Form 720 Filing Instructions

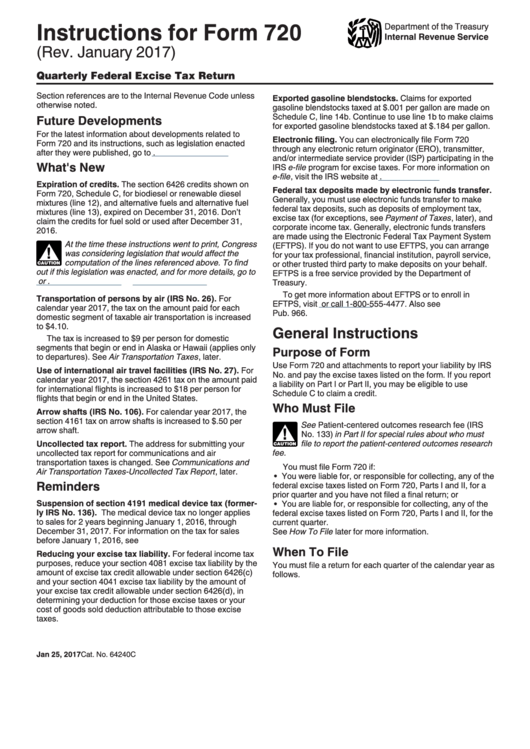

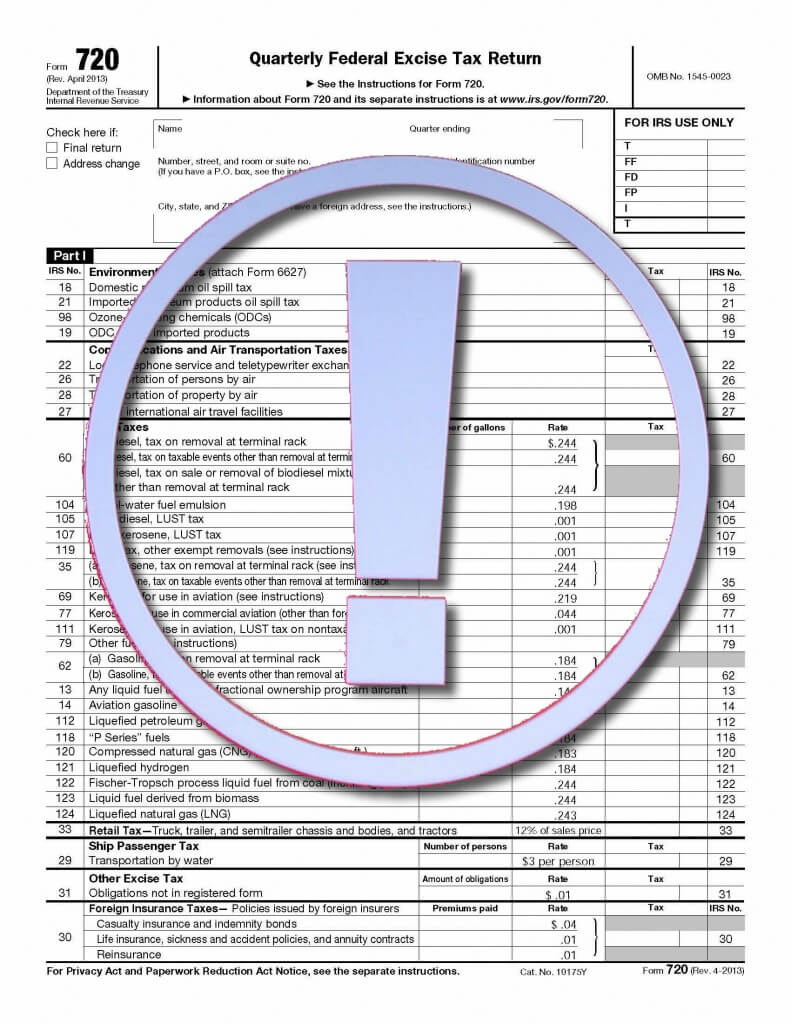

Form 720 Filing Instructions - Web you must file form 720 if: Web filling out form 720. • you were liable for, or responsible for collecting, any of the federal excise taxes listed on form 720, parts i and ii, for a prior quarter and you haven’t filed a final return; See the instructions for form 720. Here's how to fill out form 720 and file it in seven steps. Web you must file form 720 if: Mail form 720 directly to the irs. For instructions and the latest information. Quarterly federal excise tax return. Complete the company information header.

