Form 5500 Late Filing Penalty

Form 5500 Late Filing Penalty - Disclaimer and limitations the u.s. That means that, for a calendar plan year, the due date would be july 31. First, check to see if the information in your delinquency notice (cp 403 or cp 406 ) is correct. If a late filing is due to reasonable cause, you can make. Web further, penalties for small plans (generally under 100 participants) are capped at $750 for a single late form 5500 and $1,500 for multiple years per plan. For returns required to be filed after december 31, 2019, the penalty for failure to file is increased to $250 a day (up to (150,000). Some plan sponsors, especially those that must have an audit performed, typically file a form 5558 to obtain an extension of that filing deadline. Each plan must be submitted separately. Web a form 5500 is typically due seven months following the end of the plan year, without extension. The total penalty for all the filings entered on the calculator will be displayed below the chart.

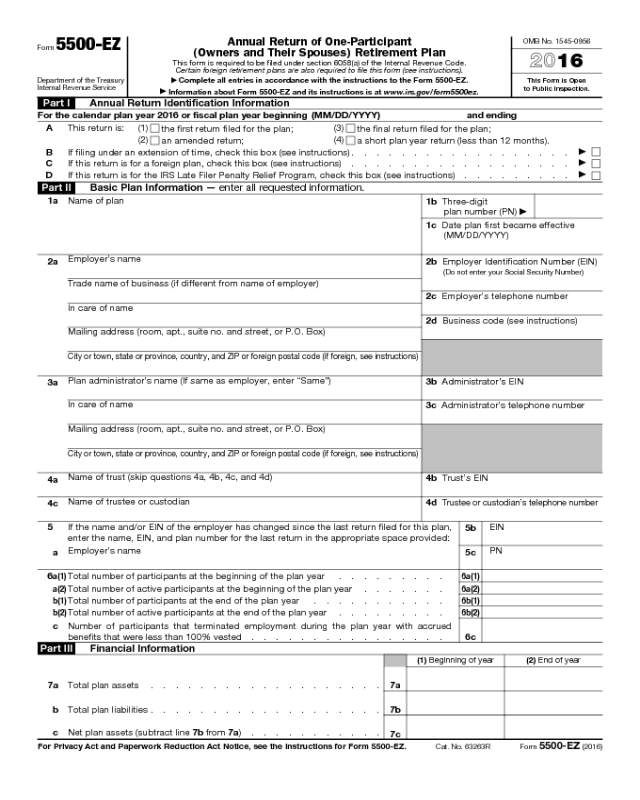

Some plan sponsors, especially those that must have an audit performed, typically file a form 5558 to obtain an extension of that filing deadline. Disclaimer and limitations the u.s. Form 5500ez delinquent filing penalty relief. If you can resolve an issue in your notice, there may be no penalty. Each plan must be submitted separately. That means that, for a calendar plan year, the due date would be july 31. Web a form 5500 is typically due seven months following the end of the plan year, without extension. We must receive a request for an extension of the time to file on or before the normal due date of your return. First, check to see if the information in your delinquency notice (cp 403 or cp 406 ) is correct. Web further, penalties for small plans (generally under 100 participants) are capped at $750 for a single late form 5500 and $1,500 for multiple years per plan.

That means that, for a calendar plan year, the due date would be july 31. We must receive a request for an extension of the time to file on or before the normal due date of your return. The total penalty for all the filings entered on the calculator will be displayed below the chart. If you can resolve an issue in your notice, there may be no penalty. Some plan sponsors, especially those that must have an audit performed, typically file a form 5558 to obtain an extension of that filing deadline. This penalty is only for the filings entered on the calculator. Web the calculator will determine the number of days late and the penalty for each filing. First, check to see if the information in your delinquency notice (cp 403 or cp 406 ) is correct. If a late filing is due to reasonable cause, you can make. See irc section 6652 (e).

Letter To Waive Penalty Charge Request To Waive Penalty Letter

Each plan must be submitted separately. We must receive a request for an extension of the time to file on or before the normal due date of your return. The total penalty for all the filings entered on the calculator will be displayed below the chart. Some plan sponsors, especially those that must have an audit performed, typically file a.

DOL 2022 Penalty Fees Wrangle 5500 ERISA Reporting and Disclosure

Web a form 5500 is typically due seven months following the end of the plan year, without extension. This penalty is only for the filings entered on the calculator. Some plan sponsors, especially those that must have an audit performed, typically file a form 5558 to obtain an extension of that filing deadline. First, check to see if the information.

Form 5500 Is Due by July 31 for Calendar Year Plans

Form 5500ez delinquent filing penalty relief. Web the calculator will determine the number of days late and the penalty for each filing. We must receive a request for an extension of the time to file on or before the normal due date of your return. Each plan must be submitted separately. The total penalty for all the filings entered on.

Filed Form 5500 Late? Here's How to Avoid Penalties

First, check to see if the information in your delinquency notice (cp 403 or cp 406 ) is correct. Penalties for large plans (generally 100 employees and over) are capped at $2,000 for a single late form 5500 and $4,000 for multiple years per plan. Web the penalty notice is cp 283, penalty charged on your form 5500 return. For.

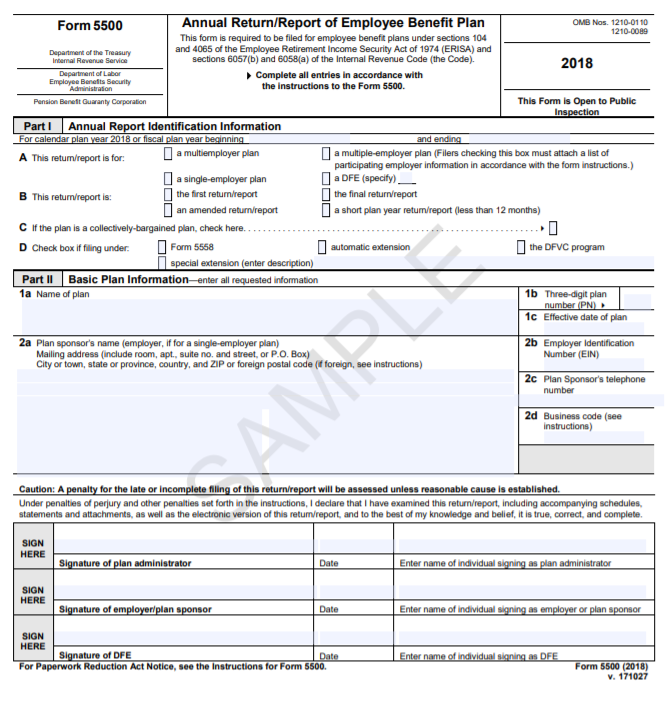

Form 5500 Instructions 5 Steps to Filing Correctly

If a late filing is due to reasonable cause, you can make. For returns required to be filed after december 31, 2019, the penalty for failure to file is increased to $250 a day (up to (150,000). Web generally the dfvcp penalty is capped at $1,500 for most small plans, $4,000 for large plans, and $750 for small 501 (c).

Certain Form 5500 Filing Deadline Extensions Granted by IRS BASIC

For returns required to be filed after december 31, 2019, the penalty for failure to file is increased to $250 a day (up to (150,000). This penalty is only for the filings entered on the calculator. Web the penalty notice is cp 283, penalty charged on your form 5500 return. Web further, penalties for small plans (generally under 100 participants).

Penalty for Late Filing Form 2290 Computer Tech Reviews

If you can resolve an issue in your notice, there may be no penalty. Some plan sponsors, especially those that must have an audit performed, typically file a form 5558 to obtain an extension of that filing deadline. That means that, for a calendar plan year, the due date would be july 31. See irc section 6652 (e). First, check.

Form 5500 Filing A Dangerous Compliance Trap BASIC

First, check to see if the information in your delinquency notice (cp 403 or cp 406 ) is correct. Each plan must be submitted separately. Web a form 5500 is typically due seven months following the end of the plan year, without extension. Department of labor is not responsible for any loss of calculations and data. See irc section 6652.

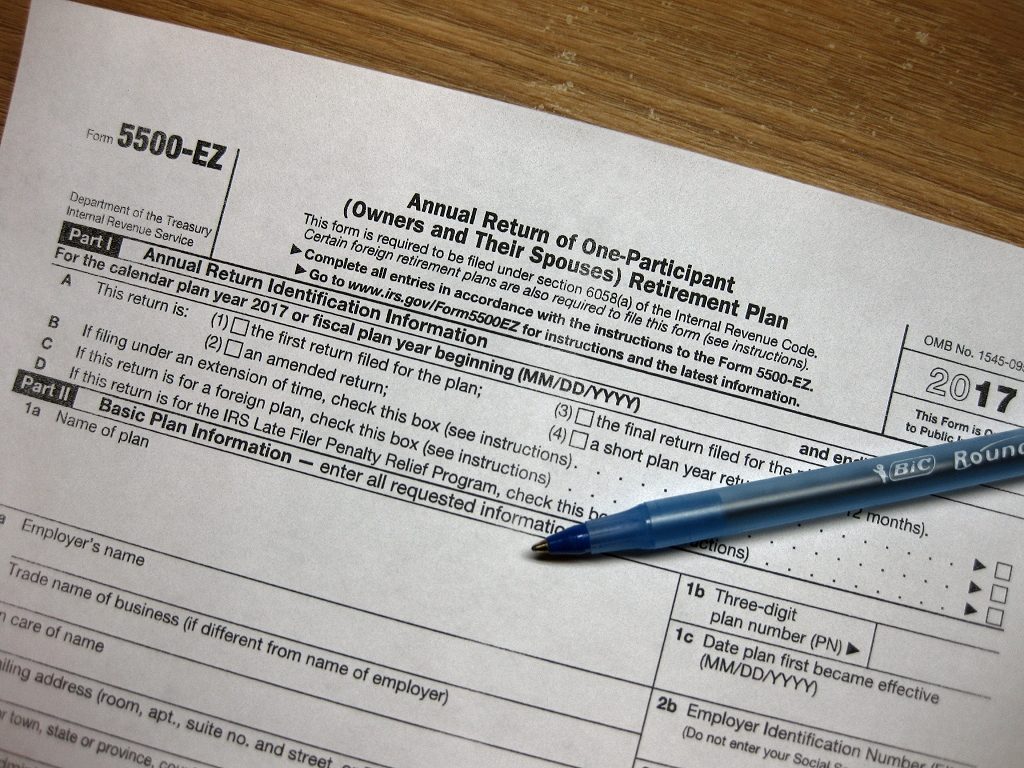

How To File The Form 5500EZ For Your Solo 401k in 2022 Good Money Sense

Web the penalty notice is cp 283, penalty charged on your form 5500 return. That means that, for a calendar plan year, the due date would be july 31. This penalty is only for the filings entered on the calculator. Web further, penalties for small plans (generally under 100 participants) are capped at $750 for a single late form 5500.

Form 5500EZ Edit, Fill, Sign Online Handypdf

Web the penalty notice is cp 283, penalty charged on your form 5500 return. Penalties for large plans (generally 100 employees and over) are capped at $2,000 for a single late form 5500 and $4,000 for multiple years per plan. That means that, for a calendar plan year, the due date would be july 31. Web further, penalties for small.

Department Of Labor Is Not Responsible For Any Loss Of Calculations And Data.

Penalties for large plans (generally 100 employees and over) are capped at $2,000 for a single late form 5500 and $4,000 for multiple years per plan. Web generally the dfvcp penalty is capped at $1,500 for most small plans, $4,000 for large plans, and $750 for small 501 (c) (3) plans. Disclaimer and limitations the u.s. First, check to see if the information in your delinquency notice (cp 403 or cp 406 ) is correct.

This Penalty Is Only For The Filings Entered On The Calculator.

Web the calculator will determine the number of days late and the penalty for each filing. Each plan must be submitted separately. We must receive a request for an extension of the time to file on or before the normal due date of your return. Web a form 5500 is typically due seven months following the end of the plan year, without extension.

The Total Penalty For All The Filings Entered On The Calculator Will Be Displayed Below The Chart.

Web the penalty notice is cp 283, penalty charged on your form 5500 return. Some plan sponsors, especially those that must have an audit performed, typically file a form 5558 to obtain an extension of that filing deadline. If you can resolve an issue in your notice, there may be no penalty. Form 5500ez delinquent filing penalty relief.

For Returns Required To Be Filed After December 31, 2019, The Penalty For Failure To File Is Increased To $250 A Day (Up To (150,000).

See irc section 6652 (e). Web further, penalties for small plans (generally under 100 participants) are capped at $750 for a single late form 5500 and $1,500 for multiple years per plan. That means that, for a calendar plan year, the due date would be july 31. If a late filing is due to reasonable cause, you can make.