Form 7202 Tax Credit

Form 7202 Tax Credit - Web form 7202 will allow tax credits on taxpayers’ 2020 filing if they had to take leave between april 1 and dec. Web to complete form 7202 in the taxact program: Web form 720 quarterly federal excise tax return. Complete, edit or print tax forms instantly. Maximum $200 family leave credit. However, we haven't received your tax return. Web the program regulations are under section 42 of the internal revenue code. Credits related to offering sick pay and family. Form 730 tax on wagering. Get ready for tax season deadlines by completing any required tax forms today.

Web form 7202 will allow tax credits on taxpayers’ 2020 filing if they had to take leave between april 1 and dec. Complete, edit or print tax forms instantly. The credits for sick leave and family leave for certain self. Form 7202 (2021) page 3 part iv credit for family. From within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner of your screen,. Web cp80 tells you we credited payments and/or other credits to your tax account for the form and tax period shown on your notice. Credits related to offering sick pay and family. Ad with the right expertise, federal tax credits and incentives could benefit your business. Work with federal tax credits and incentives specialists who have decades of experience. Solved • by intuit • 170 • updated december 21, 2022.

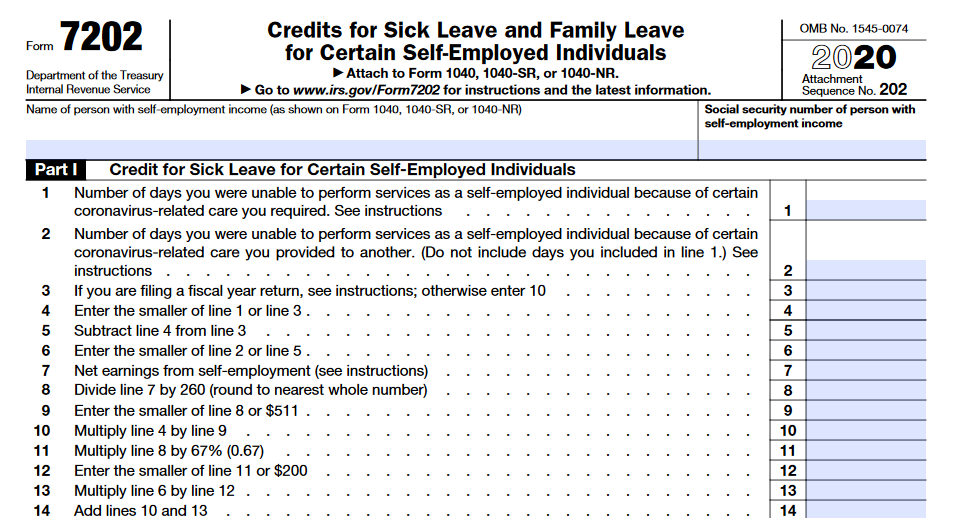

Web cp80 tells you we credited payments and/or other credits to your tax account for the form and tax period shown on your notice. From within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner of your screen,. Web maximum $511 paid sick leave credit per day, and $5,110 in the aggregate. Get ready for tax season deadlines by completing any required tax forms today. Maximum $200 family leave credit. Form 730 tax on wagering. Web form 7202 will allow tax credits on taxpayers’ 2020 filing if they had to take leave between april 1 and dec. Web the program regulations are under section 42 of the internal revenue code. Ad get a payroll tax refund & receive up to $26k per employee even if you received ppp funds. Complete, edit or print tax forms instantly.

