Form 8990 Instructions 2021

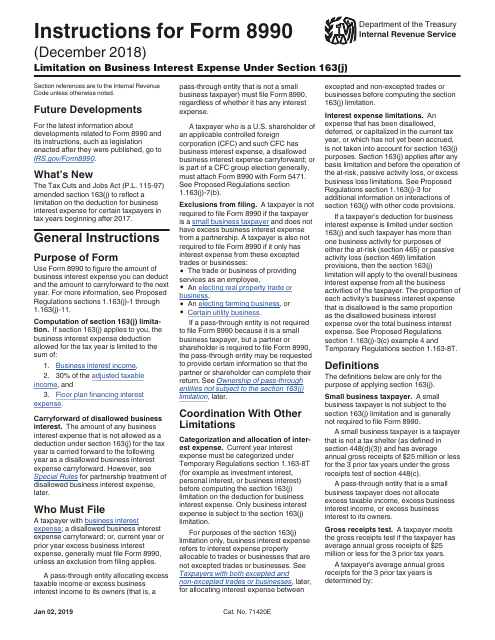

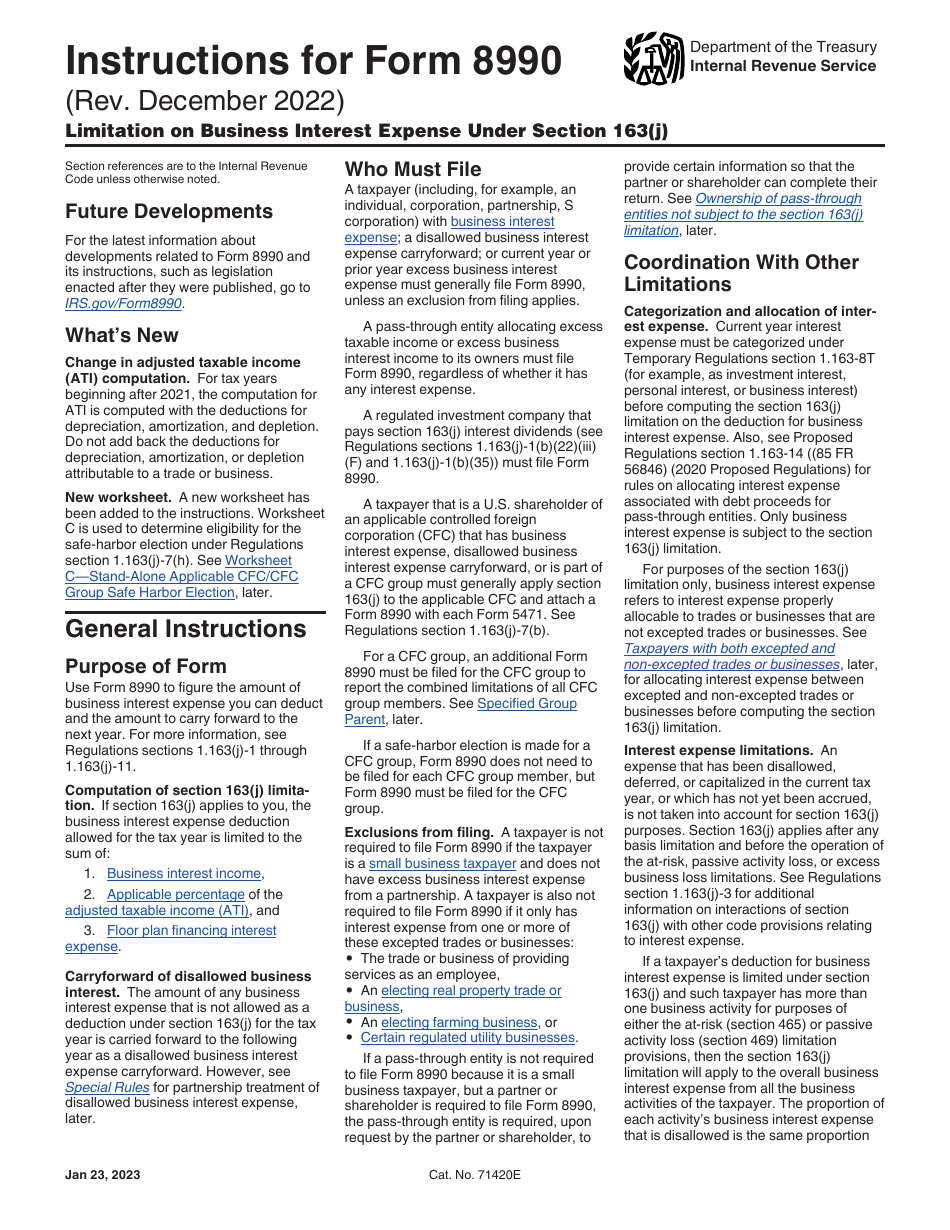

Form 8990 Instructions 2021 - Sign in products lacerte proconnect proseries easyacct quickbooks online accountant. For tax years beginning after 2021, the computation for ati is computed with the deductions for depreciation, amortization, and depletion. A taxpayer may generally apply the 2020 final regulations for taxable years beginning after december 31, 2017, so long as the taxpayer and its related parties consistently apply all of the rules of the 2020 final regulations. Web developments related to form 8990 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8990. Web taxpayers must calculate their business interest expense deductions on irs form 8990 to comply with the business interest limitation requirements outlined in internal revenue code section 163 (j). December 2022) department of the treasury internal revenue service limitation on business interest expense under section 163(j) attach to your tax return. Change in adjusted taxable income (ati) computation. Computation of section 163(j) limitation. For more information on the filing requirements and calculations, see the form 8990 instructions. Taxpayer name(s) shown on tax return identification number yes no yes no yes no

Web on january 19, 2021, the irs published additional final regulations (t.d. Web taxpayers must calculate their business interest expense deductions on irs form 8990 to comply with the business interest limitation requirements outlined in internal revenue code section 163 (j). Carryforward of disallowed business interest. Web get your taxes done wstewart level 2 form 8990 for dummies looking for help from some of the more knowledgable members here, like @nexchap and others. What’s new change in adjusted taxable income (ati) computation. For more information on the