Form 8949 Exception Reporting Statement

Form 8949 Exception Reporting Statement - Web to attach the statement for form 8949 do the following: The instructions i'm finding indicate to use the 'link to form' option. Web total to be reported on form 8949, part i with box b checked see attached statement b (a) description of property (example: Web the irs recommends that you save the pdf attachment of form 8949 as form 8949 exception to reporting followed by a name to identify the broker. Web follow these steps if the disposition entered isn't from a summary: Form 8949 isn't required for certain transactions. Form 8949 explained basic layout 8949 categories who needs to use? Form 8949 exception reporting statement. See exception 3 under the instructions for line 1. The sale or exchange of a capital asset not reported on.

Check box a, b, or. Form 8949 exception reporting statement. Only use the broker tab if you're entering a consolidated broker statement. Individuals use form 8949 to report: Web in the link to form (defaults to main form) field, click on sch d/form 8949. Click the b&d tab or the broker tab. Go to edit > electronic filing attachments. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Select form 8949 exception reporting statement. Web schedule d, line 1a;

Click the b&d tab or the broker tab. In field product select federal. Web form 8949 exception 1 below is an excerpt from the irs instructions (emphasis and bullets added). Instead of reporting each of your transactions on a separate row of part i or ii, you can report them on an attached. The sale or exchange of a capital asset not reported on. Edit, sign and save irs 8949 instructions form. See exception 3 under the instructions for line 1. You aren’t required to report these transactions on form 8949 (see instructions). Web gain, form 8949 will show the adjustment as a negative number in the amount of the net gain, with adjustment code h and basis type f and no net gain/loss. Web select on the link to form (defaults to main form) dropdown menu.

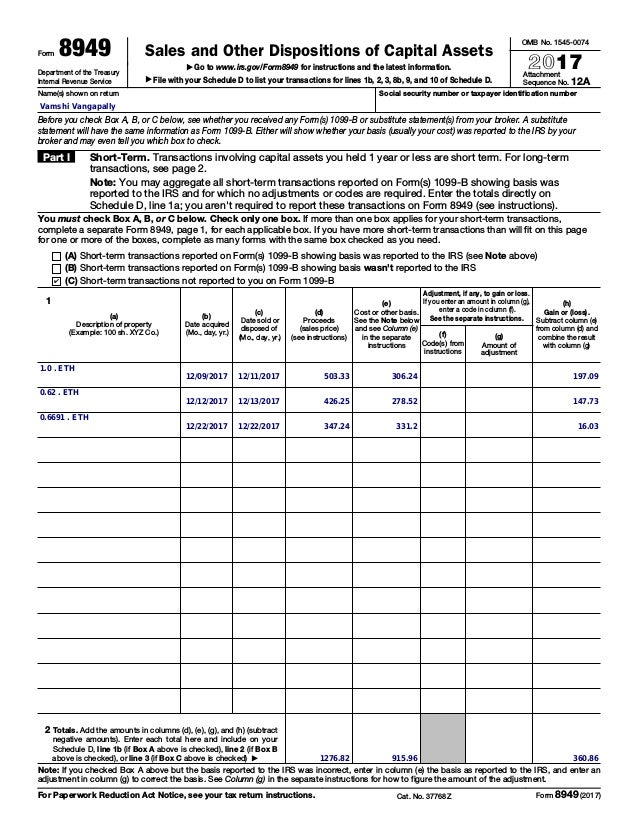

Sample 8949 Document BearTax

Web where is form 8949? Check box a, b, or. Form 8949 (sales and other dispositions of capital assets) records the details of your. Individuals use form 8949 to report: Web capital gains, 8949, exception to reporting.