Memo SelfEmployed People, Don't Miss Your 2020 Coronavirus Tax

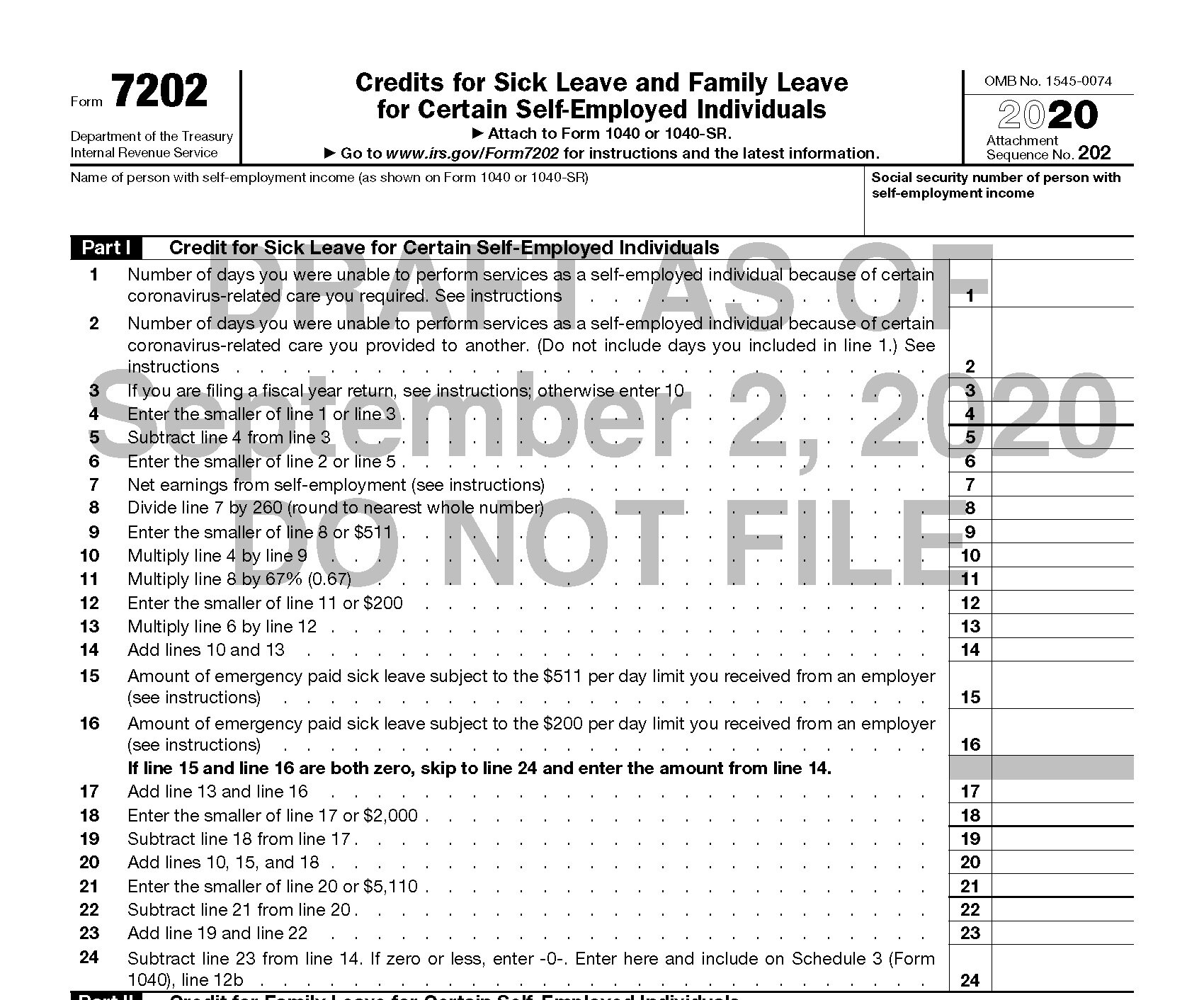

Credits related to offering sick pay and family. Essentially, if you worked for an employer this year, you. Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Family leave credit = 2/3 of the paid sick leave credit. The tax credit encourages developers to build affordable.

The IRS could write you a check... Duke Alexander Moore EA Facebook

Child and dependent care information taxslayer pro: However, we haven't received your tax return. Family leave credit = 2/3 of the paid sick leave credit. Businesses can receive up to $26k per eligible employee. Web form 720 quarterly federal excise tax return.

IRS Form 7202 LinebyLine Instructions 2022 Sick Leave and Family

Get ready for tax season deadlines by completing any required tax forms today. Web to complete form 7202 in the taxact program: Credits related to offering sick pay and family. Web the program regulations are under section 42 of the internal revenue code. Ad access irs tax forms.

Desktop 2020 Form 7202 Credits for Sick Leave and Family Leave for

Work with federal tax credits and incentives specialists who have decades of experience. Web maximum $511 paid sick leave credit per day, and $5,110 in the aggregate. Solved • by intuit • 170 • updated december 21, 2022. Web cp80 tells you we credited payments and/or other credits to your tax account for the form and tax period shown on.

Printable Fileable IRS Form 7202 Self Employed Sick Leave and Family

Credits related to offering sick pay and family. Form 7202 (2021) page 3 part iv credit for family. Maximum $200 family leave credit. Web form 7202 will allow tax credits on taxpayers’ 2020 filing if they had to take leave between april 1 and dec. Businesses can receive up to $26k per eligible employee.

Form 7202 Pdf Fill and Sign Printable Template Online US Legal Forms

Ad with the right expertise, federal tax credits and incentives could benefit your business. Work with federal tax credits and incentives specialists who have decades of experience. Web form 7202 will allow tax credits on taxpayers’ 2020 filing if they had to take leave between april 1 and dec. Get ready for tax season deadlines by completing any required tax.

Tax update usa Tax forms, Tax, Independent contractor

Web form 720 quarterly federal excise tax return. Businesses can receive up to $26k per eligible employee. Complete, edit or print tax forms instantly. Solved • by intuit • 170 • updated december 21, 2022. Essentially, if you worked for an employer this year, you.

Draft of Form to be Used by SelfEmployed Individuals to Compute FFCRA

Complete, edit or print tax forms instantly. Web the program regulations are under section 42 of the internal revenue code. Ad access irs tax forms. Credits related to offering sick pay and family. The tax credit encourages developers to build affordable housing to meet the needs of the community.

Draft of Form to be Used by SelfEmployed Individuals to Compute FFCRA

Child and dependent care information taxslayer pro: However, we haven't received your tax return. Family leave credit = 2/3 of the paid sick leave credit. Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. From within your taxact return ( online or desktop), click federal (on.

IRS comes with a New Form 7202 to Claim Tax Credits for Sick and Family

Web low income housing tax credit (lihtc) this program provides federal and state tax credits to investors in affordable housing through an annual competitive application. Ad get a payroll tax refund & receive up to $26k per employee even if you received ppp funds. Family leave credit = 2/3 of the paid sick leave credit. However, we haven't received your.

Web Low Income Housing Tax Credit (Lihtc) This Program Provides Federal And State Tax Credits To Investors In Affordable Housing Through An Annual Competitive Application.

The credits for sick leave and family leave for certain self. Ad with the right expertise, federal tax credits and incentives could benefit your business. Ad access irs tax forms. Web how to generate form 7202 in lacerte.

Credits Related To Offering Sick Pay And Family.

Family leave credit = 2/3 of the paid sick leave credit. From within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner of your screen,. Businesses can receive up to $26k per eligible employee. Web to complete form 7202 in the taxact program:

Form 730 Tax On Wagering.

Essentially, if you worked for an employer this year, you. The tax credit encourages developers to build affordable housing to meet the needs of the community. Work with federal tax credits and incentives specialists who have decades of experience. Web cp80 tells you we credited payments and/or other credits to your tax account for the form and tax period shown on your notice.

Web Maximum $511 Paid Sick Leave Credit Per Day, And $5,110 In The Aggregate.

Web the program regulations are under section 42 of the internal revenue code. Get ready for tax season deadlines by completing any required tax forms today. Web form 7202 will allow tax credits on taxpayers’ 2020 filing if they had to take leave between april 1 and dec. Child and dependent care information taxslayer pro: