Form 8843 Instructions

Form 8843 Instructions - Mail your tax return by the due date (including extensions) to the address shown in your tax return instructions. You are a nonresident alien; Source income* during 2016 (or less than $4050) the purpose of form 8843 is to demonstrate to the u.s. And help determine tax responsibility. Web form 8843 must be filed if an individual is: Government that you are eligible for nonresident alien status for tax purposes and therefore exempt from being taxed on income you may have from outside the u.s. You can not file this form electronically, you must mail the paper form. In 2021, whether they worked and earned money or not, are required to complete and send in the 8843 form. Web how to fill out the federal form 8843 all international students & scholars (including their dependents) present in the u.s. Web mail your completed form 8843 to:

Alien individuals use form 8843 to explain excluded days of presence in the u.s. For foreign nationals who had no u.s. For the substantial presence test. For the prior calendar year is april 15th of the current year.” Web mail your completed form 8843 to: In 2021, whether they worked and earned money or not, are required to complete and send in the 8843 form. Web how to fill out the federal form 8843 all international students & scholars (including their dependents) present in the u.s. Web irs form 8843 is a tax form used be foreign nationals to document the number of days spent outside of the u.s. • a nonresident alien (an individual who has not passed the green card test or the substantial presence test.) • present in the u.s. Web you must file a form 8843 if:

In 2021, whether they worked and earned money or not, are required to complete and send in the 8843 form. Web mail your completed form 8843 to: Web mail form 8843 and supporting documents in an envelope to the following address: They do not need to be received by that date. Current form 8843 and supporting documents must be mailed by june 15th. You are a nonresident alien; You were present in the us in the previous tax year; For foreign nationals who had no u.s. Web you must file a form 8843 if: Alien individuals use form 8843 to explain excluded days of presence in the u.s.

