Form 990 Instructions 2022

Form 990 Instructions 2022 - Web schedule a (form 990) 2022 explain in explain in detail in schedule a (form 990) 2022 page check here if the organization satisfied the integral part test as a qualifying trust on nov. Web most of the changes to the 2022 form 990, schedules and instructions are relatively minor clarifications and updates. An organization checks “cash” on form 990, part xii, line 1. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Instructions for these schedules are combined with the schedules. Web see instructions form (2022) form 990 (2022) page check if schedule o contains a response or note to any line in this part viii. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form as it may be made public. Certain exempt organizations file this form to provide the irs with the information required by section 6033. Schedule c (form 990) 2022 ¥ section 501(c)(3) organizations: (b) current year (a) prior year (optional)

Certain exempt organizations file this form to provide the irs with the information required by section 6033. Instructions for these schedules are combined with the schedules. (b) current year (a) prior year (optional) Some of the more significant changes include: Schedule c (form 990) 2022 ¥ section 501(c)(3) organizations: Web schedule a (form 990) 2022 explain in explain in detail in schedule a (form 990) 2022 page check here if the organization satisfied the integral part test as a qualifying trust on nov. Web see instructions form (2022) form 990 (2022) page check if schedule o contains a response or note to any line in this part viii. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form as it may be made public. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. An organization checks “cash” on form 990, part xii, line 1.

An organization checks “cash” on form 990, part xii, line 1. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form as it may be made public. Schedule c (form 990) 2022 ¥ section 501(c)(3) organizations: Some of the more significant changes include: Certain exempt organizations file this form to provide the irs with the information required by section 6033. Instructions for these schedules are combined with the schedules. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web schedule a (form 990) 2022 explain in explain in detail in schedule a (form 990) 2022 page check here if the organization satisfied the integral part test as a qualifying trust on nov. Web most of the changes to the 2022 form 990, schedules and instructions are relatively minor clarifications and updates. Web see instructions form (2022) form 990 (2022) page check if schedule o contains a response or note to any line in this part viii.

