Form 8801 Instructions 2022

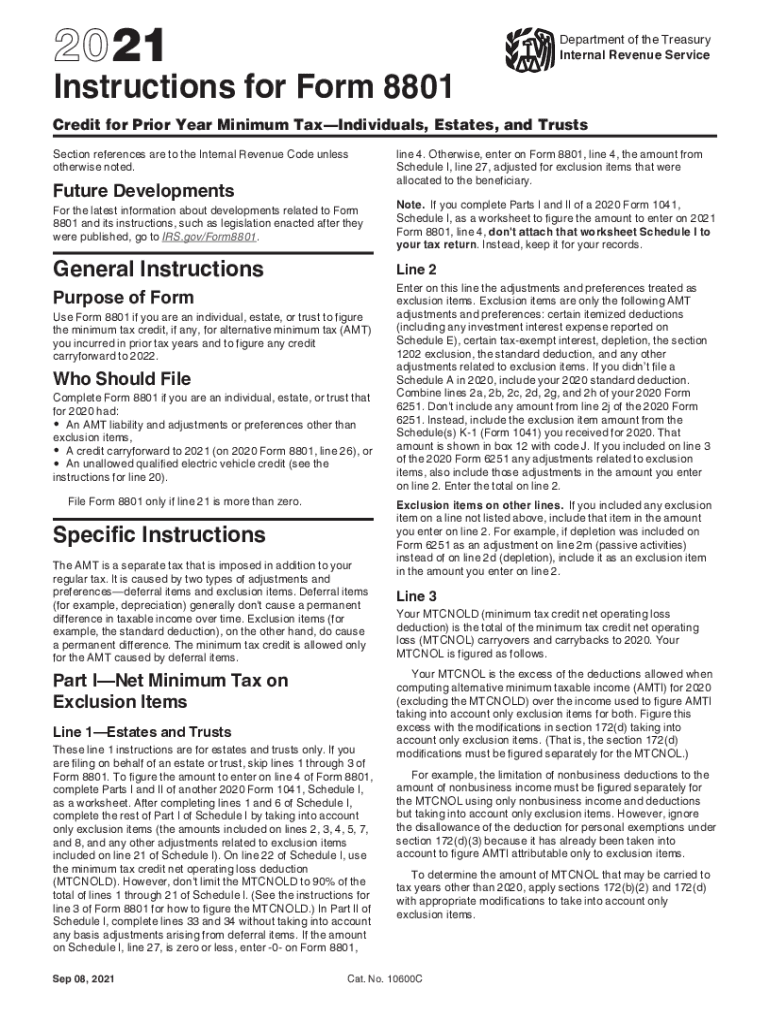

Form 8801 Instructions 2022 - Department of the treasury internal revenue service (99) credit for prior year minimum tax— individuals, estates, and trusts. Department of the treasury internal revenue service (99) credit for prior year minimum tax— individuals, estates, and trusts. Ad download or email irs 8801 & more fillable forms, register and subscribe now! Form 8801 is used to calculate the minimum tax credit, if any, for alternative minimum tax (amt) incurred in prior. Enjoy smart fillable fields and interactivity. Web future developments for the latest information about developments related to form 8881 and its instructions, such as legislation enacted after they were published, go to. Web individuals, trusts, and estates should file form ct‑8801 if the individuals, trusts, or estates had a connecticut alternative minimum tax liability in 2021 and adjustments or items of. The days of terrifying complex tax and legal forms are over. Web general instructions purpose of form use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in. Edit, sign and print tax forms on any device with uslegalforms.

The days of terrifying complex tax and legal forms are over. Web 30 votes how to fill out and sign irs form 8801 online? Edit, sign and print tax forms on any device with uslegalforms. Web (see the instructions for line 3 of form 8801 for how to figure the mtcnold.) in part ii of schedule i, complete lines 33 and 34 without taking into account any basis adjustments. Department of the treasury internal revenue service (99) credit for prior year minimum tax— individuals, estates, and trusts. Instructions to 2022 form 8801;. Web department of the treasury internal revenue service credit for prior year minimum tax— individuals, estates, and trusts go to www.irs.gov/form8801 for instructions and the. Enjoy smart fillable fields and interactivity. Ad download or email irs 8801 & more fillable forms, register and subscribe now! Web follow the simple instructions below:

Edit, sign and print tax forms on any device with uslegalforms. Web future developments for the latest information about developments related to form 8881 and its instructions, such as legislation enacted after they were published, go to. Web (see the instructions for line 3 of form 8801 for how to figure the mtcnold.) in part ii of schedule i, complete lines 33 and 34 without taking into account any basis adjustments. Form 8801 is used to calculate the minimum tax credit, if any, for alternative minimum tax (amt) incurred in prior. Instructions to 2022 form 8801;. Ad download or email irs 8801 & more fillable forms, register and subscribe now! The days of terrifying complex tax and legal forms are over. Web click on the following links to go the forms and their instructions. Web general instructions purpose of form use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in. Web department of the treasury internal revenue service credit for prior year minimum tax— individuals, estates, and trusts go to www.irs.gov/form8801 for instructions and the.

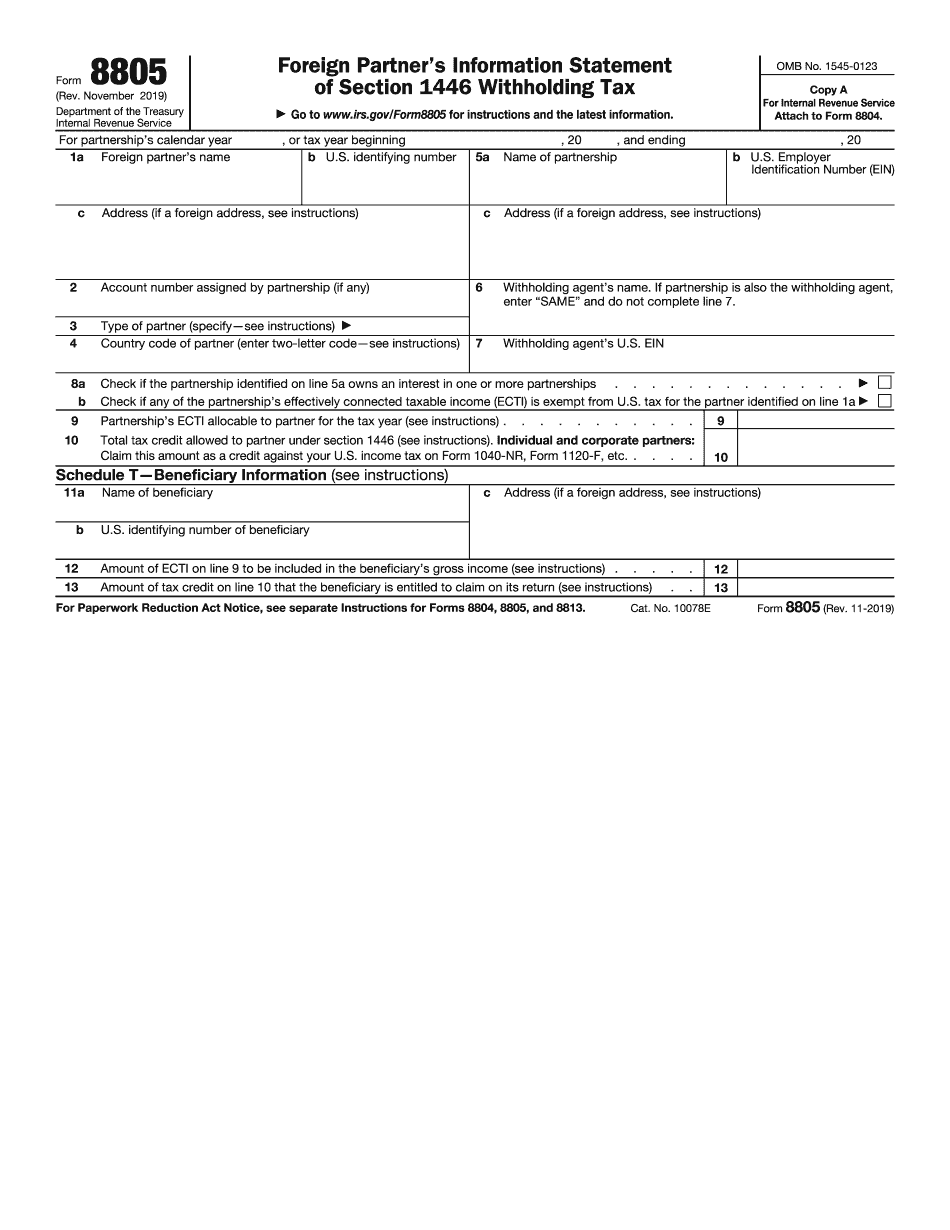

form 8804 instructions 20192022 Fill Online, Printable, Fillable

The days of terrifying complex tax and legal forms are over. Web click on the following links to go the forms and their instructions. Web 30 votes how to fill out and sign irs form 8801 online? Department of the treasury internal revenue service (99) credit for prior year minimum tax— individuals, estates, and trusts. Get your online template and.

Form 8801 Instructions Fill Out and Sign Printable PDF Template signNow

Web click on the following links to go the forms and their instructions. Web individuals, trusts, and estates should file form ct‑8801 if the individuals, trusts, or estates had a connecticut alternative minimum tax liability in 2021 and adjustments or items of. Department of the treasury internal revenue service (99) credit for prior year minimum tax— individuals, estates, and trusts..

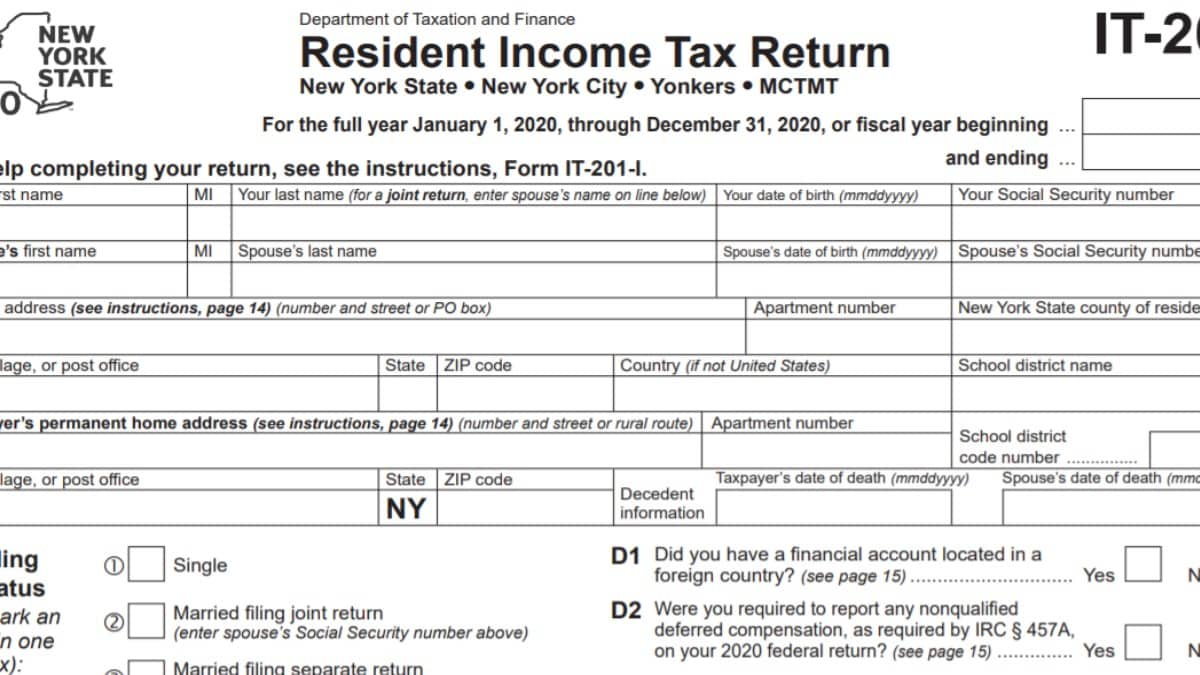

IT201 Instructions 2022 2023 State Taxes TaxUni

Web individuals, trusts, and estates should file form ct‑8801 if the individuals, trusts, or estates had a connecticut alternative minimum tax liability in 2021 and adjustments or items of. Web follow the simple instructions below: Ad download or email irs 8801 & more fillable forms, register and subscribe now! Edit, sign and print tax forms on any device with uslegalforms..

Form 8801 Irs Memo on the Piece of Paper. Stock Image Image of form

Department of the treasury internal revenue service (99) credit for prior year minimum tax— individuals, estates, and trusts. Ad download or email irs 8801 & more fillable forms, register and subscribe now! Web click on the following links to go the forms and their instructions. Web general instructions purpose of form use form 8801 if you are an individual, estate,.