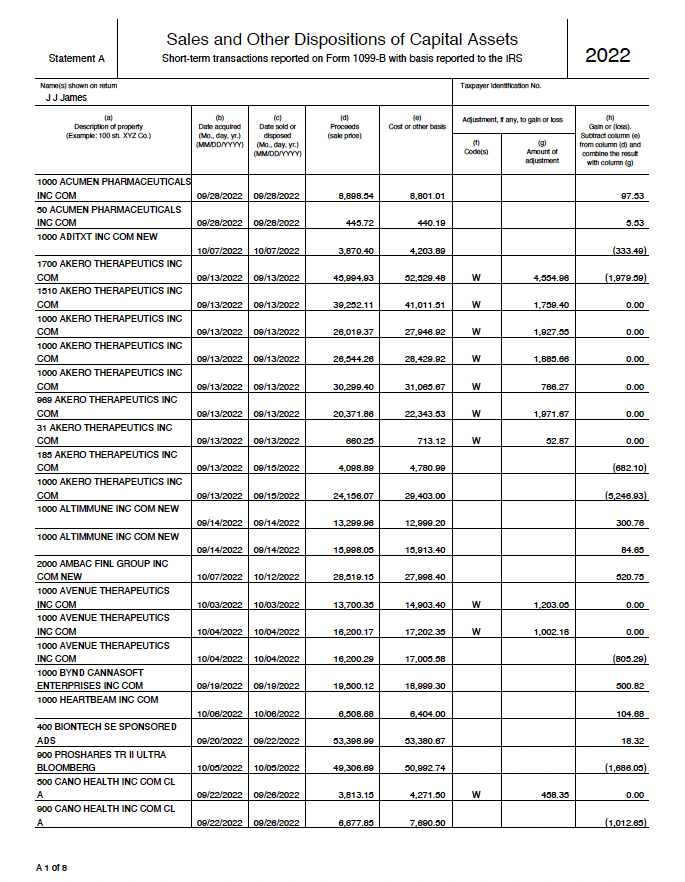

Form 8949 Exception 2 When Electronically Filing Form 1040

In field return select tax return. Click the b&d tab or the broker tab. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Web form 8949 exception 1 below is an excerpt from the irs instructions (emphasis and bullets added). You may be able to.

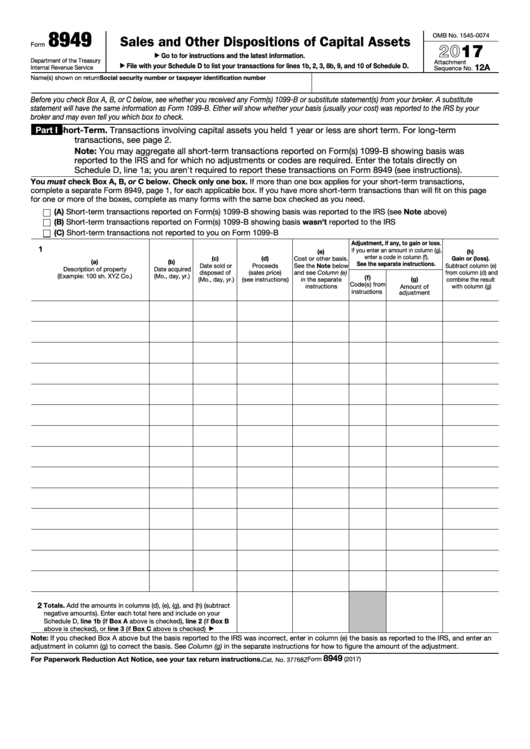

2016 Form 8949 Fill Online, Printable, Fillable, Blank pdfFiller

You may be able to. Web total to be reported on form 8949, part i with box b checked see attached statement b (a) description of property (example: Individuals use form 8949 to report: Instead of reporting each of your transactions on a separate row of part i or ii, you can report them on an attached. Individuals use form.

Form 8949 Exception 2 When Electronically Filing Form 1040

Follow these steps if you prefer to paper file the summary with form 8453: The instructions i'm finding indicate to use the 'link to form' option. Select the + next to form 8949. See exception 3 under the instructions for line 1. Web total to be reported on form 8949, part i with box b checked see attached statement b.

Fillable Form 8949 Sales And Other Dispositions Of Capital Assets

Individuals use form 8949 to report: Form 8949 isn't required for certain transactions. You aren’t required to report these transactions on form 8949 (see instructions). Solved•by turbotax•6685•updated april 12, 2023. Web gain, form 8949 will show the adjustment as a negative number in the amount of the net gain, with adjustment code h and basis type f and no net.

