Form 8849 Instructions

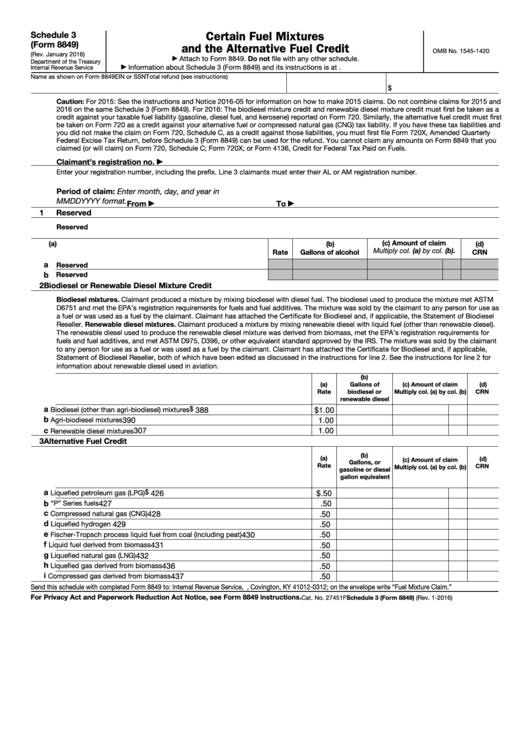

Form 8849 Instructions - Web taxpayers who wish to claim the credit must file form 8849, claim for refund of excise taxes, and include schedule 3, certain fuel mixtures and the alternative fuel credit. Web the following claimants must use form 8849 for annual claims: Name as shown on form 8849. Total refund (see instructions) $ period of claim: December 2020) department of the treasury internal revenue service. Web taxact ® does not support form 8849 claim for refund of excise taxes. Don’t file with any other schedule. Offering electronic filing of form 8849 satisfies the congressional mandate to provide filers an electronic option for filing form 8849 with schedules 2, 3, or 8. Tax payers should not file form 8849 to make adjustments to. Who shouldn’t file 8849 form?

Web the following claimants must use form 8849 for annual claims: Below are the links to these forms if you wish to complete and paper file them. Name as shown on form 8849. Total refund (see instructions) $ caution: What’s new changes are discussed under what’s new in the instructions for each schedule. Web why is irs offering electronic filing of form 8849, claim for refund of excise taxes? Web tax form 8849 should be filed by, anyone who overpaid taxes on form 2290; Use this form to claim a refund of excise taxes on certain fuel related sales. Total refund (see instructions) $ period of claim: Reminders • you can electronically file form 8849 through any electronic return originator (ero), transmitter, and/or

This is a separate return from the individual tax return on federal form 1040 u.s. If the above requirements are not met, see annual claims in. Web information about form 8849, claim for refund of excise taxes, including recent updates, related forms and instructions on how to file. Sales by registered ultimate vendors. What’s new changes are discussed under what’s new in the instructions for each schedule. Owners of vehicles who traveled 5000 miles or less on public highways; Web taxact ® does not support form 8849 claim for refund of excise taxes. Only one claim may be filed per quarter. Don’t file with any other schedule. December 2020) department of the treasury internal revenue service.

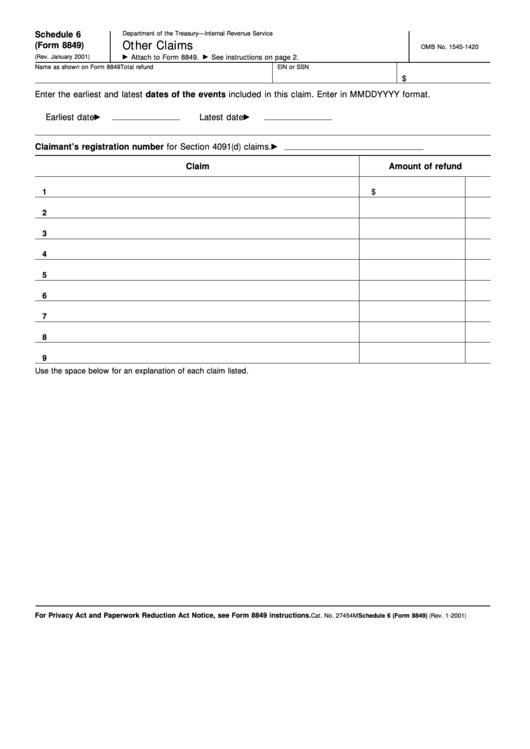

Fillable Schedule 6 (Form 8849) Other Claims printable pdf download

Below are the links to these forms if you wish to complete and paper file them. For these claimants, the taxable year is based on the calendar Do not file with any other schedule. This is a separate return from the individual tax return on federal form 1040 u.s. Tax payers should not file form 8849 to make adjustments to.

