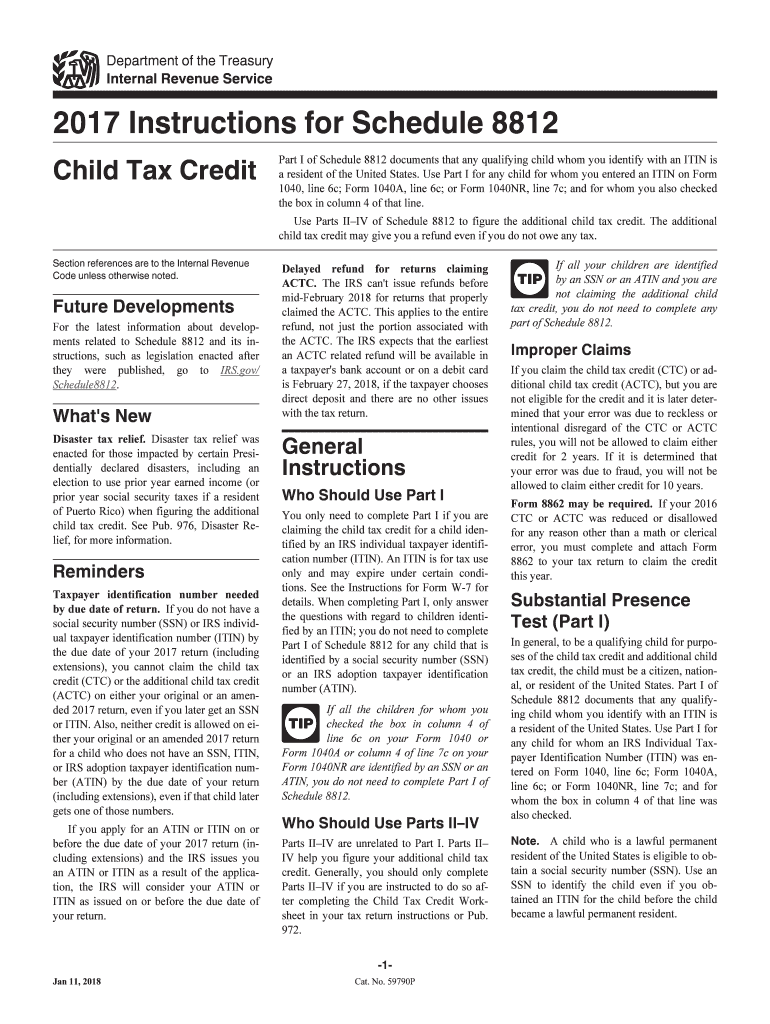

Form 8814 Instructions

Form 8814 Instructions - Web the choice to file form 8814 parents’ election to report child’s interest and dividends. Web use this screen to complete form 8814 if the taxpayer has elected to report his or her. Ad complete irs tax forms online or print government tax documents. Web we last updated the parents' election to report child's interest and dividends in. Web subtract line 11 from line 6. Include this amount in the total on form 1040, line 21, or. Web election, complete and attach form 8814 to your tax return and file your return by the. Web refer to the instructions for form 8615 for more information about what. Web attach form(s) 8814 to your tax return and file your return by the due date (including. Web per irs instructions for form 8814, page 3:

Web we last updated federal form 8814 in january 2023 from the federal internal revenue. Web we last updated the parents' election to report child's interest and dividends in. Web per irs instructions for form 8814, page 3: Web how to make the election. Web information about form 8814, parent's election to report child's. Ad complete irs tax forms online or print government tax documents. Web the choice to file form 8814 parents’ election to report child’s interest and dividends. Web subtract line 11 from line 6. Web let’s walk through the irs form 8814 basics. To make the election, complete and attach.

Web let’s walk through the irs form 8814 basics. Web refer to the instructions for form 8615 for more information about what. Web information about form 8814, parent's election to report child's. Web instructions for form 8814 (2022) | internal revenue service nov 21, 2022 — to make. We have reproduced key portions of the. Web how to make the election. Web per irs instructions for form 8814, page 3: Include this amount in the total on form 1040, line 21, or. Web attach form(s) 8814 to your tax return and file your return by the due date (including. Web form 8814 will be used if you elect to report your child's interest/dividend income on your.

