Form 941 Due Dates For 2023

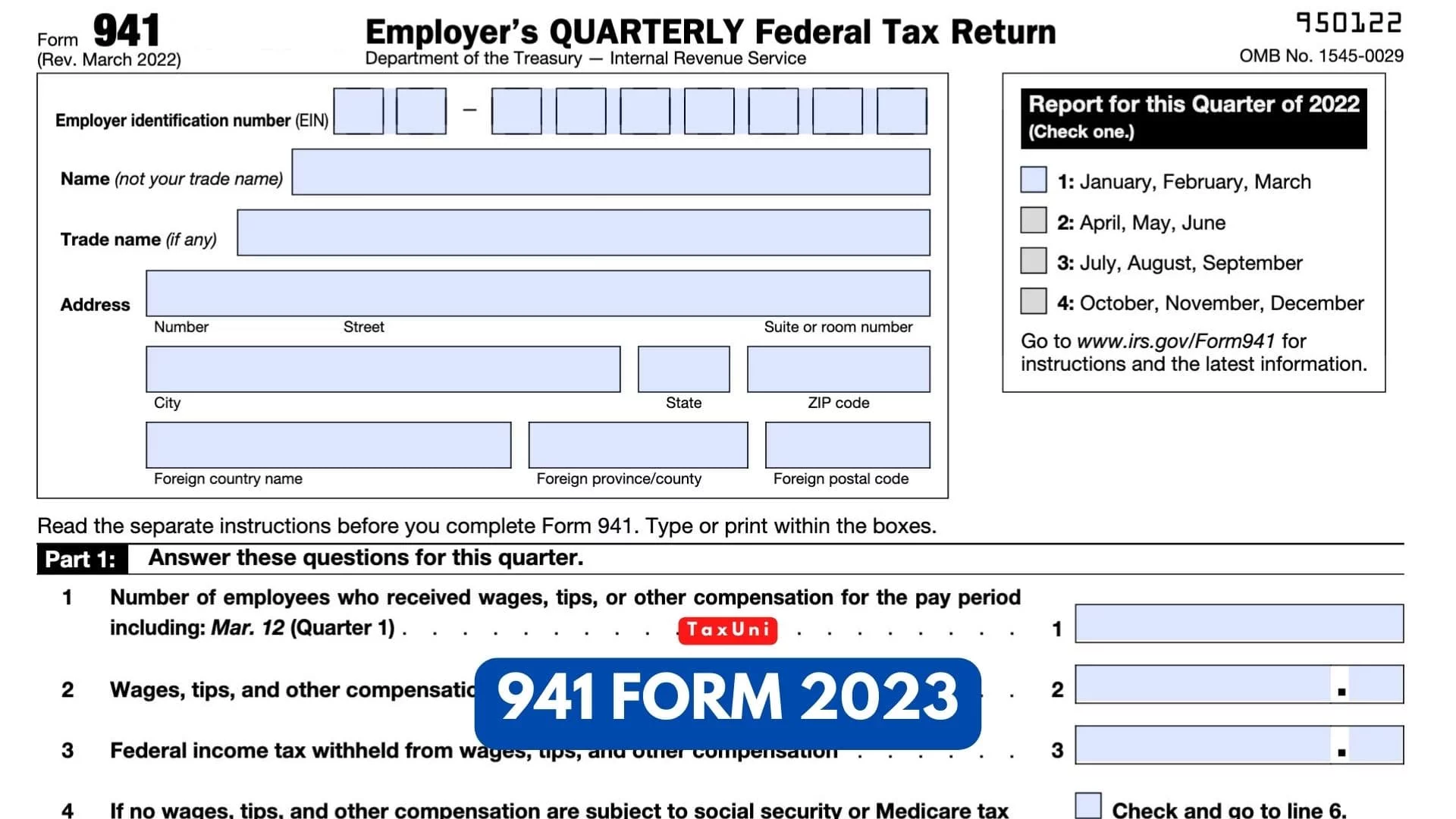

Form 941 Due Dates For 2023 - Web the rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2021, and. Form 941 is used to report the social security, medicare, and income taxes withheld from employee. Deposit dates tips to balance. Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. Web april 30 july 31 october 31 in addition to this, the due date for paying taxes may vary as well. Those returns are processed in. Web line by line review of the 2023 form 941 third quarter pending changes to the third quarter tips for completing the schedule b—liability dates vs. Web form 941 for q1, 2023 is due in a week, meet the irs deadline with taxbandits taxbandits april 24, 2023 at 12:30 pm · 3 min read rock hill, sc /. Web your form 941 is due by the last day of the month that follows the end of the quarter. Web the 2nd quarter filing deadline for 2023 form 941, employer’s quarterly federal tax return, is july 31, 2023.

