Form 8606 Backdoor Roth

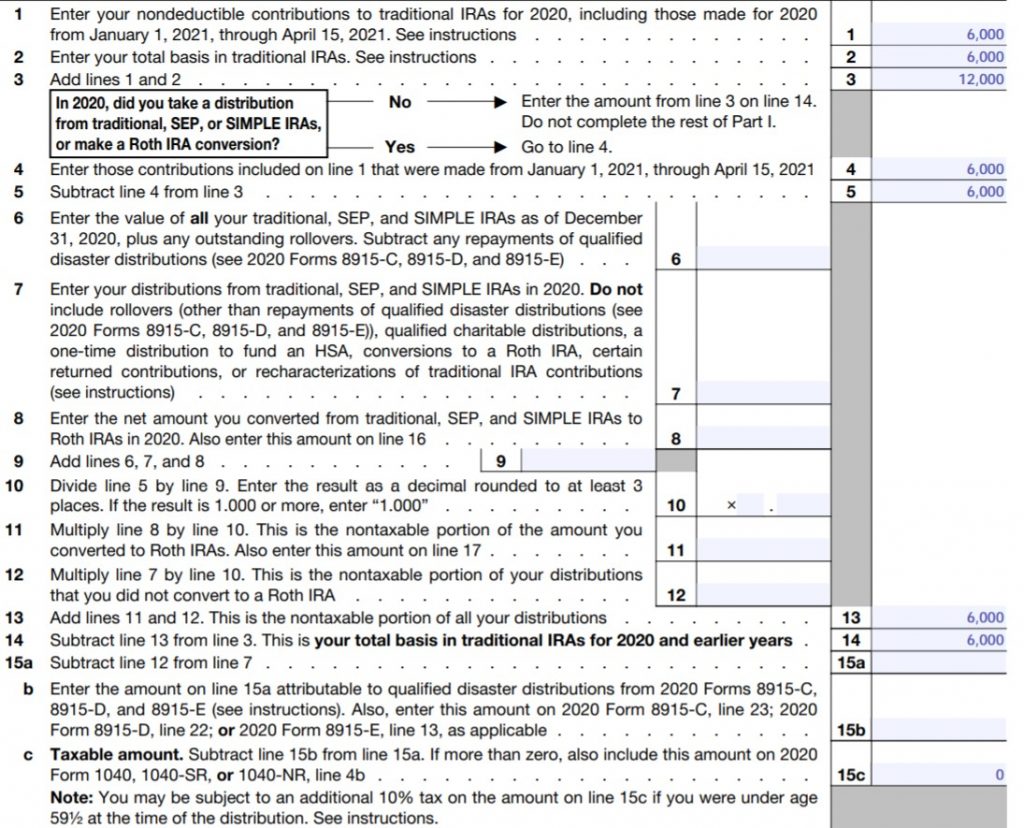

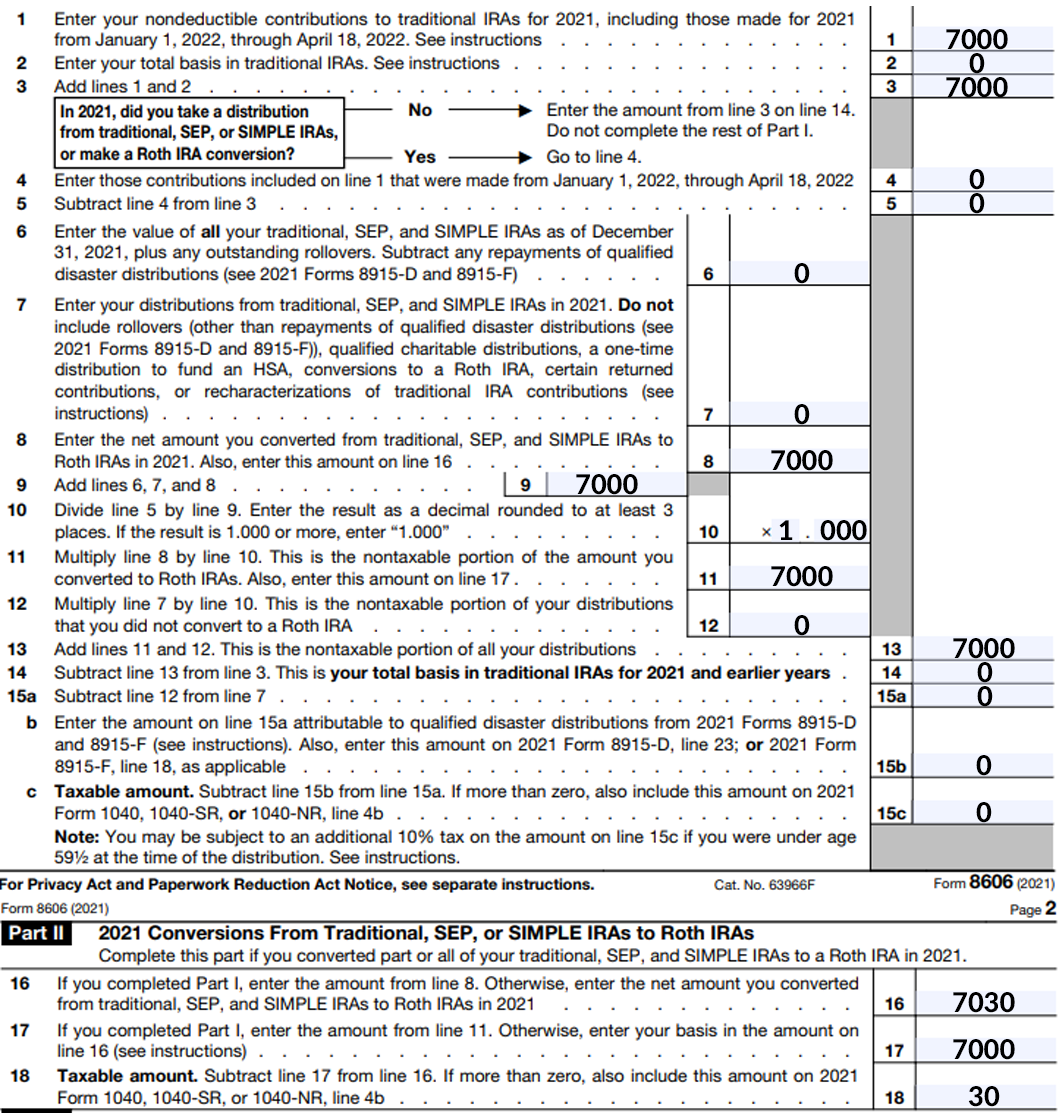

Form 8606 Backdoor Roth - Made a 2018 $5.5k ira contribution in early 2019. In some cases, you can transfer. Web use form 8606 to report: Web if you have ever tried a backdoor roth conversion yourself and don’t know what form 8606 is, that is a problem. Web use form 8606 to report: Contributing to a nondeductible traditional ira; Distributions from traditional, sep, or simple iras, if you have a basis in these iras;. Web notice that on form 8606, you're not required to include 401 (k) money in the calculation of taxable income from a conversion. I contributed $6000 after tax money to traditional ira in. 2 part ii 2022 conversions from traditional, sep, or simple iras to roth iras complete this part if you converted part or all of your traditional, sep,.

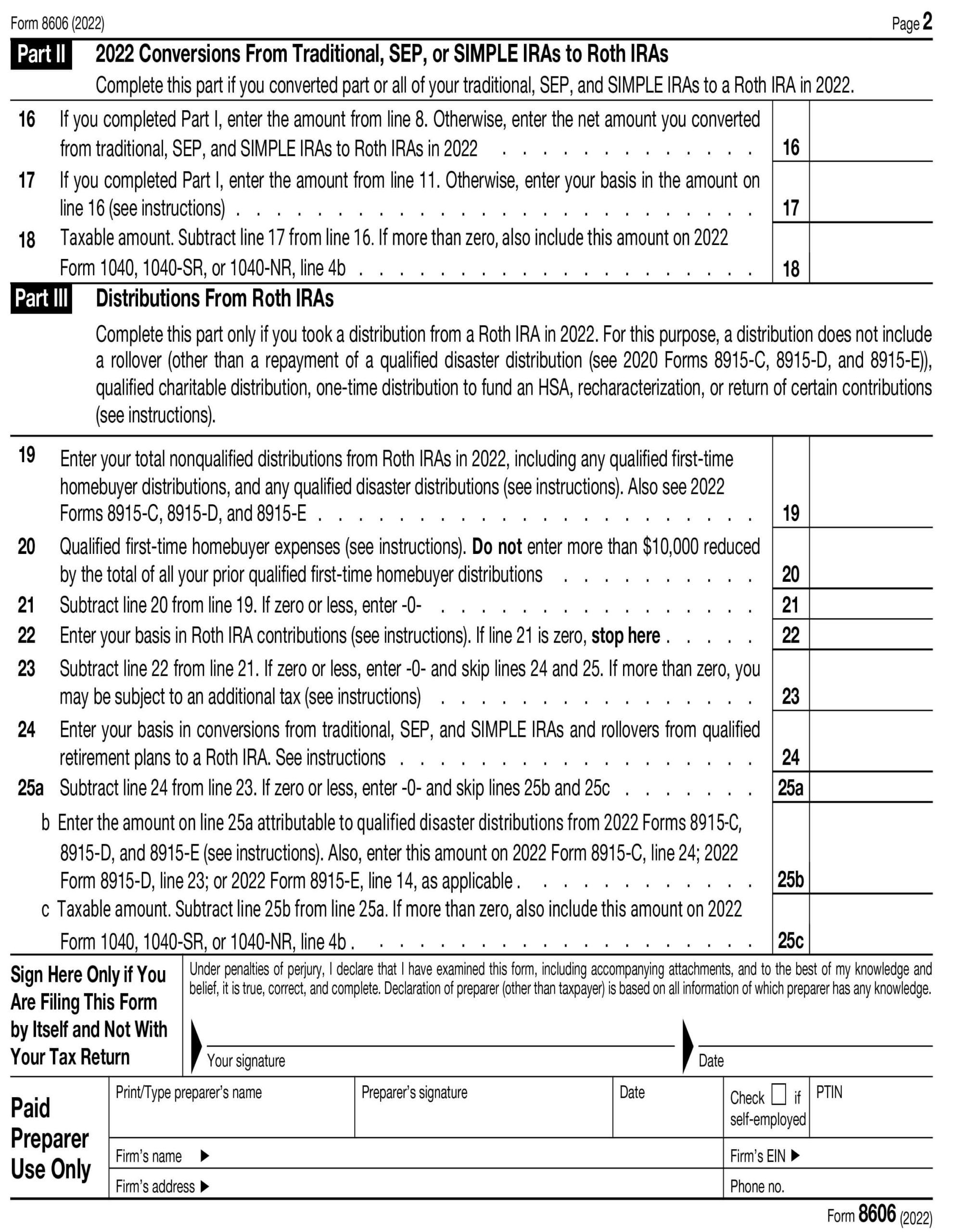

Web form 8606 (2022) page. Nondeductible contributions you made to traditional iras; Web use form 8606 to report: Distributions from traditional, sep, or simple iras, if you have a basis in these iras;. Web form 8606 is a crucial irs document that taxpayers must be familiar with, particularly those who are interested in executing a backdoor roth ira conversion. Web the main reasons for filing form 8606 include the following: Did a roth conversions of that contribution in early 2019. Web the increase or decrease in basis is reported using irs form 8606. Web if you have ever tried a backdoor roth conversion yourself and don’t know what form 8606 is, that is a problem. Contributing to a nondeductible traditional ira;

Did a roth conversions of that contribution in early 2019. Nondeductible contributions you made to traditional iras. Web the increase or decrease in basis is reported using irs form 8606. Web if you have ever tried a backdoor roth conversion yourself and don’t know what form 8606 is, that is a problem. Web form 8606 is a crucial irs document that taxpayers must be familiar with, particularly those who are interested in executing a backdoor roth ira conversion. Web for purposes of form 8606, a traditional ira is an individual retirement account or an individual retirement annuity other than a sep, simple, or roth ira. Contributing to a nondeductible traditional ira; Distributions from traditional, sep, or simple iras, if you have a basis in these iras;. Web the main reasons for filing form 8606 include the following: Web notice that on form 8606, you're not required to include 401 (k) money in the calculation of taxable income from a conversion.

The Backdoor Roth IRA and December 31st The FI Tax Guy

Web form 8606 is a crucial irs document that taxpayers must be familiar with, particularly those who are interested in executing a backdoor roth ira conversion. Web timeline of contributions to backdoor roth ira. Form 8606 is used to report several financial transactions but the. Web use form 8606 to report: I contributed $6000 after tax money to traditional ira.

Make Backdoor Roth Easy On Your Tax Return

Form 8606 is used to report several financial transactions but the. I contributed $6000 after tax money to traditional ira in. Did a roth conversions of that contribution in early 2019. Nondeductible contributions you made to traditional iras. Web ( if you're required to file form 8606 to report a nondeductible contribution to a traditional ira, but don’t do so,.

