Form 8910 Alternative Motor Vehicle Credit

Form 8910 Alternative Motor Vehicle Credit - If you or a loved one was injured because of an unreasonably unsafe design, or because of a faulty vehicle component (like tires, air. The credit attributable to depreciable property (vehicles. Web how to save money with missouri green driver incentives | dmv.org. Get multiple quotes in minutes. Web use this form to claim the credit for certain alternative motor vehicles. 1, 2005, the credit is 40 percent of the incremental cost or conversion cost for each. Web the alternative motor vehicle credit expired in 2021. The alternative motor vehicle credit expired for vehicles purchased after 2021. Web • use this form to claim the credit for certain alternative motor vehicles. The credit attributable to depreciable property (vehicles used for.

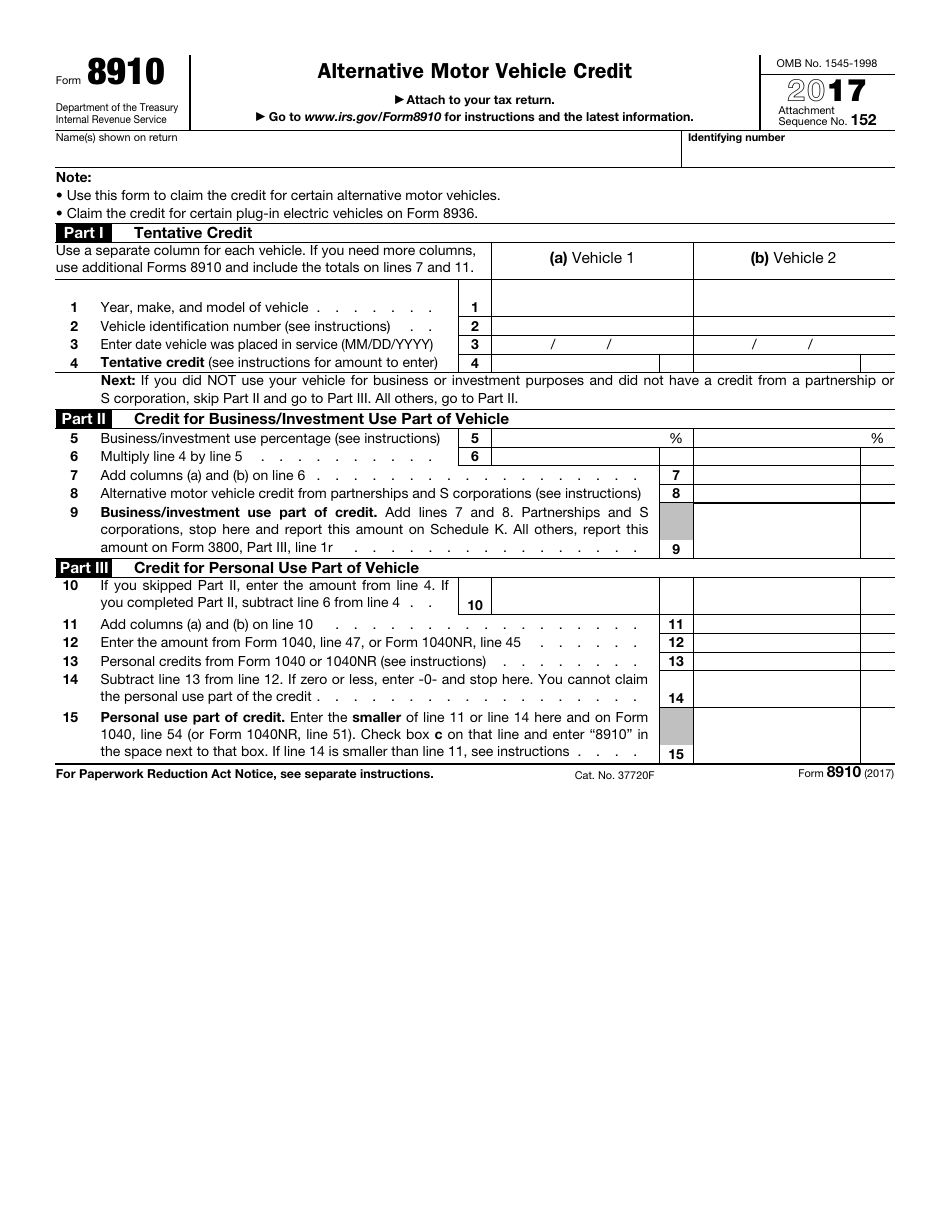

For tax year 2022, this credit is only available for a vehicle purchased in 2021 but not placed in service until 2022. The credit attributable to depreciable property (vehicles. Web what vehicles qualify for form 8910, alternative motor vehicle credit? 1, 2005, the credit is 40 percent of the incremental cost or conversion cost for each. Web the miscellaneous tax credits offered by the state of missouri, are administered by several government agencies including the missouri department of revenue, and are listed. Get multiple quotes in minutes. The alternative motor vehicle credit expired for vehicles purchased after 2021. Web what vehicles qualify for the alternative motor vehicle credit (form 8910)? The credit attributable to depreciable property (vehicles used for. Use this form to claim the credit for certain alternative motor vehicles acquired in 2017 but not placed in service until 2018 (see instructions).

For tax year 2022, this credit is only available for a vehicle purchased in 2021 but not placed in service until 2022. If you or a loved one was injured because of an unreasonably unsafe design, or because of a faulty vehicle component (like tires, air. If you did not use. Web you've come to the right place. It added income limits, price caps and. Web the 2023 chevrolet bolt. Web check the claiming alternative motor vehicle credit (8910) box. Web use form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year. 1, 2005, the credit is 40 percent of the incremental cost or conversion cost for each. If the vehicle is used for business, the necessary basis adjustment for.

Form 8911 Alternative Fuel Vehicle Refueling Property Credit (2014

Use this form to claim the credit for certain alternative motor vehicles. The credit attributable to depreciable property (vehicles used for. The alternative motor vehicle credit expired for vehicles purchased after 2021. For tax year 2022, this credit is only available for a vehicle purchased in 2021 but not placed in service until 2022. Put your policy to the test.

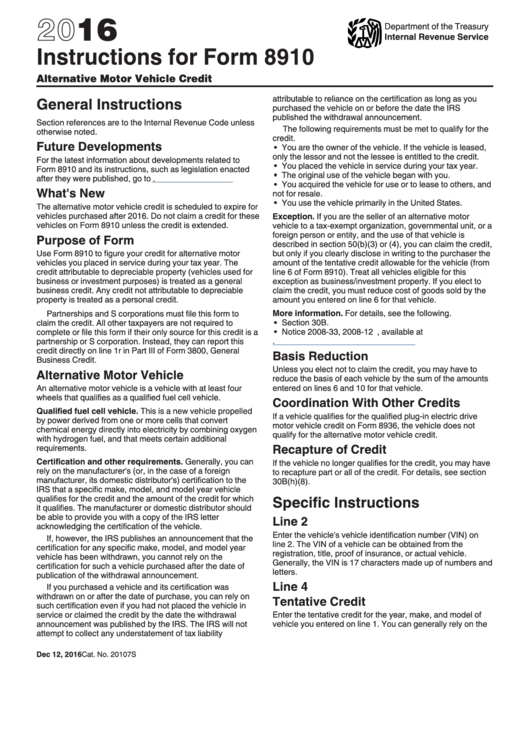

Instructions For Form 8910 Alternative Motor Vehicle Credit 2016

Web what vehicles qualify for the alternative motor vehicle credit (form 8910)? Web the 2023 chevrolet bolt. The credit attributable to depreciable property (vehicles used for. Web the alternative motor vehicle credit expired in 2021. Web the miscellaneous tax credits offered by the state of missouri, are administered by several government agencies including the missouri department of revenue, and are.

What is Form 8910 alternative motor vehicle credit? Leia aqui What is

Web the alternative motor vehicle credit expired in 2021. Web what vehicles qualify for the alternative motor vehicle credit (form 8910)? Web use this form to claim the credit for certain alternative motor vehicles. We last updated the alternative. For tax year 2022, this credit is only available for a vehicle purchased in 2021 but not placed in service until.

IRS Form 8910 Download Fillable PDF or Fill Online Alternative Motor

The alternative motor vehicle credit expired for vehicles purchased after 2021. Web how to save money with missouri green driver incentives | dmv.org. Web use form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year. Web use form 8910 to figure your credit for alternative motor vehicles you placed in service during.

Form 8910 Alternative Motor Vehicle Credit (2014) Free Download

Web the 2023 chevrolet bolt. Web use form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year. Web the alternative motor vehicle credit expired in 2021. The credit attributable to depreciable property (vehicles used for. Web what vehicles qualify for the alternative motor vehicle credit (form 8910)?

