Form 965-B

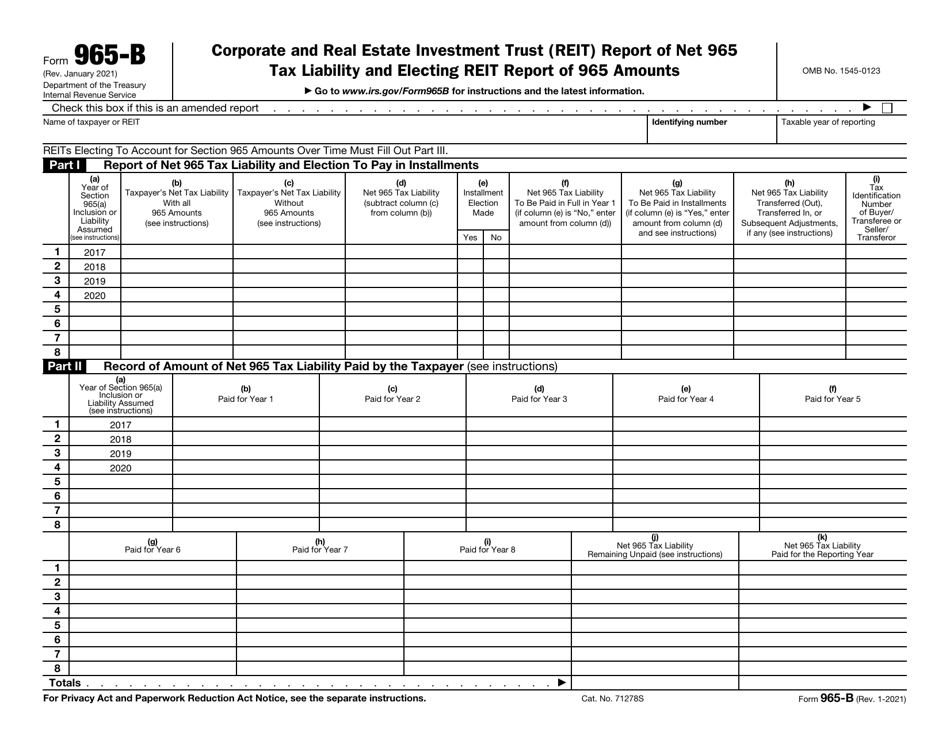

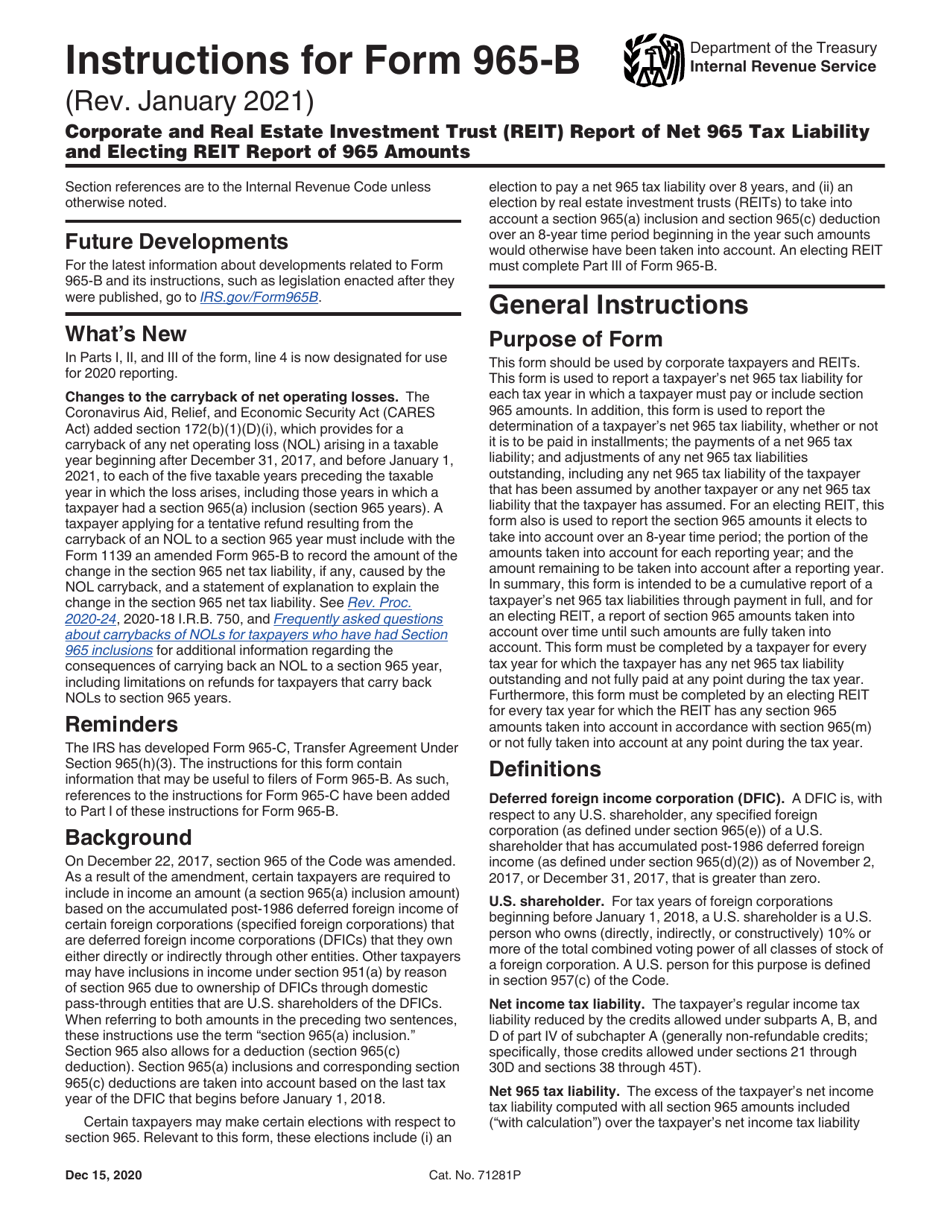

Form 965-B - Shareholders of a dfic should use schedules a, b, and c to calculate section 965(a) inclusion amounts. Web in summary, this form is intended to be a cumulative report of a taxpayer’s net 965 tax liabilities through payment in full, and for an electing reit, a report of section 965 amounts taken into account over time until such amounts are fully taken into account. In addition, this form is used to report the These and other forms and schedules are available on the irs website. January 2021) corporate and real estate investment trust (reit) report of net 965 tax liability and electing reit report of 965 amounts department of the treasury internal revenue service go to www.irs.gov/form965b for instructions and the latest information. See the instructions for your income tax return for general information about electronic filing. A detailed description of the acceleration or triggering event; If you file your income tax return electronically, form 965 and separate schedules f and h are filed with the electronic income tax return. Web this form is used to report a taxpayer’s net 965 tax liability for changes to the carryback of net operating losses. Web allocated in accordance with section 965(b) should file form 965.

These and other forms and schedules are available on the irs website. If you file your income tax return electronically, form 965 and separate schedules f and h are filed with the electronic income tax return. Shareholders of a dfic should use schedules a, b, and c to calculate section 965(a) inclusion amounts. Web allocated in accordance with section 965(b) should file form 965. • section 965(a) inclusions (schedules a, b, and c). In addition, this form is used to report the A detailed description of the acceleration or triggering event; January 2021) corporate and real estate investment trust (reit) report of net 965 tax liability and electing reit report of 965 amounts department of the treasury internal revenue service go to www.irs.gov/form965b for instructions and the latest information. Web in summary, this form is intended to be a cumulative report of a taxpayer’s net 965 tax liabilities through payment in full, and for an electing reit, a report of section 965 amounts taken into account over time until such amounts are fully taken into account. Web electronic filing of form 965.

If you file your income tax return electronically, form 965 and separate schedules f and h are filed with the electronic income tax return. The each tax year in which a taxpayer must pay or include section coronavirus aid, relief, and economic security act (cares 965 amounts. January 2021) corporate and real estate investment trust (reit) report of net 965 tax liability and electing reit report of 965 amounts department of the treasury internal revenue service go to www.irs.gov/form965b for instructions and the latest information. Web allocated in accordance with section 965(b) should file form 965. Web in summary, this form is intended to be a cumulative report of a taxpayer’s net 965 tax liabilities through payment in full, and for an electing reit, a report of section 965 amounts taken into account over time until such amounts are fully taken into account. A detailed description of the acceleration or triggering event; • section 965(a) inclusions (schedules a, b, and c). Web electronic filing of form 965. Shareholders of a dfic should use schedules a, b, and c to calculate section 965(a) inclusion amounts. Web this form is used to report a taxpayer’s net 965 tax liability for changes to the carryback of net operating losses.

IRS Form 965B Download Fillable PDF or Fill Online Corporate and Real

If you file your income tax return electronically, form 965 and separate schedules f and h are filed with the electronic income tax return. Web in summary, this form is intended to be a cumulative report of a taxpayer’s net 965 tax liabilities through payment in full, and for an electing reit, a report of section 965 amounts taken into.

IRS 3520A 2020 Fill out Tax Template Online US Legal Forms

Web electronic filing of form 965. See the instructions for your income tax return for general information about electronic filing. A detailed description of the acceleration or triggering event; Web allocated in accordance with section 965(b) should file form 965. These and other forms and schedules are available on the irs website.

Download Instructions for IRS Form 965B Corporate and Real Estate

In addition, this form is used to report the January 2021) corporate and real estate investment trust (reit) report of net 965 tax liability and electing reit report of 965 amounts department of the treasury internal revenue service go to www.irs.gov/form965b for instructions and the latest information. If you file your income tax return electronically, form 965 and separate schedules.

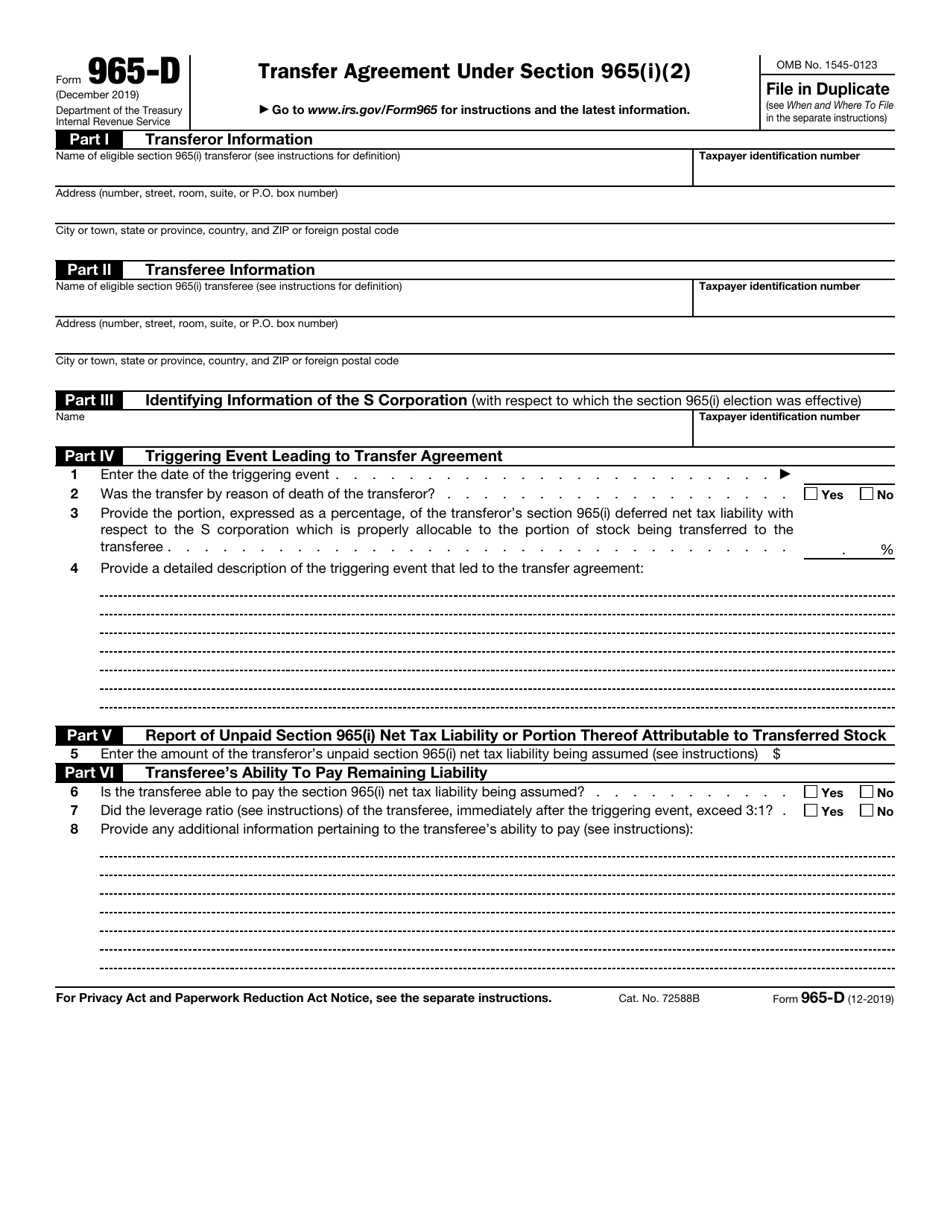

IRS Form 965D Download Fillable PDF or Fill Online Transfer Agreement

Web in summary, this form is intended to be a cumulative report of a taxpayer’s net 965 tax liabilities through payment in full, and for an electing reit, a report of section 965 amounts taken into account over time until such amounts are fully taken into account. Shareholders of a dfic should use schedules a, b, and c to calculate.

