Form 8863 Instructions 2021

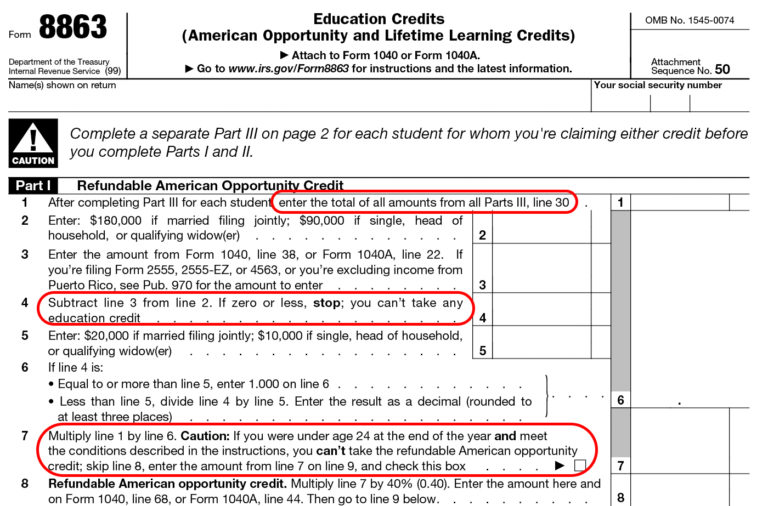

Form 8863 Instructions 2021 - Web how to calculate magi eligible educational institution defined which expenses aren’t covered by aotc and llc? Go to www.irs.gov/form8863 for instructions and the latest information. Web overview if you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return. The lifetime learning credit magi limit increases to $180,000 if you're What's new limits on modified adjusted gross income (magi). The types of educational credits this tax form covers what types of educational expenses qualify for these tax credits Web llc, you (or your dependent) must be (or have been) a student who is (or was) enrolled in at least one course during the tax year, and have a modified adjusted gross income below the threshold (for 2020, the threshold is $69,000 or $139,000 for joint filers). 50 name(s) shown on return Go to www.irs.gov/form8863 for instructions and the latest information. Web for the latest information about developments related to form 8863 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8863.

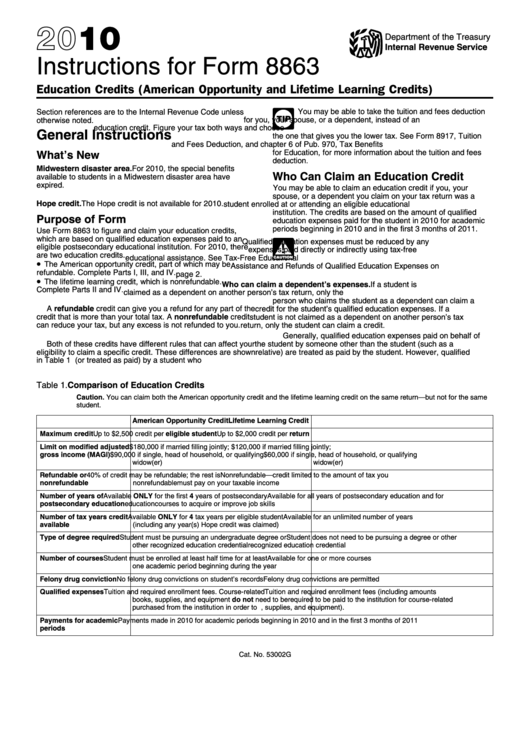

The education credits are designed to offset updated for current information. Go to www.irs.gov/form8863 for instructions and the latest information. In this article, we’ll explore irs form 8863, education credits. What's new limits on modified adjusted gross income (magi). Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. The types of educational credits this tax form covers what types of educational expenses qualify for these tax credits Irs form 8863 instructions tips for irs form 8863 what is form 8863? Go to www.irs.gov/form8863 for instructions and the latest information. Web step by step instructions comments in the united states, education credits can be one of the biggest tax benefits for many families. Web how to calculate magi eligible educational institution defined which expenses aren’t covered by aotc and llc?

Web for the latest information about developments related to form 8863 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8863. The types of educational credits this tax form covers what types of educational expenses qualify for these tax credits Web step by step instructions comments in the united states, education credits can be one of the biggest tax benefits for many families. The education credits are designed to offset updated for current information. Web overview if you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return. In this article, we’ll explore irs form 8863, education credits. Find out more about what education expenses qualify. Web llc, you (or your dependent) must be (or have been) a student who is (or was) enrolled in at least one course during the tax year, and have a modified adjusted gross income below the threshold (for 2020, the threshold is $69,000 or $139,000 for joint filers). Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Go to www.irs.gov/form8863 for instructions and the latest information.

Form 8863 Instructions & Information on the Education Credit Form

Web overview if you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return. Web how to calculate magi eligible educational institution defined which expenses aren’t covered by aotc and llc? Use form 8863 to figure and claim your education credits, which are based on.

AOTC & LLC Two Higher Education Tax Benefits For US Taxpayers The

Go to www.irs.gov/form8863 for instructions and the latest information. The types of educational credits this tax form covers what types of educational expenses qualify for these tax credits Web step by step instructions comments in the united states, education credits can be one of the biggest tax benefits for many families. Web form 8863 is used by individuals to figure.

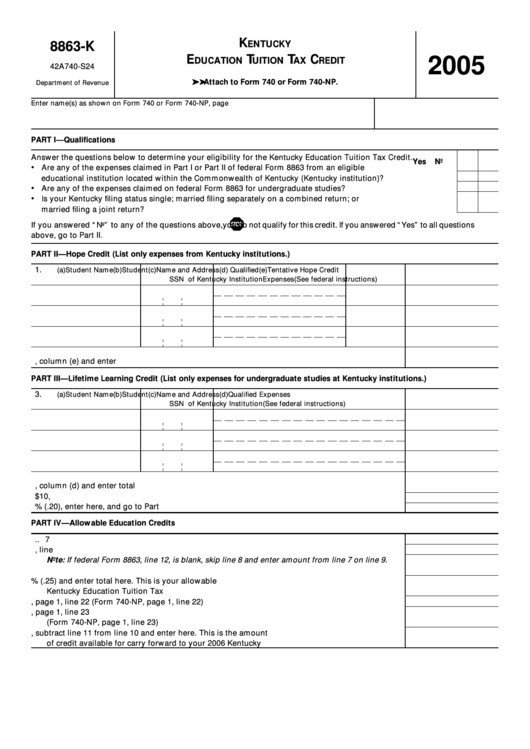

Fillable Form 8863K Education Tuition Tax Credit 2005 printable pdf

The types of educational credits this tax form covers what types of educational expenses qualify for these tax credits The american opportunity credit (aoc), part of which may be refundable, and the lifetime learning credit (llc), which is not refundable. Go to www.irs.gov/form8863 for instructions and the latest information. Web how to calculate magi eligible educational institution defined which expenses.

MW My 2004 Federal and State Tax Returns

Web llc, you (or your dependent) must be (or have been) a student who is (or was) enrolled in at least one course during the tax year, and have a modified adjusted gross income below the threshold (for 2020, the threshold is $69,000 or $139,000 for joint filers). Find out more about what education expenses qualify. In this article, we’ll.

Form 8863 Instructions Information On The Education 1040 Form Printable

Go to www.irs.gov/form8863 for instructions and the latest information. The types of educational credits this tax form covers what types of educational expenses qualify for these tax credits Go to www.irs.gov/form8863 for instructions and the latest information. Web step by step instructions comments in the united states, education credits can be one of the biggest tax benefits for many families..

