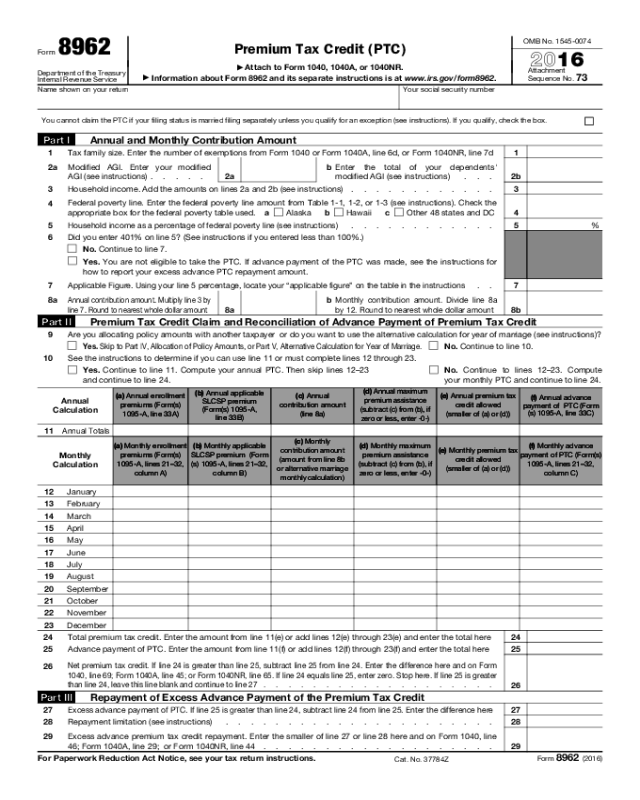

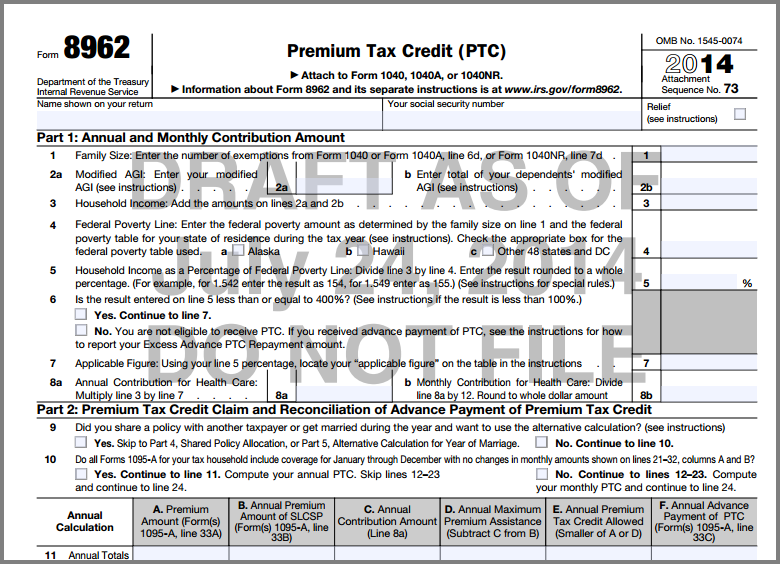

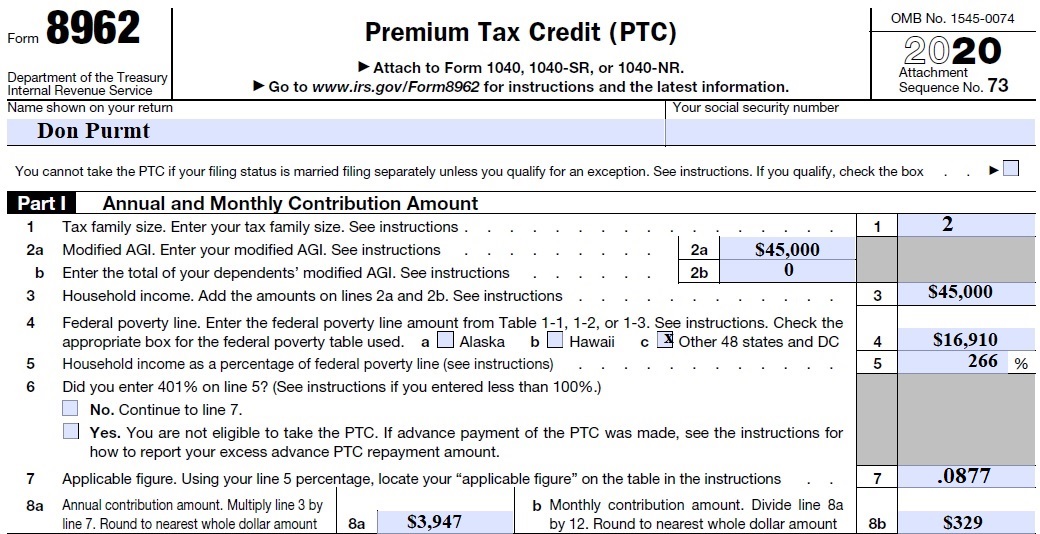

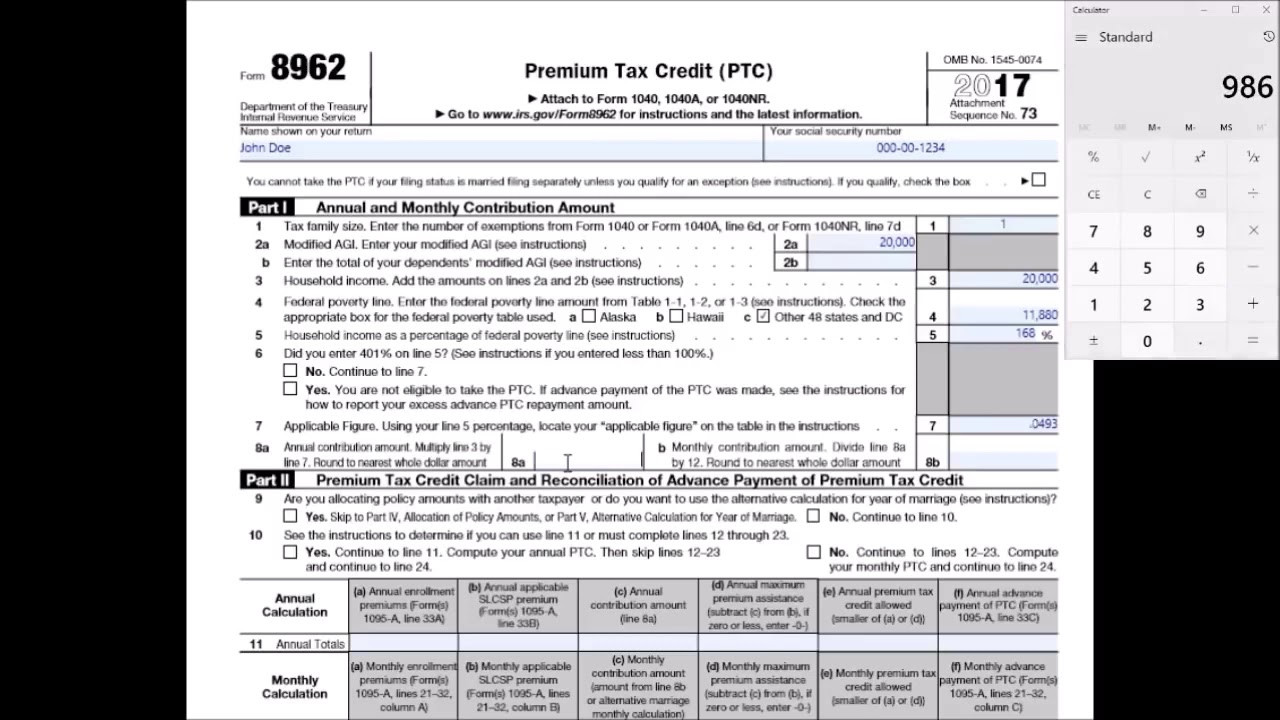

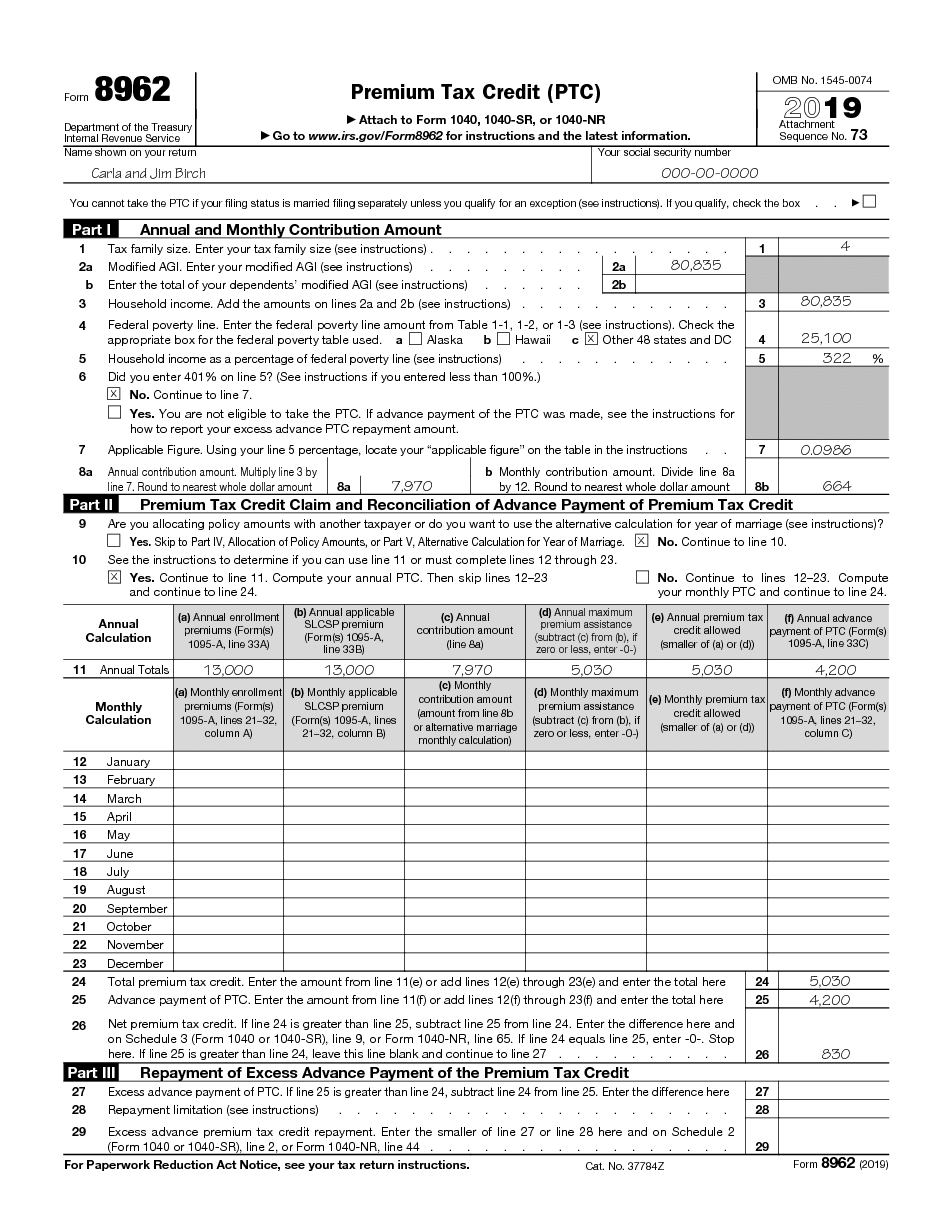

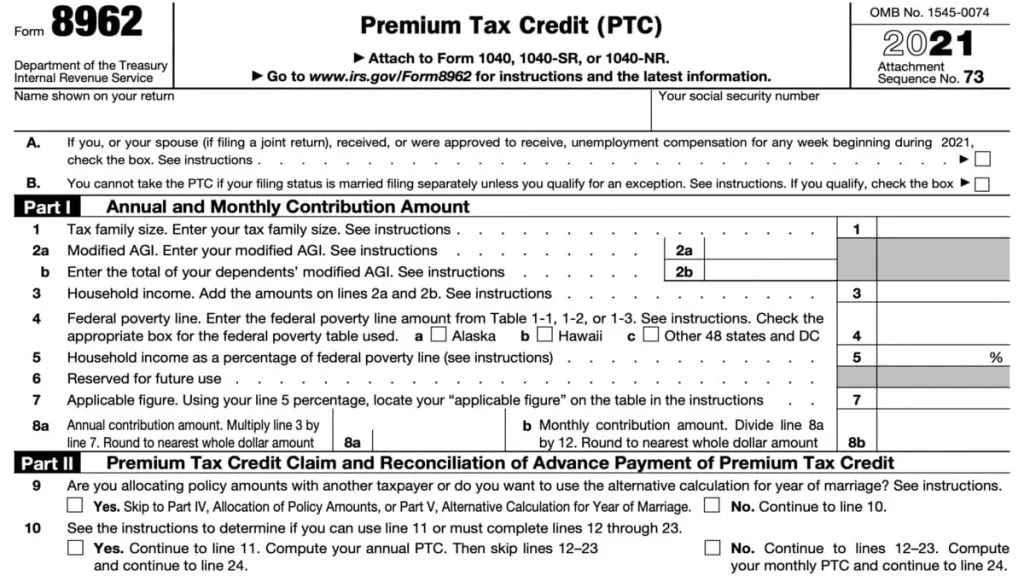

Form 8962 For 2022

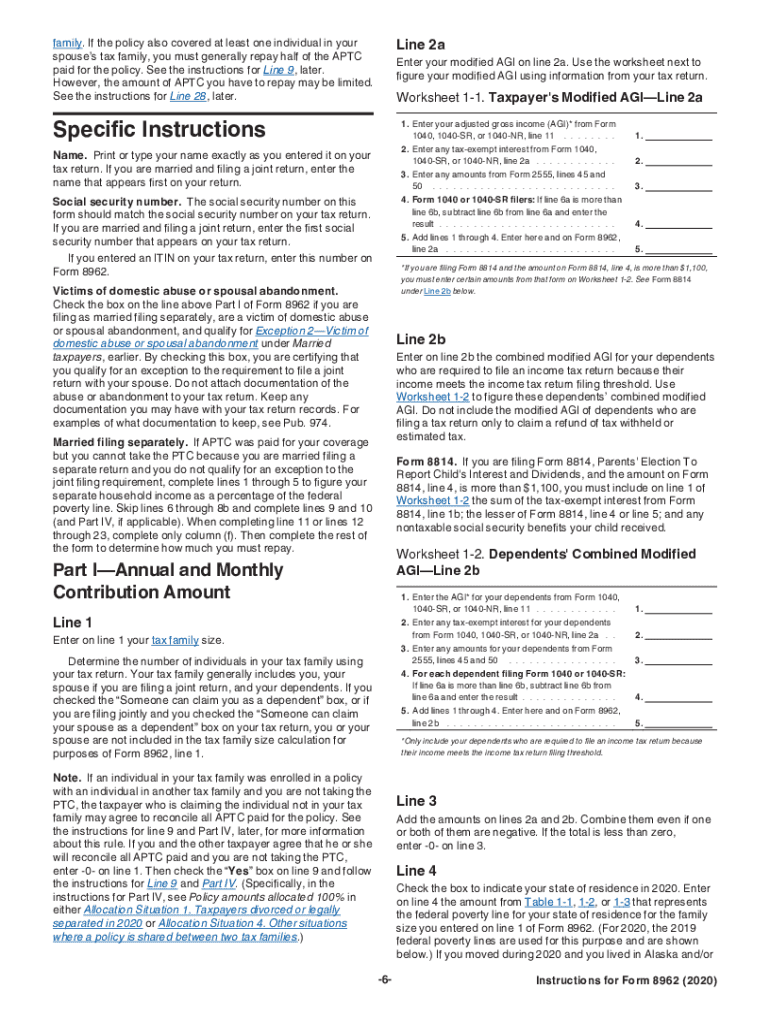

Form 8962 For 2022 - If you’re claiming a net premium tax credit for 2022,. Web we last updated the premium tax credit in december 2022, so this is the latest version of form 8962, fully updated for tax year 2022. Web up to $40 cash back easily complete a printable irs 8962 form 2022 online. You have to include form 8962 with your tax