As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Web the deadline to file 941 will be the last day of the month following the end of the quarter. Quarter one (january, february, march): Web for 2023, the “lookback period” is july 1, 2021, through june 30, 2022. The total tax reported on forms 941 during the “lookback period” is. Web line by line review of the 2023 form 941 third quarter pending changes to the third quarter tips for completing the schedule b—liability dates vs. Web rock hill, sc / accesswire / july 28, 2023 / the next business day, monday, july 31, 2023, is the deadline for employers to file form 941 with the irs. Web form 941 is generally due by the last day of the month following the end of the quarter. Deposit dates tips to balance. Web the deadline to file form 941 for q1 of 2023 falls on may 1, 2023.

Web form 941 for q1, 2023 is due in a week, meet the irs deadline with taxbandits taxbandits april 24, 2023 at 12:30 pm · 3 min read rock hill, sc /. We provide this information to ensure. For 2023, form 941 is due by may 1, july 31, october 31,january 31. Web if the employer deferred paying the employer share of social security tax or the railroad retirement tax equivalent in 2020, 50% of the deferred amount of the employer share of. Web april 30 july 31 october 31 in addition to this, the due date for paying taxes may vary as well. Web form 941 is generally due by the last day of the month following the end of the quarter. Deposit dates tips to balance. Rock hill, sc / accesswire / july 28, 2023 / the next business day, monday, july 31, 2023, is the deadline for employers to file form 941 with. Web the deadline to file form 941 for q1 of 2023 falls on may 1, 2023. Reporting income tax withholding and fica taxes for first quarter 2023 (form 941) and paying any tax due.

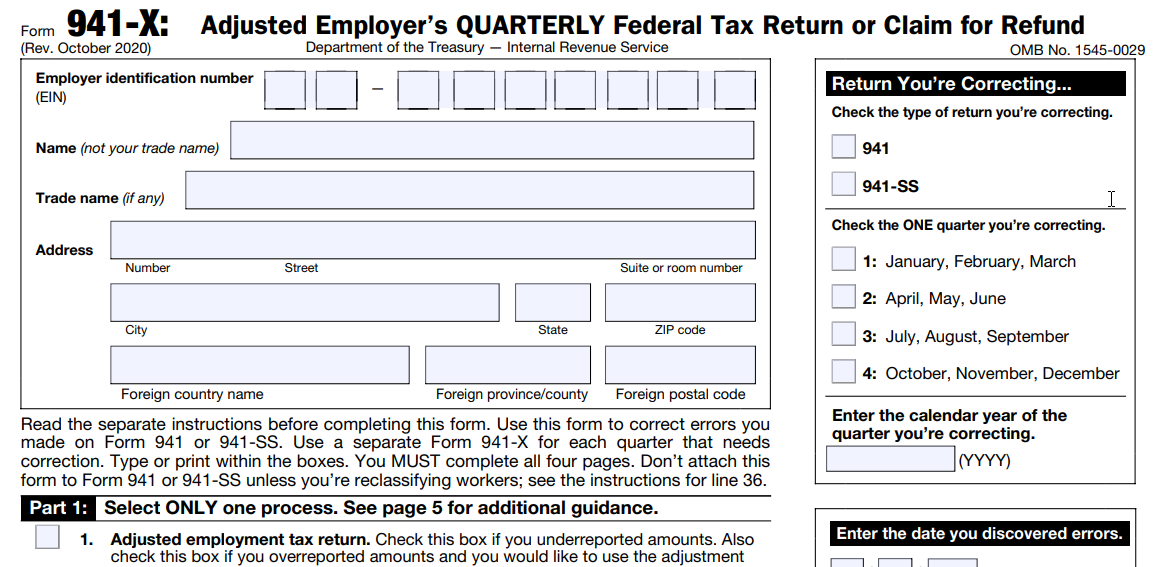

How to fill out IRS Form 941 2019 PDF Expert

Web line by line review of the 2023 form 941 third quarter pending changes to the third quarter tips for completing the schedule b—liability dates vs. Form 941 is used to report the social security, medicare, and income taxes withheld from employee. Web state zip code foreign country name foreign province/county foreign postal code 950122 omb no. Deposit dates tips.

2023 Payroll Tax & Form 941 Due Dates Paylocity

However, in general, they are relatively the same as the previous year. July 22, 2023 5:00 a.m. Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. We provide this information to ensure. Those returns are processed in.

941 Form 2023

Web april 30 july 31 october 31 what is the penalty for failing to file form 941? Web form 941 for q1, 2023 is due in a week, meet the irs deadline with taxbandits taxbandits april 24, 2023 at 12:30 pm · 3 min read rock hill, sc /. Web your form 941 is due by the last day of.