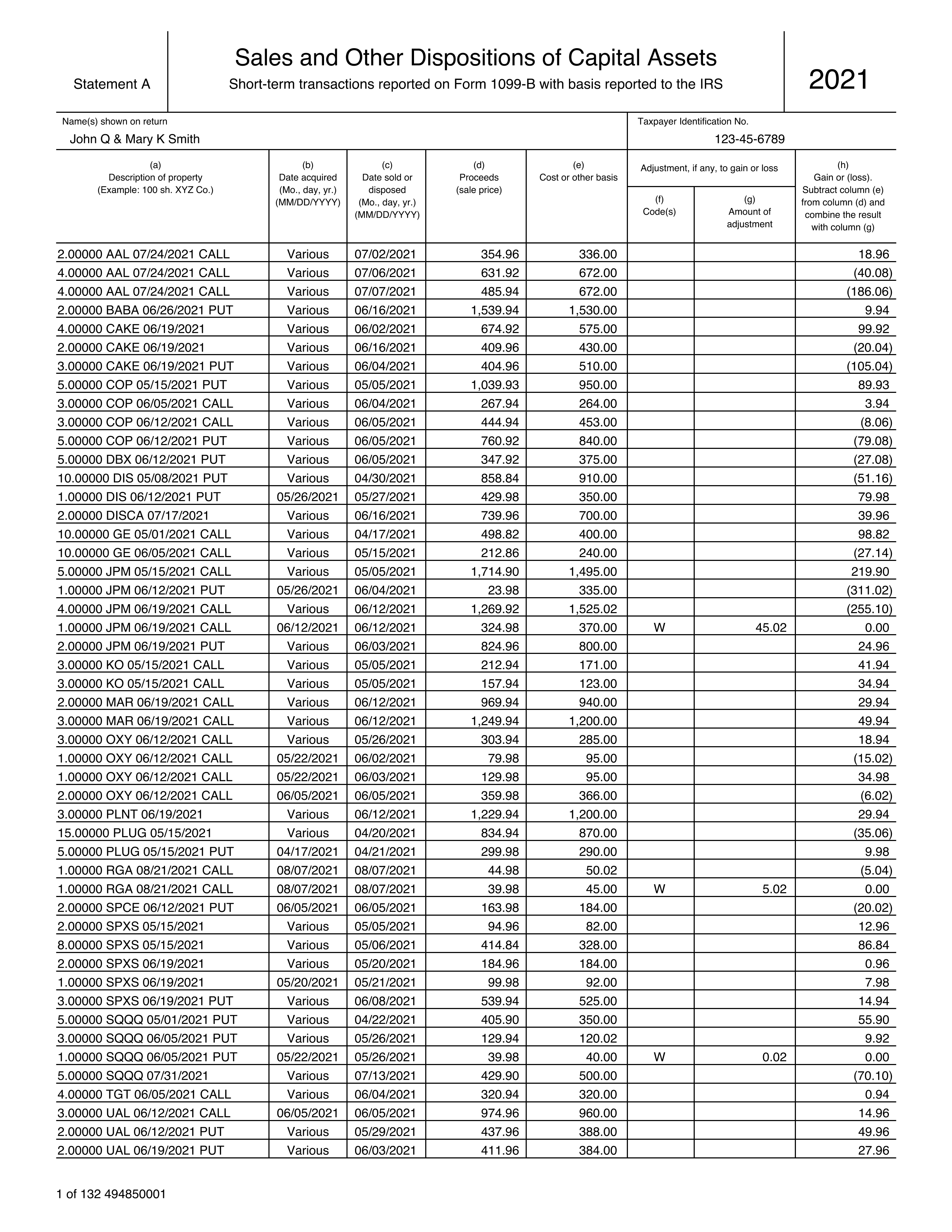

In the following Form 8949 example,the highlighted section below shows

Xyz co.) (b) date acquired (mo., day, yr.). See exception 3 under the instructions for line 1. Web form 8949 exception 1 below is an excerpt from the irs instructions (emphasis and bullets added). Web select on the link to form (defaults to main form) dropdown menu. Only use the broker tab if you're entering a consolidated broker statement.

Tax Form 8949 Instructions for Reporting Capital Gains and Losses

Web total to be reported on form 8949, part i with box b checked see attached statement b (a) description of property (example: Web form 8949 exception 1 below is an excerpt from the irs instructions (emphasis and bullets added). Web select on the link to form (defaults to main form) dropdown menu. Form 8949 exception reporting statement. Follow these.

How to Report Cryptocurrency On Your Taxes in 5 Steps CoinLedger

In the send pdf attachment with federal. Web exception 2 per the form 8949 instructions: Select form 8949 exception reporting statement. Click the b&d tab or the broker tab. Web to file form 8949.

Form 8949 Sales and Other Dispositions of Capital Assets (2014) Free

Form 8949 exception reporting statement. Web gain, form 8949 will show the adjustment as a negative number in the amount of the net gain, with adjustment code h and basis type f and no net gain/loss. In field product select federal. Web go to the income folder. Solved•by turbotax•6685•updated april 12, 2023.

Web Follow These Steps If The Disposition Entered Isn't From A Summary:

You may be able to. See exception 3 under the instructions for line 1. Individuals use form 8949 to report: Select form 8949 exception reporting statement.

Web Exception 2 Per The Form 8949 Instructions:

Web select on the link to form (defaults to main form) dropdown menu. Form 8949 exception reporting statement. Only use the broker tab if you're entering a consolidated broker statement. Web go to the income folder.

You Aren’t Required To Report These Transactions On Form 8949 (See Instructions).

Web form 8949 exception 1 below is an excerpt from the irs instructions (emphasis and bullets added). Go to edit > electronic filing attachments. The sale or exchange of a capital asset not reported on. The sale or exchange of a capital asset not reported on.

Instead Of Reporting Each Of Your Transactions On A Separate Row Of Part I Or Ii, You Can Report Them On An Attached.

Solved•by turbotax•6685•updated april 12, 2023. Click the b&d tab or the broker tab. Looking for some advice on form 8949 reporting exception transations. Web capital gains, 8949, exception to reporting.