Form 8996 To Certify As A Qualified Opportunity Fund

Form 8996 To Certify As A Qualified Opportunity Fund - Web partnerships and corporations that invested in qualified opportunity funds are likely already familiar with form 8996. Sign up and browse today. Qualified opportunity zone businesses do not file form 8996. That form must be completed. The 2022 instructions for form 8996, qualified opportunity fund, will make it clear that a. Web qualified opportunity fund 8996 part i general information and certification 1 type of taxpayer: Web a qualified opportunity fund (qof) is a corporation or partnership created for the purpose of investing in qozs. Taxpayers that invest in qoz property through a qof can defer the recognition of certain gains. The form was created so that corporations. Our comments meant to bring taxpayer reporting.

Taxpayers that invest in qoz property through a qof can defer the recognition of certain gains. Sign up and browse today. Ad benefit from sizable tax advantages by investing in qualified opportunity funds. To do so, irs form 8996 must be filed by all. Web a qualified opportunity fund (qof) is a corporation or partnership created for the purpose of investing in qozs. To encourage investment, the tcja allows a. That form must be completed. Web partnerships and corporations that invested in qualified opportunity funds are likely already familiar with form 8996. Web form 8996 is filed only by qualified opportunity funds. Our comments meant to bring taxpayer reporting.

Web the irs has published a private letter ruling on section 1400z and treasury regulation section 301.9100 regarding an extension of time to file form 8996 for an. The irs has published a private letter ruling on section 1400z and treasury regulation section 301.9100 granting relief to deem taxpayer’s form 8996. Qualified opportunity zone businesses do not file form 8996. Sign up and browse today. That form must be completed. Our comments meant to bring taxpayer reporting. Web a qualified opportunity fund (qof) is a corporation or partnership created for the purpose of investing in qozs. Web annually, qoz funds are required to submit form 8996, qualified opportunity fund, to certify to the irs the qof status, provide investment information. Taxpayers that invest in qoz property through a qof can defer the recognition of certain gains. Ad benefit from sizable tax advantages by investing in qualified opportunity funds.

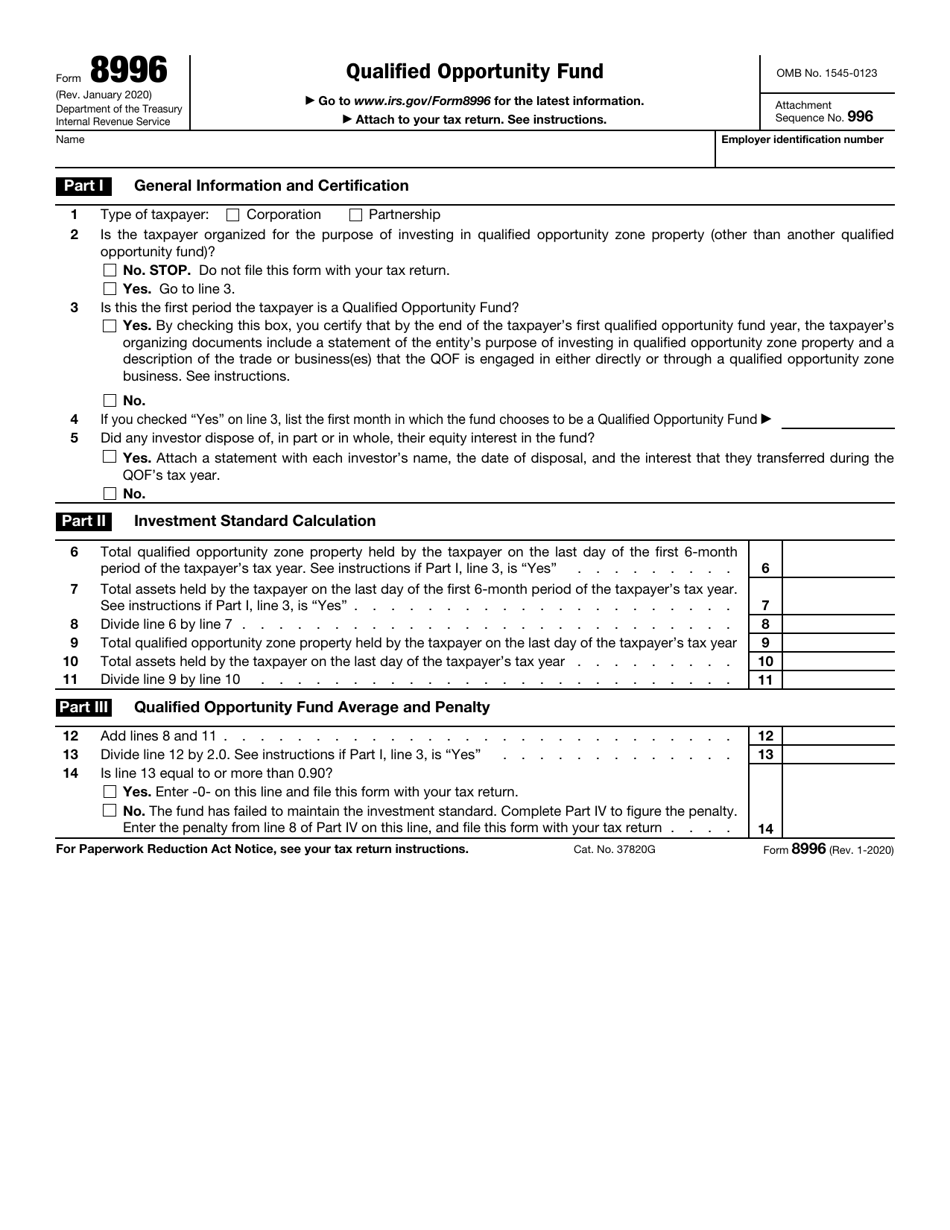

Download Instructions for IRS Form 8996 Qualified Opportunity Fund PDF

That form must be completed. To do so, irs form 8996 must be filed by all. Taxpayers that invest in qoz property through a qof can defer the recognition of certain gains. Web 3 rows description of the trade or business(es) that the qof is engaged in either directly or through a. Web february 25, 2022 podcast taxpayers can defer.

Fill Free fillable Form 8996 Qualified Opportunity Fund (IRS) PDF form

Web form 8996 is filed only by qualified opportunity funds. That form must be completed. Web the irs has published a private letter ruling on section 1400z and treasury regulation section 301.9100 regarding an extension of time to file form 8996 for an. Corporation partnership 2 is the taxpayer organized for the purpose of. Ad benefit from sizable tax advantages.

IRS Form 8996 Qualified Opportunity Fund Lies On Flat Lay Office Table

Corporation partnership 2 is the taxpayer organized for the purpose of. The irs has published a private letter ruling on section 1400z and treasury regulation section 301.9100 granting relief to deem taxpayer’s form 8996. Web form 8996 is filed only by qualified opportunity funds. Web annually, qoz funds are required to submit form 8996, qualified opportunity fund, to certify to.

Download Instructions for IRS Form 8996 Qualified Opportunity Fund PDF

Ad benefit from sizable tax advantages by investing in qualified opportunity funds. Web a qualified opportunity fund (qof) is a corporation or partnership created for the purpose of investing in qozs. Web 3 rows description of the trade or business(es) that the qof is engaged in either directly or through a. Web annually, qoz funds are required to submit form.

Download Instructions for IRS Form 8996 Qualified Opportunity Fund PDF

Web investment in qualified opportunity funds (qofs). Web february 25, 2022 podcast taxpayers can defer taxes by reinvesting capital gains from an asset sale into a qof. Web a qualified opportunity fund (qof) is a corporation or partnership created for the purpose of investing in qozs. The irs has published a private letter ruling on section 1400z and treasury regulation.

IRS form 8996 Qualified opportunity fund lies on flat lay office table

Web annually, qoz funds are required to submit form 8996, qualified opportunity fund, to certify to the irs the qof status, provide investment information. Sign up and browse today. Qualified opportunity fund (irs) form is 4 pages long and contains: The irs has published a private letter ruling on section 1400z and treasury regulation section 301.9100 granting relief to deem.

Download Instructions for IRS Form 8996 Qualified Opportunity Fund PDF

Web the irs has published a private letter ruling on section 1400z and treasury regulation section 301.9100 regarding an extension of time to file form 8996 for an. The 2022 instructions for form 8996, qualified opportunity fund, will make it clear that a. Sign up and browse today. Web annually, qoz funds are required to submit form 8996, qualified opportunity.

IRS Form 8996 Download Fillable PDF or Fill Online Qualified

Sign up and browse today. Our comments meant to bring taxpayer reporting. Web annually, qoz funds are required to submit form 8996, qualified opportunity fund, to certify to the irs the qof status, provide investment information. Taxpayers that invest in qoz property through a qof can defer the recognition of certain gains. Web investment in qualified opportunity funds (qofs).

Download Instructions for IRS Form 8996 Qualified Opportunity Fund PDF

To do so, irs form 8996 must be filed by all. Ad benefit from sizable tax advantages by investing in qualified opportunity funds. Web february 25, 2022 podcast taxpayers can defer taxes by reinvesting capital gains from an asset sale into a qof. Our comments meant to bring taxpayer reporting. Web annually, qoz funds are required to submit form 8996,.

Fill Free fillable Form 8996 Qualified Opportunity Fund (IRS) PDF form

Web partnerships and corporations that invested in qualified opportunity funds are likely already familiar with form 8996. Web the irs has published a private letter ruling on section 1400z and treasury regulation section 301.9100 regarding an extension of time to file form 8996 for an. Web investment in qualified opportunity funds (qofs). Qualified opportunity zone businesses do not file form.

To Do So, Irs Form 8996 Must Be Filed By All.

Ad benefit from sizable tax advantages by investing in qualified opportunity funds. Web form 8996 is filed only by qualified opportunity funds. Web qualified opportunity fund 8996 part i general information and certification 1 type of taxpayer: These new funds provide massive tax incentives for investing capital.

The Irs Has Published A Private Letter Ruling On Section 1400Z And Treasury Regulation Section 301.9100 Granting Relief To Deem Taxpayer’s Form 8996.

Qualified opportunity zone businesses do not file form 8996. Web a qualified opportunity fund (qof) is a corporation or partnership created for the purpose of investing in qozs. Sign up and browse today. Web annually, qoz funds are required to submit form 8996, qualified opportunity fund, to certify to the irs the qof status, provide investment information.

Web Partnerships And Corporations That Invested In Qualified Opportunity Funds Are Likely Already Familiar With Form 8996.

Web 3 rows description of the trade or business(es) that the qof is engaged in either directly or through a. That form must be completed. The form was created so that corporations. Web the form 8996:

Our Comments Meant To Bring Taxpayer Reporting.

Web investment in qualified opportunity funds (qofs). Corporation partnership 2 is the taxpayer organized for the purpose of. To encourage investment, the tcja allows a. Qualified opportunity fund (irs) form is 4 pages long and contains: