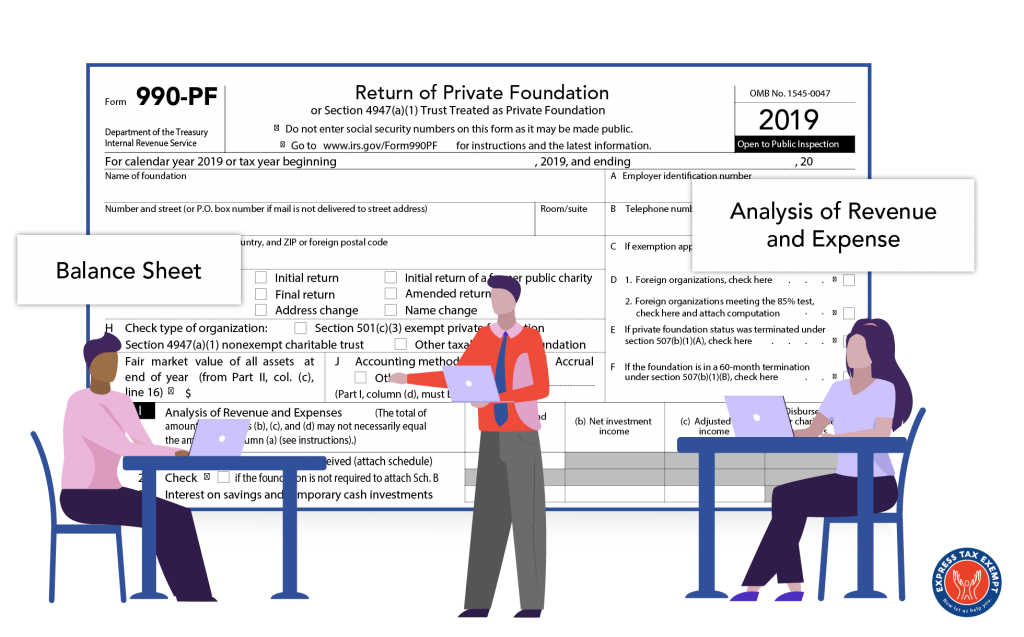

Instructions to file your Form 990PF A Complete Guide

Information relevant to paper filing. Related organizations and unrelated partnerships pdf. Go to www.irs.aov/form990 for instructions and the latest information. Web for paperwork reduction act notice, see instructions. Schedule g (form 990) 2022 omb no.

form 990 schedule m instructions 2017 Fill Online, Printable

Complete if the organization is a section 501(c)(3) organization or a section 4947(a)(1) nonexempt charitable trust. Web form 990 return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form as it may be made public. Related organizations and unrelated partnerships.

Form 990/990EZ Schedule A IRS Form 990 Schedule A Instructions

Web form 990 must be filed by an organization exempt from income tax under section 501(a) (including an organization that hasn't applied for recognition of exemption) if it has either (1) gross receipts greater than or equal to $200,000, or (2) total assets greater than or equal to $500,000 at the end of the tax year (with exceptions described. Web.

Liquidation, Termination, Dissolution, Or Significant Disposition Of Assets (Instructions Included In Schedule) Schedule O Pdf.

Schedule g (form 990) 2022 omb no. Supplemental information to form 990 (instructions included in schedule) schedule r pdf. Complete if the organization is a section 501(c)(3) organization or a section 4947(a)(1) nonexempt charitable trust. Information relevant to paper filing.

Related Organizations And Unrelated Partnerships Pdf.

Web form 990 must be filed by an organization exempt from income tax under section 501(a) (including an organization that hasn't applied for recognition of exemption) if it has either (1) gross receipts greater than or equal to $200,000, or (2) total assets greater than or equal to $500,000 at the end of the tax year (with exceptions described. Web for paperwork reduction act notice, see instructions. Go to www.irs.aov/form990 for instructions and the latest information. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: