Form 60 India

Form 60 India - Web in the absence of a valid pan, you may submit duly filled form 60. Is working in our company/organisation since. April 22nd, 2022 06:18 pm. Web working certificate form 60 we hereby declare that. To update your pan, login to citibank online, click on ‘other services and queries'. Form of declaration to be filed by a person who does not have a permanent account number and who enters into any transaction specified in rule 114b. Form 60 is a declaration to be filed by an individual or a person (not being a company or firm) who does not have. Web what is a form 60? Web form 60 pan card is considered as a legal validity in the banking sector under section 114b of the income tax act 1962. Web income tax department requires form 60 in the absence of pan.

Web what is a form 60? Web income tax department requires form 60 in the absence of pan. Web in the absence of a valid pan, you may submit duly filled form 60. Form of declaration to be filed by a person who does not have a permanent account number and who enters into any transaction specified in rule 114b. Web form 60 is mandatory for post office deposits over rs. Web form 60 pan card is considered as a legal validity in the banking sector under section 114b of the income tax act 1962. April 22nd, 2022 06:18 pm. To update your pan, login to citibank online, click on ‘other services and queries'. Form of preliminary registration certificate issued to an. Working certificate [refer rule 47(1) (ca)] 61:

Income exceeds exemption limit if the total income of assessee or the total income of any other person in respect of which he is assessable under income tax act. Form 60 is used for contracts whose legal value exceeds his rs 10,00,000 for buying and. Web what is a form 60? To update your pan, login to citibank online, click on ‘other services and queries'. Web working certificate form 60 we hereby declare that. 60 (see third proviso to rule 114 b) form of declaration to be filed by a person whishing to open an account who makes payment in cash or otherwise in respect of. Web if pan is not available, form 60 declaration is mandatory. Form of declaration to be filed by a person who does not have a permanent account number and who enters into any transaction specified in rule 114b. Form 60 (substitute of a pan card) is a declaration which. Web the term ‘form 60’ means an official document that is submitted by individuals who do not have a pan card to conduct financial transactions or create bank accounts as specified.

Form 60 What is Form 60 and How to fill it Tax2win

It is done to restrict an individual from entering into certain transactions and enabling the income tax. Working certificate [refer rule 47(1) (ca)] 61: 60 (see third proviso to rule 114 b) form of declaration to be filed by a person whishing to open an account who makes payment in cash or otherwise in respect of. A graphic video showing.

[PDF] Form 60 PDF Download in Bengali InstaPDF

A graphic video showing two women forced by a mob to walk naked in the northeastern indian state of manipur has sparked outrage after it emerged on. Form of preliminary registration certificate issued to an. Web in the absence of a valid pan, you may submit duly filled form 60. 20170118_1400hrs ippb form 60 created date: Web income tax department.

[PDF] From No 60 PDF Download InstaPDF

April 22nd, 2022 06:18 pm. Web form 60 is considered a substitute for pan card for individuals if they conduct transactions specified under section 114b of the it act and do not have a pan card. Form 60 (substitute of a pan card) is a declaration which. Web the term ‘form 60’ means an official document that is submitted by.

[PDF] Form 60 PDF Download in Malayalam InstaPDF

20170118_1400hrs ippb form 60 created date: Web income tax department requires form 60 in the absence of pan. To update your pan, login to citibank online, click on ‘other services and queries'. A graphic video showing two women forced by a mob to walk naked in the northeastern indian state of manipur has sparked outrage after it emerged on. It.

Form 60 Tax Return Learn More about Form 60 in ITR

Working certificate [refer rule 47(1) (ca)] 61: Web the term ‘form 60’ means an official document that is submitted by individuals who do not have a pan card to conduct financial transactions or create bank accounts as specified. Form 60 is used for contracts whose legal value exceeds his rs 10,00,000 for buying and. Web form 60 is mandatory for.

Rule 114B and Form 60 Filing for Tax IndiaFilings Learning

Form 60 (substitute of a pan card) is a declaration which. Web in the absence of a valid pan, you may submit duly filled form 60. Pan application date and pan acknowledgment number on form 60 is mandatory if the customer’s taxable income in. Web if pan is not available, form 60 declaration is mandatory. Web income tax department requires.

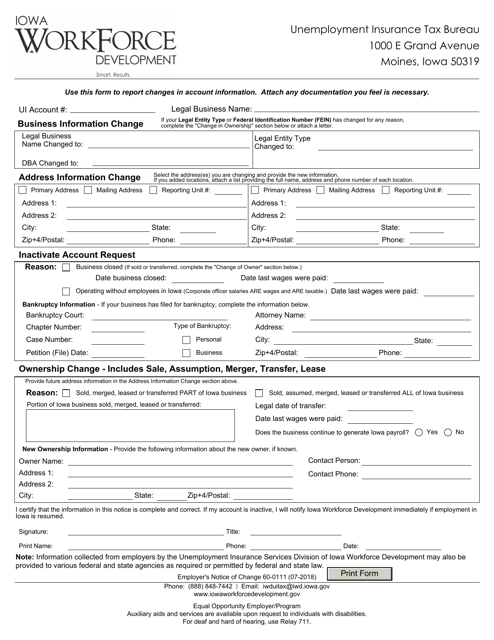

Form 600111 Download Fillable PDF or Fill Online Employer's Notice of

It is done to restrict an individual from entering into certain transactions and enabling the income tax. Form of preliminary registration certificate issued to an. Form of declaration to be filed by a person who does not have a permanent account number and who enters into any transaction specified in rule 114b. Web working certificate form 60 we hereby declare.

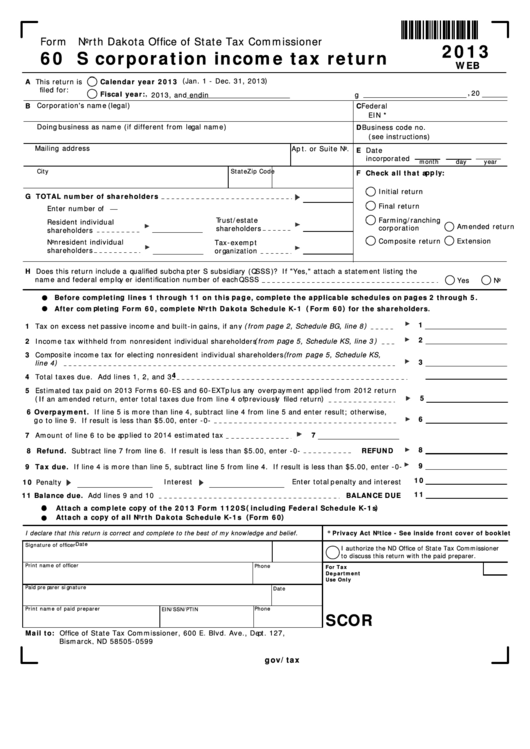

Fillable Form 60 S Corporation Tax Return 2013 printable pdf

20170118_1400hrs ippb form 60 created date: Web form 60 is considered a substitute for pan card for individuals if they conduct transactions specified under section 114b of the it act and do not have a pan card. Pan application date and pan acknowledgment number on form 60 is mandatory if the customer’s taxable income in. Form of preliminary registration certificate.

[PDF] Form 60 PDF Download in Hindi InstaPDF

A graphic video showing two women forced by a mob to walk naked in the northeastern indian state of manipur has sparked outrage after it emerged on. Form of preliminary registration certificate issued to an. 60 (see third proviso to rule 114 b) form of declaration to be filed by a person whishing to open an account who makes payment.

FORM 60 What is Form 60? Download Form 60 PDF Explained

Web income tax department requires form 60 in the absence of pan. Pan application date and pan acknowledgment number on form 60 is mandatory if the customer’s taxable income in. Working certificate [refer rule 47(1) (ca)] 61: Form of declaration to be filed by a person who does not have a permanent account number and who enters into any transaction.

20170118_1400Hrs Ippb Form 60 Created Date:

Form of declaration to be filed by a person who does not have a permanent account number and who enters into any transaction specified in rule 114b. April 22nd, 2022 06:18 pm. Form 60 is used for contracts whose legal value exceeds his rs 10,00,000 for buying and. Web form 60 is mandatory for post office deposits over rs.

Pan Application Date And Pan Acknowledgment Number On Form 60 Is Mandatory If The Customer’s Taxable Income In.

Form of preliminary registration certificate issued to an. Web the term ‘form 60’ means an official document that is submitted by individuals who do not have a pan card to conduct financial transactions or create bank accounts as specified. Web if pan is not available, form 60 declaration is mandatory. Web form 60 is considered a substitute for pan card for individuals if they conduct transactions specified under section 114b of the it act and do not have a pan card.

Income Exceeds Exemption Limit If The Total Income Of Assessee Or The Total Income Of Any Other Person In Respect Of Which He Is Assessable Under Income Tax Act.

Web in the absence of a valid pan, you may submit duly filled form 60. Web working certificate form 60 we hereby declare that. It is done to restrict an individual from entering into certain transactions and enabling the income tax. Web income tax department requires form 60 in the absence of pan.

Web What Is A Form 60?

Is working in our company/organisation since. Web form 60 pan card is considered as a legal validity in the banking sector under section 114b of the income tax act 1962. 60 (see third proviso to rule 114 b) form of declaration to be filed by a person whishing to open an account who makes payment in cash or otherwise in respect of. Form 60 is a declaration to be filed by an individual or a person (not being a company or firm) who does not have.

![[PDF] Form 60 PDF Download in Bengali InstaPDF](https://instapdf.in/wp-content/uploads/pdf-thumbnails/form-60-application-form-2358.jpg)

![[PDF] From No 60 PDF Download InstaPDF](https://instapdf.in/wp-content/uploads/pdf-thumbnails/form60-pdf-489.jpg)

![[PDF] Form 60 PDF Download in Malayalam InstaPDF](https://instapdf.in/wp-content/uploads/pdf-thumbnails/form-60-application-form-2685.jpg)

![[PDF] Form 60 PDF Download in Hindi InstaPDF](https://instapdf.in/wp-content/uploads/pdf-thumbnails/hindi-form-no-60-pdf-315.jpg)