Form 8606 Roth Conversion

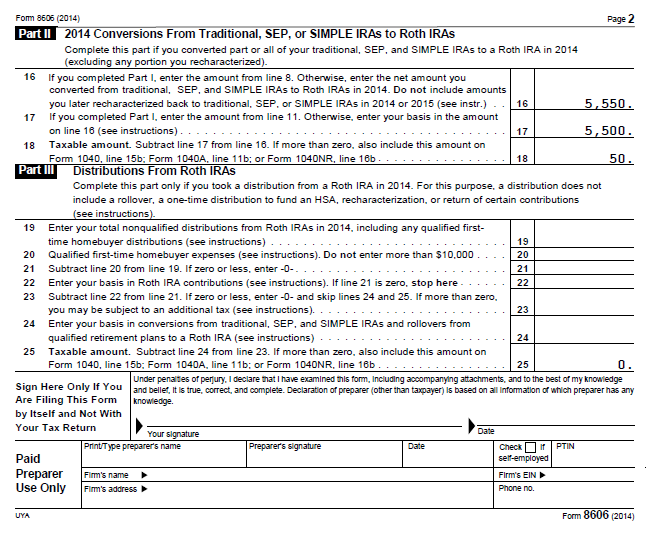

Form 8606 Roth Conversion - Distributions from traditional, sep, or simple iras, if you have ever made. Web what is irs form 8606? However, when there’s a mix of pretax and. Web 1 enter your nondeductible contributions to traditional iras for 2019, including those made for 2019 from january 1, 2020, through april 15, 2020. Web 2 days agoeric bronnenkant, head of tax at betterment, keeps track of his roth accounting on a spreadsheet, and tracks conversions with irs form 8606. Web if i understand correctly, your wife made a deductible traditional ira contribution for 2015 (with the deduction appearing on 2015 form 1040 line 32 or form. Nondeductible contributions you made to traditional iras, distributions from traditional, sep, or simple iras, if you have ever made. I made a nondeductible $6000 contribution to a traditional ira for the first time and invested it, but. Web you’ll need to report the transfer on form 8606 to tell the irs which portion of your roth conversion is taxable, he said. Reporting nondeductible ira contributions reporting distributions from traditional iras, sep iras, or simple iras if there is basis.

Web 1 enter your nondeductible contributions to traditional iras for 2019, including those made for 2019 from january 1, 2020, through april 15, 2020. I made a nondeductible $6000 contribution to a traditional ira for the first time and invested it, but. However, when there’s a mix of pretax and. Web ed wrote a march 20th article for investment news about the avalanche of questions about to come in (if they haven't already) on form 8606. Web if i understand correctly, your wife made a deductible traditional ira contribution for 2015 (with the deduction appearing on 2015 form 1040 line 32 or form. Reporting nondeductible ira contributions reporting distributions from traditional iras, sep iras, or simple iras if there is basis. Web if you choose to convert your traditional plan to a roth, you will need to file form 8606. Web if you took a roth ira distribution (other than an amount rolled over or recharacterized or a returned contribution) before 2022 in excess of your basis in regular roth ira. Web what is irs form 8606? Distributions from traditional, sep, or simple iras, if you have ever made.

Taxpayers use form 8606 to report a number of transactions relating to what the internal revenue service (irs) calls individual retirement. Web use form 8606 to report: Web the roth ira conversion calculator is intended to serve as an educational tool and should not be the primary basis of your investment, financial, or tax planning decisions. Nondeductible contributions you made to traditional iras, distributions from traditional, sep, or simple iras, if you have ever made. Web if you choose to convert your traditional plan to a roth, you will need to file form 8606. Distributions from traditional, sep, or simple iras, if you have ever made. Reporting nondeductible ira contributions reporting distributions from traditional iras, sep iras, or simple iras if there is basis. Web use form 8606 to report: Web ed wrote a march 20th article for investment news about the avalanche of questions about to come in (if they haven't already) on form 8606. Web 2 days agoeric bronnenkant, head of tax at betterment, keeps track of his roth accounting on a spreadsheet, and tracks conversions with irs form 8606.

united states How to file form 8606 when doing a recharacterization

The amount of the ira converted to the roth will be treated as ordinary. Web if i understand correctly, your wife made a deductible traditional ira contribution for 2015 (with the deduction appearing on 2015 form 1040 line 32 or form. Web if you took a roth ira distribution (other than an amount rolled over or recharacterized or a returned.

united states How to file form 8606 when doing a recharacterization

Has no basis in any traditional iras. Web if i understand correctly, your wife made a deductible traditional ira contribution for 2015 (with the deduction appearing on 2015 form 1040 line 32 or form. Distributions from traditional, sep, or simple iras, if you have ever made. Web 2 days agoeric bronnenkant, head of tax at betterment, keeps track of his.

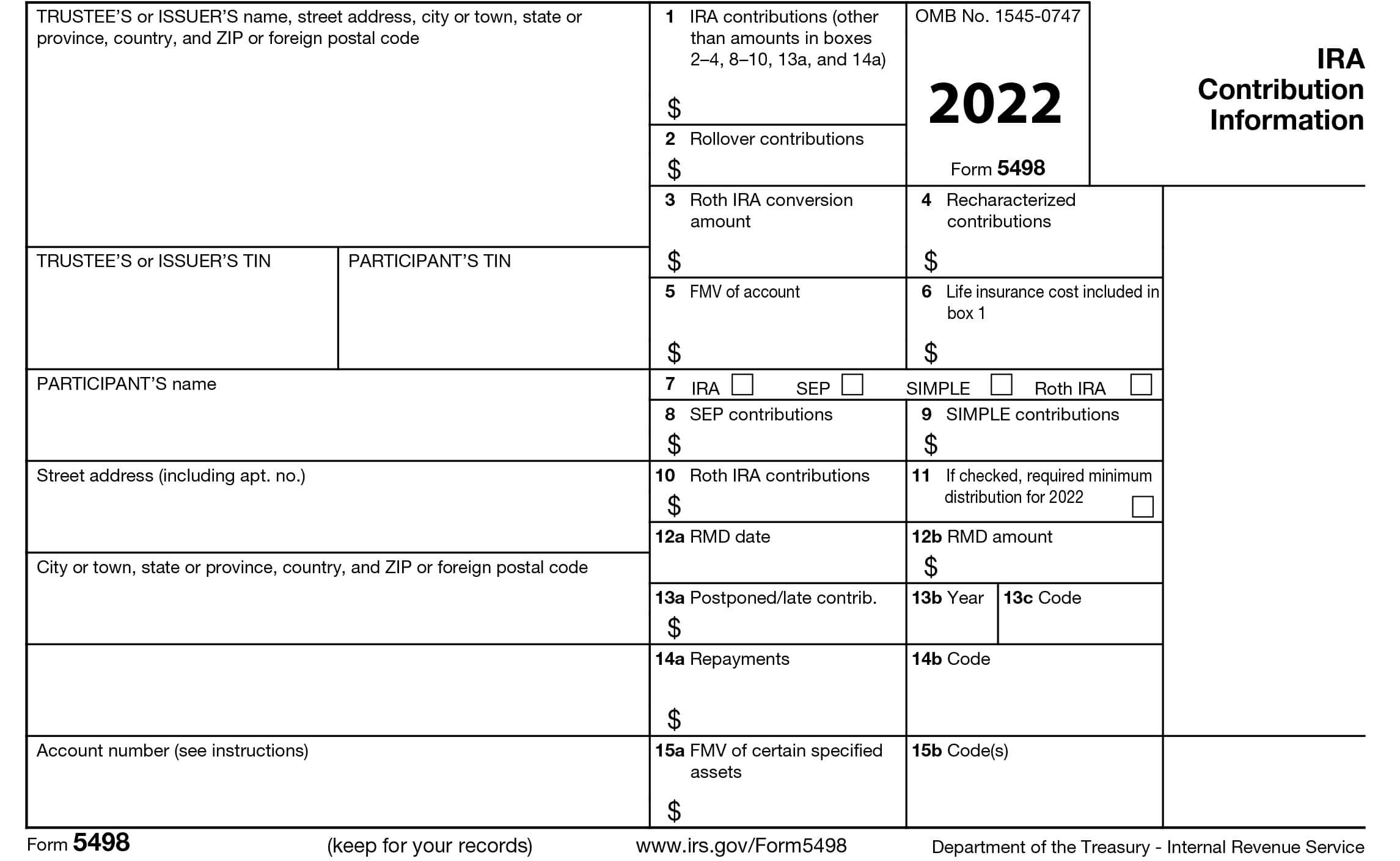

Roth Ira Conversion Form Universal Network

Nondeductible contributions you made to traditional iras. Web what is irs form 8606? Web ed wrote a march 20th article for investment news about the avalanche of questions about to come in (if they haven't already) on form 8606. Web if you choose to convert your traditional plan to a roth, you will need to file form 8606. Web 1.

