Form 8958 Examples

Form 8958 Examples - Web information about form 8958, allocation of tax amounts between certain individuals in community property states, including recent updates, related forms and instructions on how to file. If mary and john elect to file separate mfs returns, then they will pay. Show details this website is not affiliated with irs. Web 1 best answer thomasm125 expert alumni your community property income will be your normal income for the year plus or minus an adjustment for your. Mary earns $15,000, and her husband john earns $25,000, for a total family income of $40,000. Web click the miscellaneous topics dropdown, then click community property allocation record (form 8958). Web complete income allocation open screen 8958 in each split return and indicate how the income is allocated. Click yes to complete or modify the community property allocation. How it works browse for the example. Web we last updated the allocation of tax amounts between certain individuals in community property states in february 2023, so this is the latest version of form 8958, fully.

Make any adjustments in the split returns. See how to get tax help at the end of this publication for information about getting. Web complete income allocation open screen 8958 in each split return and indicate how the income is allocated. Web you calculate the tax on the community property, and pay that. Web information about form 8958, allocation of tax amounts between certain individuals in community property states, including recent updates, related forms and instructions on how to file. If mary and john elect to file separate mfs returns, then they will pay. Click yes to complete or modify the community property allocation. The form 8958 allows the irs to match the amounts on your tax return to the source documents. Web 1 best answer thomasm125 expert alumni your community property income will be your normal income for the year plus or minus an adjustment for your. Use this form to determine the allocation of tax amounts.

Show details this website is not affiliated with irs. How it works browse for the example. Web click the miscellaneous topics dropdown, then click community property allocation record (form 8958). Click yes to complete or modify the community property allocation. Make any adjustments in the split returns. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. See how to get tax help at the end of this publication for information about getting. Income allocation information is required when electronically filing a return with. Web complete income allocation open screen 8958 in each split return and indicate how the income is allocated. Web 1 best answer thomasm125 expert alumni your community property income will be your normal income for the year plus or minus an adjustment for your.

Fill Free fillable Form 8958 2019 Allocation of Tax Amounts PDF form

Click yes to complete or modify the community property allocation. Web we last updated the allocation of tax amounts between certain individuals in community property states in february 2023, so this is the latest version of form 8958, fully. See how to get tax help at the end of this publication for information about getting. Web you calculate the tax.

p555 by Paul Thompson Issuu

Web we last updated the allocation of tax amounts between certain individuals in community property states in february 2023, so this is the latest version of form 8958, fully. Income allocation information is required when electronically filing a return with. How it works browse for the example. Web information about form 8958, allocation of tax amounts between certain individuals in.

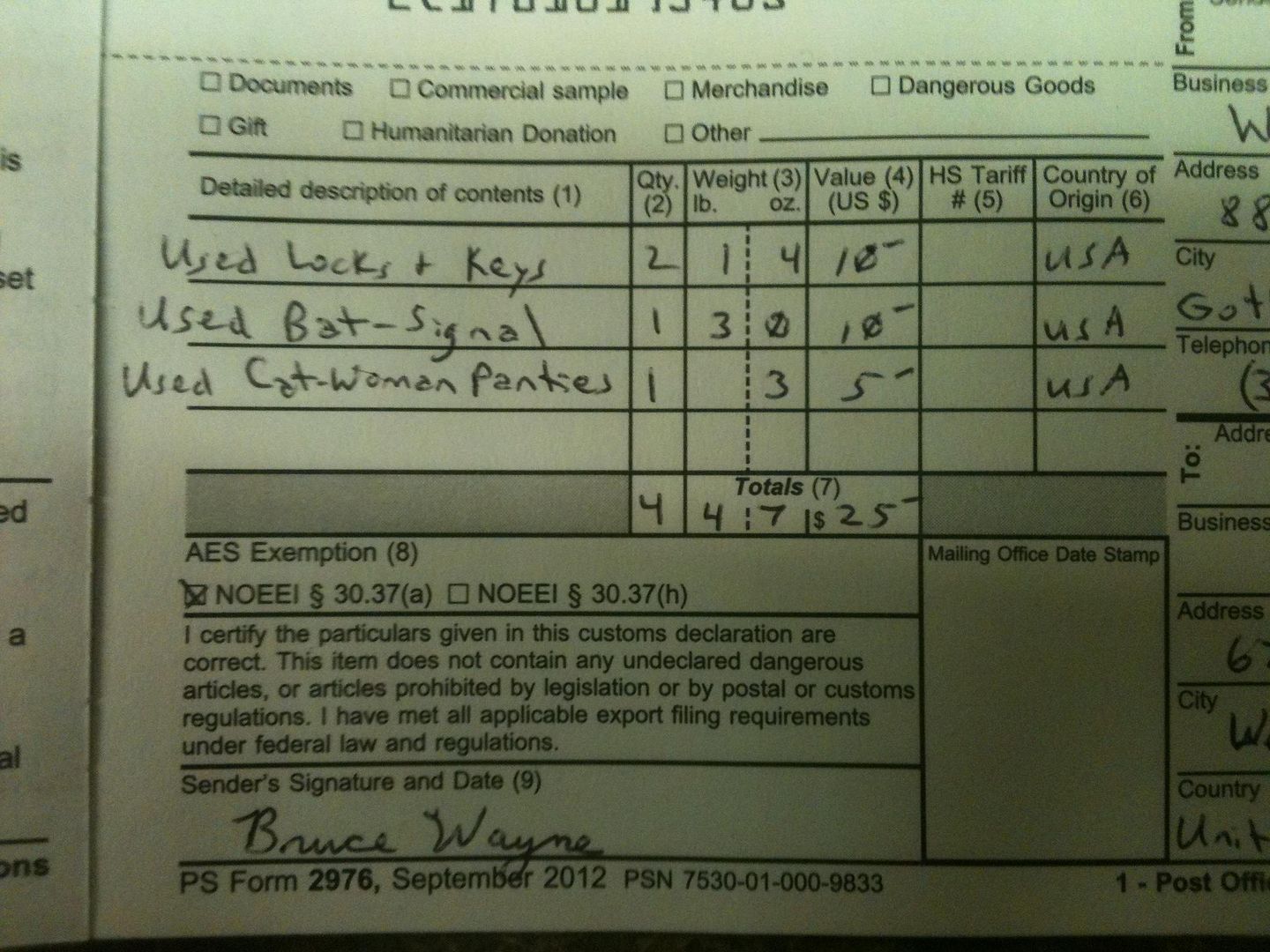

View topic ARF's guide to international shipping . Keypicking

Web you calculate the tax on the community property, and pay that. Web 1 best answer thomasm125 expert alumni your community property income will be your normal income for the year plus or minus an adjustment for your. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or.

Fillable Form 8958 Allocation Of Tax Amounts Between Certain

Make any adjustments in the split returns. Web 1 best answer thomasm125 expert alumni your community property income will be your normal income for the year plus or minus an adjustment for your. Mary earns $15,000, and her husband john earns $25,000, for a total family income of $40,000. The form 8958 allows the irs to match the amounts on.