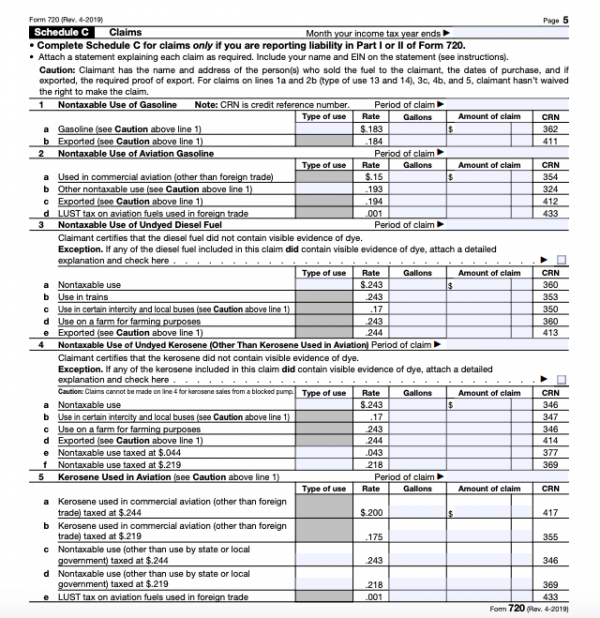

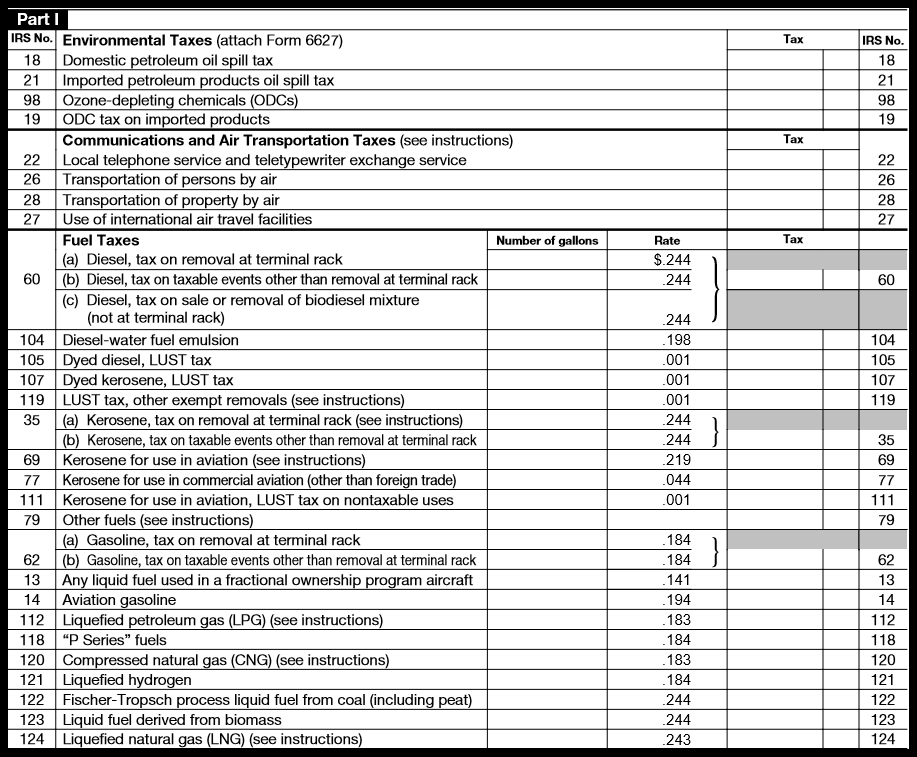

• you were liable for, or responsible for collecting, any of the federal excise taxes listed on form 720, parts i and ii, for a prior quarter and you haven’t filed a final return; Web form 720 is for businesses that need to report excise tax paid on targeted goods and services. Irs form 720 you can also view the 2023 fee notice from the irs here. Web form 720, quarterly federal excise tax return is also available for optional electronic filing. For example, various types of diesel fuel require the payment of approximately 24 cents for each gallon. Or • you are liable for, or responsible for collecting, any of the federal excise taxes listed on form 720, parts i and ii, for the Web information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how to file. • you were liable for, or responsible for collecting, any of the federal excise taxes listed on form 720, parts i and ii, for a prior quarter and you haven’t filed a final return; For instructions and the latest information. Web how to complete form 720.