2020 Form IRS 941PR Fill Online, Printable, Fillable, Blank pdfFiller

Web the 2nd quarter filing deadline for 2023 form 941, employer’s quarterly federal tax return, is july 31, 2023. There is also a small update to the instruction box for line 5. Web your form 941 is due by the last day of the month that follows the end of the quarter. Deposit dates tips to balance. Annual personal income.

Form 941 Employer's Quarterly Federal Tax Return Definition

Web the irs has introduced a second worksheet for form 941. Web april 30 july 31 october 31 what is the penalty for failing to file form 941? Reporting income tax withholding and fica taxes for first quarter 2023 (form 941) and paying any tax due. Web state zip code foreign country name foreign province/county foreign postal code 950122 omb.

New Form 941 for Q2 2022 Revised IRS Form 941 For 2nd Quarter

We provide this information to ensure. Since april 15 falls on a saturday, and emancipation day. Web 2023 irs form 941 deposit rules and schedule oct 18, 2022 released september 30, 2022 notice 931 sets the deposit rules and schedule for form 941 this. Quarter one (january, february, march): Web payroll tax returns.

EFile Form 941 for 2022 File 941 Electronically at 4.95

Form 941 is used to report the social security, medicare, and income taxes withheld from employee. For 2023, form 941 is due by may 1, july 31, october 31,january 31. Web 2023 irs form 941 deposit rules and schedule oct 18, 2022 released september 30, 2022 notice 931 sets the deposit rules and schedule for form 941 this. We provide.

Irs 941 Instructions Publication 15 All Are Here

Web for 2023, the “lookback period” is july 1, 2021, through june 30, 2022. Since april 15 falls on a saturday, and emancipation day. Web the deadline to file form 941 for q1 of 2023 falls on may 1, 2023. For 2023, form 941 is payable the may 2, august 1, october 31, & As of july 13, 2023, the.

2021 IRS Form 941 Deposit Rules and Schedule

Web the deadline to file form 941 for q1 of 2023 falls on may 1, 2023. Web which deadline to file 941 will be the last date of the month later the end of the quarter. Web form 941 for q1, 2023 is due in a week, meet the irs deadline with taxbandits taxbandits april 24, 2023 at 12:30 pm.

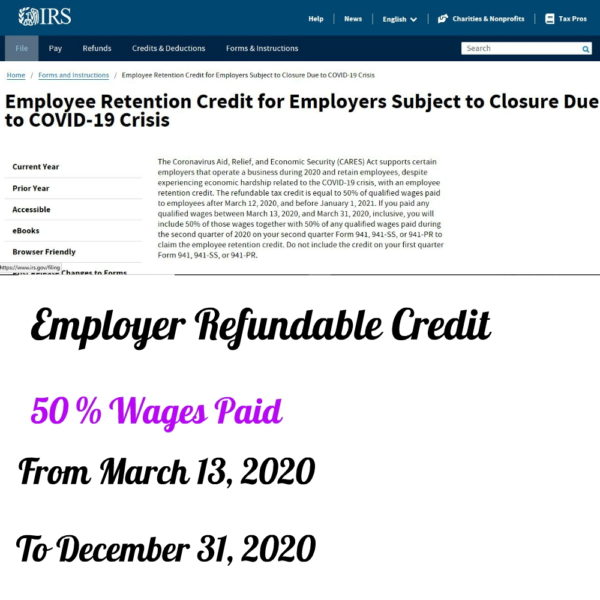

2020 Form 941 Employee Retention Credit for Employers subject to

Web the rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2021, and. Deposit dates tips to balance. We provide this information to ensure. Web the irs has introduced a second worksheet for form 941. Web april 30 july 31 october 31.

Deposit Dates Tips To Balance.

Web the deadline to file 941 will be the last day of the month following the end of the quarter. Web payroll tax returns. Reporting income tax withholding and fica taxes for first quarter 2023 (form 941) and paying any tax due. Web form 941 is generally due by the last day of the month following the end of the quarter.

We Provide This Information To Ensure.

July 22, 2023 5:00 a.m. Web the 2nd quarter filing deadline for 2023 form 941, employer’s quarterly federal tax return, is july 31, 2023. Web rock hill, sc / accesswire / july 28, 2023 / the next business day, monday, july 31, 2023, is the deadline for employers to file form 941 with the irs. For 2023, form 941 is payable the may 2, august 1, october 31, &

There Is Also A Small Update To The Instruction Box For Line 5.

Web form 941 for q1, 2023 is due in a week, meet the irs deadline with taxbandits taxbandits april 24, 2023 at 12:30 pm · 3 min read rock hill, sc /. However, in general, they are relatively the same as the previous year. For 2023, form 941 is due by may 1, july 31, october 31,january 31. Since april 15 falls on a saturday, and emancipation day.

Web April 30 July 31 October 31 In Addition To This, The Due Date For Paying Taxes May Vary As Well.

As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Those returns are processed in. Web the rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2021, and. Quarter one (january, february, march):

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)