Fixing Backdoor Roth IRAs The FI Tax Guy

Web if you took a roth ira distribution (other than an amount rolled over or recharacterized or a returned contribution) before 2022 in excess of your basis in regular roth ira. I made a nondeductible $6000 contribution to a traditional ira for the first time and invested it, but. Reporting nondeductible ira contributions reporting distributions from traditional iras, sep iras,.

form 8606 for roth conversion Fill Online, Printable, Fillable Blank

Web ed wrote a march 20th article for investment news about the avalanche of questions about to come in (if they haven't already) on form 8606. Web 2 days agoeric bronnenkant, head of tax at betterment, keeps track of his roth accounting on a spreadsheet, and tracks conversions with irs form 8606. Web eric bronnenkant, head of tax at betterment,.

First time backdoor Roth Conversion. form 8606 help

Reporting nondeductible ira contributions reporting distributions from traditional iras, sep iras, or simple iras if there is basis. Taxpayers use form 8606 to report a number of transactions relating to what the internal revenue service (irs) calls individual retirement. Nondeductible contributions you made to traditional iras, distributions from traditional, sep, or simple iras, if you have ever made. Web you’ll.

Roth Conversion Do I Need Form 8606 r/fidelityinvestments

The amount of the ira converted to the roth will be treated as ordinary. Web the roth ira conversion calculator is intended to serve as an educational tool and should not be the primary basis of your investment, financial, or tax planning decisions. Only made deductible contributions to traditional iras and did not convert any funds to a roth ira..

Backdoor IRA Gillingham CPA

• you converted part, but not all, of your traditional, sep, and. Has no basis in any traditional iras. Web if i understand correctly, your wife made a deductible traditional ira contribution for 2015 (with the deduction appearing on 2015 form 1040 line 32 or form. The amount of the ira converted to the roth will be treated as ordinary..

Backdoor Roth A Complete HowTo

Nondeductible contributions you made to traditional iras. Web the roth ira conversion calculator is intended to serve as an educational tool and should not be the primary basis of your investment, financial, or tax planning decisions. Web if you choose to convert your traditional plan to a roth, you will need to file form 8606. Has no basis in any.

First time backdoor Roth Conversion. form 8606 help

Web ed wrote a march 20th article for investment news about the avalanche of questions about to come in (if they haven't already) on form 8606. Web the roth ira conversion calculator is intended to serve as an educational tool and should not be the primary basis of your investment, financial, or tax planning decisions. Web you’ll need to report.

Distributions From Traditional, Sep, Or Simple Iras, If You Have Ever Made.

Web you’ll need to report the transfer on form 8606 to tell the irs which portion of your roth conversion is taxable, he said. Web if i understand correctly, your wife made a deductible traditional ira contribution for 2015 (with the deduction appearing on 2015 form 1040 line 32 or form. However, when there’s a mix of pretax and. Has no basis in any traditional iras.

Web Eric Bronnenkant, Head Of Tax At Betterment, Keeps Track Of His Roth Accounting On A Spreadsheet, And Tracks Conversions With Irs Form 8606.

Web what is irs form 8606? Web 2 days agoeric bronnenkant, head of tax at betterment, keeps track of his roth accounting on a spreadsheet, and tracks conversions with irs form 8606. Web 1 enter your nondeductible contributions to traditional iras for 2019, including those made for 2019 from january 1, 2020, through april 15, 2020. I made a nondeductible $6000 contribution to a traditional ira for the first time and invested it, but.

• You Converted Part, But Not All, Of Your Traditional, Sep, And.

Web ed wrote a march 20th article for investment news about the avalanche of questions about to come in (if they haven't already) on form 8606. Web use form 8606 to report: Only made deductible contributions to traditional iras and did not convert any funds to a roth ira. Web the roth ira conversion calculator is intended to serve as an educational tool and should not be the primary basis of your investment, financial, or tax planning decisions.

Nondeductible Contributions You Made To Traditional Iras.

Nondeductible contributions you made to traditional iras, distributions from traditional, sep, or simple iras, if you have ever made. The amount of the ira converted to the roth will be treated as ordinary. Web if you choose to convert your traditional plan to a roth, you will need to file form 8606. Web if you took a roth ira distribution (other than an amount rolled over or recharacterized or a returned contribution) before 2022 in excess of your basis in regular roth ira.