Form 943-A

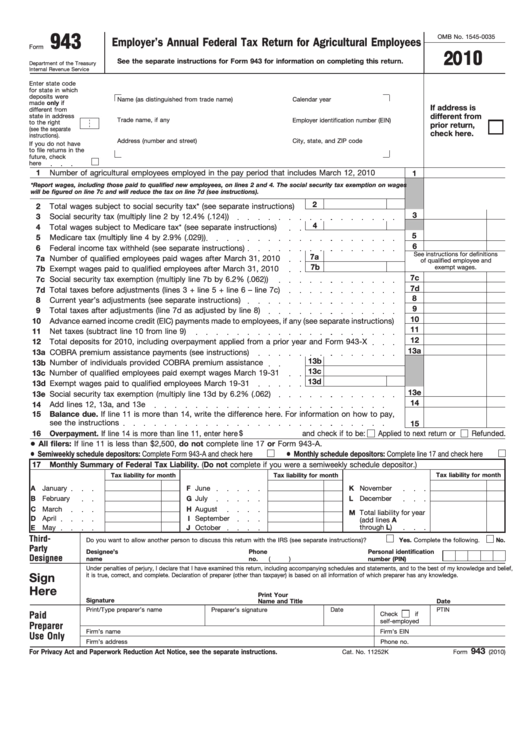

Form 943-A - Get a fillable 943 form 2022 template online. Web up to $32 cash back form 943, employer’s annual federal tax return for agricultural employees, is used to report federal income tax, social security and medicare. If you’re a monthly schedule depositor, complete section 17 and check the box. Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022. Ad access irs tax forms. Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes for wages paid to. Web the rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages for leave taken after march 31, 2021, and before october 1,. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere.

Web agricultural employers (who deposit income tax withheld and social security and medicare taxes on a semiweekly schedule) use this form to report their tax liability. Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes for wages paid to. Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022. Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. Get a fillable 943 form 2022 template online. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. Web the rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages for leave taken after march 31, 2021, and before october 1,. Web form 943 (schedule r) allows (1) an agent appointed by an employer or payer or (2) a customer who enters into a contract that meets the requirements under. In other words, it is a tax form used to report federal income tax, social. Also, you must enter the liabilities previously reported for the year that did not change.

Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022. Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes for wages paid to. Get a fillable 943 form 2022 template online. If you’re a monthly schedule depositor, complete section 17 and check the box. Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. Web this change means that many agricultural producers may now qualify for the 2020 erc. Ad access irs tax forms. In other words, it is a tax form used to report federal income tax, social. Also, you must enter the liabilities previously reported for the year that did not change. Web form 943, is the employer’s annual federal tax return for agricultural employees.

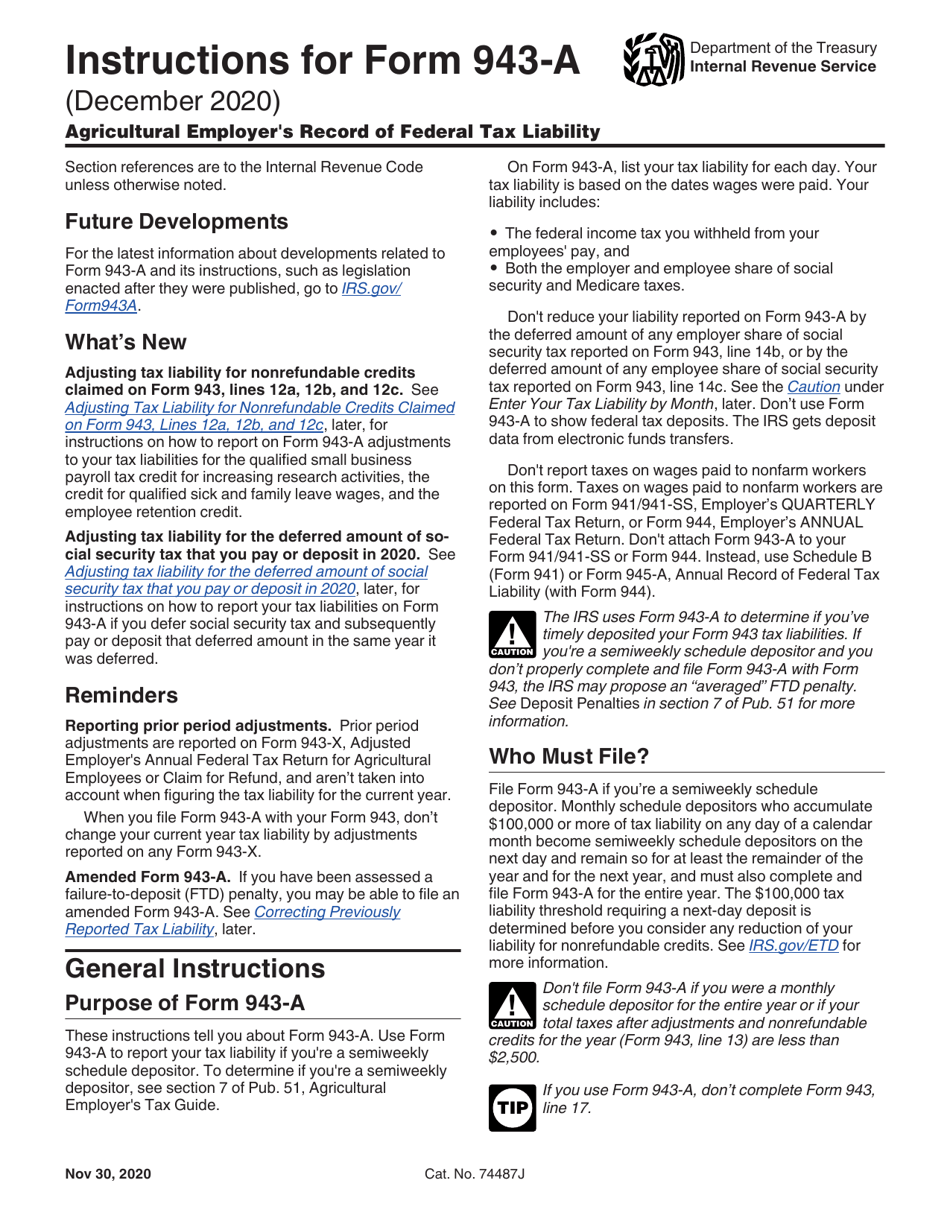

Download Instructions for IRS Form 943A Agricultural Employer's Record

In other words, it is a tax form used to report federal income tax, social. Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes for wages paid to. Ad access irs tax forms. Web up to $32 cash back form 943, employer’s annual federal tax return for agricultural.

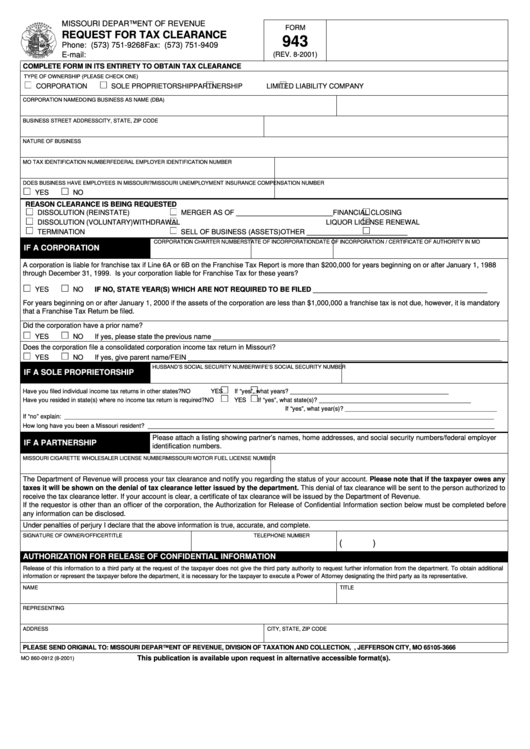

Form 943 Request For Tax Clearance printable pdf download

Web form 943, is the employer’s annual federal tax return for agricultural employees. Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022. Web up to $32 cash back form 943, employer’s annual federal tax return for agricultural employees,.