• you were liable for, or responsible for collecting, any of the federal excise taxes listed on form 720, parts i and ii, for a prior quarter and you haven’t filed a final return; Web filling out form 720. Web file form 720 before the specified due date. Web you must file form 720 if: June 2023) department of the treasury internal revenue service. For instructions and the latest information. Form 720 includes a line for each type of excise tax that you may be responsible for paying. Web how to complete form 720. Here's how to fill out form 720 and file it in seven steps. Form 720 is used by taxpayers to report liability by irs number and to pay the excise taxes listed on the form.

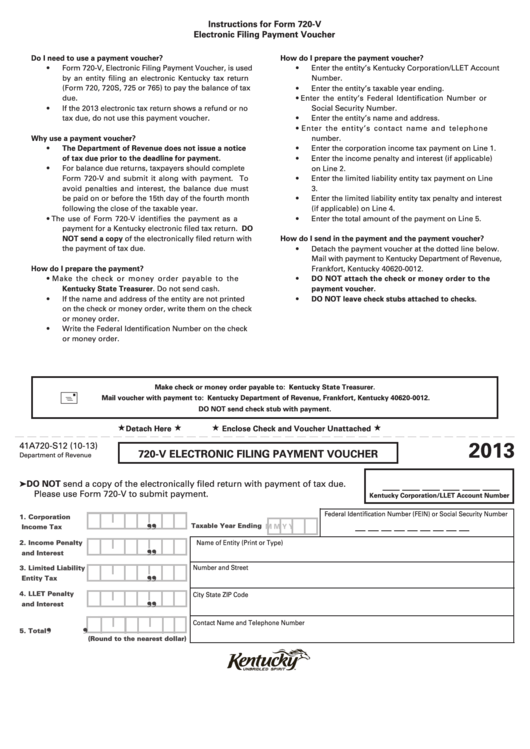

Form 720V Electronic Filing Payment Voucher 2013 printable pdf

In the examples below, the company plan covered an average of 3 participants and had a plan year that ended on december 31, 2022. There are two ways to file: • you were liable for, or responsible for collecting, any of the federal excise taxes listed on form 720, parts i and ii, for a prior quarter and you haven’t.

Form 720 Instructions Where to Get IRS Form 720 and How to Fill It Out

A majority of the excise taxes are charged based on unit sales or weight. Or • you are liable for, or responsible for collecting, any of the federal excise taxes listed on form 720, parts i and ii, for the Irs still accepts paper forms 720. For instructions and the latest information. Or • you are liable for, or responsible.

Instructions For Form 720 2017 printable pdf download

Form 720 includes a line for each type of excise tax that you may be responsible for paying. Web you must file form 720 if: Or • you are liable for, or responsible for collecting, any of the federal excise taxes listed on form 720, parts i and ii, for the Or • you are liable for, or responsible for.

Electronic Filing for Federal Excise Taxes Form 720

Web file form 720 before the specified due date. Mail form 720 directly to the irs. Complete the company information header. Web you must file form 720 if: Web you must file form 720 if:

Fill Free fillable MidAmerica PDF forms

In the examples below, the company plan covered an average of 3 participants and had a plan year that ended on december 31, 2022. Web you must file form 720 if: Irs form 720 you can also view the 2023 fee notice from the irs here. Web file form 720 before the specified due date. Mail form 720 directly to.