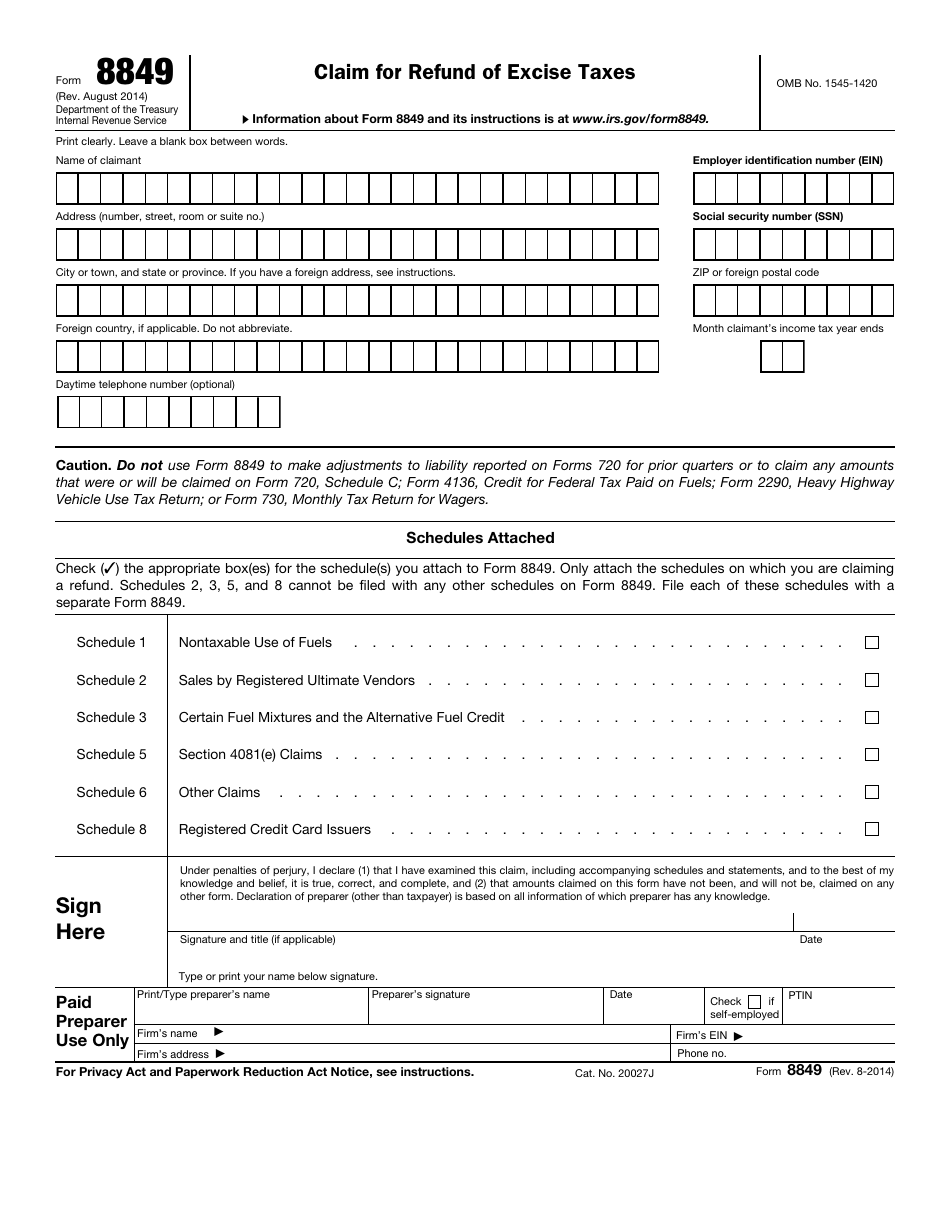

Form 8849 Claim for Refund of Excise Taxes (2014) Free Download

Owners of sold, destroyed, or stolen vehicles; Reminders • you can electronically file form 8849 through any electronic return originator (ero), transmitter, and/or What’s new changes are discussed under what’s new in the instructions for each schedule. Below are the links to these forms if you wish to complete and paper file them. Web the following claimants must use form.

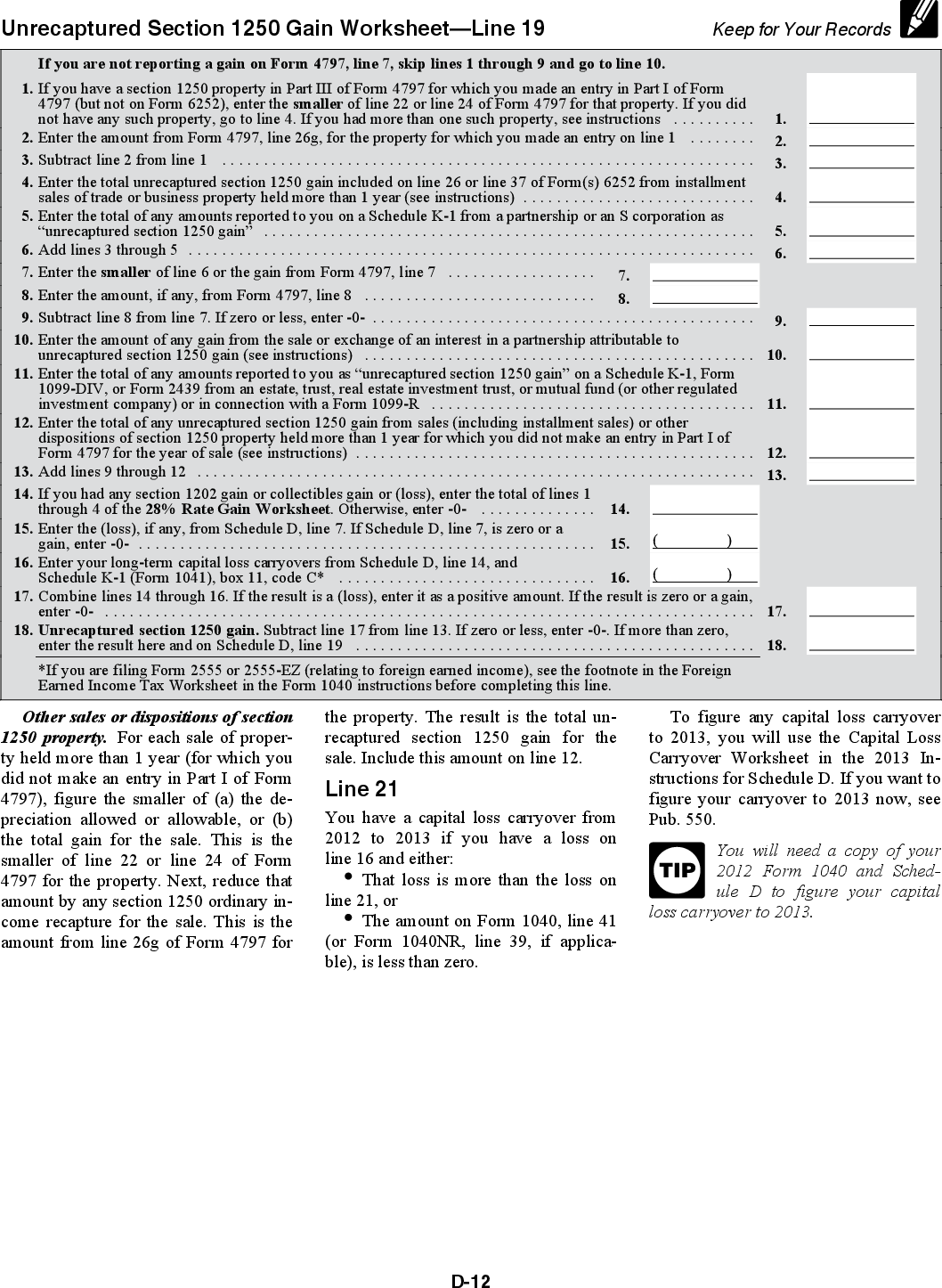

2012 IRS Form 8949 Instructions Images Frompo

Enter the earliest and latest date of the claim on page 1. If the above requirements are not met, see annual claims in. May 2020) nontaxable use of fuels department of the treasury internal revenue service attach to form 8849. For these claimants, the taxable year is based on the calendar Do not file with any other schedule.

Fill Free fillable Sales by Registered Ultimate Vendors Form 8849

May 2020) nontaxable use of fuels department of the treasury internal revenue service attach to form 8849. Web the following claimants must use form 8849 for annual claims: Below are the links to these forms if you wish to complete and paper file them. Web information about form 8849, claim for refund of excise taxes, including recent updates, related forms.

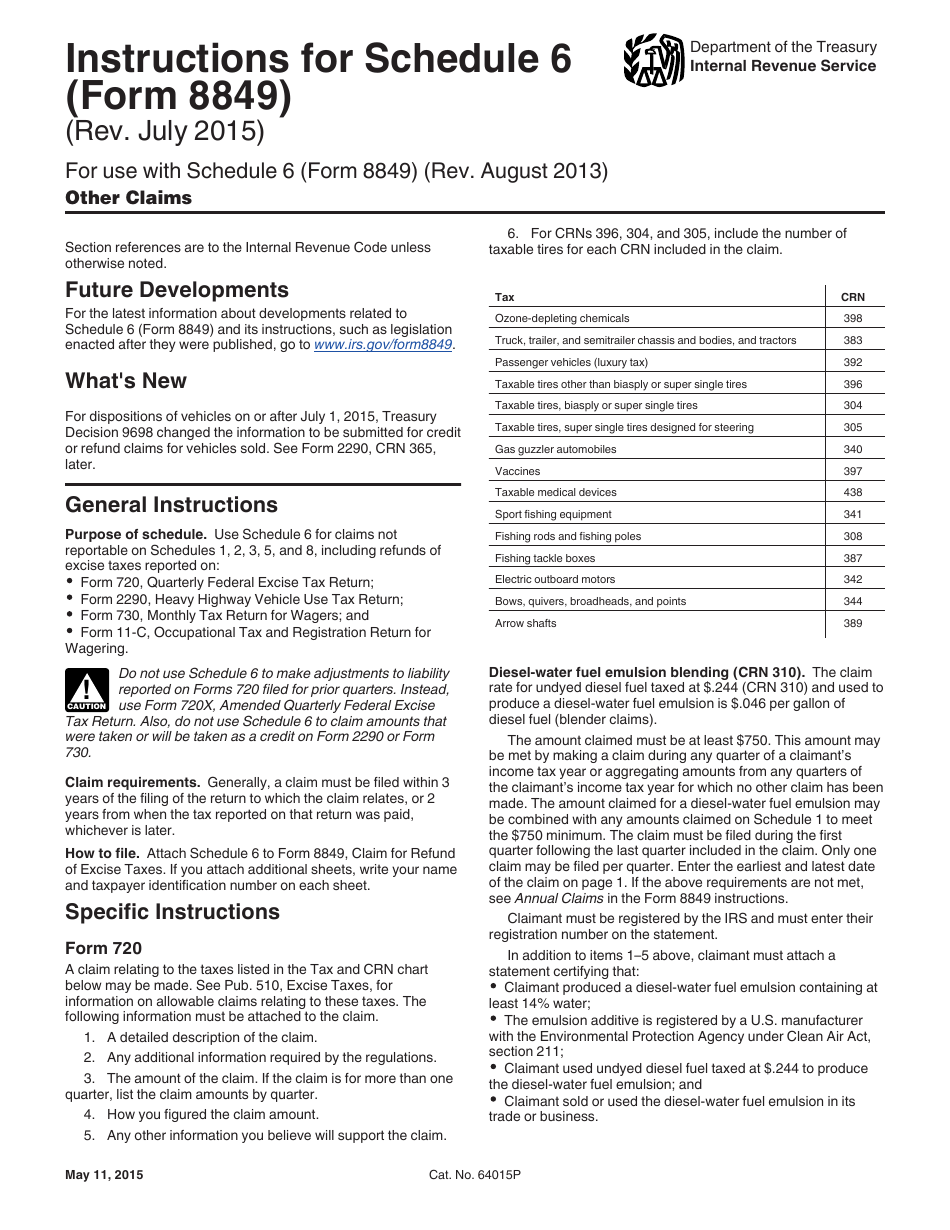

Download Instructions for IRS Form 8849 Schedule 6 Other Claims PDF

Web the claim must be filed during the first quarter following the last quarter included in the claim. December 2020) department of the treasury internal revenue service. Name as shown on form 8849. Owners of vehicles who traveled 5000 miles or less on public highways; Use this form to claim a refund of excise taxes on certain fuel related sales.

Fillable Schedule 3 (Form 8849) Certain Fuel Mixtures And The

Below are the links to these forms if you wish to complete and paper file them. Owners of sold, destroyed, or stolen vehicles; Sales by registered ultimate vendors. Web taxpayers who wish to claim the credit must file form 8849, claim for refund of excise taxes, and include schedule 3, certain fuel mixtures and the alternative fuel credit. If the.

IRS Form 8849 Download Fillable PDF or Fill Online Claim for Refund of

Web the claim must be filed during the first quarter following the last quarter included in the claim. For these claimants, the taxable year is based on the calendar Offering electronic filing of form 8849 satisfies the congressional mandate to provide filers an electronic option for filing form 8849 with schedules 2, 3, or 8. Who shouldn’t file 8849 form?.

Form 8849 Claim for Refund of Excise Taxes (2014) Free Download

If the above requirements are not met, see annual claims in. Reminders • you can electronically file form 8849 through any electronic return originator (ero), transmitter, and/or Owners of vehicles who traveled 7500 miles or less. Web tax form 8849 should be filed by, anyone who overpaid taxes on form 2290; Web information about form 8849, claim for refund of.

Complete information on form 8849 e filing process

What’s new changes are discussed under what’s new in the instructions for each schedule. Enter the earliest and latest date of the claim on page 1. Below are the links to these forms if you wish to complete and paper file them. Sales by registered ultimate vendors. December 2020) department of the treasury internal revenue service.

Form 8849 (Schedule 2) Sales by Registered Ultimate Vendors (2012

Name as shown on form 8849. Don’t file with any other schedule. December 2020) department of the treasury internal revenue service. Web taxpayers who wish to claim the credit must file form 8849, claim for refund of excise taxes, and include schedule 3, certain fuel mixtures and the alternative fuel credit. For these claimants, the taxable year is based on.

Who Shouldn’t File 8849 Form?

Web tax form 8849 should be filed by, anyone who overpaid taxes on form 2290; May 2020) nontaxable use of fuels department of the treasury internal revenue service attach to form 8849. Tax payers should not file form 8849 to make adjustments to. December 2020) department of the treasury internal revenue service.

Do Not File With Any Other Schedule.

This is a separate return from the individual tax return on federal form 1040 u.s. Name as shown on form 8849. Web why is irs offering electronic filing of form 8849, claim for refund of excise taxes? Web the claim must be filed during the first quarter following the last quarter included in the claim.

Use This Form To Claim A Refund Of Excise Taxes On Certain Fuel Related Sales.

Don’t file with any other schedule. Offering electronic filing of form 8849 satisfies the congressional mandate to provide filers an electronic option for filing form 8849 with schedules 2, 3, or 8. Owners of vehicles who traveled 5000 miles or less on public highways; Enter the earliest and latest date of the claim on page 1.

Web Form 8849 And Its Instructions Or Separate Schedules, Such As Legislation Enacted After They Were Published, Go To Www.irs.gov/Form8849.

Web taxact ® does not support form 8849 claim for refund of excise taxes. Web taxpayers who wish to claim the credit must file form 8849, claim for refund of excise taxes, and include schedule 3, certain fuel mixtures and the alternative fuel credit. What’s new changes are discussed under what’s new in the instructions for each schedule. Owners of sold, destroyed, or stolen vehicles;