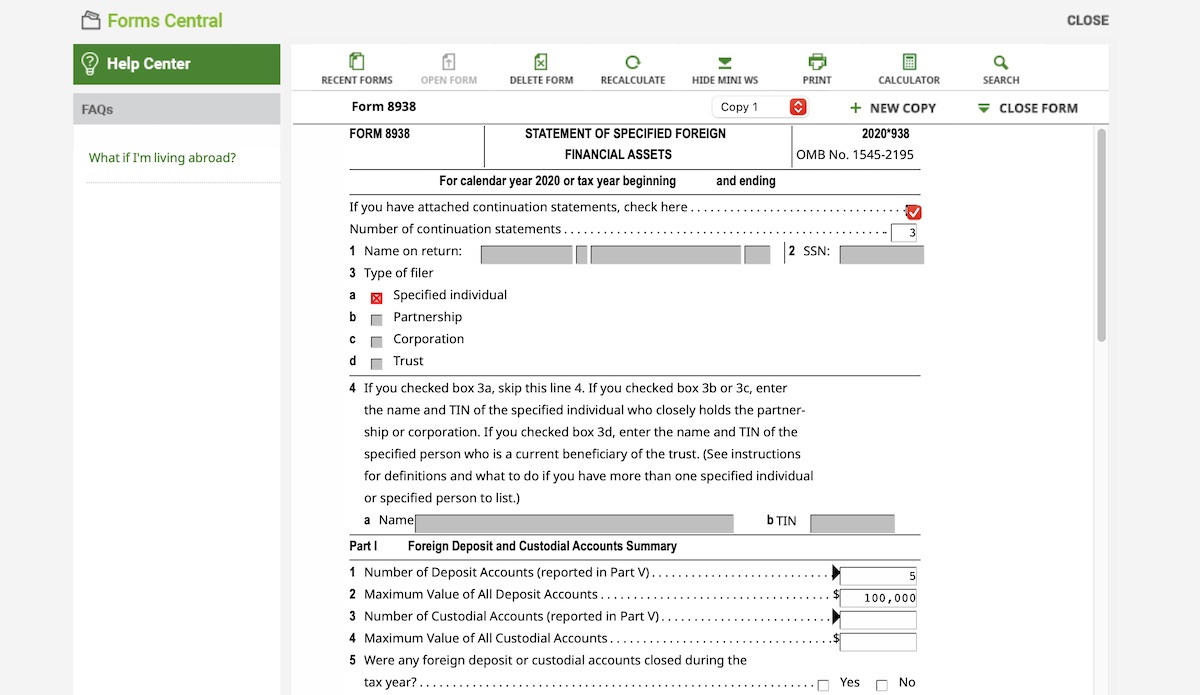

How to Add Continuation Pages with Form 8938 in H&R Block (Reporting

Web use a form 8958 example template to make your document workflow more streamlined. Show details this website is not affiliated with irs. How it works browse for the example. Web complete income allocation open screen 8958 in each split return and indicate how the income is allocated. Web 8958 allocation of tax amounts between certain individuals in community property.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Make any adjustments in the split returns. How it works browse for the example. If mary and john elect to file separate mfs returns, then they will pay. Click yes to complete or modify the community property allocation. Income allocation information is required when electronically filing a return with.

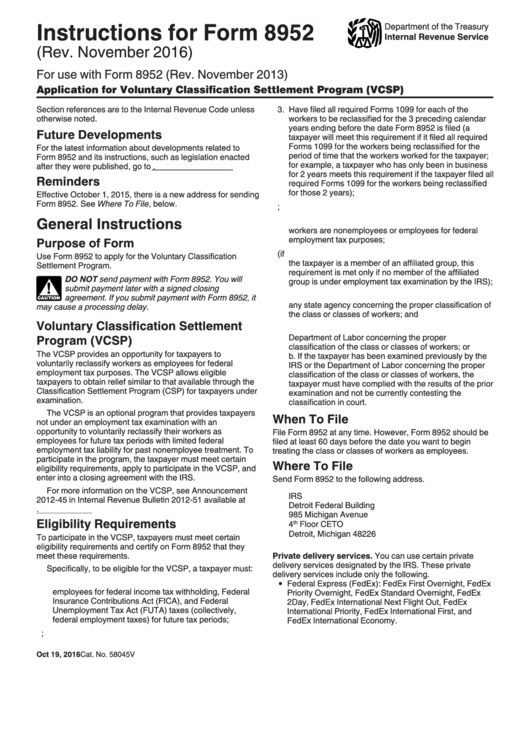

Instructions For Form 8952 Department Of The Treasury 2016

Web complete income allocation open screen 8958 in each split return and indicate how the income is allocated. If mary and john elect to file separate mfs returns, then they will pay. Show details this website is not affiliated with irs. Web 1 best answer thomasm125 expert alumni your community property income will be your normal income for the year.

Form 8958 Fill Out and Sign Printable PDF Template signNow

How it works browse for the example. Web 1 best answer thomasm125 expert alumni your community property income will be your normal income for the year plus or minus an adjustment for your. Use this form to determine the allocation of tax amounts. Make any adjustments in the split returns. Web click the miscellaneous topics dropdown, then click community property.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

The form 8958 allows the irs to match the amounts on your tax return to the source documents. Mary earns $15,000, and her husband john earns $25,000, for a total family income of $40,000. Use this form to determine the allocation of tax amounts. Web complete income allocation open screen 8958 in each split return and indicate how the income.

3.11.3 Individual Tax Returns Internal Revenue Service

Click yes to complete or modify the community property allocation. My wife and i are married filing separately and live in a community. How it works browse for the example. Use this form to determine the allocation of tax amounts. Web you calculate the tax on the community property, and pay that.

My Wife And I Are Married Filing Separately And Live In A Community.

Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. If mary and john elect to file separate mfs returns, then they will pay. Web we last updated the allocation of tax amounts between certain individuals in community property states in february 2023, so this is the latest version of form 8958, fully. How it works browse for the example.

Web Information About Form 8958, Allocation Of Tax Amounts Between Certain Individuals In Community Property States, Including Recent Updates, Related Forms And Instructions On How To File.

Web 1 best answer thomasm125 expert alumni your community property income will be your normal income for the year plus or minus an adjustment for your. Make any adjustments in the split returns. Web click the miscellaneous topics dropdown, then click community property allocation record (form 8958). The form 8958 allows the irs to match the amounts on your tax return to the source documents.

Web If Your Resident State Is A Community Property State, And You File A Federal Tax Return Separately From Your Spouse Or Registered Domestic Partner, Use Form 8958 To Report Half.

Web use a form 8958 example template to make your document workflow more streamlined. Web you calculate the tax on the community property, and pay that. See how to get tax help at the end of this publication for information about getting. Income allocation information is required when electronically filing a return with.

Click Yes To Complete Or Modify The Community Property Allocation.

Mary earns $15,000, and her husband john earns $25,000, for a total family income of $40,000. Web 8958 allocation of tax amounts between certain individuals in community property states. Web common questions about entering form 8958 income for community property allocation in lacerte. Web complete income allocation open screen 8958 in each split return and indicate how the income is allocated.