Form 8910 Alternative Motor Vehicle Credit (2014) Free Download

Enter the fields under the vehicle information subsection:. Web the miscellaneous tax credits offered by the state of missouri, are administered by several government agencies including the missouri department of revenue, and are listed. The credit attributable to depreciable property (vehicles. For tax year 2022, this credit is only available for a vehicle purchased in 2021 but not placed in.

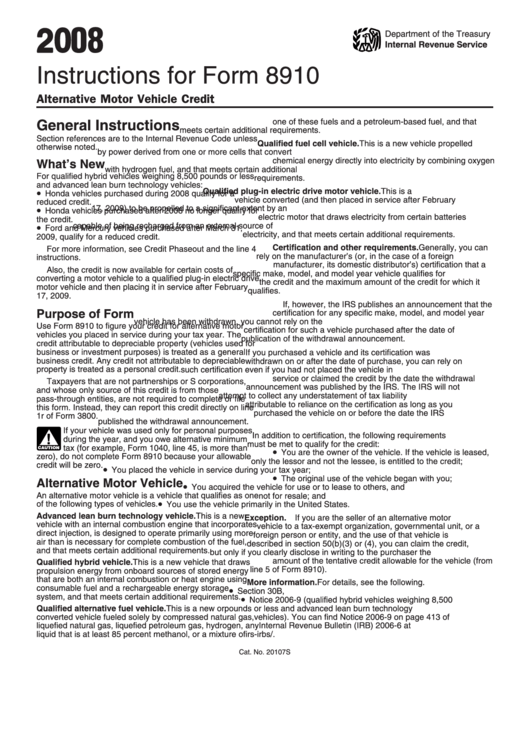

Instructions For Form 8910 Alternative Motor Vehicle Credit 2008

Put your policy to the test. Web use form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year. Web the miscellaneous tax credits offered by the state of missouri, are administered by several government agencies including the missouri department of revenue, and are listed. 1, 2005, the credit is 40 percent of.

Instructions for Form 8910, Alternative Motor Vehicle Credit

Web check the claiming alternative motor vehicle credit (8910) box. Web the alternative motor vehicle credit expired in 2021. Enter the vehicle identification number (vin). Web use this form to claim the credit for certain alternative motor vehicles. Web how to save money with missouri green driver incentives | dmv.org.

Download Instructions for IRS Form 8910 Alternative Motor Vehicle

Put your policy to the test. The credit attributable to depreciable property (vehicles used for. Web check the claiming alternative motor vehicle credit (8910) box. Web the miscellaneous tax credits offered by the state of missouri, are administered by several government agencies including the missouri department of revenue, and are listed. Use this form to claim the credit for certain.

What is Form 8910 alternative motor vehicle credit? Leia aqui What is

If you did not use. If you or a loved one was injured because of an unreasonably unsafe design, or because of a faulty vehicle component (like tires, air. Web what vehicles qualify for form 8910, alternative motor vehicle credit? Web the miscellaneous tax credits offered by the state of missouri, are administered by several government agencies including the missouri.

Web Use Form 8910 To Figure Your Credit For Alternative Motor Vehicles You Placed In Service During Your Tax Year.

The credit attributable to depreciable property (vehicles. The alternative motor vehicle credit expired for vehicles purchased after 2021. Enter the vehicle identification number (vin). If the vehicle is used for business, the necessary basis adjustment for.

The Credit Attributable To Depreciable Property (Vehicles Used For.

Web • use this form to claim the credit for certain alternative motor vehicles. Web the 2023 chevrolet bolt. Use this form to claim the credit for certain alternative motor vehicles acquired in 2017 but not placed in service until 2018 (see instructions). Put your policy to the test.

Web Check The Claiming Alternative Motor Vehicle Credit (8910) Box.

Web the alternative motor vehicle credit expired in 2021. Web use this form to claim the credit for certain alternative motor vehicles. Use this form to claim the credit for certain alternative motor vehicles. Web use form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year.

Web You've Come To The Right Place.

We last updated the alternative. The inflation reduction act of 2022 overhauled the ev tax credit, worth up to $7,500. 1, 2005, the credit is 40 percent of the incremental cost or conversion cost for each. If you or a loved one was injured because of an unreasonably unsafe design, or because of a faulty vehicle component (like tires, air.