Form 7004 Llc

Form 7004 Llc - Web file form 7004 by the 15th day of the 6th month following the close of the tax year. Since the llc is disregarded (unless you explicitly chose. Complete, edit or print tax forms instantly. Clear pricing and no hidden fees. Web file form 7004 online with the irs in minutes. Web irs form 7004 instructions are used by various types of businesses to complete the form that extends the filing deadline on their taxes. Web irs form 7004 is the application for automatic extension of time to file certain business income tax, information, and other returns. it's used to request more. A foreign corporation with an office or place of business. Corporations, entities, & trusts can extend the time to file 1120, 1065 and 1041 tax returns in few steps. To file for an llc extension, file form 7004:

Web file form 7004 online with the irs in minutes. Corporations, entities, & trusts can extend the time to file 1120, 1065 and 1041 tax returns in few steps. Web form 7004 has changed for some entities. Web you need to file form 4868 on behalf of yourselves as individuals, and form 7004 on behalf of the llc as the partnership. Web form 7004 provides businesses an additional 6 month of time to file their business tax returns. See where to file, later. The code is '09' for a form 1065, unless your llc is treated as a s. Web to successfully use form 7004, you’ll have to: Web irs form 7004 instructions are used by various types of businesses to complete the form that extends the filing deadline on their taxes. De, you can file form 7004 through fax or mail by the regular due date of the return.

Web which form code do i use on form 7004 for a llc partnership when filing an extension? Web purpose of form. To file for an llc extension, file form 7004: File form 7004 before or on the deadline of the. Web file form 7004 online with the irs in minutes. A foreign corporation with an office or place of business. Complete, edit or print tax forms instantly. Select the appropriate form from the table below to determine where to. Requests for a tax filing extension. See where to file, later.

Irs Form 7004 amulette

Complete, edit or print tax forms instantly. De, you can file form 7004 through fax or mail by the regular due date of the return. Download or email irs 7004 & more fillable forms, register and subscribe now! Web to successfully use form 7004, you’ll have to: You cannot file form 7004 electronically.

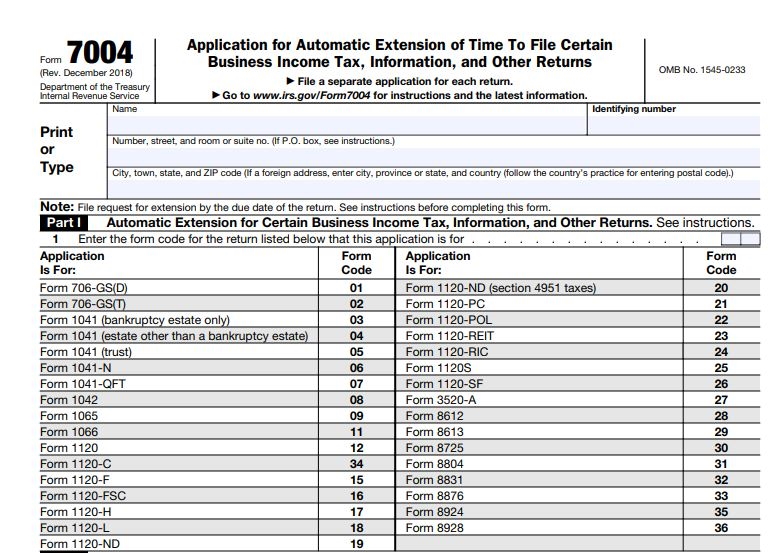

2020 IRS Form 7004 A Complete Guide! IRSForm7004

Make your business official today in less than 10 minutes. Web irs form 7004 is an application for automatic extension of time to file certain business income tax, information, and other returns. Web form 7004 provides businesses an additional 6 month of time to file their business tax returns. Businesses operating as a single member llc or sole proprietorship must.

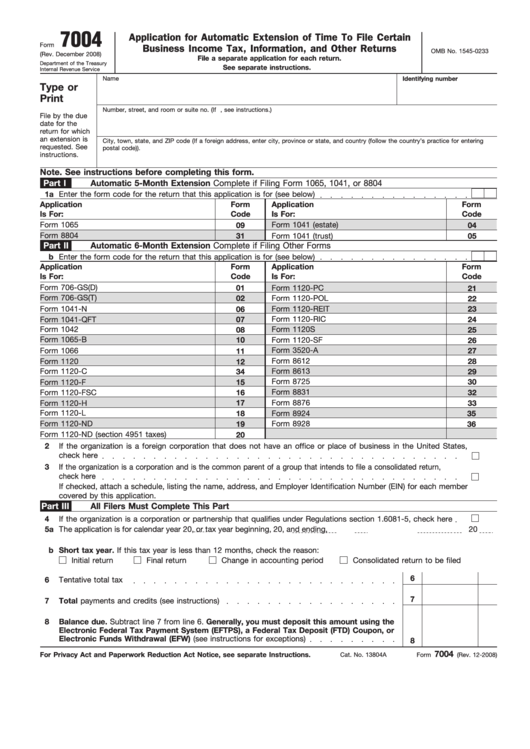

Fillable Form 7004 (Rev. December 2008) printable pdf download

Estimate and pay the taxes you owe; See where to file, later. File form 7004 before or on the deadline of the. Complete, edit or print tax forms instantly. We offer a full suite of startup services to support you in your continued success.

2020 IRS Form 7004 A Complete Guide! IRSForm7004

Web file form 7004 by the 15th day of the 6th month following the close of the tax year. Since the llc is disregarded (unless you explicitly chose. Select the appropriate form from the table below to determine where to. Clear pricing and no hidden fees. Web how do i file form 7004, application for automatic extension of time to.

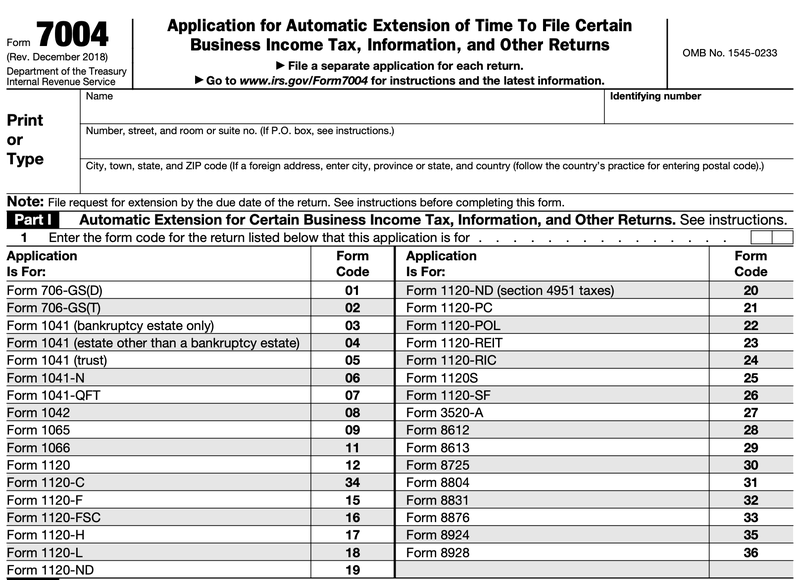

Form 7004 For Form 1065 Nina's Soap

Ad free registered agent service for first year. Web purpose of form. Web irs form 7004 is the application for automatic extension of time to file certain business income tax, information, and other returns. it's used to request more. Payment of tax line 1a—extension date. Top services compared & ranked

Where to file Form 7004 Federal Tax TaxUni

File form 7004 before or on the deadline of the. Web to successfully use form 7004, you’ll have to: We offer a full suite of startup services to support you in your continued success. Download or email irs 7004 & more fillable forms, register and subscribe now! Web purpose of form use form 7004 to request an automatic extension of.

How to File a Business Tax Extension in 2021 The Blueprint

General instructions purpose of form use form 7004 to request an automatic extension of time to file certain. Requests for a tax filing extension. Corporations, entities, & trusts can extend the time to file 1120, 1065 and 1041 tax returns in few steps. Top services compared & ranked Web irs form 7004 is an application for automatic extension of time.

How to file an LLC Tax extension Form 7004 Bette Hochberger, CPA, CGMA

Payment of tax line 1a—extension date. Web form 7004 provides businesses an additional 6 month of time to file their business tax returns. Web file form 7004 by the 15th day of the 6th month following the close of the tax year. Corporations, entities, & trusts can extend the time to file 1120, 1065 and 1041 tax returns in few.

Get an Extension on Your Business Taxes with Form 7004 Excel Capital

Estimate and pay the taxes you owe; Make your business official today in less than 10 minutes. Since the llc is disregarded (unless you explicitly chose. You cannot file form 7004 electronically. Payment of tax line 1a—extension date.

Form 12 Extension Why You Should Not Go To Form 12 Extension AH

Web to successfully use form 7004, you’ll have to: Web how do i file form 7004, application for automatic extension of time to file certain business income tax, information, and other returns? To file for an llc extension, file form 7004: File form 7004 before or on the deadline of the. Complete, edit or print tax forms instantly.

Complete, Edit Or Print Tax Forms Instantly.

Web file form 7004 by the 15th day of the 6th month following the close of the tax year. By the tax filing due date (april 15th for most businesses) who needs to file: Download or email irs 7004 & more fillable forms, register and subscribe now! There are three different parts to this tax.

Ad Free Registered Agent Service For First Year.

Web use the chart to determine where to file form 7004 based on the tax form you complete. You cannot file form 7004 electronically. Web irs form 7004 is an application for automatic extension of time to file certain business income tax, information, and other returns. The code is '09' for a form 1065, unless your llc is treated as a s.

Web You Need To File Form 4868 On Behalf Of Yourselves As Individuals, And Form 7004 On Behalf Of The Llc As The Partnership.

Corporations, entities, & trusts can extend the time to file 1120, 1065 and 1041 tax returns in few steps. Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Payment of tax line 1a—extension date. Application for automatic extension of time to file certain business income tax information, and other returns.

A Foreign Corporation With An Office Or Place Of Business.

File form 7004 before or on the deadline of the. Ad focus on your business & let professionals handle your paperwork. Businesses operating as a single member llc or sole proprietorship must file. Estimate and pay the taxes you owe;