filing requirements and calculations, see the form 8990 instructions. Change in adjusted taxable income (ati) computation. For tax years beginning after 2021, the computation for ati is computed with the deductions for depreciation, amortization, and depletion. A taxpayer may generally apply the 2020 final regulations for taxable years beginning after december 31, 2017, so long as the taxpayer and its related parties consistently apply all of the rules of the 2020 final regulations. December 2022) department of the treasury internal revenue service limitation on business interest expense under section 163(j) attach to your tax return.

December 2022) department of the treasury internal revenue service limitation on business interest expense under section 163(j) attach to your tax return. Web taxpayers must calculate their business interest expense deductions on irs form 8990 to comply with the business interest limitation requirements outlined in internal revenue code section 163 (j). Sign in products lacerte proconnect proseries easyacct quickbooks online accountant. Change in adjusted taxable income (ati) computation. A taxpayer may generally apply the 2020 final regulations for taxable years beginning after december 31, 2017, so long as the taxpayer and its related parties consistently apply all of the rules of the 2020 final regulations. Taxpayer name(s) shown on tax return identification number yes no yes no yes no Web information about form 8990, limitation on business interest expense under section 163(j), including recent updates, related forms and instructions on how to file. For more information on the filing requirements and calculations, see the form 8990 instructions. Carryforward of disallowed business interest. For tax years beginning after 2021, the computation for ati is computed with the deductions for depreciation, amortization, and depletion.