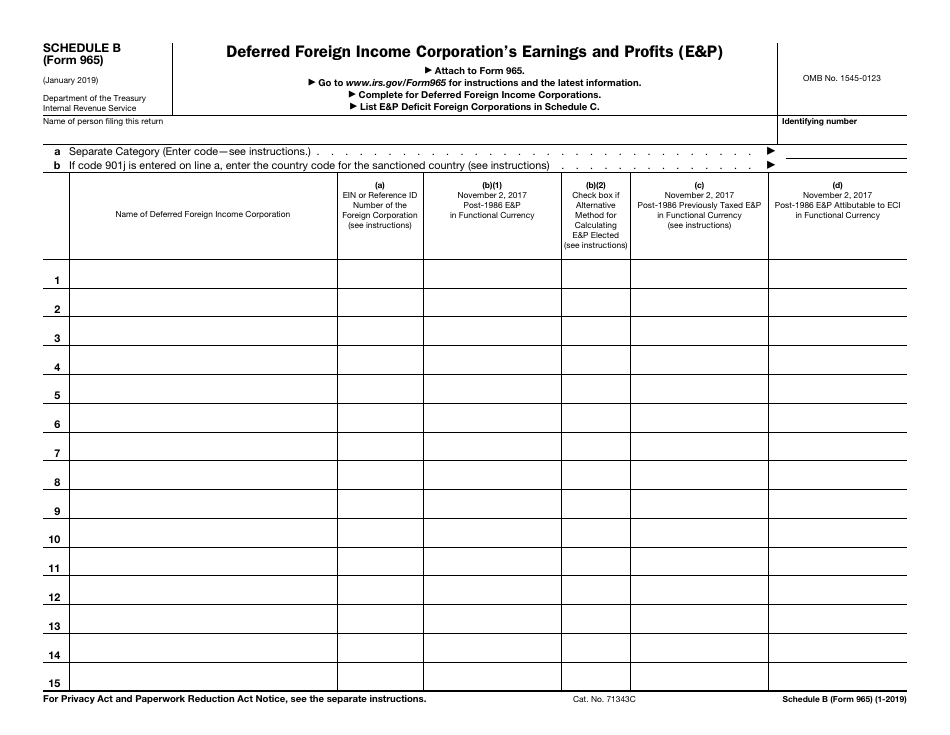

IRS Form 965 Schedule B Download Fillable PDF or Fill Online Deferred

Shareholders of a dfic should use schedules a, b, and c to calculate section 965(a) inclusion amounts. In addition, this form is used to report the Web this form is used to report a taxpayer’s net 965 tax liability for changes to the carryback of net operating losses. These and other forms and schedules are available on the irs website..

Form 11 Worksheet Five Things You Should Know Before Embarking On Form

See the instructions for your income tax return for general information about electronic filing. A detailed description of the acceleration or triggering event; Web in summary, this form is intended to be a cumulative report of a taxpayer’s net 965 tax liabilities through payment in full, and for an electing reit, a report of section 965 amounts taken into account.

286 Real Estate Investment Trust Reit Stock Photos Free & Royalty

If you file your income tax return electronically, form 965 and separate schedules f and h are filed with the electronic income tax return. Web in summary, this form is intended to be a cumulative report of a taxpayer’s net 965 tax liabilities through payment in full, and for an electing reit, a report of section 965 amounts taken into.

Form 965 Instrument Flight Rules Pilot (Aeronautics)

Web this form is used to report a taxpayer’s net 965 tax liability for changes to the carryback of net operating losses. Shareholders of a dfic should use schedules a, b, and c to calculate section 965(a) inclusion amounts. These and other forms and schedules are available on the irs website. If you file your income tax return electronically, form.