What Is A 8801 Form cloudshareinfo

The days of terrifying complex tax and legal forms are over. Ad download or email irs 8801 & more fillable forms, register and subscribe now! Edit, sign and print tax forms on any device with uslegalforms. Web 30 votes how to fill out and sign irs form 8801 online? Web click on the following links to go the forms and.

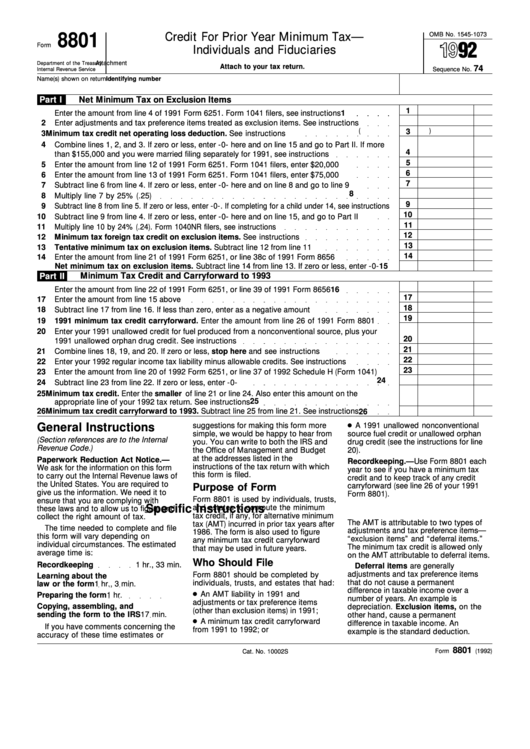

Form 8801 Credit For Prior Year Minimum Tax Individuals And

Department of the treasury internal revenue service (99) credit for prior year minimum tax— individuals, estates, and trusts. Web general instructions purpose of form use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in. Instructions to 2022 form 6251; Get your online template.

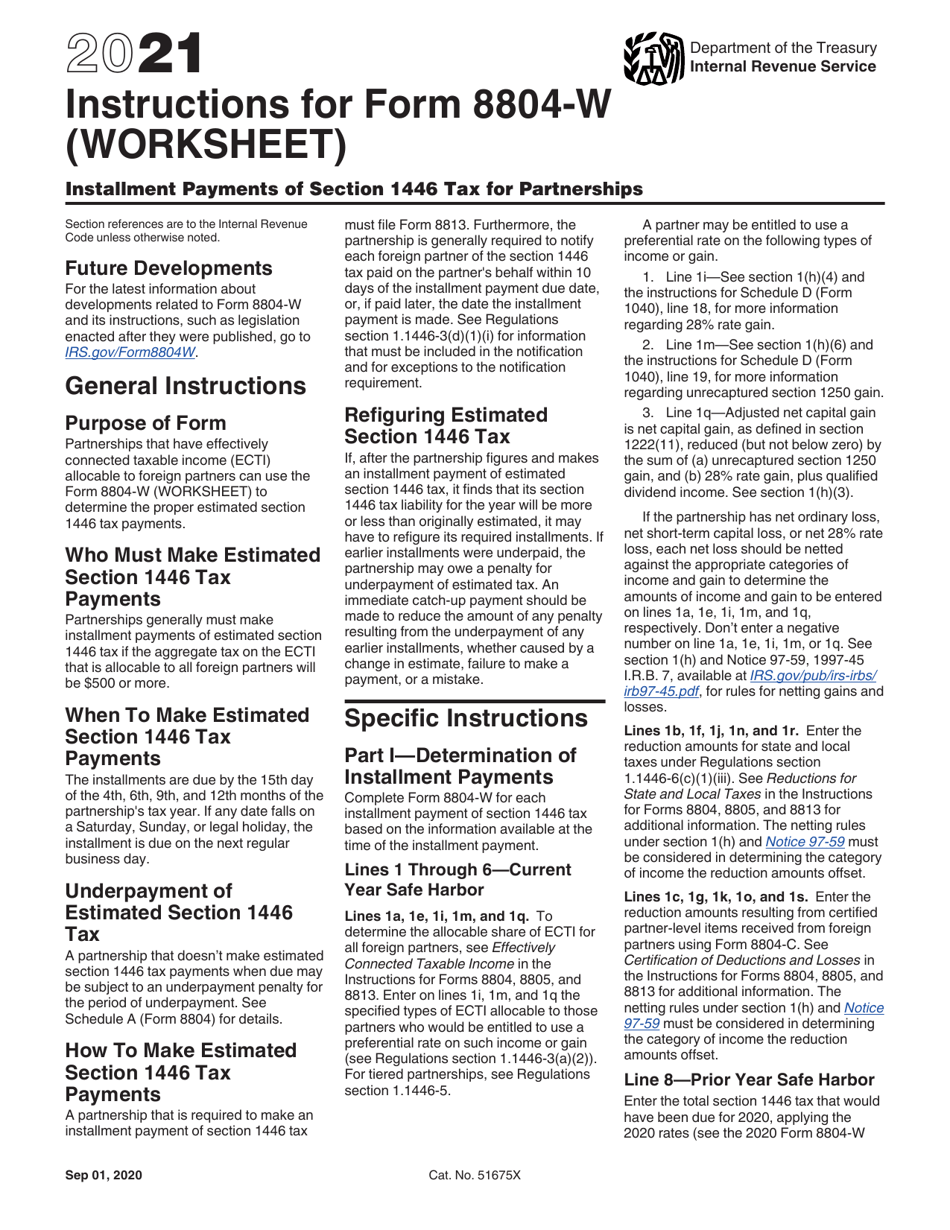

Download Instructions for IRS Form 8804W Installment Payments of

Web (see the instructions for line 3 of form 8801 for how to figure the mtcnold.) in part ii of schedule i, complete lines 33 and 34 without taking into account any basis adjustments. Web department of the treasury internal revenue service credit for prior year minimum tax— individuals, estates, and trusts go to www.irs.gov/form8801 for instructions and the. Instructions.

Form 8801 Credit for Prior Year Minimum Tax Individuals, Estates

Enjoy smart fillable fields and interactivity. Web 30 votes how to fill out and sign irs form 8801 online? Form 8801 is used to calculate the minimum tax credit, if any, for alternative minimum tax (amt) incurred in prior. Edit, sign and print tax forms on any device with uslegalforms. Web individuals, trusts, and estates should file form ct‑8801 if.

What Is A 8801 Form cloudshareinfo

Edit, sign and print tax forms on any device with uslegalforms. Web follow the simple instructions below: Get your online template and fill it in using progressive features. Web click on the following links to go the forms and their instructions. Instructions to 2022 form 8801;.

Form 8802 Instructions 2021 2022 IRS Forms Zrivo

Instructions to 2022 form 6251; Edit, sign and print tax forms on any device with uslegalforms. Department of the treasury internal revenue service (99) credit for prior year minimum tax— individuals, estates, and trusts. Web follow the simple instructions below: Web department of the treasury internal revenue service credit for prior year minimum tax— individuals, estates, and trusts go to.

Web (See The Instructions For Line 3 Of Form 8801 For How To Figure The Mtcnold.) In Part Ii Of Schedule I, Complete Lines 33 And 34 Without Taking Into Account Any Basis Adjustments.

The days of terrifying complex tax and legal forms are over. Web future developments for the latest information about developments related to form 8881 and its instructions, such as legislation enacted after they were published, go to. Instructions to 2022 form 8801;. Web department of the treasury internal revenue service credit for prior year minimum tax— individuals, estates, and trusts go to www.irs.gov/form8801 for instructions and the.

Web Follow The Simple Instructions Below:

Web general instructions purpose of form use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in. Department of the treasury internal revenue service (99) credit for prior year minimum tax— individuals, estates, and trusts. Department of the treasury internal revenue service (99) credit for prior year minimum tax— individuals, estates, and trusts. Form 8801 is used to calculate the minimum tax credit, if any, for alternative minimum tax (amt) incurred in prior.

Edit, Sign And Print Tax Forms On Any Device With Uslegalforms.

Ad download or email irs 8801 & more fillable forms, register and subscribe now! Web individuals, trusts, and estates should file form ct‑8801 if the individuals, trusts, or estates had a connecticut alternative minimum tax liability in 2021 and adjustments or items of. Get your online template and fill it in using progressive features. Instructions to 2022 form 6251;

Web 30 Votes How To Fill Out And Sign Irs Form 8801 Online?

Enjoy smart fillable fields and interactivity. Web click on the following links to go the forms and their instructions.