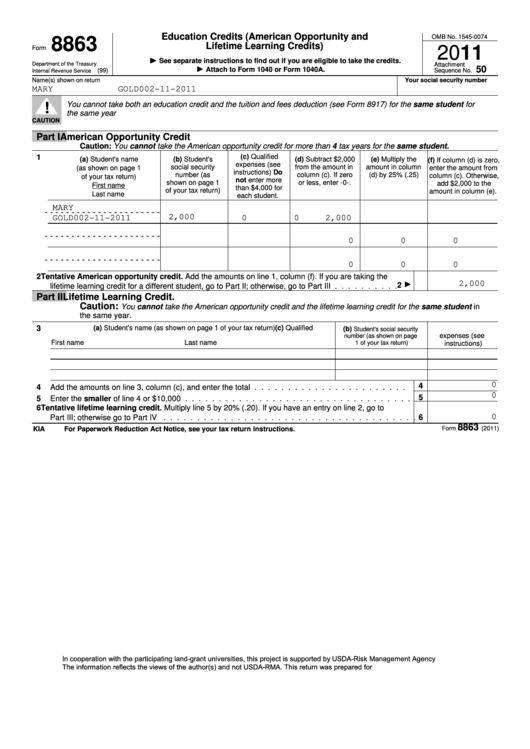

Sample Form 8863 Education Credits (American Opportunity And Lifetime

Web overview if you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return. Find out more about what education expenses qualify. Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.). Use form 8863 to.

1040 Schedule 3 (Drake18 and Drake19) (Schedule3)

Web overview if you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return. The american opportunity credit (aoc), part of which may be refundable, and the lifetime learning credit (llc), which is not refundable. Go to www.irs.gov/form8863 for instructions and the latest information. Web.

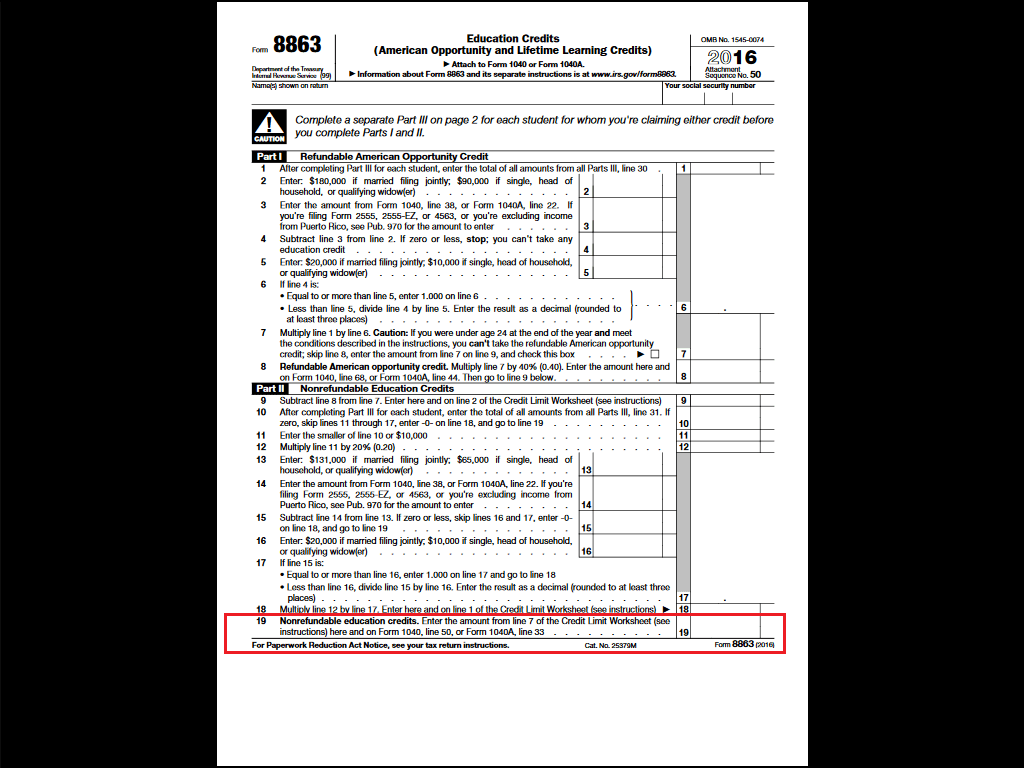

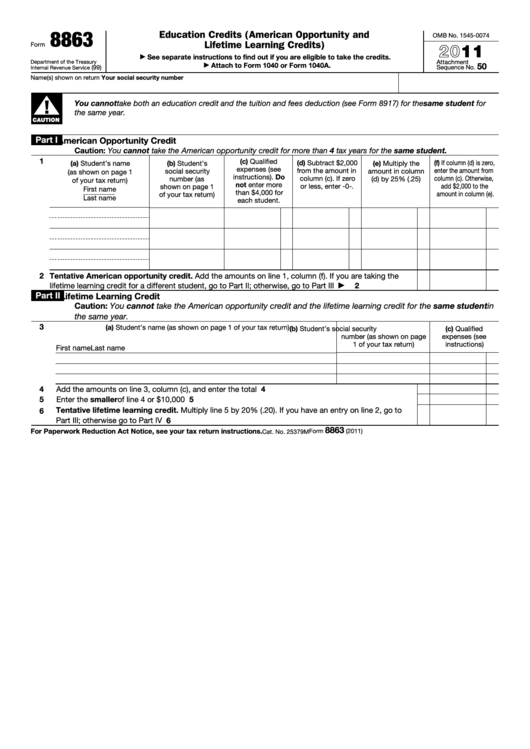

Fillable Form 8863 Education Credits (American Opportunity And

The education credits are designed to offset updated for current information. Web llc, you (or your dependent) must be (or have been) a student who is (or was) enrolled in at least one course during the tax year, and have a modified adjusted gross income below the threshold (for 2020, the threshold is $69,000 or $139,000 for joint filers). 50.

Instructions For Form 8863 Education Credits (American Opportunity

The types of educational credits this tax form covers what types of educational expenses qualify for these tax credits Web llc, you (or your dependent) must be (or have been) a student who is (or was) enrolled in at least one course during the tax year, and have a modified adjusted gross income below the threshold (for 2020, the threshold.

IRS Update for Form 8863 Education Tax Credits The TurboTax Blog

Web llc, you (or your dependent) must be (or have been) a student who is (or was) enrolled in at least one course during the tax year, and have a modified adjusted gross income below the threshold (for 2020, the threshold is $69,000 or $139,000 for joint filers). 50 name(s) shown on return Irs form 8863 instructions tips for irs.

The American Opportunity Credit (Aoc), Part Of Which May Be Refundable, And The Lifetime Learning Credit (Llc), Which Is Not Refundable.

What's new limits on modified adjusted gross income (magi). In this article, we’ll explore irs form 8863, education credits. Irs form 8863 instructions tips for irs form 8863 what is form 8863? Web overview if you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return.

The Types Of Educational Credits This Tax Form Covers What Types Of Educational Expenses Qualify For These Tax Credits

Go to www.irs.gov/form8863 for instructions and the latest information. The lifetime learning credit magi limit increases to $180,000 if you're Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.). Web for the latest information about developments related to form 8863 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8863.

Go To Www.irs.gov/Form8863 For Instructions And The Latest Information.

Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. The education credits are designed to offset updated for current information. Web how to calculate magi eligible educational institution defined which expenses aren’t covered by aotc and llc? 50 name(s) shown on return

Web Llc, You (Or Your Dependent) Must Be (Or Have Been) A Student Who Is (Or Was) Enrolled In At Least One Course During The Tax Year, And Have A Modified Adjusted Gross Income Below The Threshold (For 2020, The Threshold Is $69,000 Or $139,000 For Joint Filers).

Find out more about what education expenses qualify. Web step by step instructions comments in the united states, education credits can be one of the biggest tax benefits for many families.