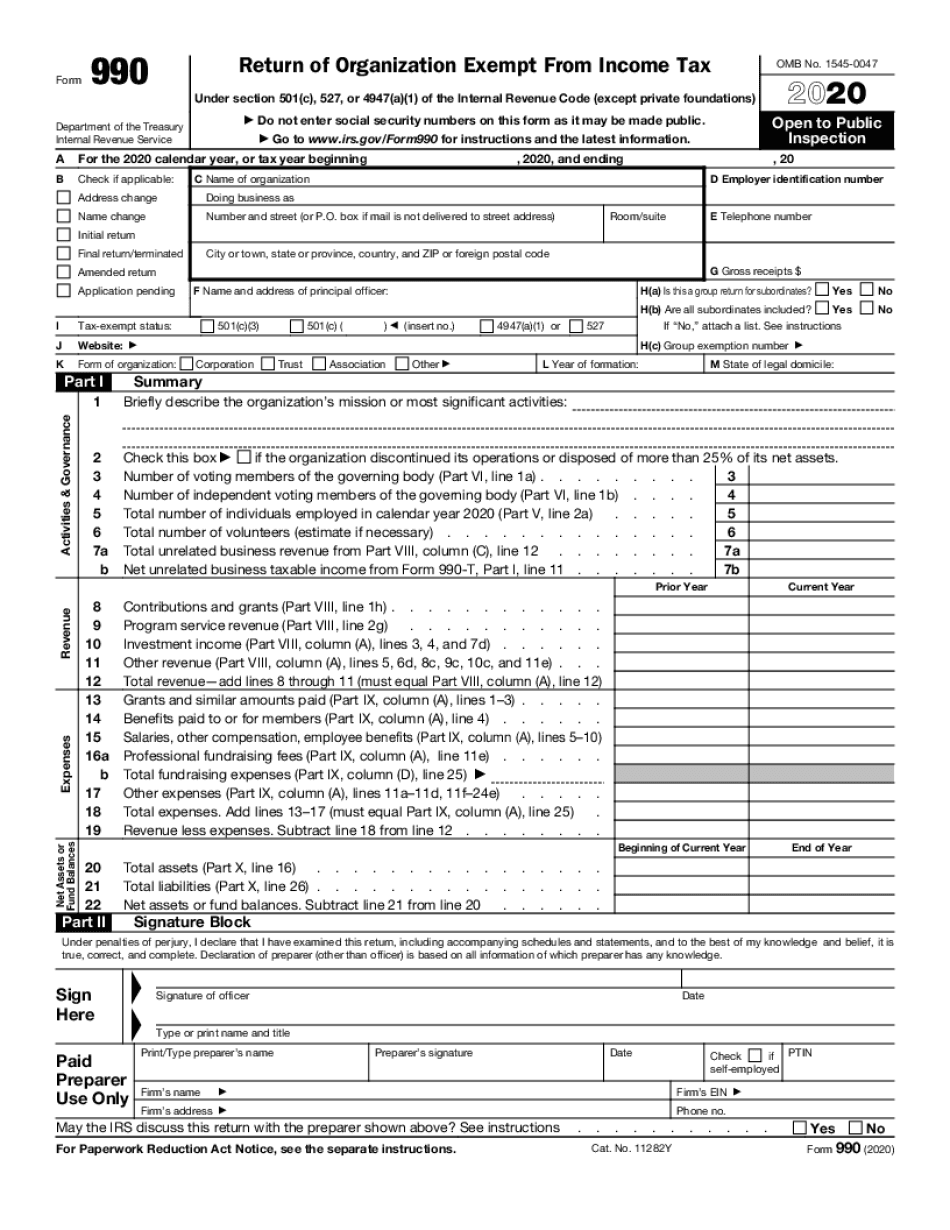

Form 990-Ez 2021

Form 990-Ez 2021 - Complete, edit or print tax forms instantly. One of the key benefits of running a 501(3)(c) nonprofit is the tax exemption that comes with it. Box if mail is not delivered to street address) room/suite city or town, state or province, country, and zip or foreign postal. Complete, edit or print tax forms instantly. Web form 990 (2021) page 2 part iii statement of program service accomplishments. Ad free for simple tax returns only with turbotax® free edition. The following are examples when form 990 return of organization. Web the irs form 990 series are informational tax forms that most nonprofits must file annually. Upload, modify or create forms. Ad access irs tax forms.

A for the 2021 calendar year, or tax year beginning , 2021, and ending , 20 b check if. Web name of organization number and street (or p.o. Try it for free now! Upload, modify or create forms. Try it for free now! The long form and short forms provide the irs with information about the organization’s. Upload, modify or create forms. Try it for free now! One of the key benefits of running a 501(3)(c) nonprofit is the tax exemption that comes with it. Form 4562 (2017) (a) classification of property (e).

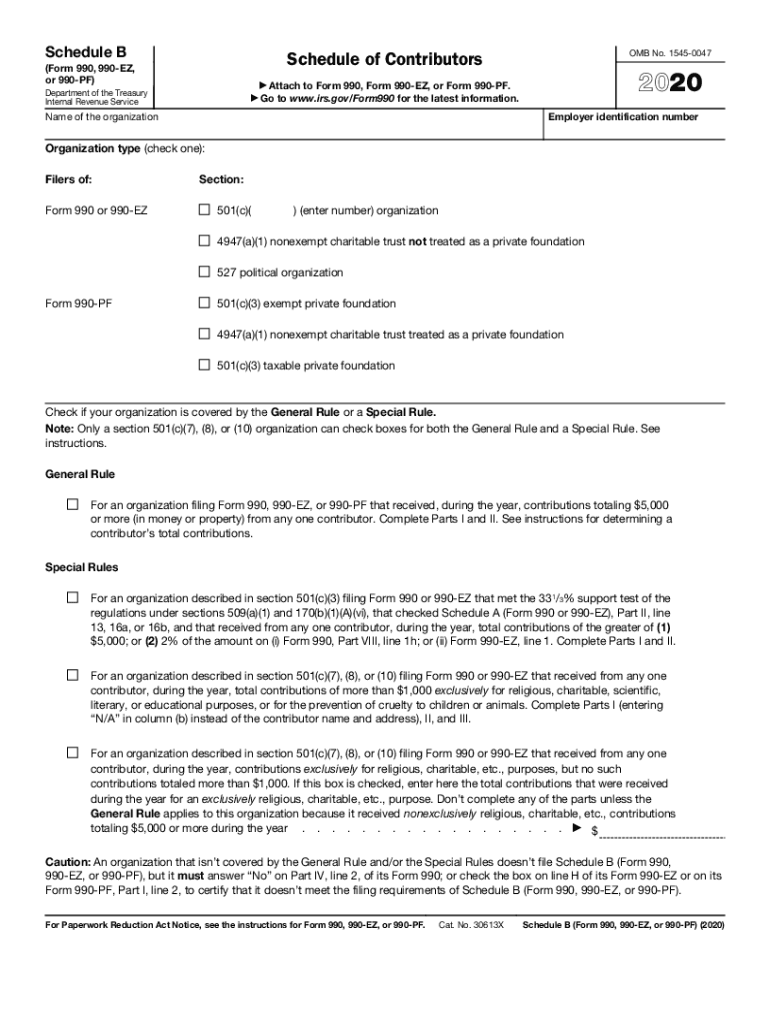

One of the key benefits of running a 501(3)(c) nonprofit is the tax exemption that comes with it. If you qualify for the 990ez , you. Try it for free now! Complete, edit or print tax forms instantly. Try it for free now! Complete, edit or print tax forms instantly. Over 12m americans filed 100% free with turbotax® last year. Schedule a (form 990) 2021 (all organizations must complete this part.) see. See if you qualify today. Try it for free now!

IRS Form 990EZ 2018 2019 Printable & Fillable Sample in PDF

Form 4562 (2017) (a) classification of property (e). Upload, modify or create forms. Complete, edit or print tax forms instantly. Try it for free now! Web form 990 (2021) page 2 part iii statement of program service accomplishments.

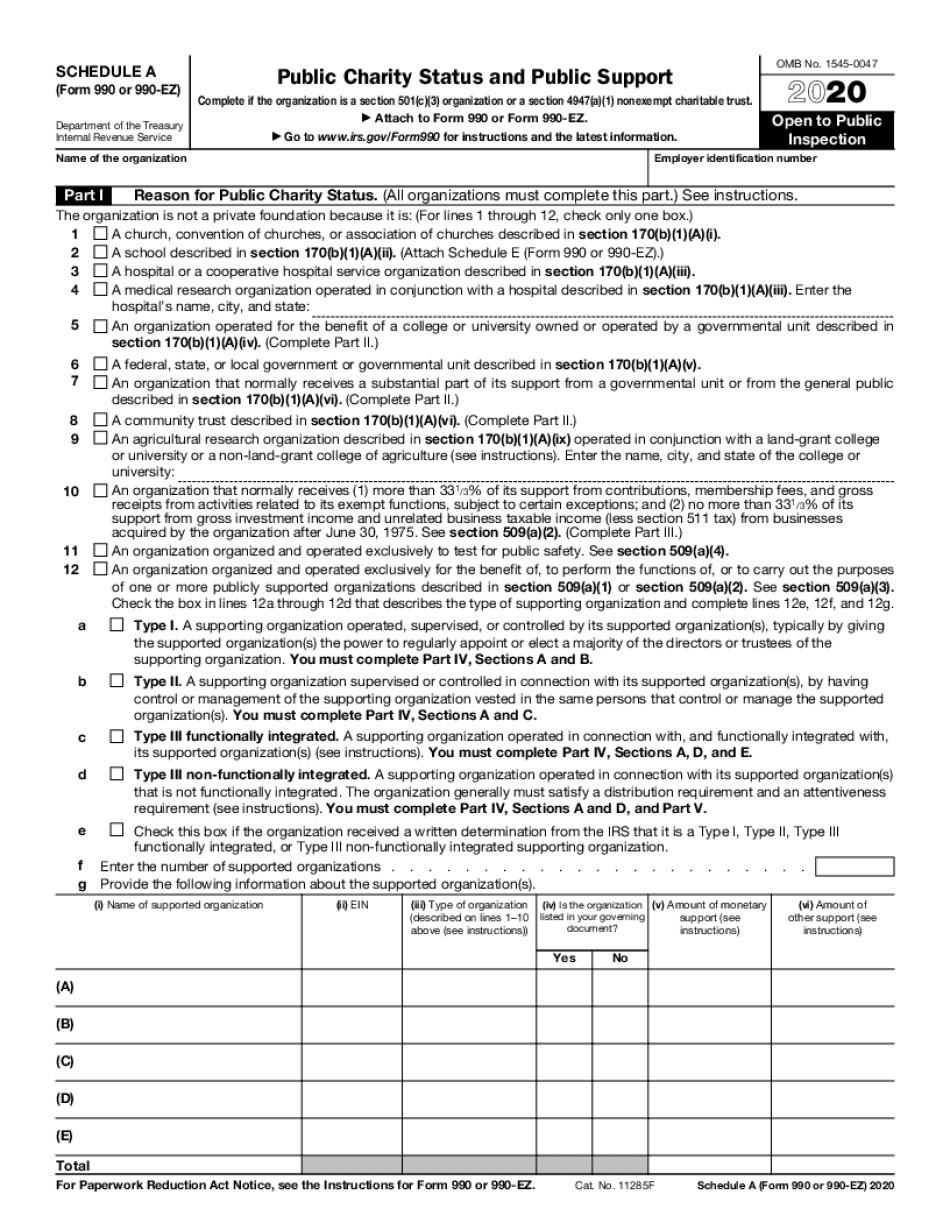

2020 form 990 schedule a Fill Online, Printable, Fillable Blank

A for the 2021 calendar year, or tax year beginning , 2021, and ending , 20 b check if. The following are examples when form 990 return of organization. Ad access irs tax forms. Try it for free now! Complete, edit or print tax forms instantly.

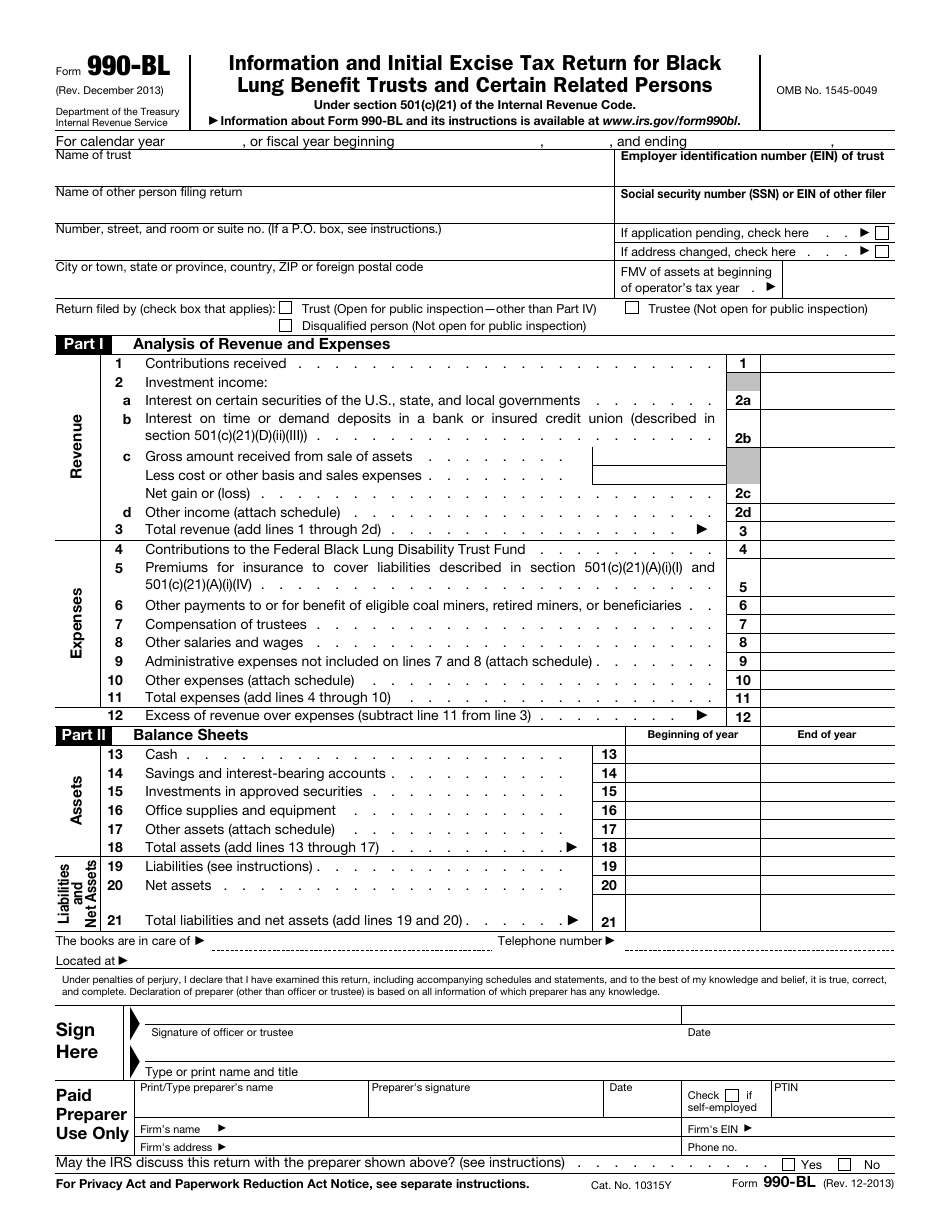

IRS Form 990BL Download Fillable PDF or Fill Online Information and

The long form and short forms provide the irs with information about the organization’s. A for the 2021 calendar year, or tax year beginning , 2021, and ending , 20 b check if. Try it for free now! Upload, modify or create forms. Ad access irs tax forms.

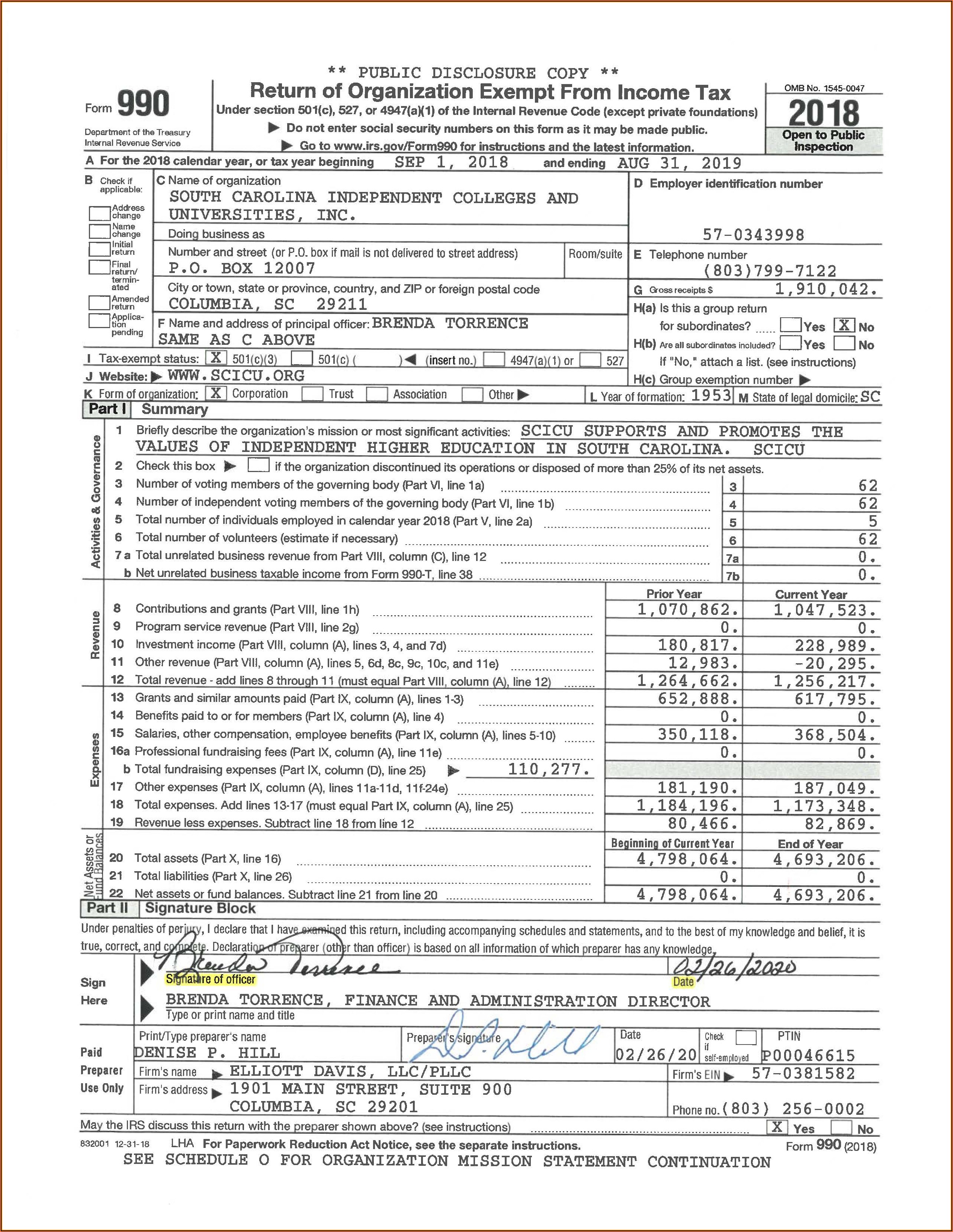

Form990 (20192020) by OutreachWorks Issuu

Try it for free now! See if you qualify today. Upload, modify or create forms. Schedule a (form 990) 2021 (all organizations must complete this part.) see. Box if mail is not delivered to street address) room/suite city or town, state or province, country, and zip or foreign postal.

199N E Postcard Fill Out and Sign Printable PDF Template signNow

If you qualify for the 990ez , you. Get ready for tax season deadlines by completing any required tax forms today. One of the key benefits of running a 501(3)(c) nonprofit is the tax exemption that comes with it. Web name of organization number and street (or p.o. For organizations with gross receipts greater than $100,000, we have a sliding.

990 ez form Fill Online, Printable, Fillable Blank

Web form 990 (2021) page 2 part iii statement of program service accomplishments. For organizations with gross receipts greater than $100,000, we have a sliding scale fee. One of the key benefits of running a 501(3)(c) nonprofit is the tax exemption that comes with it. Try it for free now! The long form and short forms provide the irs with.

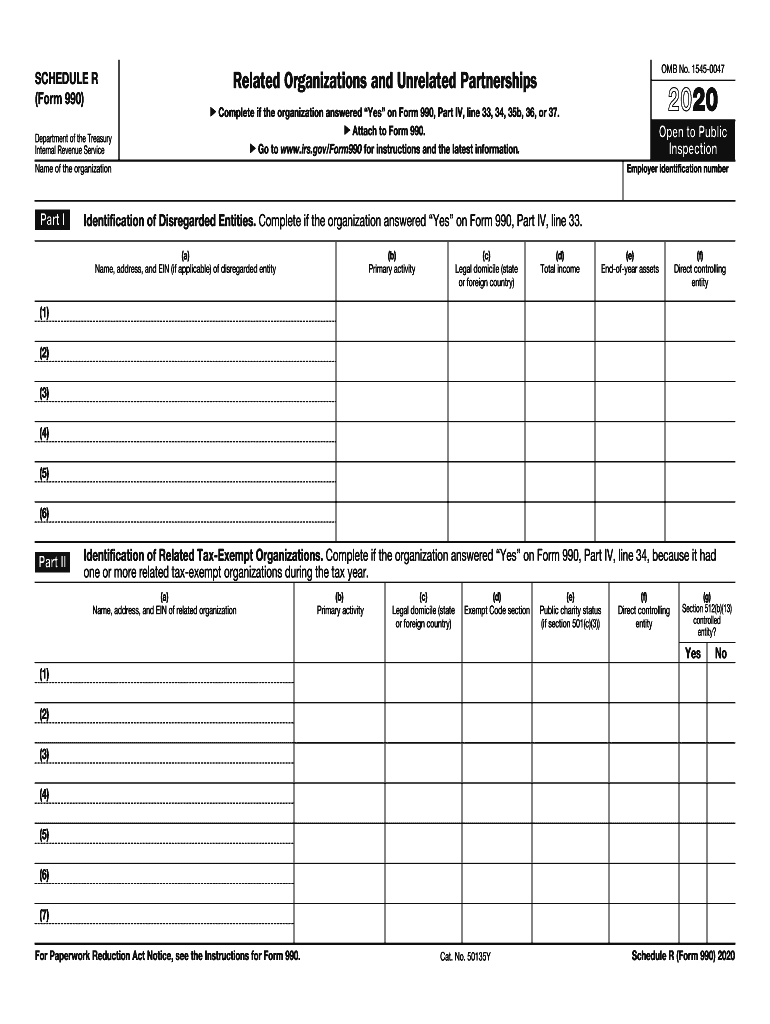

Form 990 Schedule R Fill Out and Sign Printable PDF Template signNow

Form 4562 (2017) (a) classification of property (e). Try it for free now! Upload, modify or create forms. Complete, edit or print tax forms instantly. Ad free for simple tax returns only with turbotax® free edition.

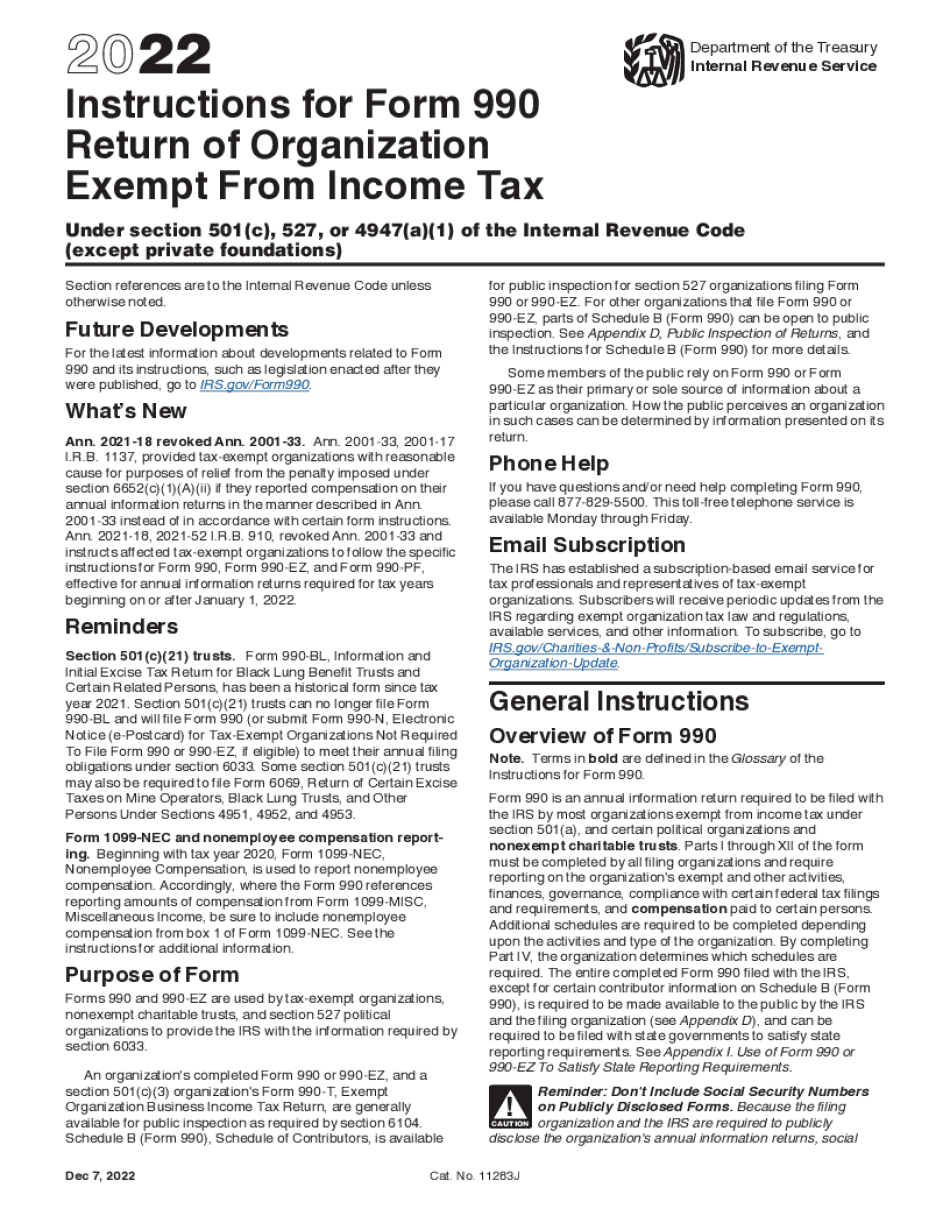

Instructions for Form 990EZ (2023)

Try it for free now! Upload, modify or create forms. For organizations with gross receipts greater than $100,000, we have a sliding scale fee. Form 4562 (2017) (a) classification of property (e). One of the key benefits of running a 501(3)(c) nonprofit is the tax exemption that comes with it.

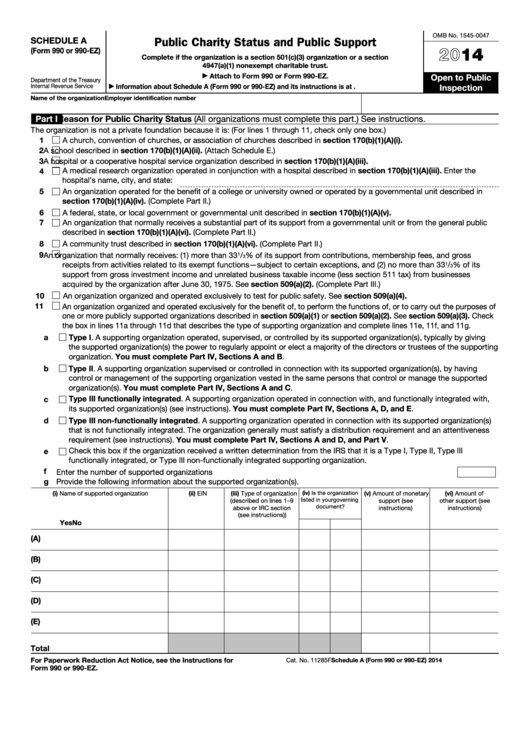

Fillable Schedule A (Form 990 Or 990Ez) Public Charity Status And

For organizations with gross receipts greater than $100,000, we have a sliding scale fee. Try it for free now! Upload, modify or create forms. Over 12m americans filed 100% free with turbotax® last year. Form 4562 (2017) (a) classification of property (e).

2014 Irs Tax Form 4562 Form Resume Examples nO9bzQ6L94

Try it for free now! One of the key benefits of running a 501(3)(c) nonprofit is the tax exemption that comes with it. If you qualify for the 990ez , you. Schedule a (form 990) 2021 (all organizations must complete this part.) see. A for the 2021 calendar year, or tax year beginning , 2021, and ending , 20 b.

The Following Are Examples When Form 990 Return Of Organization.

If you qualify for the 990ez , you. Try it for free now! Complete, edit or print tax forms instantly. As of 2021, this form has been discontinued, and all.

See If You Qualify Today.

Schedule a (form 990) 2021 (all organizations must complete this part.) see. Try it for free now! Get ready for tax season deadlines by completing any required tax forms today. Form 4562 (2017) (a) classification of property (e).

Try It For Free Now!

Complete, edit or print tax forms instantly. A for the 2021 calendar year, or tax year beginning , 2021, and ending , 20 b check if. Box if mail is not delivered to street address) room/suite city or town, state or province, country, and zip or foreign postal. One of the key benefits of running a 501(3)(c) nonprofit is the tax exemption that comes with it.

Ad Free For Simple Tax Returns Only With Turbotax® Free Edition.

Upload, modify or create forms. The long form and short forms provide the irs with information about the organization’s. Web the irs form 990 series are informational tax forms that most nonprofits must file annually. Web form 990 (2021) page 2 part iii statement of program service accomplishments.