Form 593 Instructions 2021

Form 593 Instructions 2021 - Web as of january 1, 2020, california real estate withholding changed. Web california real estate withholding if you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form 593,. Enjoy smart fillable fields and interactivity. Web how to fill out and sign 2021 form 593 online? Web for more information visit ftb.ca.gov Estimate the amount of the seller's/transferor's loss or zero gain for. First, complete your state return. Web see instructions for form 593, part iv. Get your online template and fill it in using progressive features. You simply need to follow these elementary.

We now have one form 593, real estate withholding statement, which is filed with ftb after every real estate. Web how to fill out and sign 2021 form 593 online? Web your california real estate withholding has to be entered on both the state and the federal return. Estimate the amount of the seller's/transferor's loss or zero gain for. • the transfer of this property is an installment sale where the buyer must withhold on the principal portion of each installment payment. I will complete form 593 for the principal portion of each installment payment. Certify the seller/transferor qualifies for a full, partial, or no withholding exemption. Web real estate withholding statement california form 593 escrow or exchange no. File your california and federal tax returns online with turbotax in minutes. Web california real estate withholding if you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form 593,.

Web efile your california tax return now efiling is easier, faster, and safer than filling out paper tax forms. Web your california real estate withholding has to be entered on both the state and the federal return. Web entering california real estate withholding on individual form 540 in proconnect. I will complete form 593 for the principal portion of each installment payment. We last updated the real estate. Web see instructions for form 593, part iv. File your california and federal tax returns online with turbotax in minutes. Web how to fill out and sign 2021 form 593 online? Enjoy smart fillable fields and interactivity. Estimate the amount of the seller's/transferor's loss or zero gain for.

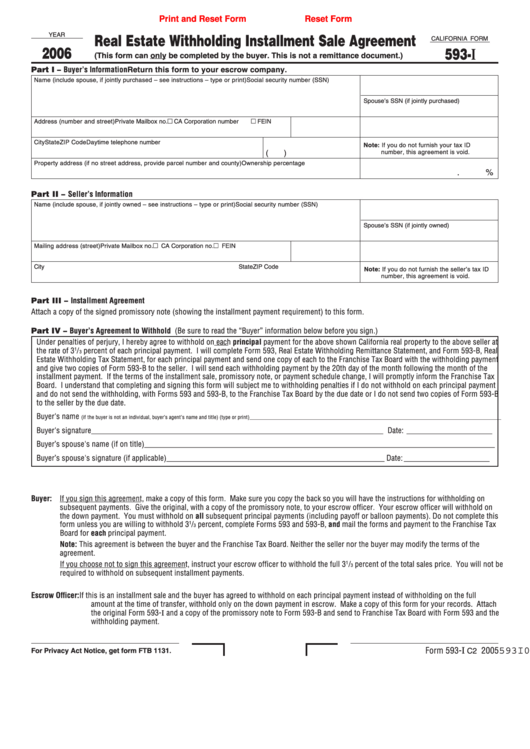

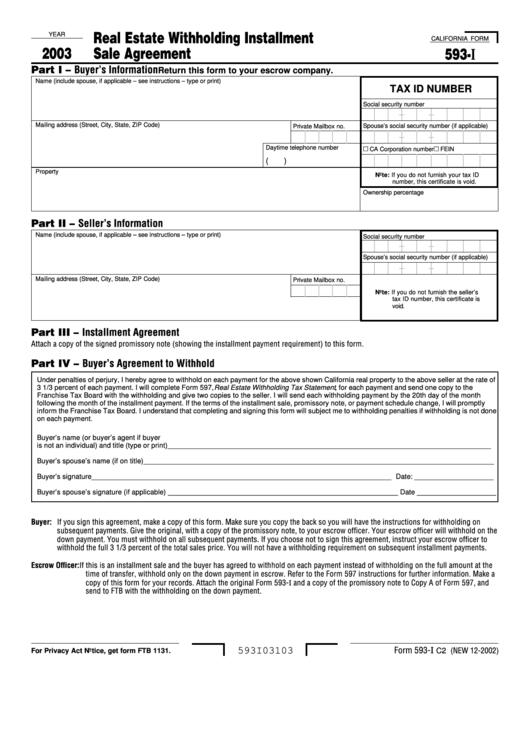

Fillable Form 593I Real Estate Withholding Installment Sale

Certify the seller/transferor qualifies for a full, partial, or no withholding exemption. We now have one form 593, real estate withholding statement, which is filed with ftb after every real estate. Web we last updated california 593 booklet from the franchise tax board in august 2021. _________________________ part i remitter information • reep • qualified. This form is for income.

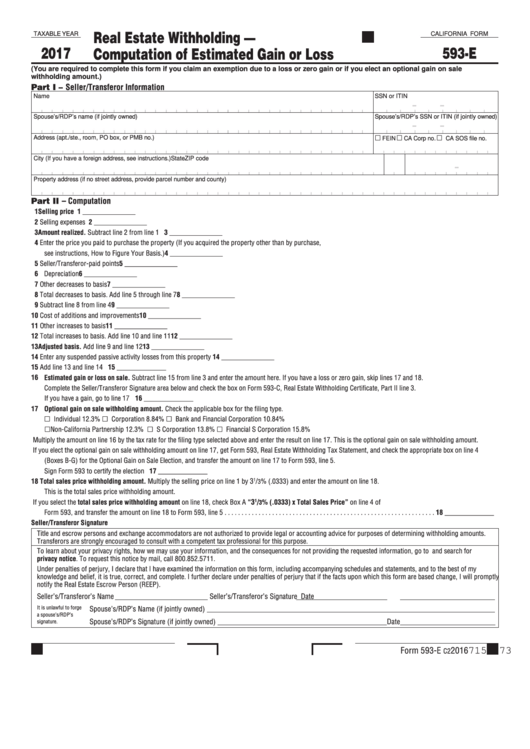

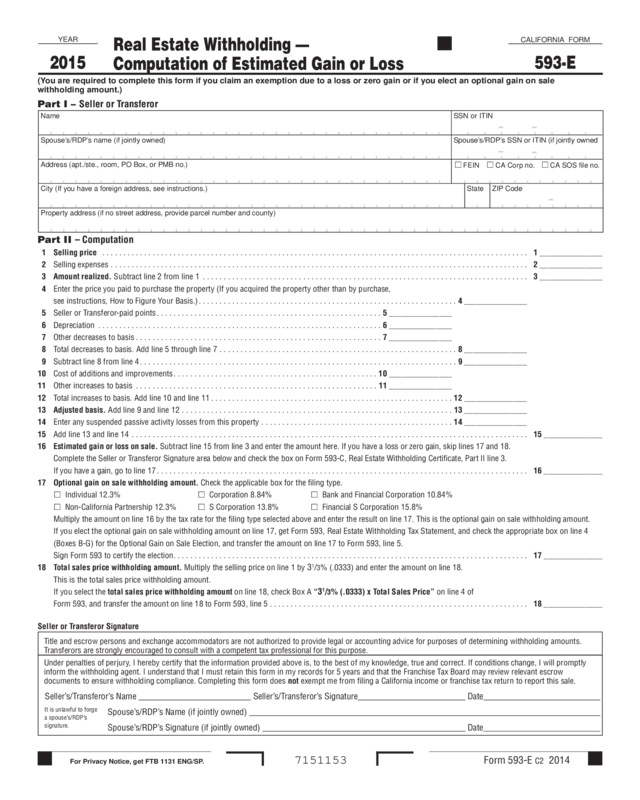

Fillable California Form 593E Real Estate Withholding Computation

Web real estate withholding statement california form 593 escrow or exchange no. Web as of january 1, 2020, california real estate withholding changed. Web instructions for form 941 pdf. When you reach take a. We now have one form 593, real estate withholding statement, which is filed with ftb after every real estate.

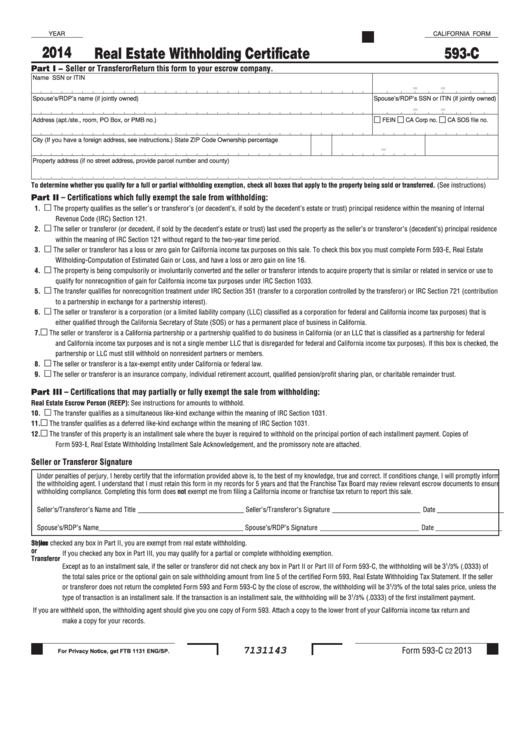

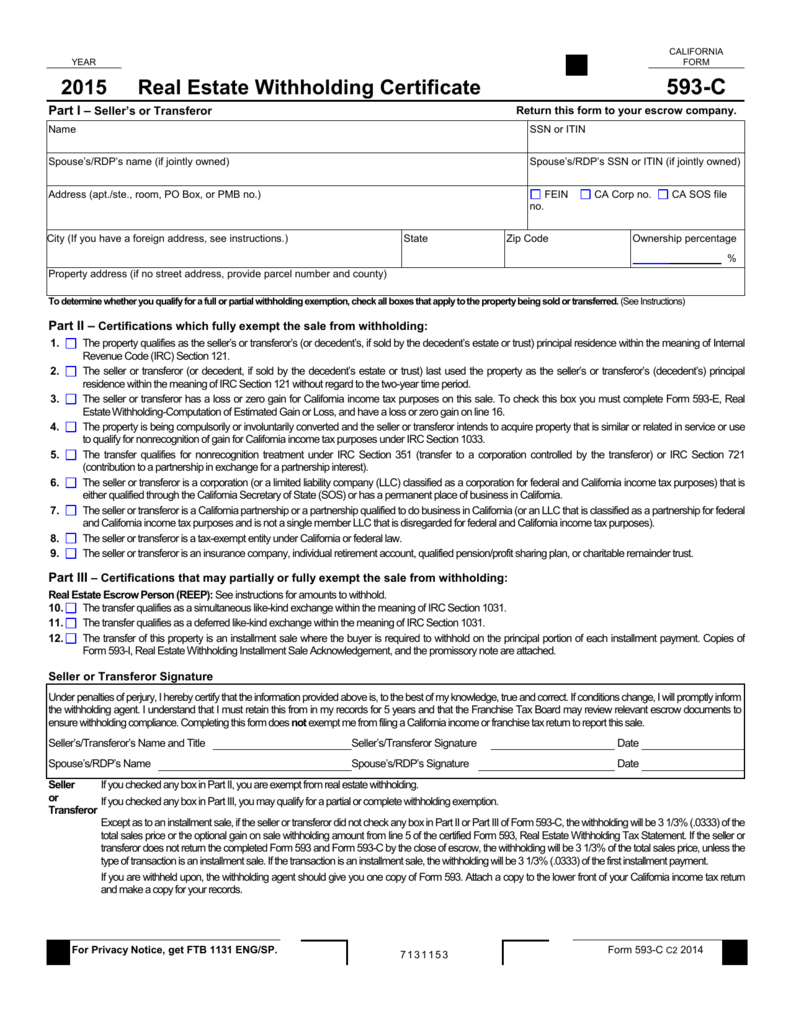

Fillable California Form 593C Real Estate Withholding Certificate

Get your online template and fill it in using progressive features. Web instructions for form 941 pdf. Inputs for ca form 593,. Web for more information visit ftb.ca.gov We last updated the real estate.

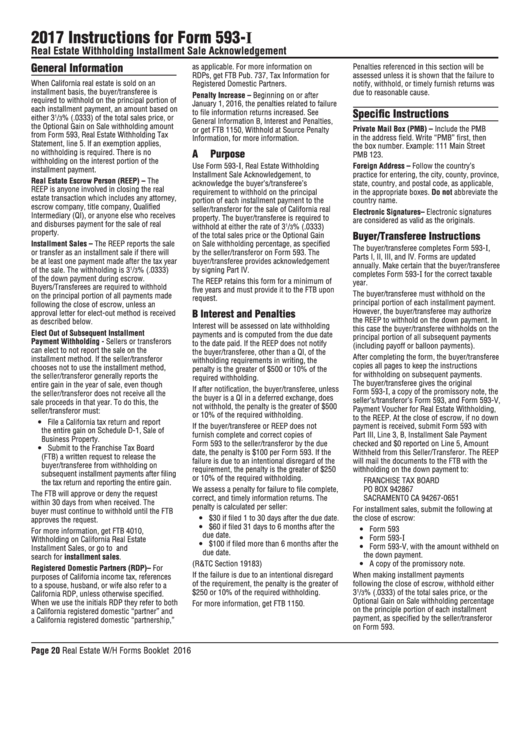

Instructions For Form 593I Real Estate Withholding Installment Sale

This article will assist you. Web if you obtain an exemption due to a loss, zero gain, or if you elect an optional gain on sale withholding amount, then you must complete this form. Application for employer identification number (ein) use this form to apply for an employer identification number. Certify the seller/transferor qualifies for a full, partial, or no.

Form 593 C slidesharetrick

Web if you obtain an exemption due to a loss, zero gain, or if you elect an optional gain on sale withholding amount, then you must complete this form. We now have one form 593, real estate withholding statement, which is filed with ftb after every real estate. First, complete your state return. Web your california real estate withholding has.

Form 5695 2021 2022 IRS Forms TaxUni

Web this article will assist you with entering the california real estate withholding reported on form 593 to print on the individual return form 540, line 73. Web entering california real estate withholding on individual form 540 in proconnect. You simply need to follow these elementary. We last updated the real estate. _________________________ part i remitter information • reep •.

Form 593I Real Estate Withholding Installment Sale Agreement

Inputs for ca form 593,. Web we last updated california 593 booklet from the franchise tax board in august 2021. Web california real estate withholding if you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form 593,. This form is for income earned in tax year 2022, with.

2015 Form 593E Real Estate Withholding Edit, Fill, Sign Online

Estimate the amount of the seller's/transferor's loss or zero gain for. You simply need to follow these elementary. File your california and federal tax returns online with turbotax in minutes. Web real estate withholding statement california form 593 escrow or exchange no. _________________________ part i remitter information • reep • qualified.

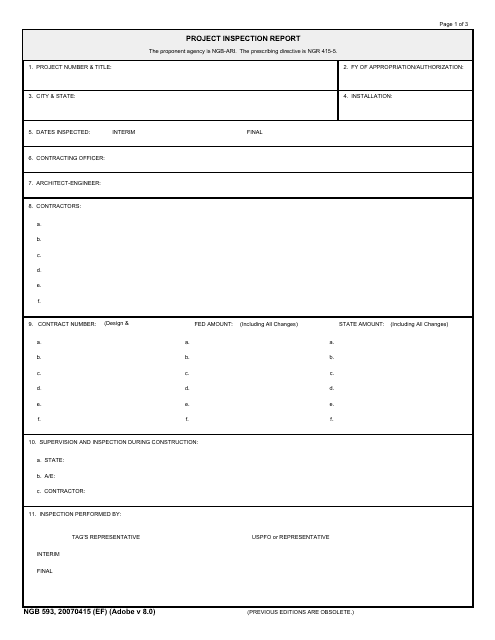

NGB Form 593 Download Fillable PDF or Fill Online Project Inspection

First, complete your state return. Web if you obtain an exemption due to a loss, zero gain, or if you elect an optional gain on sale withholding amount, then you must complete this form. File your california and federal tax returns online with turbotax in minutes. Web your california real estate withholding has to be entered on both the state.

593 Withholding Form Fill Out and Sign Printable PDF Template signNow

Web how to fill out and sign 2021 form 593 online? This form is for income earned in tax year 2022, with tax returns due in april. When you reach take a. Web california real estate withholding if you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form.

Web See Instructions For Form 593, Part Iv.

File your california and federal tax returns online with turbotax in minutes. We now have one form 593, real estate withholding statement, which is filed with ftb after every real estate. Web efile your california tax return now efiling is easier, faster, and safer than filling out paper tax forms. Web if you obtain an exemption due to a loss, zero gain, or if you elect an optional gain on sale withholding amount, then you must complete this form.

Web Instructions For Form 941 Pdf.

Web california real estate withholding if you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form 593,. Solved • by intuit • 4 • updated july 14, 2022. When you reach take a. Web this article will assist you with entering the california real estate withholding reported on form 593 to print on the individual return form 540, line 73.

You Simply Need To Follow These Elementary.

Web your california real estate withholding has to be entered on both the state and the federal return. First, complete your state return. Web for more information visit ftb.ca.gov Get your online template and fill it in using progressive features.

Web We Last Updated California 593 Booklet From The Franchise Tax Board In August 2021.

Web form 593, real estate withholding statement, of the principal portion of each installment payment. This form is for income earned in tax year 2022, with tax returns due in april. Estimate the amount of the seller's/transferor's loss or zero gain for. This article will assist you.