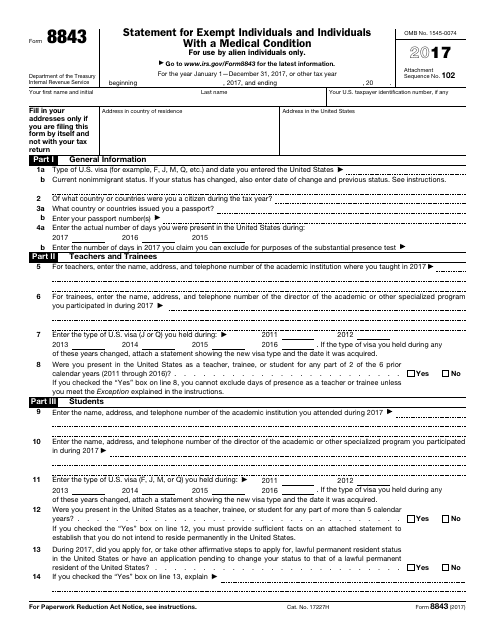

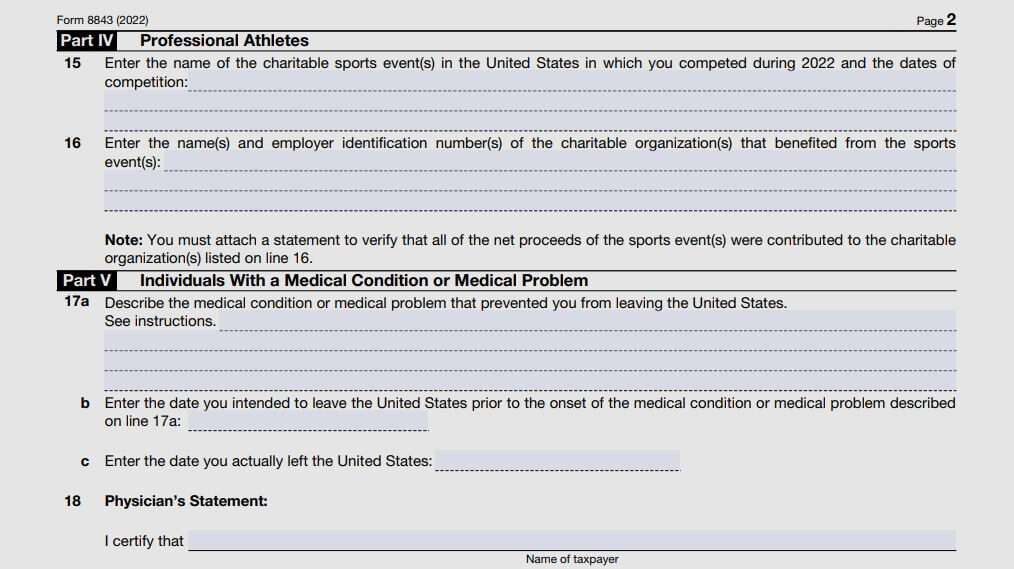

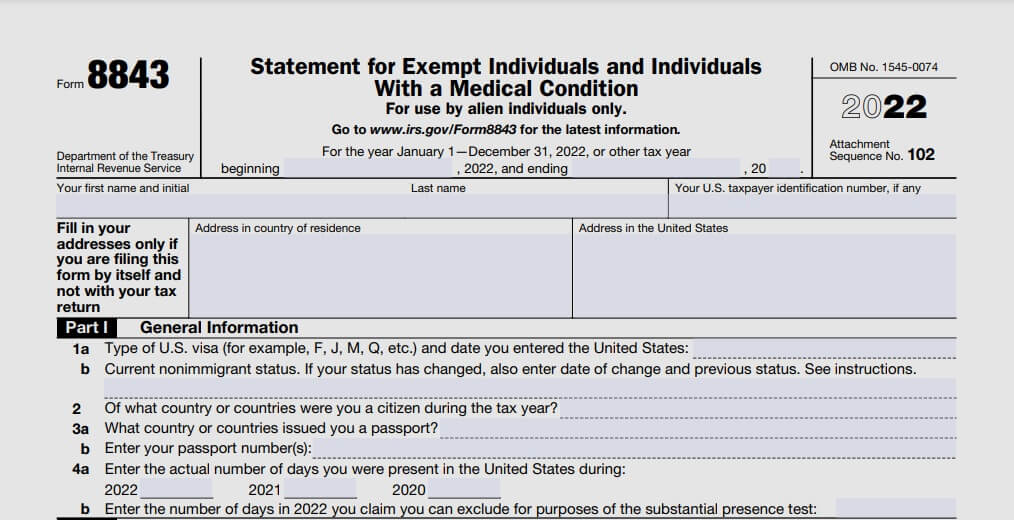

IRS Form 8843 Download Fillable PDF or Fill Online Statement for Exempt

You can not file this form electronically, you must mail the paper form. If you are claiming the rev. Current form 8843 and supporting documents must be mailed by june 15th. • a nonresident alien (an individual who has not passed the green card test or the substantial presence test.) • present in the u.s. For foreign nationals who had.

Form 8843 Instructions How to fill out 8843 form online & file it

For the substantial presence test. Source income* during 2016 (or less than $4050) the purpose of form 8843 is to demonstrate to the u.s. Web how to fill out the federal form 8843 all international students & scholars (including their dependents) present in the u.s. And help determine tax responsibility. Web instructions for form 8843.

LEGO 8843 ForkLift Truck Set Parts Inventory and Instructions LEGO

Current form 8843 and supporting documents must be mailed by june 15th. Web mail form 8843 and supporting documents in an envelope to the following address: • present in the u.s. Web mail your completed form 8843 to: The deadline for mailing your 8843:

Tax how to file form 8843 (1)

They do not need to be received by that date. The deadline for mailing your 8843: You were present in the us in the previous tax year; Source income* during 2016 (or less than $4050) the purpose of form 8843 is to demonstrate to the u.s. Web you must file a form 8843 if:

Form 8843 Instructions How to fill out 8843 form online & file it

You are a nonresident alien; For the prior calendar year is april 15th of the current year.” For any day during 2021. Current form 8843 and supporting documents must be mailed by june 15th. And help determine tax responsibility.

form 8843 example Fill Online, Printable, Fillable Blank

For foreign nationals who had no u.s. Access to a free online form completion wizard is available. Source income* during 2016 (or less than $4050) the purpose of form 8843 is to demonstrate to the u.s. For any day during 2021. • a nonresident alien (an individual who has not passed the green card test or the substantial presence test.).

Form 8843 Statement for Exempt Individuals and Individuals with a

Web irs form 8843 is a tax form used be foreign nationals to document the number of days spent outside of the u.s. Even if you don’t need to file an income tax return, you should file the form 8843 if the above criteria apply. Web you must file a form 8843 if: Government that you are eligible for nonresident.

IRS Form 8843 Editable and Printable Statement to Fill out

Web form 8843 must be filed if an individual is: Web you must file a form 8843 if: In 2021, whether they worked and earned money or not, are required to complete and send in the 8843 form. Even if you don’t need to file an income tax return, you should file the form 8843 if the above criteria apply..

What is Form 8843 and How Do I File it? Sprintax Blog

Mail your tax return by the due date (including extensions) to the address shown in your tax return instructions. Web instructions for form 8843. Alien individuals use form 8843 to explain excluded days of presence in the u.s. If you are claiming the rev. For any day during 2021.

Form 8843 Statement for Exempt Individuals and Individuals with a

If you are claiming the rev. Even if you don’t need to file an income tax return, you should file the form 8843 if the above criteria apply. You are a nonresident alien; Web information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent updates, related forms, and instructions on how to file. Web.

You Are A Nonresident Alien;

Web form 8843 must be filed if an individual is: Access to a free online form completion wizard is available. Web mail your completed form 8843 to: • a nonresident alien (an individual who has not passed the green card test or the substantial presence test.) • present in the u.s.

• Present In The U.s.

Web you must file a form 8843 if: Source income* during 2016 (or less than $4050) the purpose of form 8843 is to demonstrate to the u.s. You can not file this form electronically, you must mail the paper form. In 2021, whether they worked and earned money or not, are required to complete and send in the 8843 form.

And Help Determine Tax Responsibility.

Even if you don’t need to file an income tax return, you should file the form 8843 if the above criteria apply. Current form 8843 and supporting documents must be mailed by june 15th. For the substantial presence test. Government that you are eligible for nonresident alien status for tax purposes and therefore exempt from being taxed on income you may have from outside the u.s.

Web Information About Form 8843, Statement For Exempt Individuals And Individuals With A Medical Condition, Including Recent Updates, Related Forms, And Instructions On How To File.

For any day during 2021. For foreign nationals who had no u.s. They do not need to be received by that date. The deadline for mailing your 8843: