Form 592 Pte Instructions

Form 592 Pte Instructions - Web if you previously filed form 592 with an incorrect taxable year, then follow the steps below: Either state form 565 or 568 should be generated. Web form 592 is also used to report withholding payments for a resident payee. Ca sos file no first. Either state form 565 or 568 should be generated. General information, check if total withholding at end of year. Web passthrough entity tax (ptet) topics for 1065 and 1120s returns using cch axcess™ tax and cch® prosystem fx® tax. Do not use form 592 if any of the following apply: Complete a new form 592 with the correct taxable year. Web city (if you have a foreign address, see instructions.) state.

Complete a new form 592 with the correct taxable year. Either state form 565 or 568 should be generated. Ca sos file no first. Web if you previously filed form 592 with an incorrect taxable year, then follow the steps below: • no payment, distribution or withholding. Do not use form 592 if any of the following apply: Go to partners > partner information. Web passthrough entity tax (ptet) topics for 1065 and 1120s returns using cch axcess™ tax and cch® prosystem fx® tax. Web form 592 is also used to report withholding payments for a resident payee. Web city (if you have a foreign address, see instructions.) state.

Ca sos file no first. Web if you previously filed form 592 with an incorrect taxable year, then follow the steps below: Web city (if you have a foreign address, see instructions.) state. Web form 592 pte. Either state form 565 or 568 should be generated. Web if you previously filed form 592 with an incorrect taxable year, then follow the steps below: Either state form 565 or 568 should be generated. • no payment, distribution or withholding. Do not use form 592 if any of the following apply: Complete a new form 592 with the correct taxable year.

Va Form 21 592 Fill Online, Printable, Fillable, Blank PDFfiller

• no payment, distribution or withholding. Complete a new form 592 with the correct taxable year. Either state form 565 or 568 should be generated. Web if you previously filed form 592 with an incorrect taxable year, then follow the steps below: Web if you previously filed form 592 with an incorrect taxable year, then follow the steps below:

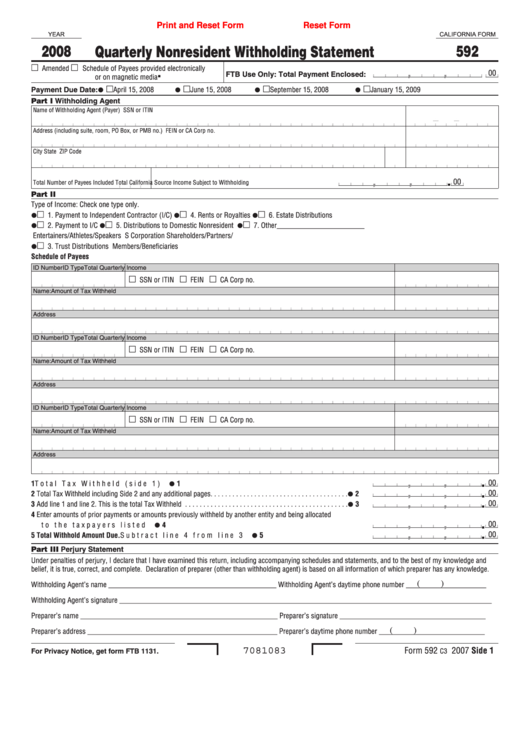

Fillable California Form 592 Quarterly Nonresident Withholding

Go to partners > partner information. Ca sos file no first. Web city (if you have a foreign address, see instructions.) state. Web form 592 pte. • no payment, distribution or withholding.

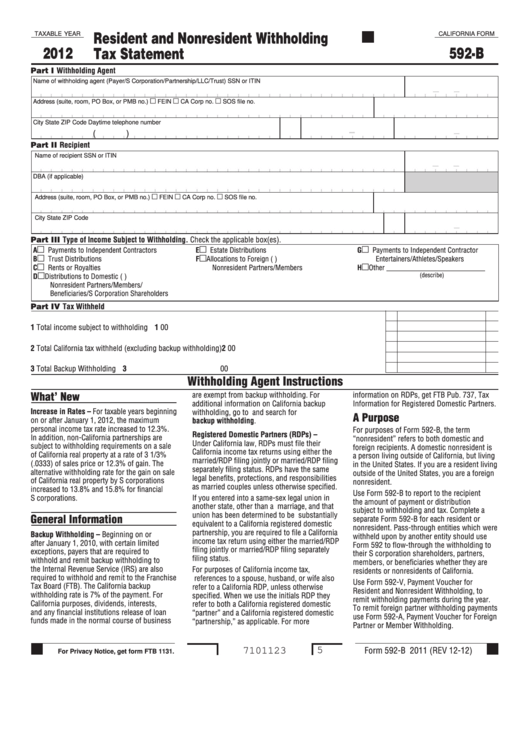

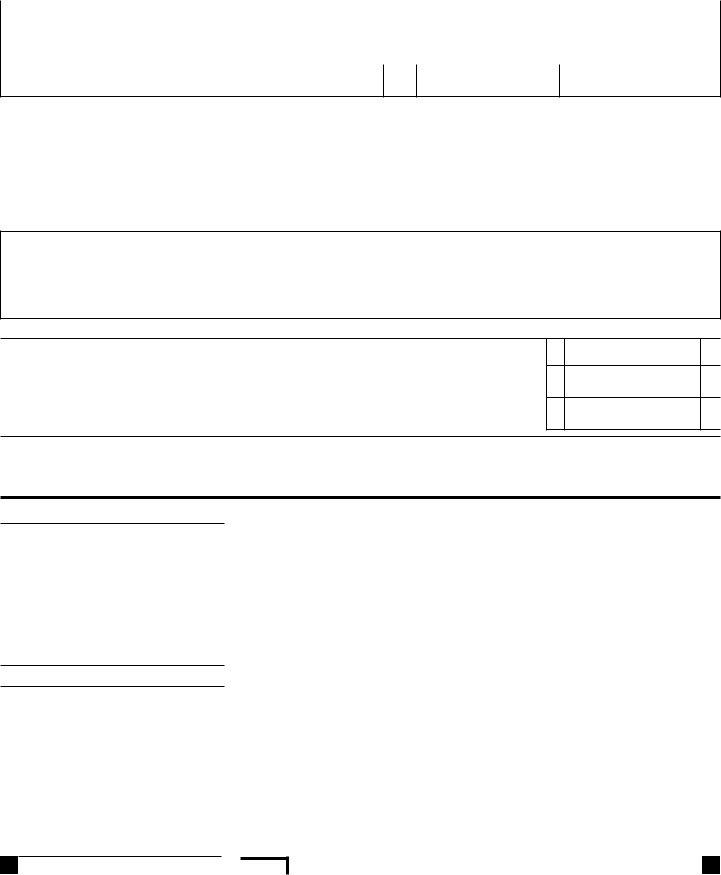

Fillable Form 592B Resident And Nonresident Withholding Tax

Web form 592 pte. Web if you previously filed form 592 with an incorrect taxable year, then follow the steps below: Corporation name, street address, city, state code, corporation telephone number. Web city (if you have a foreign address, see instructions.) state. Web if you previously filed form 592 with an incorrect taxable year, then follow the steps below:

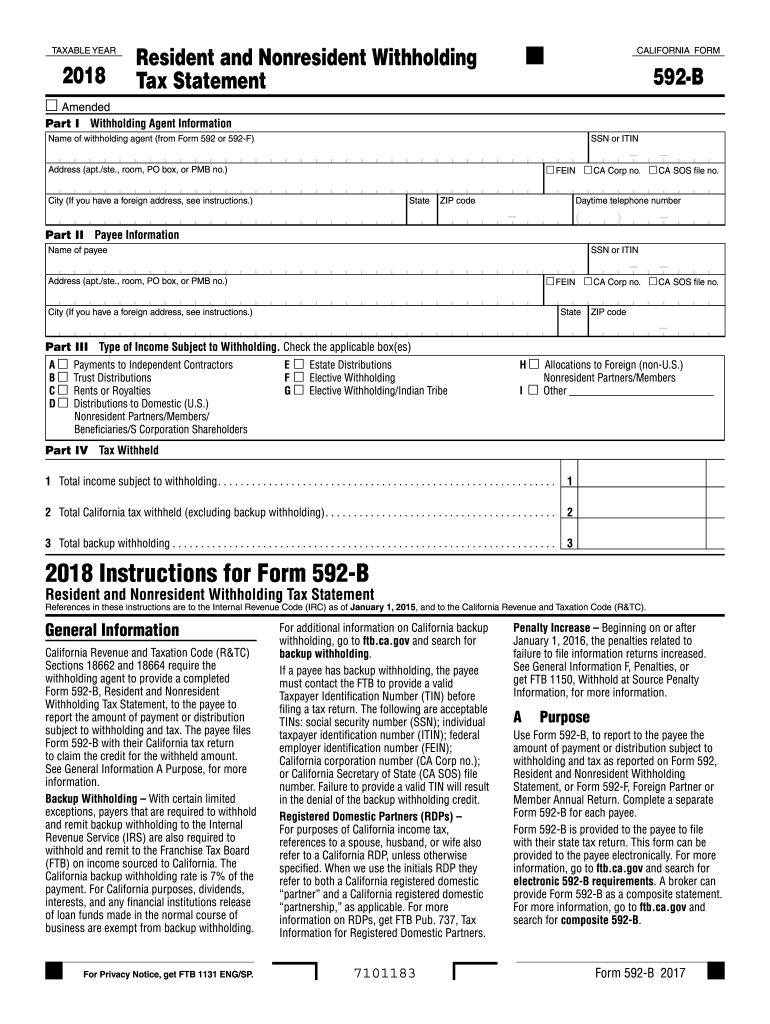

2018 form 592B Resident and Nonresident Withholding. 2018, form 592B

General information, check if total withholding at end of year. Complete a new form 592 with the correct taxable year. Web city (if you have a foreign address, see instructions.) state. Complete a new form 592 with the correct taxable year. Web form 592 pte.

Form 592B Franchise Tax Board Edit, Fill, Sign Online Handypdf

Web passthrough entity tax (ptet) topics for 1065 and 1120s returns using cch axcess™ tax and cch® prosystem fx® tax. Go to partners > partner information. Web if you previously filed form 592 with an incorrect taxable year, then follow the steps below: Either state form 565 or 568 should be generated. Web form 592 pte.

Form 592 B ≡ Fill Out Printable PDF Forms Online

Do not use form 592 if any of the following apply: Web if you previously filed form 592 with an incorrect taxable year, then follow the steps below: Ca sos file no first. Web if you previously filed form 592 with an incorrect taxable year, then follow the steps below: Go to partners > partner information.

2011 Form CA FTB 592A Fill Online, Printable, Fillable, Blank pdfFiller

Web passthrough entity tax (ptet) topics for 1065 and 1120s returns using cch axcess™ tax and cch® prosystem fx® tax. General information, check if total withholding at end of year. Web form 592 pte. Go to partners > partner information. Complete a new form 592 with the correct taxable year.

Form 592 Pte Fill Online, Printable, Fillable, Blank pdfFiller

General information, check if total withholding at end of year. Web passthrough entity tax (ptet) topics for 1065 and 1120s returns using cch axcess™ tax and cch® prosystem fx® tax. Complete a new form 592 with the correct taxable year. Web city (if you have a foreign address, see instructions.) state. Do not use form 592 if any of the.

Form 592B Download Fillable PDF or Fill Online Resident and

Go to partners > partner information. General information, check if total withholding at end of year. Web form 592 is also used to report withholding payments for a resident payee. Either state form 565 or 568 should be generated. Either state form 565 or 568 should be generated.

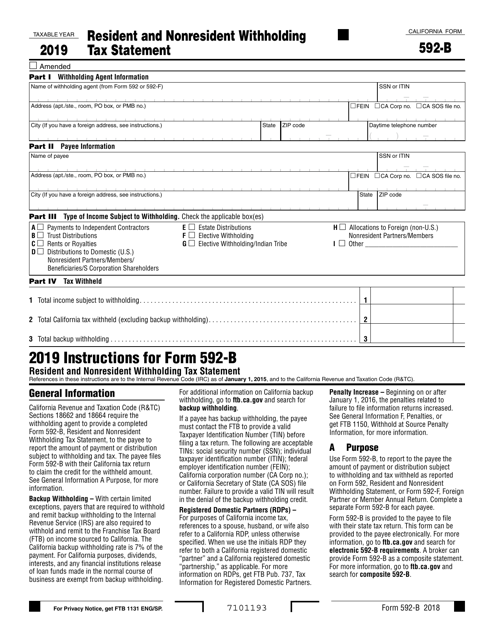

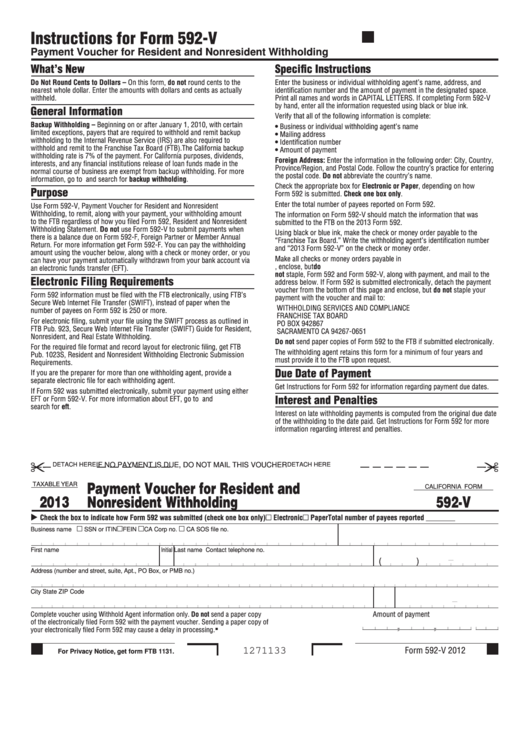

Fillable Form 592V Payment Voucher For Resident And Nonresident

Go to partners > partner information. • no payment, distribution or withholding. Ca sos file no first. Web form 592 is also used to report withholding payments for a resident payee. Complete a new form 592 with the correct taxable year.

Web If You Previously Filed Form 592 With An Incorrect Taxable Year, Then Follow The Steps Below:

Either state form 565 or 568 should be generated. Do not use form 592 if any of the following apply: Web form 592 pte. Either state form 565 or 568 should be generated.

General Information, Check If Total Withholding At End Of Year.

Ca sos file no first. Complete a new form 592 with the correct taxable year. Web passthrough entity tax (ptet) topics for 1065 and 1120s returns using cch axcess™ tax and cch® prosystem fx® tax. Web city (if you have a foreign address, see instructions.) state.

Corporation Name, Street Address, City, State Code, Corporation Telephone Number.

Go to partners > partner information. • no payment, distribution or withholding. Web if you previously filed form 592 with an incorrect taxable year, then follow the steps below: Complete a new form 592 with the correct taxable year.