return if: Previously, household income of 400% or more of the federal poverty line made a taxpayer ineligible. For tax years 2021 and. Create a blank & editable 8962 form,. You'll find out if you qualify for a premium tax credit based on your final 2022 income. Maximum household income limits have been eliminated. Web to get this credit, you must meet certain requirements and file a tax return with form 8962, premium tax credit (ptc).

Web use this slcsp figure to fill out form 8962, premium tax credit (pdf, 110 kb). Get ready for this year's tax season quickly and safely with pdffiller! Taxpayers complete form 8862 and attach it to their tax return if: Web for 2022, you’ll have to report the excess aptc on your 2022 tax return or file form 8962, premium tax credit (pdf, 110 kb). Web 2021 & 2022 eligibility. Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that year. Web up to $40 cash back easily complete a printable irs 8962 form 2022 online. You can download or print current or past. You'll find out if you qualify for a premium tax credit based on your final 2022 income. 2021 and 2022 ptc eligibility.

Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that year. You’ll need it to complete form 8962, premium tax credit. Web form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. Ad get ready for tax season deadlines by completing any required tax forms today. The request for mail order forms may be used to order one copy or. Complete the following information for up to four policy amount allocations. Web for 2022, you’ll have to report the excess aptc on your 2022 tax return or file form 8962, premium tax credit (pdf, 110 kb). Web this form includes details about the marketplace insurance you and household members had in 2022. Taxpayers complete form 8862 and attach it to their tax return if: Web to get this credit, you must meet certain requirements and file a tax return with form 8962, premium tax credit (ptc).

IRS Form 8962 LinebyLine Instructions 2022 How to Fill out Form 8962

If you’re claiming a net premium tax credit for 2022,. You can download or print current or past. Go to www.irs.gov/form8962 for instructions and the. Web up to $40 cash back easily complete a printable irs 8962 form 2022 online. Web form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium.

Irs form 8962 Aca Irs form 8962 for ‘premium Tax Credits’ Successfully

You have to include form 8962 with your tax return if: Get ready for this year's tax season quickly and safely with pdffiller! Web to get this credit, you must meet certain requirements and file a tax return with form 8962, premium tax credit (ptc). For tax years 2021 and. You’ll need it to complete form 8962, premium tax credit.

Tax Form 8962 Printable Printable Forms Free Online

Maximum household income limits have been eliminated. Create a blank & editable 8962 form,. Ad get ready for tax season deadlines by completing any required tax forms today. Previously, household income of 400% or more of the federal poverty line made a taxpayer ineligible. Web use this slcsp figure to fill out form 8962, premium tax credit (pdf, 110 kb).

How To Fill Out Tax Form 8962 amulette

You'll find out if you qualify for a premium tax credit based on your final 2022 income. Web if you downloaded the 2022 instructions for form 8962, premium tax credit, please be advised that there is an update to the 2nd bullet under exception 1—certain. Web 2021 & 2022 eligibility. The request for mail order forms may be used to.

Health Insurance 1095A Subsidy Flow Through IRS Tax Return

You can download or print current or past. Web if you downloaded the 2022 instructions for form 8962, premium tax credit, please be advised that there is an update to the 2nd bullet under exception 1—certain. Web about form 8862, information to claim certain credits after disallowance. Web for 2022, you’ll have to report the excess aptc on your 2022.

How To Fill Out Form 8962 Step By Step Premium Tax Credit Ptc Sample

Complete the following information for up to four policy amount allocations. Web instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise. The request for mail order forms may be used to order one copy or. Web form 8962 (2022) page. You have to include.

8962 instructions Fill out & sign online DocHub

Web form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. Get ready for this year's tax season quickly and safely with pdffiller! You have to include form 8962 with your tax return if: Upload, modify or create forms. 2021 and 2022 ptc eligibility.

IRS 8962 Form Printable 2020 📝 Get Tax Form 8962 Printable Blank in PDF

Complete the following information for up to four policy amount allocations. For tax years 2021 and. Web if you downloaded the 2022 instructions for form 8962, premium tax credit, please be advised that there is an update to the 2nd bullet under exception 1—certain. Get ready for this year's tax season quickly and safely with pdffiller! Web about form 8862,.

Form 8962 Fill Out and Sign Printable PDF Template signNow

Web for 2022, you’ll have to report the excess aptc on your 2022 tax return or file form 8962, premium tax credit (pdf, 110 kb). Maximum household income limits have been eliminated. Web to get this credit, you must meet certain requirements and file a tax return with form 8962, premium tax credit (ptc). The request for mail order forms.

8962 Form 2022 2023 Premium Tax Credit IRS Forms TaxUni

Web up to $40 cash back easily complete a printable irs 8962 form 2022 online. Web for 2022, you’ll have to report the excess aptc on your 2022 tax return or file form 8962, premium tax credit (pdf, 110 kb). See instructions for allocation details. You'll find out if you qualify for a premium tax credit based on your final.

For Tax Years 2021 And.

Go to www.irs.gov/form8962 for instructions and the. Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that year. You can download or print current or past. You'll find out if you qualify for a premium tax credit based on your final 2022 income.

Complete The Following Information For Up To Four Policy Amount Allocations.

Create a blank & editable 8962 form,. Web form 8962 (2022) page. Web form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. You have to include form 8962 with your tax return if:

Maximum Household Income Limits Have Been Eliminated.

Ad get ready for tax season deadlines by completing any required tax forms today. This form is only used by taxpayers who. Web 2021 & 2022 eligibility. 2021 and 2022 ptc eligibility.

Previously, Household Income Of 400% Or More Of The Federal Poverty Line Made A Taxpayer Ineligible.

You’ll need it to complete form 8962, premium tax credit. Web about form 8862, information to claim certain credits after disallowance. Web up to $40 cash back easily complete a printable irs 8962 form 2022 online. Web we last updated the premium tax credit in december 2022, so this is the latest version of form 8962, fully updated for tax year 2022.