Download Instructions for IRS Form 8990 Limitation on Business Interest

What’s new change in adjusted taxable income (ati) computation. Computation of section 163(j) limitation. For tax years beginning after 2021, the computation for ati is computed with the deductions for depreciation, amortization, and depletion. Web developments related to form 8990 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8990. Computation of allowable business interest expense.

How to find form 1125 E Compensation of officers online YouTube

A taxpayer may generally apply the 2020 final regulations for taxable years beginning after december 31, 2017, so long as the taxpayer and its related parties consistently apply all of the rules of the 2020 final regulations. Web developments related to form 8990 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8990. For more information.

Download Instructions for IRS Form 8990 Limitation on Business Interest

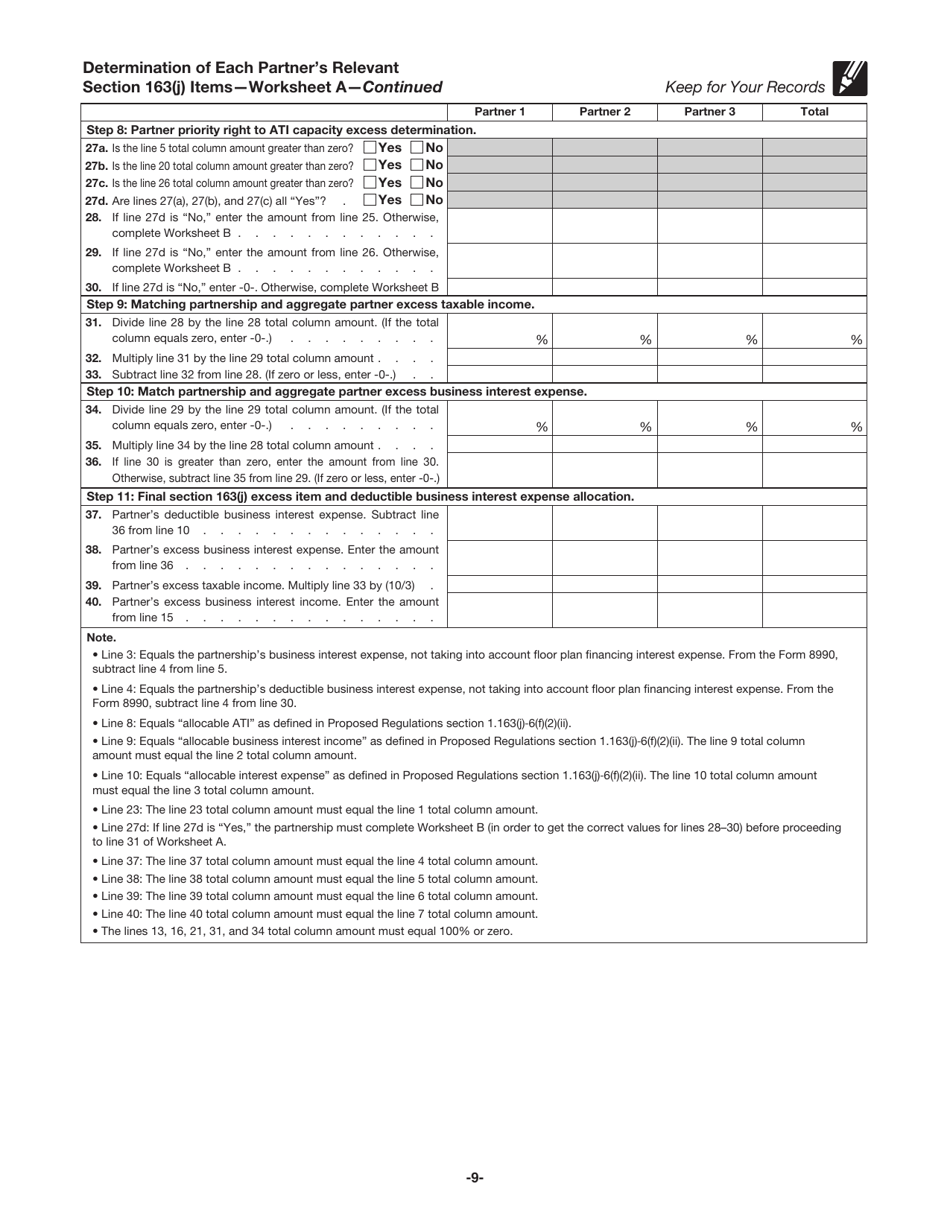

Table of contents how do i complete irs form 8990? For more information on the filing requirements and calculations, see the form 8990 instructions. For tax years beginning after 2021, the computation for ati is computed with the deductions for depreciation, amortization, and depletion. Use form 8990 to calculate the amount of business interest expense you can deduct and the.

K1 Excess Business Interest Expense ubisenss

Web form 8990 calculates the business interest expense deduction and carryover amounts.the form utilizes the section 163(j) limitation on business interest expenses in coordination with other limits. Use form 8990 to calculate the amount of business interest expense you can deduct and the amount to carry forward to the next year. What’s new change in adjusted taxable income (ati) computation..

Download Instructions for IRS Form 8990 Limitation on Business Interest

For tax years beginning after 2021, the computation for ati is computed with the deductions for depreciation, amortization, and depletion. Change in adjusted taxable income (ati) computation. Web taxpayers must calculate their business interest expense deductions on irs form 8990 to comply with the business interest limitation requirements outlined in internal revenue code section 163 (j). Web form 8990 calculates.

8990 Fill out & sign online DocHub

Table of contents how do i complete irs form 8990? Sign in products lacerte proconnect proseries easyacct quickbooks online accountant. Computation of allowable business interest expense part ii: December 2022) department of the treasury internal revenue service limitation on business interest expense under section 163(j) attach to your tax return. Web form 8990 calculates the business interest expense deduction and.

Fill Free fillable form 8990 limitation on business interest expense

Change in adjusted taxable income (ati) computation. Web information about form 8990, limitation on business interest expense under section 163(j), including recent updates, related forms and instructions on how to file. For more information on the filing requirements and calculations, see the form 8990 instructions. For tax years beginning after 2021, the computation for ati is computed with the deductions.

1040NJ Data entry guidelines for a New Jersey partnership K1

Computation of allowable business interest expense part ii: December 2022) department of the treasury internal revenue service limitation on business interest expense under section 163(j) attach to your tax return. Web get your taxes done wstewart level 2 form 8990 for dummies looking for help from some of the more knowledgable members here, like @nexchap and others. Taxpayer name(s) shown.

Download Instructions for IRS Form 8990 Limitation on Business Interest

Sign in products lacerte proconnect proseries easyacct quickbooks online accountant. December 2022) department of the treasury internal revenue service limitation on business interest expense under section 163(j) attach to your tax return. Taxpayer name(s) shown on tax return identification number yes no yes no yes no A taxpayer may generally apply the 2020 final regulations for taxable years beginning after.

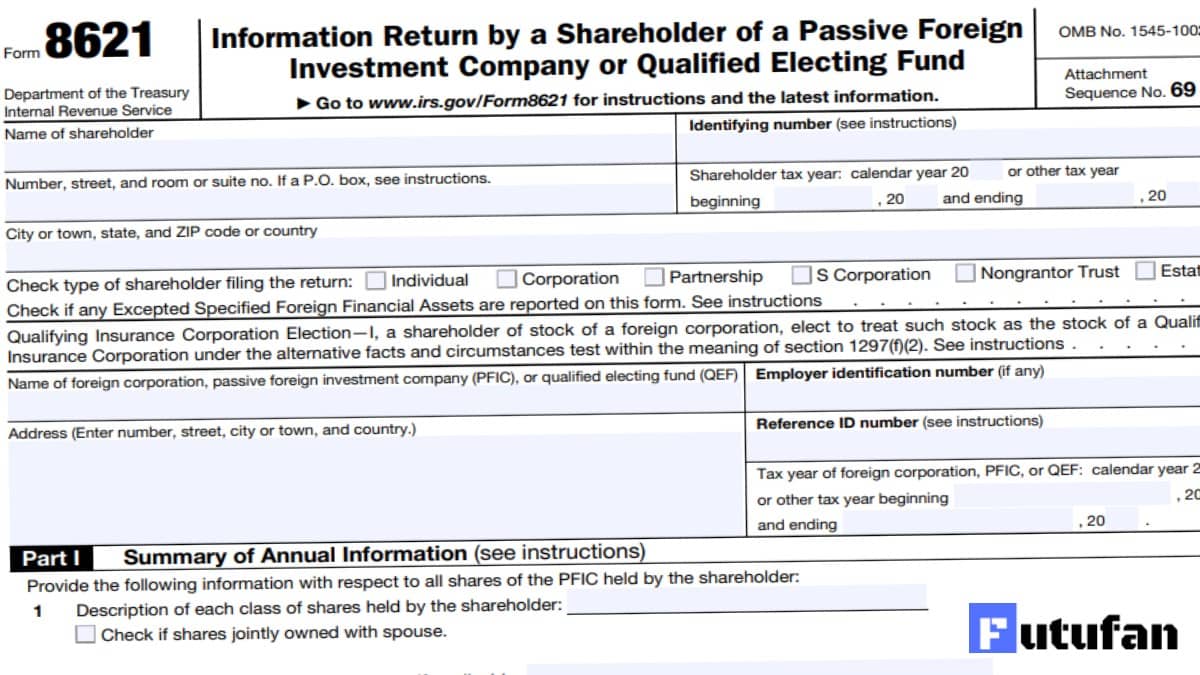

Form 8621 Instructions 2021 2022 IRS Forms

Sign in products lacerte proconnect proseries easyacct quickbooks online accountant. Carryforward of disallowed business interest. Computation of section 163(j) limitation. Table of contents how do i complete irs form 8990? Web information about form 8990, limitation on business interest expense under section 163(j), including recent updates, related forms and instructions on how to file.

Web Taxpayers Must Calculate Their Business Interest Expense Deductions On Irs Form 8990 To Comply With The Business Interest Limitation Requirements Outlined In Internal Revenue Code Section 163 (J).

What’s new change in adjusted taxable income (ati) computation. Sign in products lacerte proconnect proseries easyacct quickbooks online accountant. Use form 8990 to calculate the amount of business interest expense you can deduct and the amount to carry forward to the next year. Taxpayer name(s) shown on tax return identification number yes no yes no yes no

Computation Of Allowable Business Interest Expense Part Ii:

Web get your taxes done wstewart level 2 form 8990 for dummies looking for help from some of the more knowledgable members here, like @nexchap and others. Carryforward of disallowed business interest. Web form 8990 calculates the business interest expense deduction and carryover amounts.the form utilizes the section 163(j) limitation on business interest expenses in coordination with other limits. For more information on the filing requirements and calculations, see the form 8990 instructions.

December 2022) Department Of The Treasury Internal Revenue Service Limitation On Business Interest Expense Under Section 163(J) Attach To Your Tax Return.

For tax years beginning after 2021, the computation for ati is computed with the deductions for depreciation, amortization, and depletion. Table of contents how do i complete irs form 8990? Web developments related to form 8990 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8990. Change in adjusted taxable income (ati) computation.

Web On January 19, 2021, The Irs Published Additional Final Regulations (T.d.

Web information about form 8990, limitation on business interest expense under section 163(j), including recent updates, related forms and instructions on how to file. A taxpayer may generally apply the 2020 final regulations for taxable years beginning after december 31, 2017, so long as the taxpayer and its related parties consistently apply all of the rules of the 2020 final regulations. Computation of section 163(j) limitation.