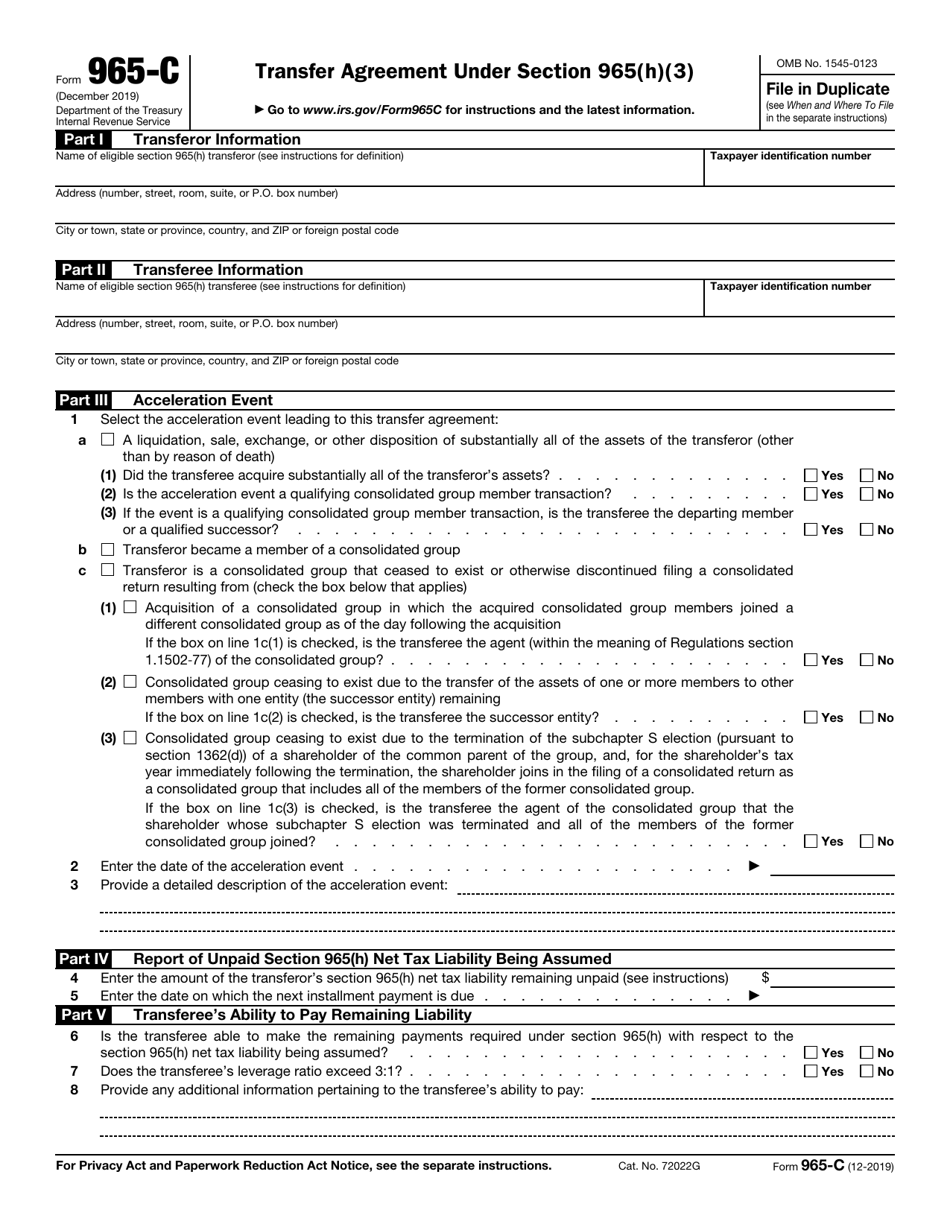

IRS Form 965C Download Fillable PDF or Fill Online Transfer Agreement

If you file your income tax return electronically, form 965 and separate schedules f and h are filed with the electronic income tax return. The each tax year in which a taxpayer must pay or include section coronavirus aid, relief, and economic security act (cares 965 amounts. See the instructions for your income tax return for general information about electronic.

Form 11b Five New Thoughts About Form 11b That Will Turn Your World

If you file your income tax return electronically, form 965 and separate schedules f and h are filed with the electronic income tax return. In addition, this form is used to report the Web allocated in accordance with section 965(b) should file form 965. Web electronic filing of form 965. See the instructions for your income tax return for general.

Web In Summary, This Form Is Intended To Be A Cumulative Report Of A Taxpayer’s Net 965 Tax Liabilities Through Payment In Full, And For An Electing Reit, A Report Of Section 965 Amounts Taken Into Account Over Time Until Such Amounts Are Fully Taken Into Account.

These and other forms and schedules are available on the irs website. Shareholders of a dfic should use schedules a, b, and c to calculate section 965(a) inclusion amounts. If you file your income tax return electronically, form 965 and separate schedules f and h are filed with the electronic income tax return. January 2021) corporate and real estate investment trust (reit) report of net 965 tax liability and electing reit report of 965 amounts department of the treasury internal revenue service go to www.irs.gov/form965b for instructions and the latest information.

See The Instructions For Your Income Tax Return For General Information About Electronic Filing.

In addition, this form is used to report the • section 965(a) inclusions (schedules a, b, and c). The each tax year in which a taxpayer must pay or include section coronavirus aid, relief, and economic security act (cares 965 amounts. Web this form is used to report a taxpayer’s net 965 tax liability for changes to the carryback of net operating losses.

Web Allocated In Accordance With Section 965(B) Should File Form 965.

Web electronic filing of form 965. A detailed description of the acceleration or triggering event;