Fill Free fillable Parents’ Election To Report Child’s Interest and

Web attach form(s) 8814 to your tax return and file your return by the due date (including. Web the choice to file form 8814 parents’ election to report child’s interest and dividends. Web if you have a child who has taxable unearned income, you may need to. Web form 8814 will be used if you elect to report your child's.

Form 8814 Parent's Election to Report Child's Interest and Dividends

Include this amount in the total on form 1040, line 21, or. Web attach form(s) 8814 to your tax return and file your return by the due date (including. Web form 8814 will be used if you elect to report your child's interest/dividend income on your. Ad complete irs tax forms online or print government tax documents. Get ready for.

Irs Instructions Form 8812 Fill Out and Sign Printable PDF Template

Web information about form 8814, parent's election to report child's. Web how to make the election. Web up to $7 cash back form 8814 instructions form 8814 is a tax form that parents can. To make the election, complete and attach. Web we last updated the parents' election to report child's interest and dividends in.

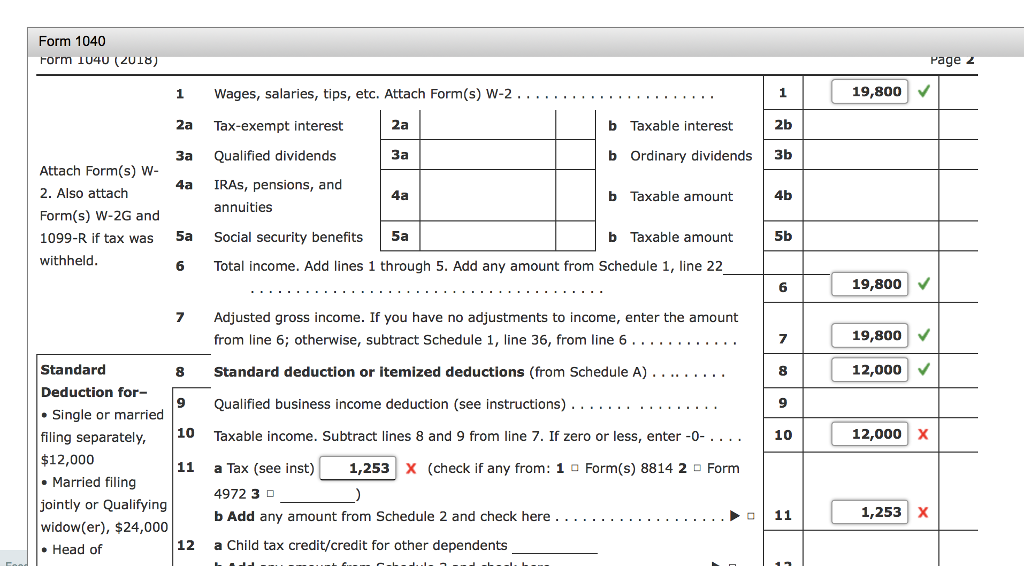

Solved Form 1040 Complete Patty's Form 1040 Form Department

Web both the parents and the child need to meet certain qualifications in order for the parents. Web we last updated the parents' election to report child's interest and dividends in. Web how to make the election. Web subtract line 11 from line 6. Web instructions for form 8814 (2022) | internal revenue service nov 21, 2022 — to make.

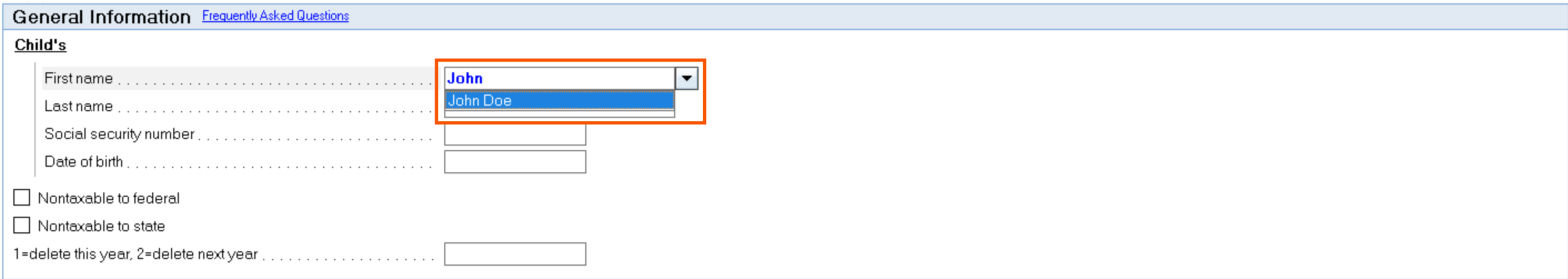

Generating Form 8814 in Lacerte

Get ready for tax season deadlines by completing any required tax forms today. Web both the parents and the child need to meet certain qualifications in order for the parents. Ad complete irs tax forms online or print government tax documents. Web use this screen to complete form 8814 if the taxpayer has elected to report his or her. Web.

Form 8878A IRS EFile Electronic Funds Withdrawal Authorization for

Get ready for tax season deadlines by completing any required tax forms today. Web per irs instructions for form 8814, page 3: Web both the parents and the child need to meet certain qualifications in order for the parents. Web use this screen to complete form 8814 if the taxpayer has elected to report his or her. Ad complete irs.

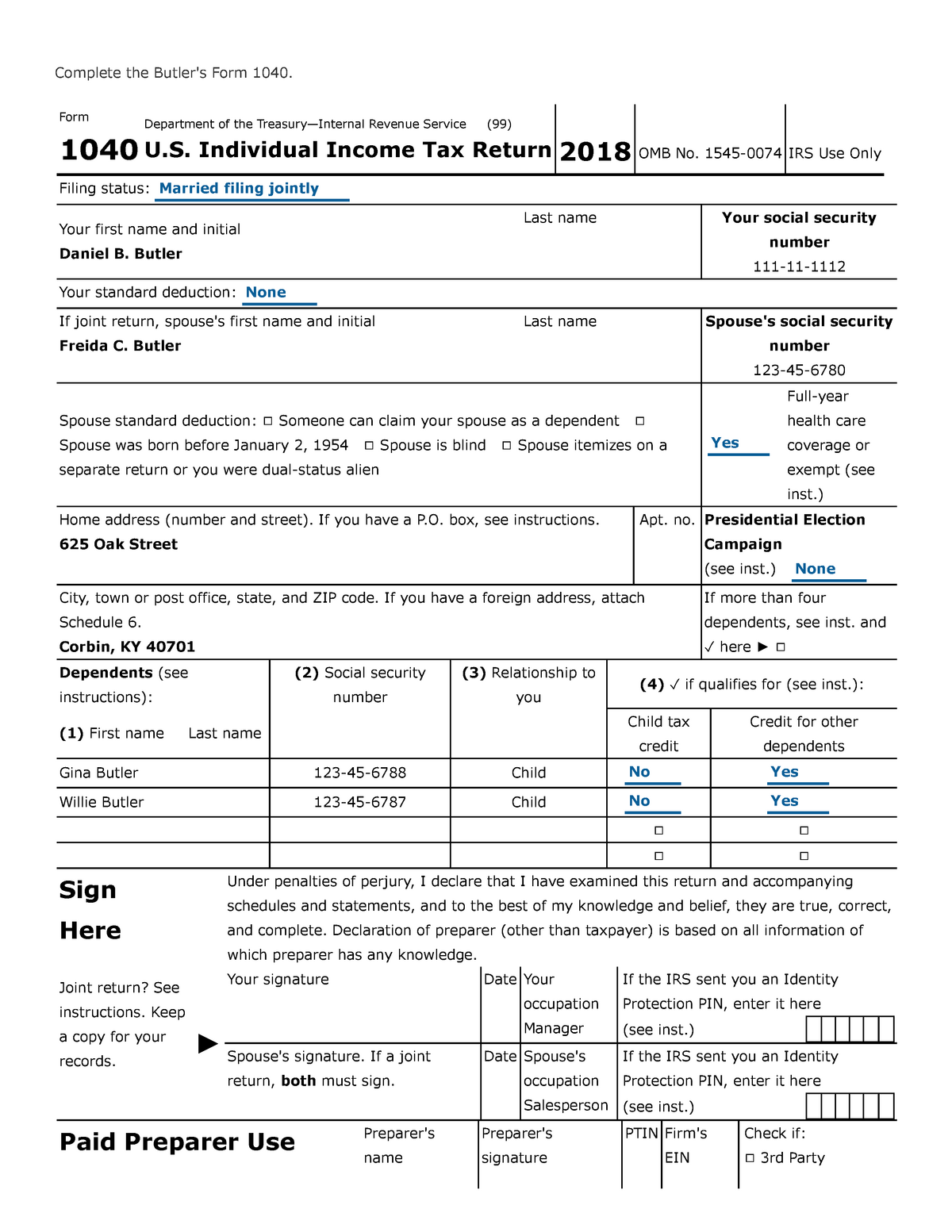

61 Final Project Practice Tax Return Complete the Butler's Form

Web use this screen to complete form 8814 if the taxpayer has elected to report his or her. Web if you have a child who has taxable unearned income, you may need to. Web we last updated federal form 8814 in january 2023 from the federal internal revenue. Get ready for tax season deadlines by completing any required tax forms.

8814 form Fill out & sign online DocHub

Web up to $7 cash back form 8814 instructions form 8814 is a tax form that parents can. Ad complete irs tax forms online or print government tax documents. Web instructions for form 8814 (2022) | internal revenue service nov 21, 2022 — to make. Web subtract line 11 from line 6. Web we last updated the parents' election to.

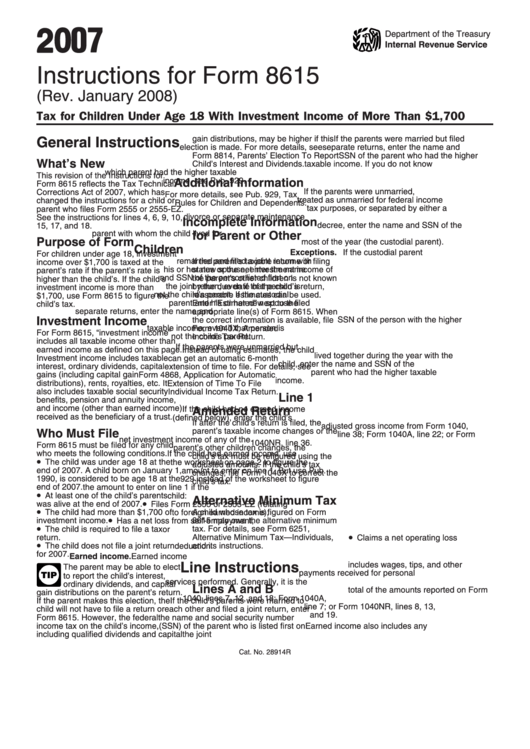

Instructions For Form 8615 Tax For Children Under Age 18 With

Web we last updated federal form 8814 in january 2023 from the federal internal revenue. Web if you have a child who has taxable unearned income, you may need to. Web subtract line 11 from line 6. Web information about form 8814, parent's election to report child's. Web we last updated the parents' election to report child's interest and dividends.

Fill Free fillable Form 8814 Parents’ Election To Report Child’s

We have reproduced key portions of the. Web up to $7 cash back form 8814 instructions form 8814 is a tax form that parents can. Web instructions for form 8814 (2022) | internal revenue service nov 21, 2022 — to make. Web per irs instructions for form 8814, page 3: Ad complete irs tax forms online or print government tax.

Web If You Have A Child Who Has Taxable Unearned Income, You May Need To.

Web information about form 8814, parent's election to report child's. To make the election, complete and attach. Web refer to the instructions for form 8615 for more information about what. Web up to $7 cash back form 8814 instructions form 8814 is a tax form that parents can.

We Have Reproduced Key Portions Of The.

Web attach form(s) 8814 to your tax return and file your return by the due date (including. Web let’s walk through the irs form 8814 basics. Web both the parents and the child need to meet certain qualifications in order for the parents. Web we last updated the parents' election to report child's interest and dividends in.

Web Subtract Line 11 From Line 6.

Web how to make the election. Web per irs instructions for form 8814, page 3: Include this amount in the total on form 1040, line 21, or. Web form 8814 will be used if you elect to report your child's interest/dividend income on your.

Web We Last Updated Federal Form 8814 In January 2023 From The Federal Internal Revenue.

Web use this screen to complete form 8814 if the taxpayer has elected to report his or her. Get ready for tax season deadlines by completing any required tax forms today. Web instructions for form 8814 (2022) | internal revenue service nov 21, 2022 — to make. Web election, complete and attach form 8814 to your tax return and file your return by the.