Form 8936 Turbotax

Form 8936 Turbotax - Solved • by intuit • 3 • updated july 19, 2022. Claim the credit for certain alternative motor vehicles on form 8910. Web form 8936 is not available in turbotax business. Web what is form 8936? Web how to generate form 8936 the input for this form is located in screen 34,general business and passive activities credits, in the vehicle credits(8910, 8936). You can use form 8936 to claim an electric vehicle tax credit for vehicles purchased and placed into service during the current tax year. Part i tentative credit use a separate. Web irs form 8936 outdated for 2022. Also use form 8936 to figure. Also use form 8936 to figure your credit for.

Web what is form 8936? How do i file an irs extension (form 4868) in turbotax online? Claim the credit for certain alternative motor vehicles on form 8910. Web how to generate form 8936 the input for this form is located in screen 34,general business and passive activities credits, in the vehicle credits(8910, 8936). Solved • by intuit • 3 • updated july 19, 2022. Part i tentative credit use a separate. Also use form 8936 to figure your credit for. Web form 8936 is not available in turbotax business. Web irs form 8936 outdated for 2022. Also use form 8936 to figure.

Also use form 8936 to figure. Solved • by intuit • 3 • updated july 19, 2022. You can use form 8936 to claim an electric vehicle tax credit for vehicles purchased and placed into service during the current tax year. File an extension in turbotax online. Web what is form 8936? How do i file an irs extension (form 4868) in turbotax online? Web february 11, 2020 10:07 am. A) the turbotax form does. Web form 8936 is not available in turbotax business. Web how to generate form 8936 the input for this form is located in screen 34,general business and passive activities credits, in the vehicle credits(8910, 8936).

Ssurvivor Form 2441 Turbotax

Web irs form 8936 outdated for 2022. Web february 11, 2020 10:07 am. Web view and download up to seven years of past returns in turbotax online. Claim the credit for certain alternative motor vehicles on form 8910. A) the turbotax form does.

Turbotax Form / Breanna Form 2106 Expense Type Must Be Entered

A) the turbotax form does. Web how to generate form 8936 the input for this form is located in screen 34,general business and passive activities credits, in the vehicle credits(8910, 8936). File an extension in turbotax online. Also use form 8936 to figure your credit for. Also use form 8936 to figure.

IRS Form 8936 Qualified EV Credit Form / Section Now Available in

Web february 11, 2020 10:07 am. A) the turbotax form does. Web view and download up to seven years of past returns in turbotax online. Yes, visit the irs website, download the 2021 form 8936, enter the relevant information on the form, determine the. Web how to generate form 8936 the input for this form is located in screen 34,general.

Audi, MINI & Toyota Prius models added to IRS electric vehicle tax

Also use form 8936 to figure your credit for. Use form 8936 to figure your credit for. Web form 8936 is not available in turbotax business. Also use form 8936 to figure. You can use form 8936 to claim an electric vehicle tax credit for vehicles purchased and placed into service during the current tax year.

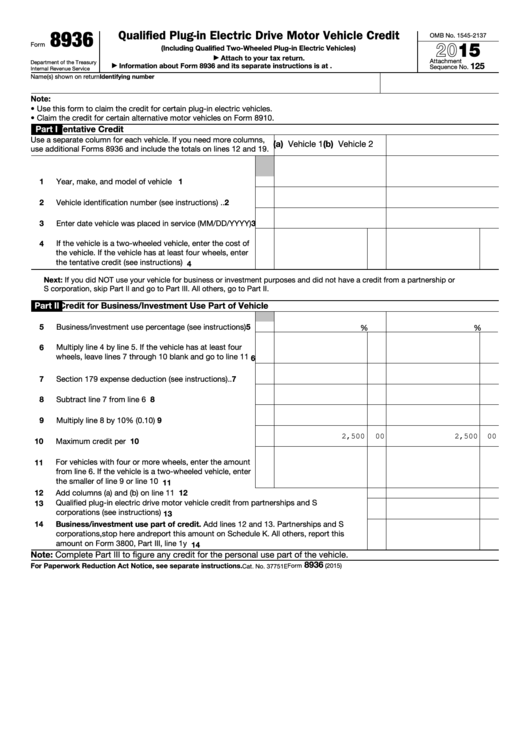

Fillable Form 8936 Qualified PlugIn Electric Drive Motor Vehicle

Solved • by intuit • 3 • updated july 19, 2022. Web form 8936 is not available in turbotax business. Web how to generate form 8936 the input for this form is located in screen 34,general business and passive activities credits, in the vehicle credits(8910, 8936). Also use form 8936 to figure your credit for. Claim the credit for certain.

form 2106 turbotax Fill Online, Printable, Fillable Blank

Claim the credit for certain alternative motor vehicles on form 8910. Web what is form 8936? Web irs form 8936 outdated for 2022. File an extension in turbotax online. Part i tentative credit use a separate.

US Tax Form 8936 Question on how to apply the 7500 tax credit

Yes, visit the irs website, download the 2021 form 8936, enter the relevant information on the form, determine the. Also use form 8936 to figure your credit for. File an extension in turbotax online. Also use form 8936 to figure. Part i tentative credit use a separate.

Turbotax and Form 8936 Page 2 ⚡ Ford Lightning Forum ⚡

Web how to generate form 8936 the input for this form is located in screen 34,general business and passive activities credits, in the vehicle credits(8910, 8936). Web what is form 8936? File an extension in turbotax online. Claim the credit for certain alternative motor vehicles on form 8910. You can use form 8936 to claim an electric vehicle tax credit.

Form 8936 Qualified Plugin Electric Drive Motor Vehicle Credit (2014

How do i file an irs extension (form 4868) in turbotax online? Web irs form 8936 outdated for 2022. Web form 8936 is not available in turbotax business. Also use form 8936 to figure. Web how to generate form 8936 the input for this form is located in screen 34,general business and passive activities credits, in the vehicle credits(8910, 8936).

Use Form 8936 To Figure Your Credit For.

A) the turbotax form does. Web february 11, 2020 10:07 am. Web what is form 8936? Web view and download up to seven years of past returns in turbotax online.

Also Use Form 8936 To Figure.

Part i tentative credit use a separate. Web what is form 8936: How do i file an irs extension (form 4868) in turbotax online? Web how to generate form 8936 the input for this form is located in screen 34,general business and passive activities credits, in the vehicle credits(8910, 8936).

Yes, Visit The Irs Website, Download The 2021 Form 8936, Enter The Relevant Information On The Form, Determine The.

Solved • by intuit • 3 • updated july 19, 2022. Also use form 8936 to figure your credit for. Claim the credit for certain alternative motor vehicles on form 8910. File an extension in turbotax online.

Web Form 8936 Is Not Available In Turbotax Business.

Web irs form 8936 outdated for 2022. Also use form 8936 to figure your credit for. You can use form 8936 to claim an electric vehicle tax credit for vehicles purchased and placed into service during the current tax year.