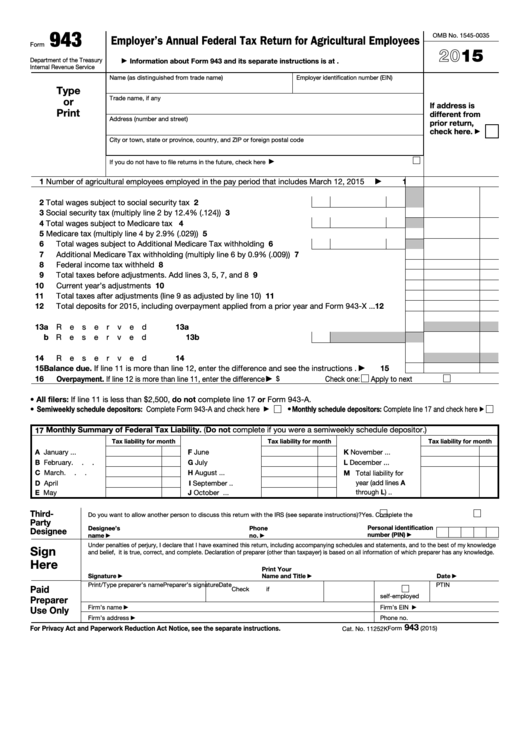

Agricultural Employer's Record of Federal Tax Liability Free Download

In other words, it is a tax form used to report federal income tax, social. Web form 943, is the employer’s annual federal tax return for agricultural employees. Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes for wages paid to. Web information about form 943, employer's annual.

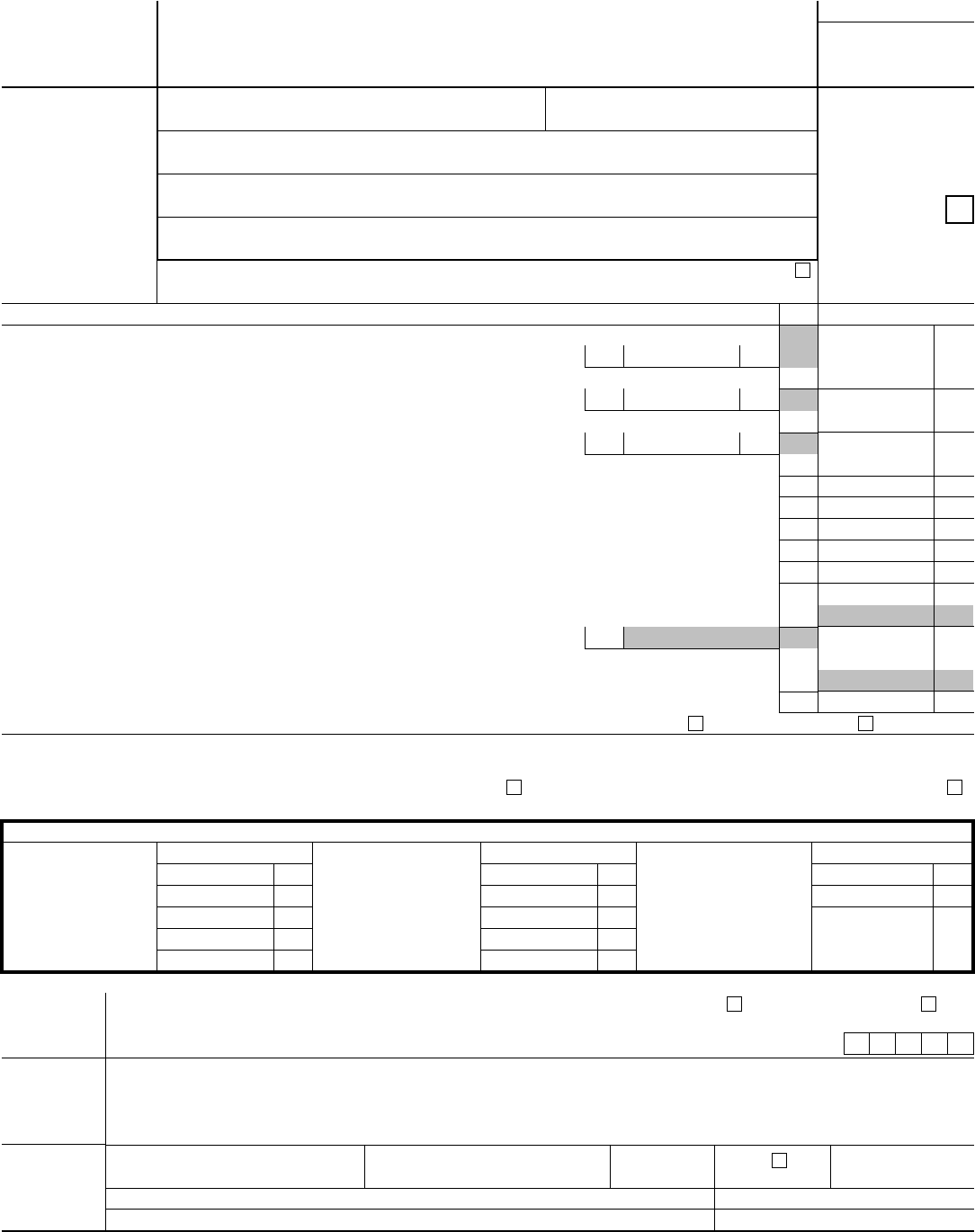

Editable IRS Form 943A 2017 2019 Create A Digital Sample in PDF

Web the rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages for leave taken after march 31, 2021, and before october 1,. Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax.

Fillable Form 943 Employer'S Annual Federal Tax Return For

Web agricultural employers (who deposit income tax withheld and social security and medicare taxes on a semiweekly schedule) use this form to report their tax liability. Ad access irs tax forms. Web up to $32 cash back form 943, employer’s annual federal tax return for agricultural employees, is used to report federal income tax, social security and medicare. Web form.

Form 943 Edit, Fill, Sign Online Handypdf

Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. Ad access irs tax forms. If you’re a monthly schedule depositor, complete section 17 and check the box. Write “amended” at the top of form. Web form 943 (schedule r) allows (1) an agent appointed by.

943a Fill Online, Printable, Fillable, Blank pdfFiller

Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. If you’re a monthly schedule depositor, complete section 17 and check the box. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Web irs form 943, ( employer's annual federal tax return for agricultural employees) is.

Form 943 Employer'S Annual Federal Tax Return For Agricultural

Ad access irs tax forms. If you’re a monthly schedule depositor, complete section 17 and check the box. Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes for wages paid to. Also, you must enter the liabilities previously reported for the year that did not change. Complete, edit.

Fill Free fillable F943x Accessible Form 943X (Rev. February 2018

To determine if you're a semiweekly schedule. Write “amended” at the top of form. In other words, it is a tax form used to report federal income tax, social. Web form 943, is the employer’s annual federal tax return for agricultural employees. Web up to $32 cash back form 943, employer’s annual federal tax return for agricultural employees, is used.

Agricultural Employer's Record of Federal Tax Liability Free Download

Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes for wages paid to. Web up to $32 cash back form 943, employer’s annual federal tax return for agricultural employees, is used to report federal income tax, social security and medicare. Get a fillable 943 form 2022 template online..

Web Agricultural Employers (Who Deposit Income Tax Withheld And Social Security And Medicare Taxes On A Semiweekly Schedule) Use This Form To Report Their Tax Liability.

Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. Also, you must enter the liabilities previously reported for the year that did not change. Complete, edit or print tax forms instantly. Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere.

Web The Rate Of Social Security Tax On Taxable Wages, Including Qualified Sick Leave Wages And Qualified Family Leave Wages For Leave Taken After March 31, 2021, And Before October 1,.

Web this change means that many agricultural producers may now qualify for the 2020 erc. Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022. Ad access irs tax forms. In other words, it is a tax form used to report federal income tax, social.

To Determine If You're A Semiweekly Schedule.

If you’re a monthly schedule depositor, complete section 17 and check the box. Web up to $32 cash back form 943, employer’s annual federal tax return for agricultural employees, is used to report federal income tax, social security and medicare. Get a fillable 943 form 2022 template online. Web form 943 (schedule r) allows (1) an agent appointed by an employer or payer or (2) a customer who enters into a contract that meets the requirements under.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Write “amended” at the top of form. Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes for wages paid to. Web form 943, is the employer’s annual federal tax return for agricultural employees.