Form 7004 Extension Due Date

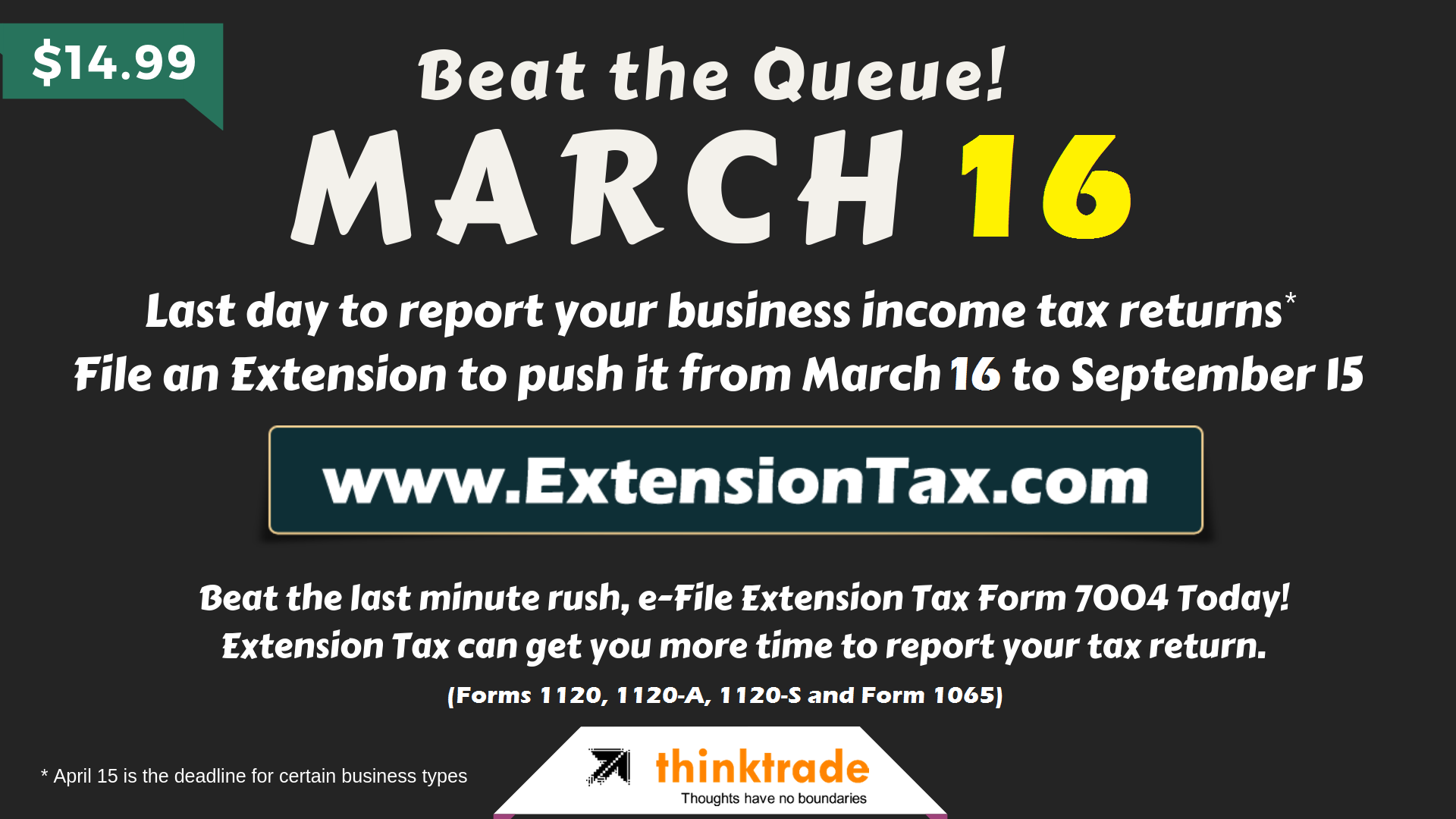

Form 7004 Extension Due Date - And for the tax returns such as 1120, 1041. This means if you are considering an extension, it’s time to get a move on! Web file request for extension by the due date of the return. Requests for a tax filing extension. You will get an automatic tax extension time of six months to file your complete reports along with. Usually, the irs form 7004 business tax extension application deadline falls on the 15th day of the third month, which is march 15th, 2022 on this year. You will get an automatic tax extension time of six months to file your complete reports along with. Web most business tax returns can be extended by filing form 7004: Complete, edit or print tax forms instantly. Web the irs has extended the filing and payment deadlines for businesses in these affected areas from march 15 and april 15, 2021, to june 15, 2021.

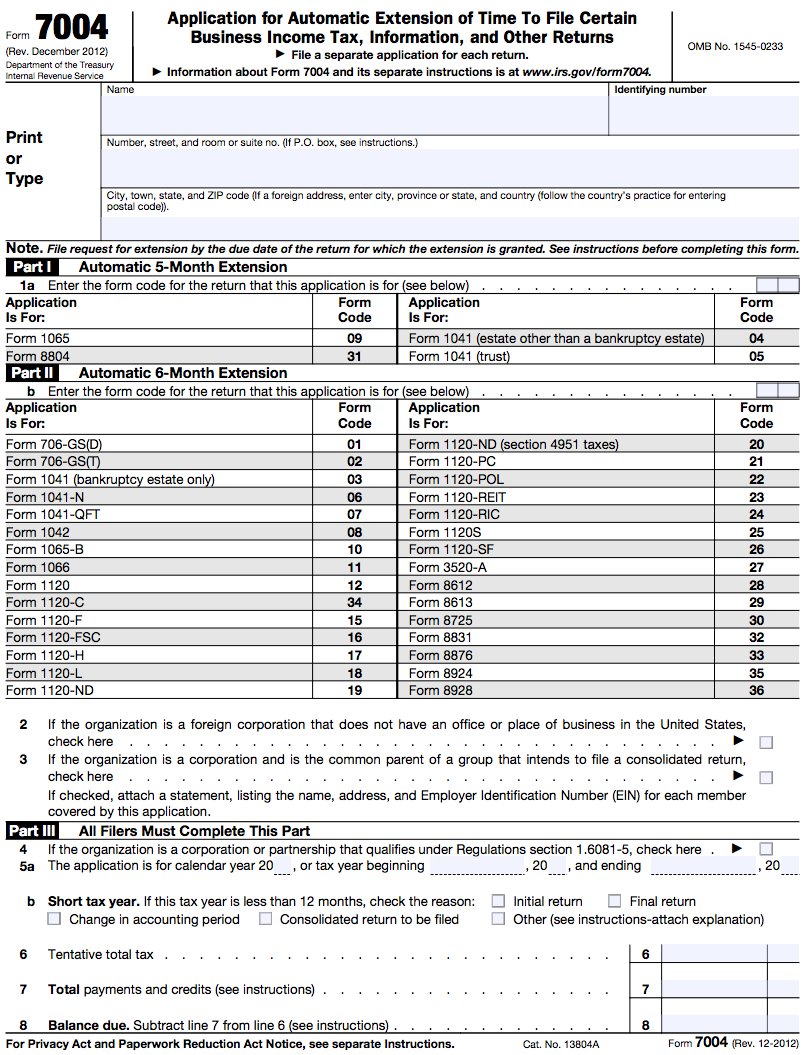

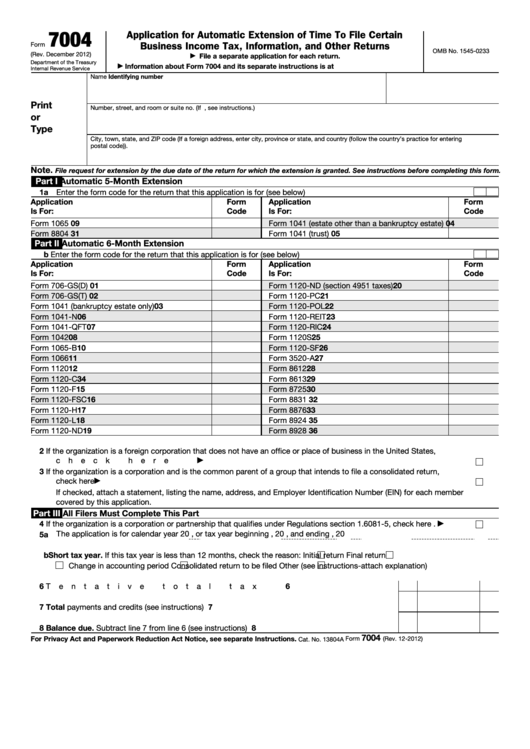

Web the purpose of form 7004: And for the tax returns such as 1120, 1041. Web for businesses operating on a calendar year, this deadline is march 15, 2022. And for the tax returns such as 1120, 1041 and others. Complete, edit or print tax forms instantly. Web there are several ways to submit form 4868. Web most business tax returns can be extended by filing form 7004: This means if you are considering an extension, it’s time to get a move on! Application for automatic extension of time to file by the original due date of the return. Requests for a tax filing extension.

By the tax filing due date (april 15th for most businesses) who needs to file: And for the tax returns such as 1120, 1041 and others. Web a 1041 extension must be filed no later than midnight on the normal due date of the return: Complete, edit or print tax forms instantly. Tentative amount of florida tax for the taxable. We last updated the application for automatic extension of time to file certain business income tax, information, and. Web general instructions purpose of forms taxpayer identification number (tin) applying for an ein who must file who must sign form 8804 paid preparer. 01/17 extension of time request florida income/ franchise tax due 1. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. The due dates of the returns can be found here for the applicable return.

Get an Extension on Your Business Taxes with Form 7004 Excel Capital

Web the irs has extended the filing and payment deadlines for businesses in these affected areas from march 15 and april 15, 2021, to june 15, 2021. Web most business tax returns can be extended by filing form 7004: Requests for a tax filing extension. The 15th day of the 4th month after the end of the tax year for.

Form 12 Extension Why You Should Not Go To Form 12 Extension AH

Usually, the irs form 7004 business tax extension application deadline falls on the 15th day of the third month, which is march 15th, 2022 on this year. Web most business tax returns can be extended by filing form 7004: Web the purpose of form 7004: The due dates of the returns can be found here for the applicable return. Web.

Form 12 Extension Why You Should Not Go To Form 12 Extension AH

Application for automatic extension of time to file by the original due date of the return. By the tax filing due date (april 15th for most businesses) who needs to file: Web the entity must file form 7004 by the due date of the return (the 15th day of the 6th month following the close of the tax year) to.

This Is Where You Need To Mail Your Form 7004 This Year Blog

Web the table below shows the deadline for filing form 7004 for business tax returns. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. When to file forms 8804. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly.

form 7004 extension due date in 2020 Extension Tax Blog

Usually, the irs form 7004 business tax extension application deadline falls on the 15th day of the third month, which is march 15th, 2022 on this year. And for the tax returns such as 1120, 1041. Web the irs has extended the filing and payment deadlines for businesses in these affected areas from march 15 and april 15, 2021, to.

Today is the Deadline to File a 2021 Form 7004 Extension Blog

You will get an automatic tax extension time of six months to file your complete reports along with. Web most business tax returns can be extended by filing form 7004: Usually, the irs form 7004 business tax extension application deadline falls on the 15th day of the third month, which is march 15th, 2022 on this year. Complete, edit or.

extension form 7004 for 2022 IRS Authorized

Application for automatic extension of time to file by the original due date of the return. Web there are several ways to submit form 4868. Tentative amount of florida tax for the taxable. And for the tax returns such as 1120, 1041 and others. This means if you are considering an extension, it’s time to get a move on!

Form 7004 Automatically Extend Your 1120 Filing Due date IRSForm7004

We last updated the application for automatic extension of time to file certain business income tax, information, and. Complete, edit or print tax forms instantly. Web there are several ways to submit form 4868. Application for automatic extension of time to file by the original due date of the return. Complete, edit or print tax forms instantly.

Fillable Form 7004 Application For Automatic Extension Of Time To

01/17 extension of time request florida income/ franchise tax due 1. And for the tax returns such as 1120, 1041 and others. Web when to file generally, form 7004 must be filed on or before the due date of the applicable tax return. Requests for a tax filing extension. Taxpayers can file form 4868 by mail, but remember to get.

When is Tax Extension Form 7004 Due? Tax Extension Online

Application for automatic extension of time to file by the original due date of the return. Web when to file generally, form 7004 must be filed on or before the due date of the applicable tax return. Complete, edit or print tax forms instantly. And for the tax returns such as 1120, 1041 and others. This means if you are.

Web The Purpose Of Form 7004:

By the tax filing due date (april 15th for most businesses) who needs to file: Web file request for extension by the due date of the return. Web general instructions purpose of forms taxpayer identification number (tin) applying for an ein who must file who must sign form 8804 paid preparer. Web when to file generally, form 7004 must be filed on or before the due date of the applicable tax return.

Complete, Edit Or Print Tax Forms Instantly.

Complete, edit or print tax forms instantly. Web for businesses operating on a calendar year, this deadline is march 15, 2022. And for the tax returns such as 1120, 1041 and others. The 15th day of the 4th month after the end of the tax year for the return.

Web There Are Several Ways To Submit Form 4868.

You will get an automatic tax extension time of six months to file your complete reports along with. Usually, the irs form 7004 business tax extension application deadline falls on the 15th day of the third month, which is march 15th, 2022 on this year. The due dates of the returns can be found here for the applicable return. And for the tax returns such as 1120, 1041.

01/17 Extension Of Time Request Florida Income/ Franchise Tax Due 1.

Web the entity must file form 7004 by the due date of the return (the 15th day of the 6th month following the close of the tax year) to request an extension. When to file forms 8804. Application for automatic extension of time to file by the original due date of the return. This means if you are considering an extension, it’s time to get a move on!