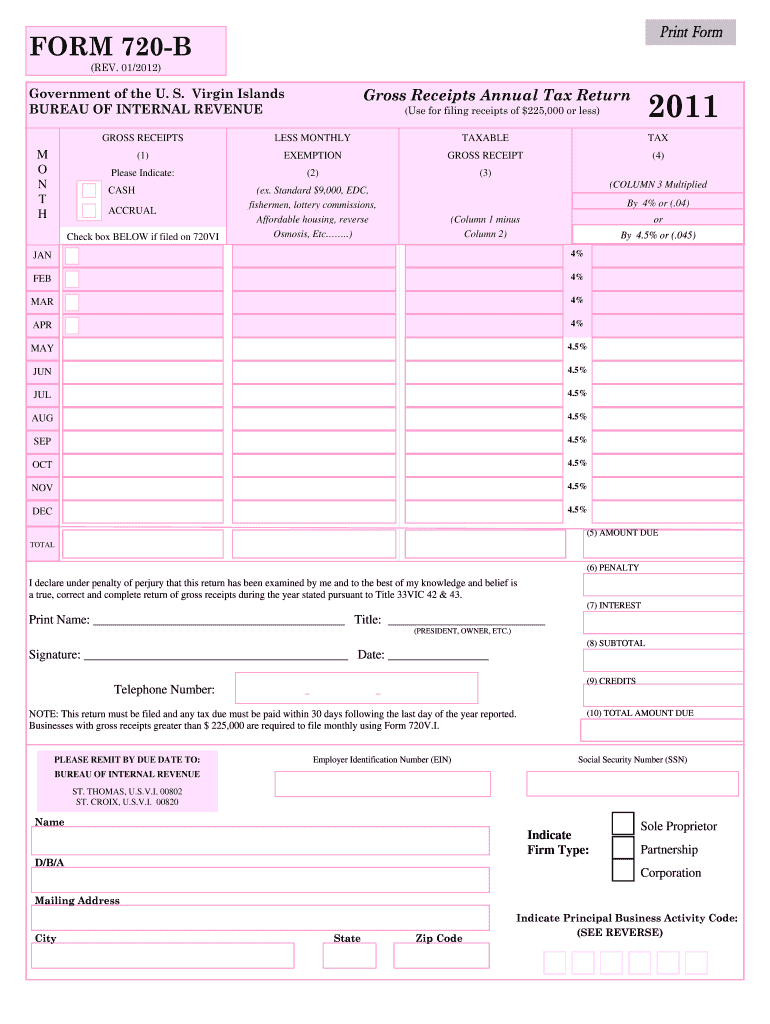

Form 720 B Fill Out and Sign Printable PDF Template signNow

• you were liable for, or responsible for collecting, any of the federal excise taxes listed on form 720, parts i and ii, for a prior quarter and you haven’t filed a final return; Mail form 720 directly to the irs. • you were liable for, or responsible for collecting, any of the federal excise taxes listed on form 720,.

Fill Free fillable F720 Form 720 (Rev. January 2020) PDF form

Web filling out form 720. For instructions and the latest information. For example, various types of diesel fuel require the payment of approximately 24 cents for each gallon. Or • you are liable for, or responsible for collecting, any of the federal excise taxes listed on form 720, parts i and ii, for the There are two ways to file:

How to Complete Form 720 Quarterly Federal Excise Tax Return

Here's how to fill out form 720 and file it in seven steps. June 2023) department of the treasury internal revenue service. Web filling out form 720. Web you must file form 720 if: There are two ways to file:

IRS Form 720 Instructions for the PatientCentered Research

Quarterly federal excise tax return. Web you must file form 720 if: • you were liable for, or responsible for collecting, any of the federal excise taxes listed on form 720, parts i and ii, for a prior quarter and you haven’t filed a final return; Form 720 is used by taxpayers to report liability by irs number and to.

IRS Updates Form 720 for Reporting ACA PCOR Fees myCafeteriaPlan

See the instructions for form 720. Web you must file form 720 if: Web file form 720 before the specified due date. • you were liable for, or responsible for collecting, any of the federal excise taxes listed on form 720, parts i and ii, for a prior quarter and you haven’t filed a final return; Form 720 is used.

Web You Must File Form 720 If:

Irs still accepts paper forms 720. For example, various types of diesel fuel require the payment of approximately 24 cents for each gallon. There are two ways to file: • you were liable for, or responsible for collecting, any of the federal excise taxes listed on form 720, parts i and ii, for a prior quarter and you haven’t filed a final return;

For Instructions And The Latest Information.

A majority of the excise taxes are charged based on unit sales or weight. Complete the company information header. Web file form 720 before the specified due date. Irs form 720 you can also view the 2023 fee notice from the irs here.

Quarterly Federal Excise Tax Return.

Here's how to fill out form 720 and file it in seven steps. See the instructions for form 720. Or • you are liable for, or responsible for collecting, any of the federal excise taxes listed on form 720, parts i and ii, for the Web you must file form 720 if:

In The Examples Below, The Company Plan Covered An Average Of 3 Participants And Had A Plan Year That Ended On December 31, 2022.

Or • you are liable for, or responsible for collecting, any of the federal excise taxes listed on form 720, parts i and ii, for the Form 720 is used by taxpayers to report liability by irs number and to pay the excise taxes listed on the form. Web form 720, quarterly federal excise tax return is also available for optional electronic filing. Web information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how to file.