Form 5500 Audit Requirements

Form 5500 Audit Requirements - Plan sponsors must generally file the return on the last day of the seventh month after their plan year ends. Web (pbgc) jointly developed the form 5500 series so ebps could use the form 5500 series forms to satisfy annual reporting requirements under title i and title iv of erisa and the irc. Web the form 5500 series is documentation designed to satisfy the annual reporting requirements under title i and title iv of the employee retirement income security act (erisa) and the internal revenue code. Web additionally, technical adjustments were made to the federal register notices to address certain provisions in secure act 2.0 of 2022 on code section 403(b) meps, including peps, minimum required distributions, and audit requirements for plans in dcg reporting arrangements. Web form 5500 audit requirements depend on whether an ebp is considered a large or small plan. Form 5500 filing requirements and instructions updated for 2023 plan years | our insights |. If your total participant count as of the first day of the plan year is less than 100, you generally don’t need to include an audit report with your form 5500. A large plan contains 100 or more participants, requires the completion of schedule h and requires an audit. Web changes to 2023 form 5500 filing requirements could reduce the number of employers who must file the form, thus reducing the number of benefit plan audits. Generally, employee benefit plans with 100 or more participants must include an audit report with form 5500.

Generally, employee benefit plans with 100 or more participants must include an audit report with form 5500. A large plan contains 100 or more participants, requires the completion of schedule h and requires an audit. The form 5500 series is part of erisa’s overall reporting and disclosure framework, which is intended to If your total participant count as of the first day of the plan year is less than 100, you generally don’t need to include an audit report with your form 5500. Web form 5500 audit requirements depend on whether an ebp is considered a large or small plan. Form 5500 filing requirements and instructions updated for 2023 plan years | our insights |. Web (pbgc) jointly developed the form 5500 series so ebps could use the form 5500 series forms to satisfy annual reporting requirements under title i and title iv of erisa and the irc. Web form 5500 requirements. Plan sponsors must generally file the return on the last day of the seventh month after their plan year ends. Web changes to 2023 form 5500 filing requirements could reduce the number of employers who must file the form, thus reducing the number of benefit plan audits.

Web (pbgc) jointly developed the form 5500 series so ebps could use the form 5500 series forms to satisfy annual reporting requirements under title i and title iv of erisa and the irc. Plan sponsors must generally file the return on the last day of the seventh month after their plan year ends. If your total participant count as of the first day of the plan year is less than 100, you generally don’t need to include an audit report with your form 5500. Web changes to 2023 form 5500 filing requirements could reduce the number of employers who must file the form, thus reducing the number of benefit plan audits. Form 5500 filing requirements and instructions updated for 2023 plan years | our insights |. Web additionally, technical adjustments were made to the federal register notices to address certain provisions in secure act 2.0 of 2022 on code section 403(b) meps, including peps, minimum required distributions, and audit requirements for plans in dcg reporting arrangements. Generally, employee benefit plans with 100 or more participants must include an audit report with form 5500. Web form 5500 audit requirements depend on whether an ebp is considered a large or small plan. The form 5500 series is part of erisa’s overall reporting and disclosure framework, which is intended to Web the form 5500 series is documentation designed to satisfy the annual reporting requirements under title i and title iv of the employee retirement income security act (erisa) and the internal revenue code.

5500 Form Audit Warren Averett

Form 5500 filing requirements and instructions updated for 2023 plan years | our insights |. Web the form 5500 series is documentation designed to satisfy the annual reporting requirements under title i and title iv of the employee retirement income security act (erisa) and the internal revenue code. Generally, employee benefit plans with 100 or more participants must include an.

Certain Form 5500 Filing Deadline Extensions Granted by IRS BASIC

If your total participant count as of the first day of the plan year is less than 100, you generally don’t need to include an audit report with your form 5500. The form 5500 series is part of erisa’s overall reporting and disclosure framework, which is intended to Web form 5500 requirements. Generally, employee benefit plans with 100 or more.

10 Questions About Form 5500 and Audit Requirements + 8 Quick Tips

Plan sponsors must generally file the return on the last day of the seventh month after their plan year ends. Web the form 5500 series is documentation designed to satisfy the annual reporting requirements under title i and title iv of the employee retirement income security act (erisa) and the internal revenue code. A large plan contains 100 or more.

Form 5500EZ Example Complete in a Few Easy Steps! [Infographic]

Web form 5500 audit requirements depend on whether an ebp is considered a large or small plan. If your total participant count as of the first day of the plan year is less than 100, you generally don’t need to include an audit report with your form 5500. Form 5500 filing requirements and instructions updated for 2023 plan years |.

How to File Form 5500EZ Solo 401k

If your total participant count as of the first day of the plan year is less than 100, you generally don’t need to include an audit report with your form 5500. Web changes to 2023 form 5500 filing requirements could reduce the number of employers who must file the form, thus reducing the number of benefit plan audits. The form.

New Compliance Requirements Impacting Form 5500 Johnson Lambert LLP

Plan sponsors must generally file the return on the last day of the seventh month after their plan year ends. If your total participant count as of the first day of the plan year is less than 100, you generally don’t need to include an audit report with your form 5500. Web additionally, technical adjustments were made to the federal.

What You Need to Know About Form 5500 Small Business 401k

Web the form 5500 series is documentation designed to satisfy the annual reporting requirements under title i and title iv of the employee retirement income security act (erisa) and the internal revenue code. Web form 5500 audit requirements depend on whether an ebp is considered a large or small plan. Web changes to 2023 form 5500 filing requirements could reduce.

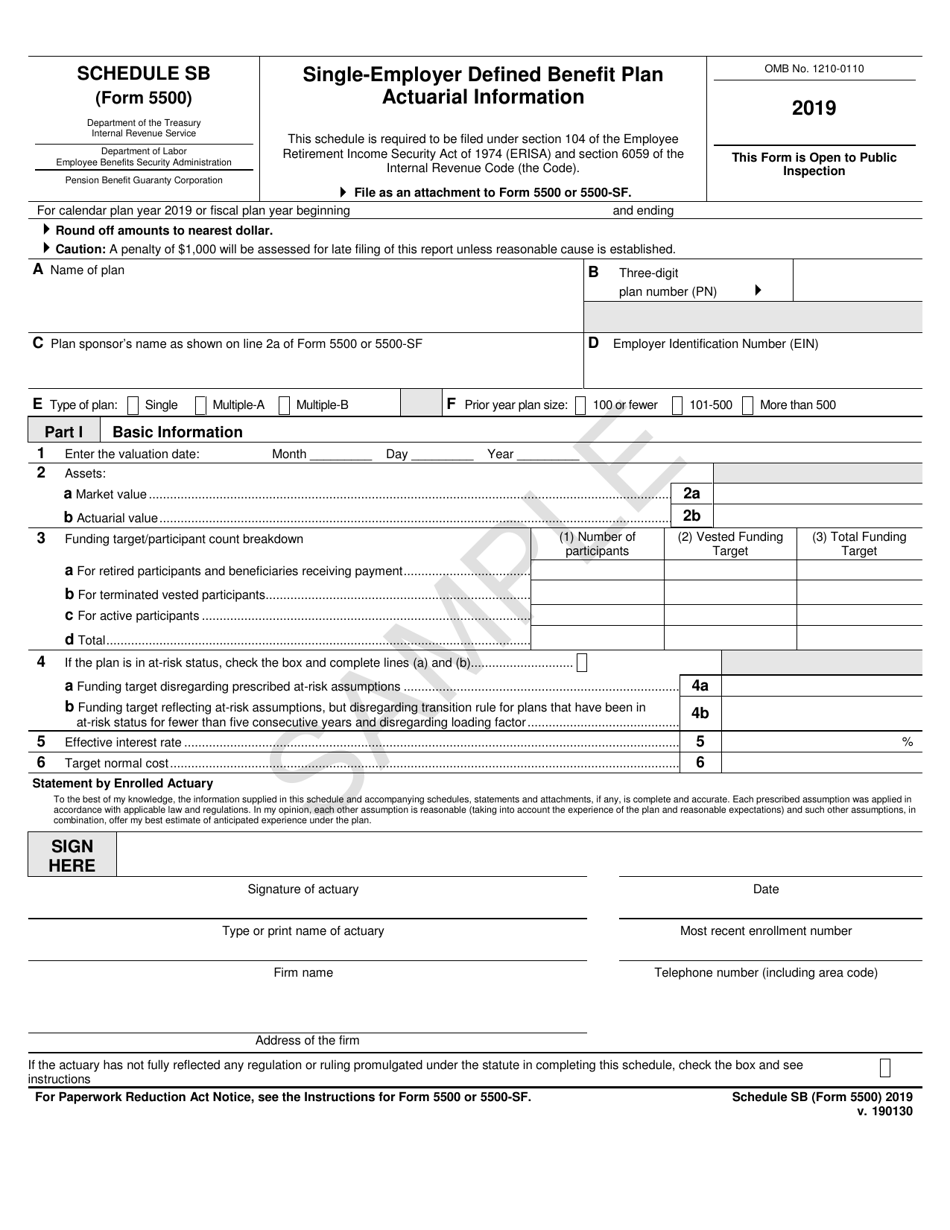

IRS Form 5500 Schedule SB Download Fillable PDF or Fill Online Single

Web additionally, technical adjustments were made to the federal register notices to address certain provisions in secure act 2.0 of 2022 on code section 403(b) meps, including peps, minimum required distributions, and audit requirements for plans in dcg reporting arrangements. Web form 5500 requirements. Web the form 5500 series is documentation designed to satisfy the annual reporting requirements under title.

Form 5500 Tips to Avoid Employee Benefit Plan Audit RKL LLP

The form 5500 series is part of erisa’s overall reporting and disclosure framework, which is intended to Web the form 5500 series is documentation designed to satisfy the annual reporting requirements under title i and title iv of the employee retirement income security act (erisa) and the internal revenue code. If your total participant count as of the first day.

Form 5500 Pdf Fillable and Editable PDF Template

Generally, employee benefit plans with 100 or more participants must include an audit report with form 5500. Web additionally, technical adjustments were made to the federal register notices to address certain provisions in secure act 2.0 of 2022 on code section 403(b) meps, including peps, minimum required distributions, and audit requirements for plans in dcg reporting arrangements. Web form 5500.

Web Changes To 2023 Form 5500 Filing Requirements Could Reduce The Number Of Employers Who Must File The Form, Thus Reducing The Number Of Benefit Plan Audits.

Plan sponsors must generally file the return on the last day of the seventh month after their plan year ends. If your total participant count as of the first day of the plan year is less than 100, you generally don’t need to include an audit report with your form 5500. Web the form 5500 series is documentation designed to satisfy the annual reporting requirements under title i and title iv of the employee retirement income security act (erisa) and the internal revenue code. Generally, employee benefit plans with 100 or more participants must include an audit report with form 5500.

Web (Pbgc) Jointly Developed The Form 5500 Series So Ebps Could Use The Form 5500 Series Forms To Satisfy Annual Reporting Requirements Under Title I And Title Iv Of Erisa And The Irc.

Form 5500 filing requirements and instructions updated for 2023 plan years | our insights |. The form 5500 series is part of erisa’s overall reporting and disclosure framework, which is intended to Web additionally, technical adjustments were made to the federal register notices to address certain provisions in secure act 2.0 of 2022 on code section 403(b) meps, including peps, minimum required distributions, and audit requirements for plans in dcg reporting arrangements. A large plan contains 100 or more participants, requires the completion of schedule h and requires an audit.

Web Form 5500 Audit Requirements Depend On Whether An Ebp Is Considered A Large Or Small Plan.

Web form 5500 requirements.

![Form 5500EZ Example Complete in a Few Easy Steps! [Infographic]](http://www.emparion.com/wp-content/uploads/2018/05/5500ez-part-2.png)