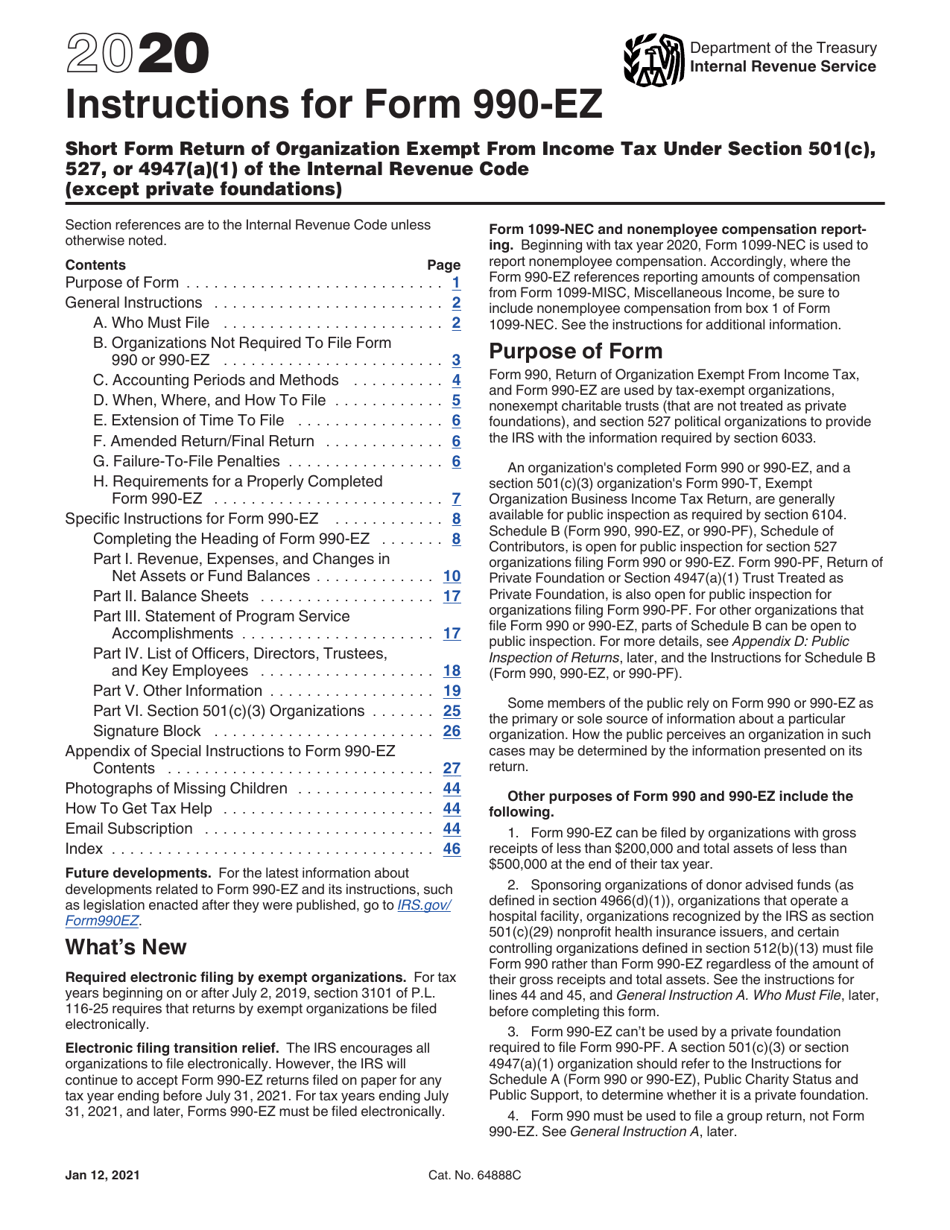

Download Instructions for IRS Form 990EZ Short Form Return of

Instructions for these schedules are combined with the schedules. Web see instructions form (2022) form 990 (2022) page check if schedule o contains a response or note to any line in this part viii. Certain exempt organizations file this form to provide the irs with the information required by section 6033. Web information about form 990, return of organization exempt.

Schedule H 990 Online PDF Template

Web see instructions form (2022) form 990 (2022) page check if schedule o contains a response or note to any line in this part viii. (b) current year (a) prior year (optional) Instructions for these schedules are combined with the schedules. An organization checks “cash” on form 990, part xii, line 1. Web information about form 990, return of organization.

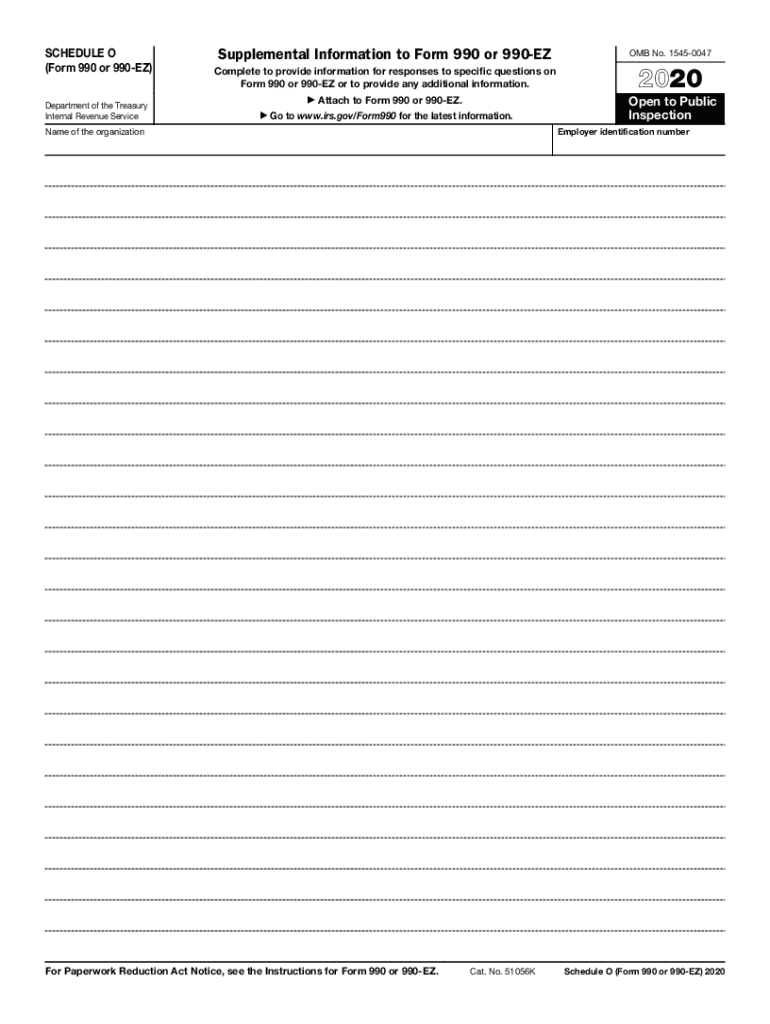

990 Schedule O Fill Out and Sign Printable PDF Template signNow

Schedule c (form 990) 2022 ¥ section 501(c)(3) organizations: Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form as it may be made public. Some of the more significant.

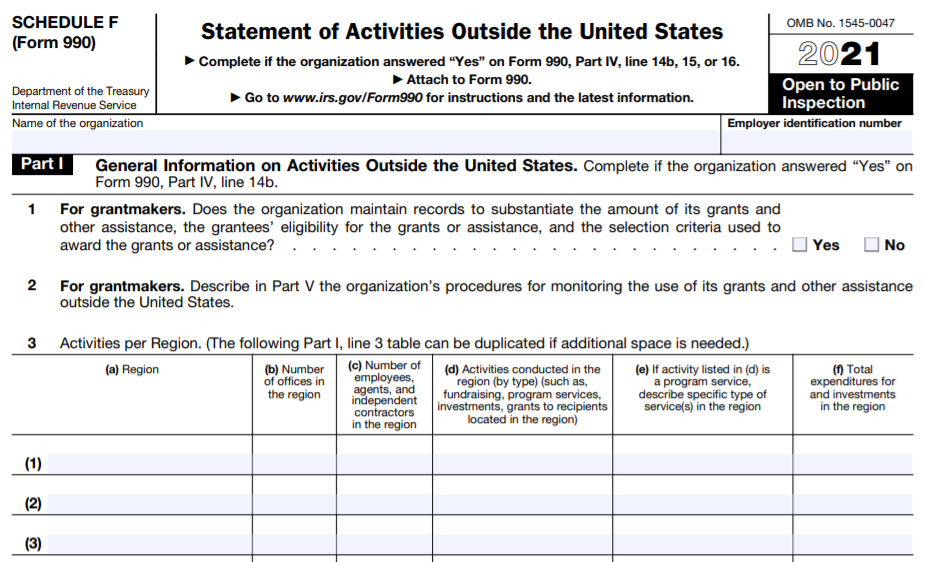

IRS Form 990 Schedule F Instructions Statement of Activities Outside

Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Certain exempt organizations file this form to provide the irs with the information required by section 6033. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c),.

IRS Instructions 990 2018 2019 Printable & Fillable Sample in PDF

Schedule c (form 990) 2022 ¥ section 501(c)(3) organizations: Instructions for these schedules are combined with the schedules. Certain exempt organizations file this form to provide the irs with the information required by section 6033. An organization checks “cash” on form 990, part xii, line 1. Some of the more significant changes include:

IRS Instructions Schedule A (990 Or 990EZ) 20202022 Fill out Tax

Web see instructions form (2022) form 990 (2022) page check if schedule o contains a response or note to any line in this part viii. Instructions for these schedules are combined with the schedules. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal.

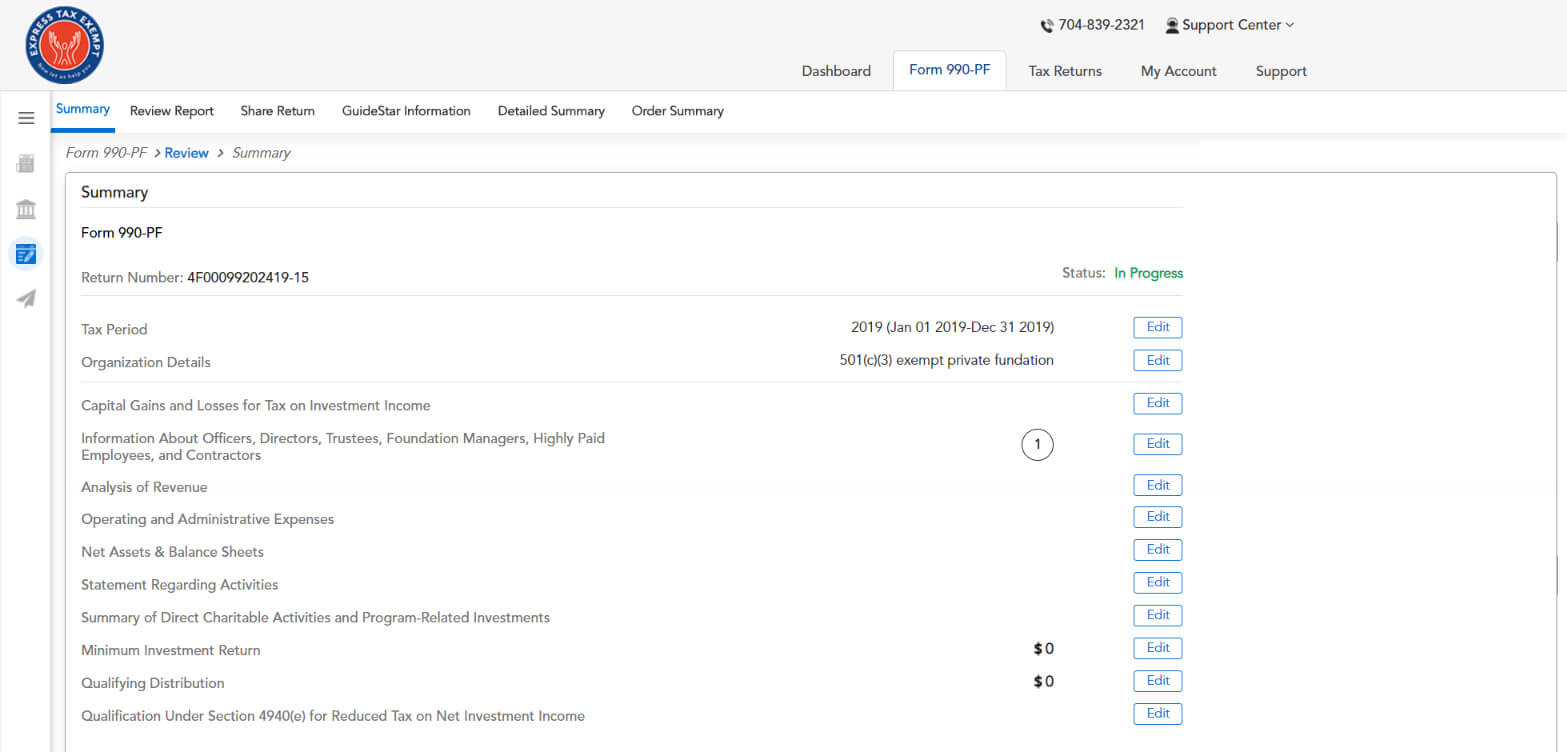

File 990PF Online Efile 990 PF Form 990PF 2021 Instructions

An organization checks “cash” on form 990, part xii, line 1. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Schedule c (form 990) 2022 ¥ section 501(c)(3) organizations: Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how.

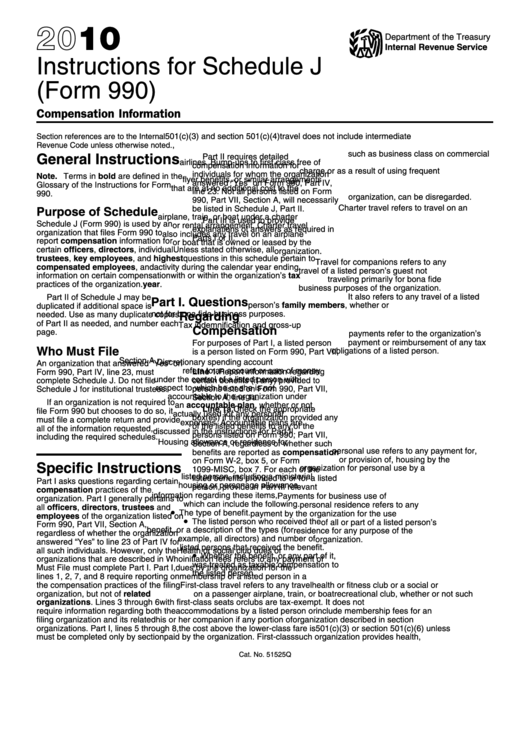

Form 990 Instructions For Schedule J printable pdf download

Web most of the changes to the 2022 form 990, schedules and instructions are relatively minor clarifications and updates. Schedule c (form 990) 2022 ¥ section 501(c)(3) organizations: An organization checks “cash” on form 990, part xii, line 1. Instructions for these schedules are combined with the schedules. Web form 990 department of the treasury internal revenue service return of.

Form 990 20141 Center for Watershed Protection

An organization checks “cash” on form 990, part xii, line 1. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. (b) current year (a) prior year (optional) Web schedule a (form 990) 2022 explain in explain in detail in schedule a (form 990) 2022 page check.

Irs Form 990 Ez Schedule A Instructions Form Resume Examples

An organization checks “cash” on form 990, part xii, line 1. Instructions for these schedules are combined with the schedules. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. (b) current year (a) prior year (optional) Web most of the changes to the 2022 form 990,.

An Organization Checks “Cash” On Form 990, Part Xii, Line 1.

Instructions for these schedules are combined with the schedules. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form as it may be made public. Web most of the changes to the 2022 form 990, schedules and instructions are relatively minor clarifications and updates. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file.

(B) Current Year (A) Prior Year (Optional)

Web schedule a (form 990) 2022 explain in explain in detail in schedule a (form 990) 2022 page check here if the organization satisfied the integral part test as a qualifying trust on nov. Schedule c (form 990) 2022 ¥ section 501(c)(3) organizations: Certain exempt organizations file this form to provide the irs with the information required by section 6033. Web see instructions form (2022) form 990 (2022) page check if schedule o contains a response or note to any line in this part viii.

Web The Following Schedules To Form 990, Return Of Organization Exempt From Income Tax, Do Not Have Separate Instructions.

Some of the more significant changes include: