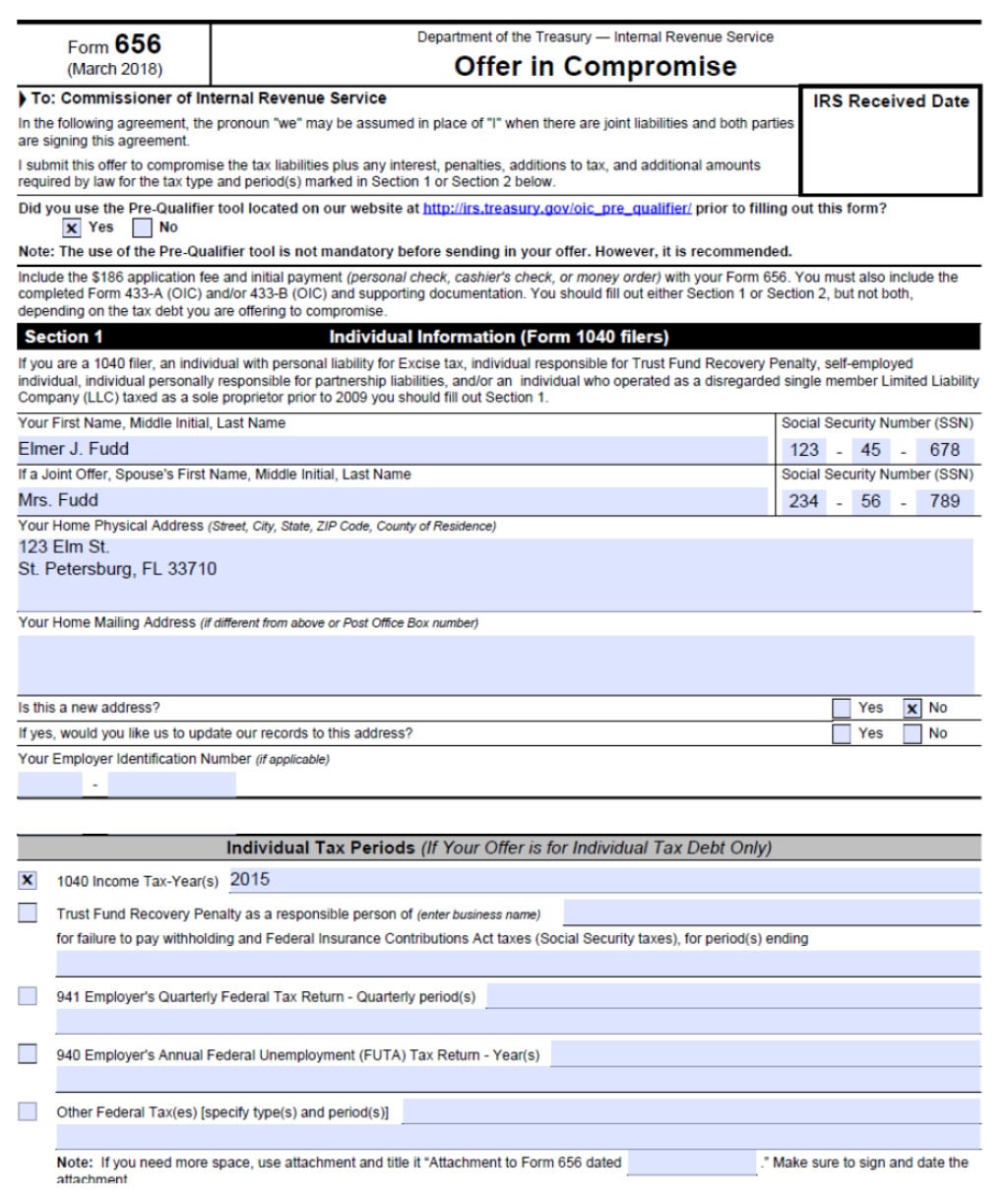

Form 656 Oic

Form 656 Oic - Web taxpayers submit an executed form 656, offer in compromise, for the irs to consider their oic. For additional assistance in calculating your doubt as to. You can download form 656 and the instructional booklet directly from the irs website. Once acceptance by the irs, it becomes a legal agreement. If you owe back taxes to the irs, the offer in compromise (oic) program could help you settle your tax debt by paying less than. An oic does not require an attorney, cpa, or. Web form 656 department of the treasury — internal revenue service (rev. Complete, edit or print tax forms instantly. More likely to pay their subsequent. Web form 656, the offer in compromise (oic), gives the irs an overview of your financial situation so it can review your debt and your ability to pay.

But first, here’s a tip. The oic process involves filing an irs form 656 with the irs. An oic does not require an attorney, cpa, or. Complete, edit or print tax forms instantly. You’ll find the actual form 656 at the end of the form 656 oic booklet. In the doubt as to collectibility situation, there exists a reasonable amount of doubt over. Get ready for tax season deadlines by completing any required tax forms today. Web form 656, the offer in compromise (oic), gives the irs an overview of your financial situation so it can review your debt and your ability to pay. Web how to request an offer in compromise from the irs. Complete, edit or print tax forms instantly.

Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. The forms can be submitted. Complete, edit or print tax forms instantly. Ad access irs tax forms. The oic process involves filing an irs form 656 with the irs. An oic does not require an attorney, cpa, or. Web explore our free tool. Web form 656 department of the treasury — internal revenue service (rev. Complete, edit or print tax forms instantly.

How to Fill Out IRS Form 656 Offer In Compromise

For additional assistance in calculating your doubt as to. An oic does not require an attorney, cpa, or. Web an oic (also known as an offer) is an agreement between you and the irs, where the irs agrees to accept less than the full amount you owe to settle the debt. Web if you meet the requirements stated above, you.

How to Fill Out IRS Form 656 Offer In Compromise

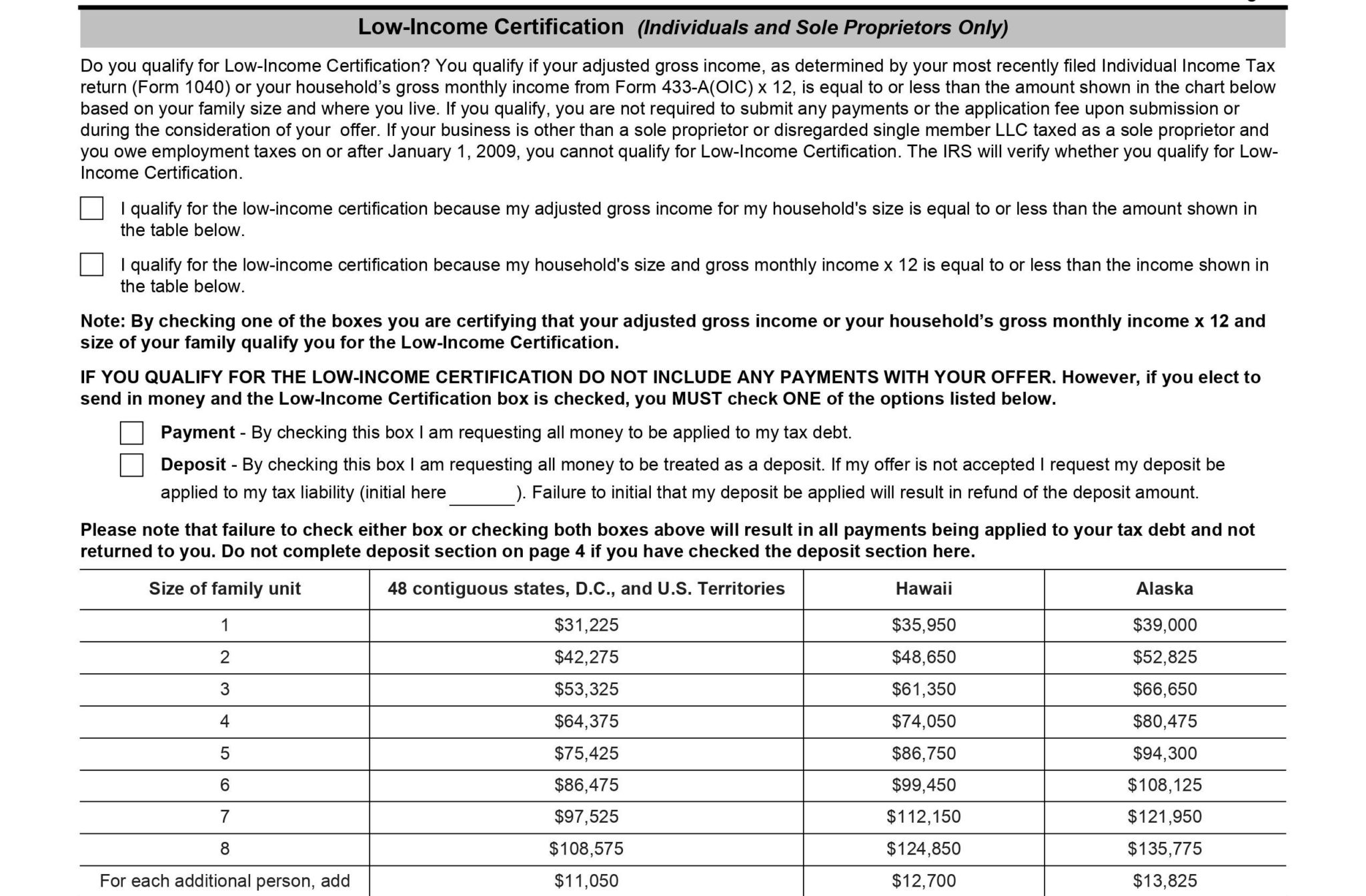

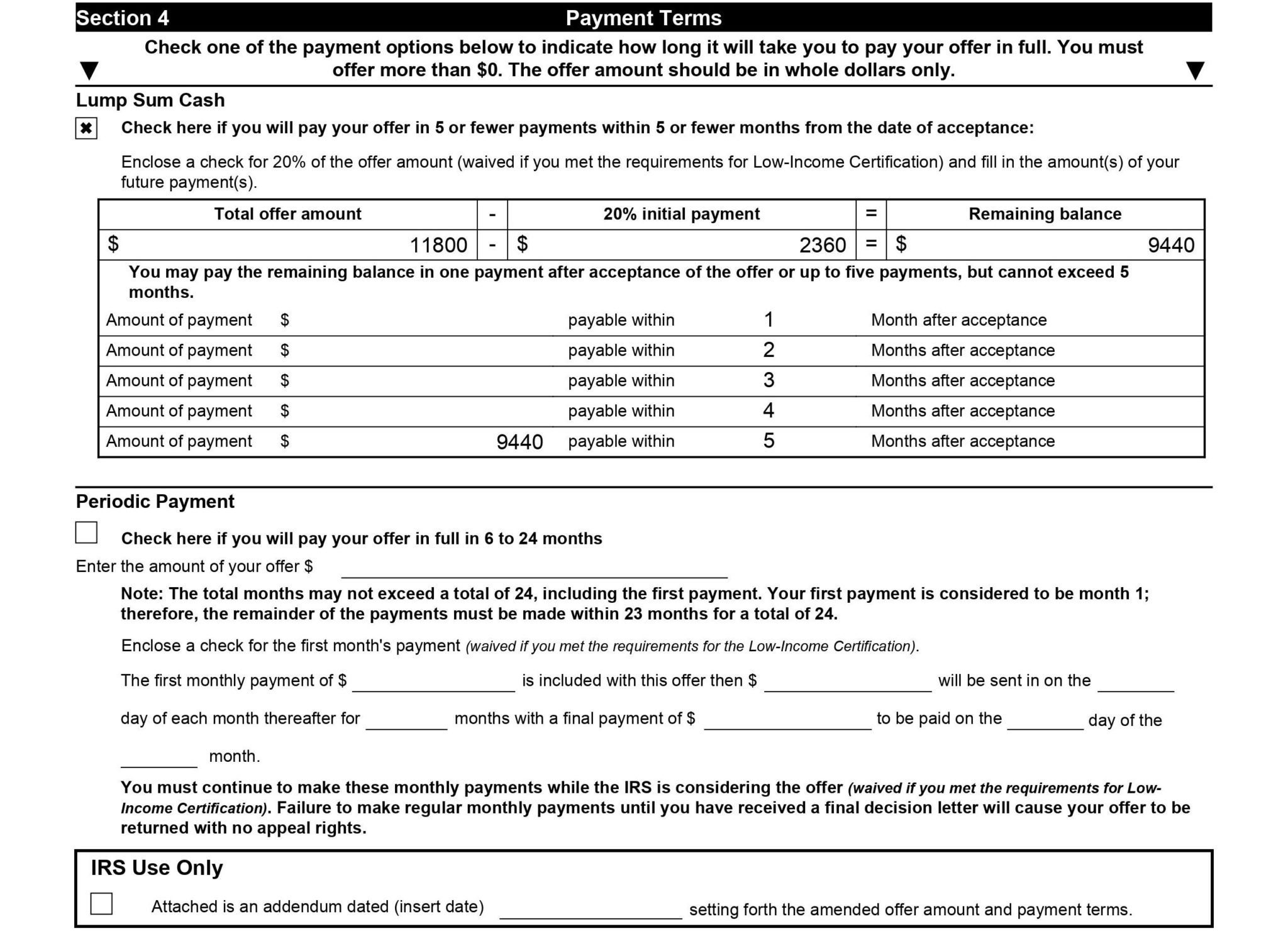

Complete, edit or print tax forms instantly. Internal revenue manual (irm) 5.8.9.4, potential default cases, (jan. But first, here’s a tip. The offer in compromise form has a fee of $205, but this can be waived if you meet the low. Ad access irs tax forms.

Offer in compromise How to Get the IRS to Accept Your Offer Law

The oic process involves filing an irs form 656 with the irs. Complete, edit or print tax forms instantly. Web an offer in compromise (oic) is a settlement on irs tax debt. But first, here’s a tip. Web if you meet the requirements stated above, you can move forward with your offer.

How to Fill Out IRS Form 656 Offer In Compromise

If you owe back taxes to the irs, the offer in compromise (oic) program could help you settle your tax debt by paying less than. Ad access irs tax forms. Web taxpayers submit an executed form 656, offer in compromise, for the irs to consider their oic. Web if you meet the requirements stated above, you can move forward with.

Fillable Form 656 Offer In Compromise (Including Form 433A (Oic

Web an offer in compromise (oic) is a settlement on irs tax debt. Web how can i apply for an offer in compromise? Complete, edit or print tax forms instantly. You can download form 656 and the instructional booklet directly from the irs website. Ad access irs tax forms.

IRS Form 433A (OIC) 2018 2019 Fill out and Edit Online PDF Template

Enter your financial information and tax filing status to calculate a preliminary offer amount. The forms can be submitted. If you owe back taxes to the irs, the offer in compromise (oic) program could help you settle your tax debt by paying less than. Web an offer in compromise (oic) is a settlement on irs tax debt. Ad access irs.

How to Fill Out IRS Form 656 Offer In Compromise

For additional assistance in calculating your doubt as to. If you owe back taxes to the irs, the offer in compromise (oic) program could help you settle your tax debt by paying less than. Web it’s used to submit an oic with the internal revenue service. But first, here’s a tip. Web how to request an offer in compromise from.

How to Fill Out IRS Form 656 Offer In Compromise

An oic does not require an attorney, cpa, or. Ad access irs tax forms. You’ll find the actual form 656 at the end of the form 656 oic booklet. The forms can be submitted. Web form 656, the offer in compromise (oic), gives the irs an overview of your financial situation so it can review your debt and your ability.

How to Fill Out IRS Form 656 Offer In Compromise

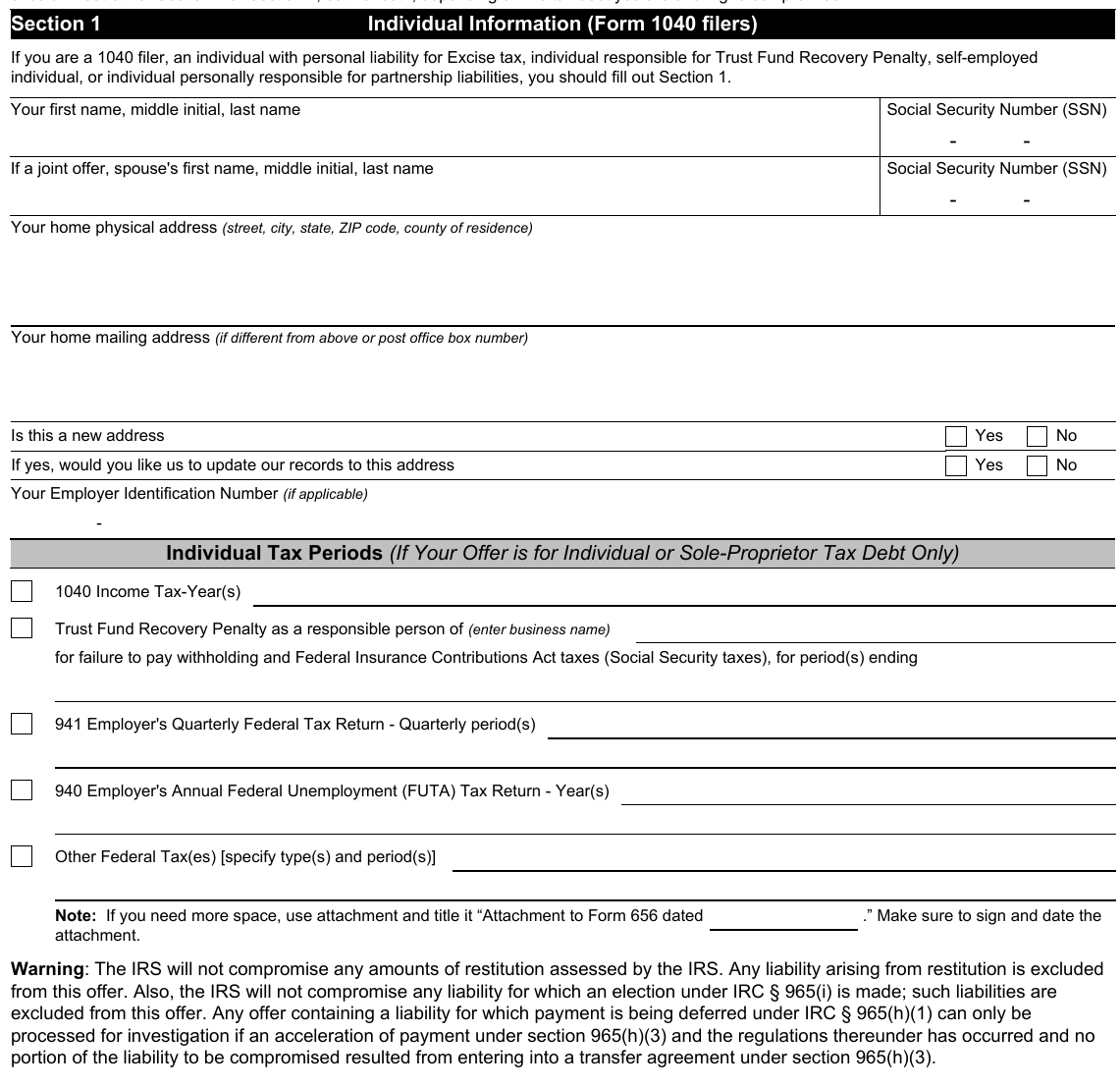

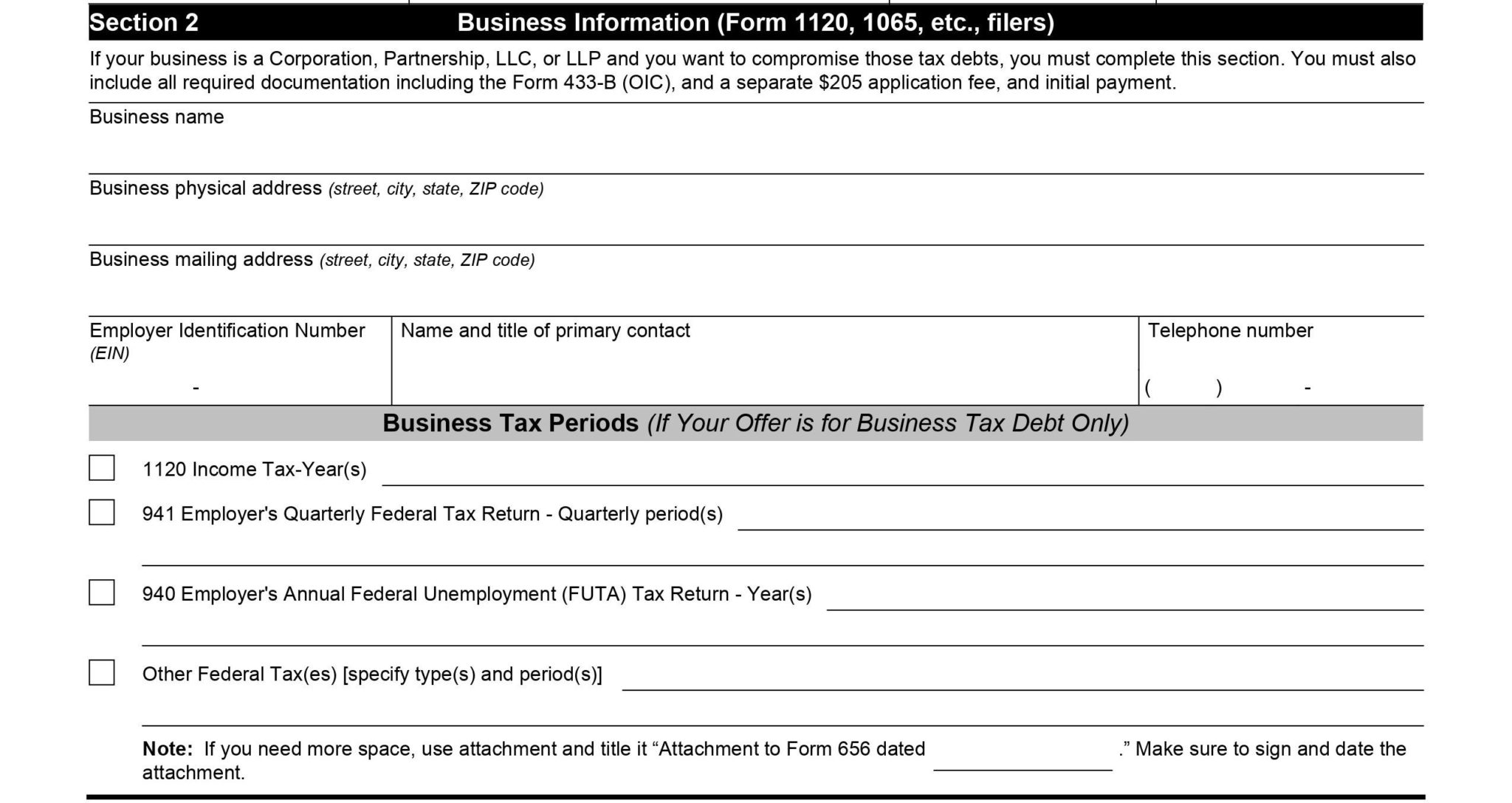

Web you must complete a form 656, offer in compromise, found in 656 booklet, offer in compromise booklet. You need to fill out a form 656 to file for an oic in two circumstances. Ad access irs tax forms. Web how to request an offer in compromise from the irs. Complete, edit or print tax forms instantly.

Form 656 OIC

Web an oic (also known as an offer) is an agreement between you and the irs, where the irs agrees to accept less than the full amount you owe to settle the debt. Web if you meet the requirements stated above, you can move forward with your offer. The forms can be submitted. Complete, edit or print tax forms instantly..

In The Doubt As To Collectibility Situation, There Exists A Reasonable Amount Of Doubt Over.

The offer in compromise form has a fee of $205, but this can be waived if you meet the low. You’ll find the actual form 656 at the end of the form 656 oic booklet. Web form 656 department of the treasury — internal revenue service (rev. For additional assistance in calculating your doubt as to.

Complete, Edit Or Print Tax Forms Instantly.

Ad access irs tax forms. You can download form 656 and the instructional booklet directly from the irs website. Web an oic (also known as an offer) is an agreement between you and the irs, where the irs agrees to accept less than the full amount you owe to settle the debt. Enter your financial information and tax filing status to calculate a preliminary offer amount.

The Forms Can Be Submitted.

Complete, edit or print tax forms instantly. Internal revenue manual (irm) 5.8.9.4, potential default cases, (jan. If you owe back taxes to the irs, the offer in compromise (oic) program could help you settle your tax debt by paying less than. Once acceptance by the irs, it becomes a legal agreement.

Web It’s Used To Submit An Oic With The Internal Revenue Service.

Get ready for tax season deadlines by completing any required tax forms today. Commissioner of internal revenue service irs received date in. Web an offer in compromise (oic) is a settlement on irs tax debt. Web how to request an offer in compromise from the irs.