Considering a Backdoor Roth Contribution? Don’t Form 8606!

Web notice that on form 8606, you're not required to include 401 (k) money in the calculation of taxable income from a conversion. Web if you have ever tried a backdoor roth conversion yourself and don’t know what form 8606 is, that is a problem. Web ( if you're required to file form 8606 to report a nondeductible contribution to.

Fixing Backdoor Roth IRAs The FI Tax Guy

Web the increase or decrease in basis is reported using irs form 8606. Web ( if you're required to file form 8606 to report a nondeductible contribution to a traditional ira, but don’t do so, you’ll be subject to a $50 penalty. Made a 2018 $5.5k ira contribution in early 2019. Web if you have ever tried a backdoor roth.

Considering a Backdoor Roth Contribution? Don’t Form 8606!

2 part ii 2022 conversions from traditional, sep, or simple iras to roth iras complete this part if you converted part or all of your traditional, sep,. Nondeductible contributions you made to traditional iras; This is the same word, but has a slightly. Web form 8606 (2022) page. Did a roth conversions of that contribution in early 2019.

Make Backdoor Roth Easy On Your Tax Return

Web use form 8606 to report: Web the increase or decrease in basis is reported using irs form 8606. This is the same word, but has a slightly. I contributed $6000 after tax money to traditional ira in. Web ( if you're required to file form 8606 to report a nondeductible contribution to a traditional ira, but don’t do so,.

SplitYear Backdoor Roth IRAs The FI Tax Guy

Contributing to a nondeductible traditional ira; Web use form 8606 to report: Distributions from traditional, sep, or simple iras, if you have ever made. Web form 8606 is a crucial irs document that taxpayers must be familiar with, particularly those who are interested in executing a backdoor roth ira conversion. Web timeline of contributions to backdoor roth ira.

Backdoor IRA Gillingham CPA

This is the same word, but has a slightly. Web ( if you're required to file form 8606 to report a nondeductible contribution to a traditional ira, but don’t do so, you’ll be subject to a $50 penalty. Form 8606 is used to report several financial transactions but the. I contributed $6000 after tax money to traditional ira in. Web.

HOW TO FILL OUT FORM 8606 BACKDOOR ROTH IRA YouTube

Web ( if you're required to file form 8606 to report a nondeductible contribution to a traditional ira, but don’t do so, you’ll be subject to a $50 penalty. Web notice that on form 8606, you're not required to include 401 (k) money in the calculation of taxable income from a conversion. Web form 8606 (2022) page. I contributed $6000.

Considering a Backdoor Roth Contribution? Don’t Form 8606!

Web form 8606 is a crucial irs document that taxpayers must be familiar with, particularly those who are interested in executing a backdoor roth ira conversion. Web for purposes of form 8606, a traditional ira is an individual retirement account or an individual retirement annuity other than a sep, simple, or roth ira. I contributed $6000 after tax money to.

Did A Roth Conversions Of That Contribution In Early 2019.

Web for purposes of form 8606, a traditional ira is an individual retirement account or an individual retirement annuity other than a sep, simple, or roth ira. Web form 8606 is a crucial irs document that taxpayers must be familiar with, particularly those who are interested in executing a backdoor roth ira conversion. Web timeline of contributions to backdoor roth ira. Web ( if you're required to file form 8606 to report a nondeductible contribution to a traditional ira, but don’t do so, you’ll be subject to a $50 penalty.

Form 8606 Is Used To Report Several Financial Transactions But The.

Nondeductible contributions you made to traditional iras. Web use form 8606 to report: This is the same word, but has a slightly. 2 part ii 2022 conversions from traditional, sep, or simple iras to roth iras complete this part if you converted part or all of your traditional, sep,.

Distributions From Traditional, Sep, Or Simple Iras, If You Have A Basis In These Iras;.

In some cases, you can transfer. Web form 8606 (2022) page. Web use form 8606 to report: Nondeductible contributions you made to traditional iras;

Web The Main Reasons For Filing Form 8606 Include The Following:

I contributed $6000 after tax money to traditional ira in. Web notice that on form 8606, you're not required to include 401 (k) money in the calculation of taxable income from a conversion. Distributions from traditional, sep, or simple iras, if you have ever made. Contributing to a nondeductible traditional ira;