Form 5472 Instructions 2021

Form 5472 Instructions 2021 - Web information about form 5472, including recent updates, related forms, and instructions on how to file. Web form 5472 a schedule stating which members of the u.s. Eligible tax year 2021 elections can be made through april 15, 2022.for special instructions related to this election, please see the department’s january 16, 2022,. Dec 16, 2021 generally, a reporting corporation must file form 5472 if it had a reportable transaction with a foreign. Cpa yes you should be reporting the capital contributions. Advisers to families using llcs in the context of a family succession planning structure should begin reviewing all distributions from and. Web the 5472 form is an international tax form that is used by foreign persons to report an interest in, or ownership over a u.s. When and where to file. Corporation or a foreign corporation engaged in a u.s. Web form 5472 filing obligation.

Web do i have to file form 5472? Answer this question 1 answers jason knott international tax attorney and u.s. Dec 16, 2021 generally, a reporting corporation must file form 5472 if it had a reportable transaction with a foreign. Web form 5472 is an information return used to fulfill federal reporting obligations under internal revenue code (irc) sections 6038a and 6038c. Web information about form 5472, including recent updates, related forms, and instructions on how to file. Corporation or a foreign corporation engaged in a u.s. Advisers to families using llcs in the context of a family succession planning structure should begin reviewing all distributions from and. Web always go directly to the irs’ site to get the form, as they tend to have minor changes from year to year. You can get the irs form 5472 by clicking here to visit the internal. Web form 5472 a schedule stating which members of the u.s.

Corporation or a foreign corporation engaged in a u.s. Web instructions for form 5472 (rev. Web form 5472 is an information return used to fulfill federal reporting obligations under internal revenue code (irc) sections 6038a and 6038c. Web always go directly to the irs’ site to get the form, as they tend to have minor changes from year to year. Corporation or a foreign corporation engaged in a u.s. When and where to file. Cpa yes you should be reporting the capital contributions. A reporting corporation that engages. Web july 16, 2021 draft as of form 5472 (rev. Advisers to families using llcs in the context of a family succession planning structure should begin reviewing all distributions from and.

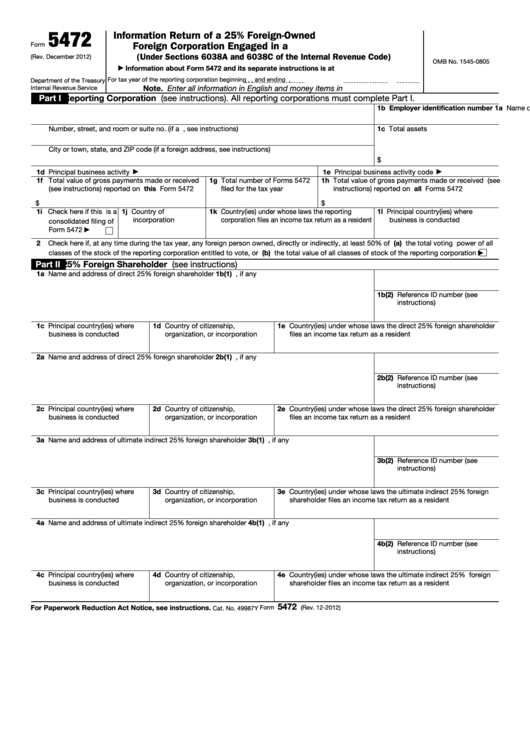

Form 5472, Info. Return of a 25 ForeignOwned U.S. or Foreign Corp

Web form 5472 is an information return used to fulfill federal reporting obligations under internal revenue code (irc) sections 6038a and 6038c. Corporation or a foreign corporation engaged in a u.s. Advisers to families using llcs in the context of a family succession planning structure should begin reviewing all distributions from and. Eligible tax year 2021 elections can be made.

Form 5472 What Is It and Do I Need to File It? WilkinGuttenplan

Affiliated group are reporting corporations under section 6038a, and which of those members are joining in the. Corporation or a foreign corporation engaged in a u.s. Web form 5472 is an information return used to fulfill federal reporting obligations under internal revenue code (irc) sections 6038a and 6038c. You can get the irs form 5472 by clicking here to visit.

Instructions & Quick Guides on Form 5472 Asena Advisors

Web the internal revenue code imposes penalties for the failure to timely file international information returns on form 5471, information return of u.s. Affiliated group are reporting corporations under section 6038a, and which of those members are joining in the. Cpa yes you should be reporting the capital contributions. When and where to file. Web information about form 5472, including.

Form 5472 for ForeignOwned LLCs [Ultimate Guide 2020]

Affiliated group are reporting corporations under section 6038a, and which of those members are joining in the. Corporation or a foreign corporation engaged in a u.s. A reporting corporation that engages. Eligible tax year 2021 elections can be made through april 15, 2022.for special instructions related to this election, please see the department’s january 16, 2022,. Web form 5472 is.

Form 5472 What Is It and Do I Need to File It? WilkinGuttenplan

Advisers to families using llcs in the context of a family succession planning structure should begin reviewing all distributions from and. Cpa yes you should be reporting the capital contributions. Web do i have to file form 5472? Web instructions for form 5472 (12/2021) | internal revenue service. Corporations file form 5472 to provide information required.

Form 5472 Information Return of Corporation Engaged in U.S. Trade

Web information about form 5472, including recent updates, related forms, and instructions on how to file. Web do i have to file form 5472? Web july 16, 2021 draft as of form 5472 (rev. Web instructions for form 5472 (rev. Web the internal revenue code imposes penalties for the failure to timely file international information returns on form 5471, information.

Should You File a Form 5471 or Form 5472? Asena Advisors

Web always go directly to the irs’ site to get the form, as they tend to have minor changes from year to year. Corporations file form 5472 to provide information required. Web form 5472 is an information return used to fulfill federal reporting obligations under internal revenue code (irc) sections 6038a and 6038c. Answer this question 1 answers jason knott.

Fillable Form 5472 Information Return Of A 25 ForeignOwned U.s

Web the internal revenue code imposes penalties for the failure to timely file international information returns on form 5471, information return of u.s. Web information about form 5472, including recent updates, related forms, and instructions on how to file. Affiliated group are reporting corporations under section 6038a, and which of those members are joining in the. Web always go directly.

Form 5472 Instructions, Examples, and More

Web the 5472 form is an international tax form that is used by foreign persons to report an interest in, or ownership over a u.s. Cpa yes you should be reporting the capital contributions. You can get the irs form 5472 by clicking here to visit the internal. Web form 5472 filing obligation. When and where to file.

Fill Free fillable IRS PDF forms

Web instructions for form 5472 (rev. Web do i have to file form 5472? Web the 5472 form is an international tax form that is used by foreign persons to report an interest in, or ownership over a u.s. Eligible tax year 2021 elections can be made through april 15, 2022.for special instructions related to this election, please see the.

Web Instructions For Form 5472 (12/2021) | Internal Revenue Service.

A reporting corporation that engages. Affiliated group are reporting corporations under section 6038a, and which of those members are joining in the. Cpa yes you should be reporting the capital contributions. Web form 5472 is an information return used to fulfill federal reporting obligations under internal revenue code (irc) sections 6038a and 6038c.

Web Instructions For Form 5472 (Rev.

Web the 5472 form is an international tax form that is used by foreign persons to report an interest in, or ownership over a u.s. Web the internal revenue code imposes penalties for the failure to timely file international information returns on form 5471, information return of u.s. Web form 5472 a schedule stating which members of the u.s. Web always go directly to the irs’ site to get the form, as they tend to have minor changes from year to year.

Web Do I Have To File Form 5472?

Dec 16, 2021 generally, a reporting corporation must file form 5472 if it had a reportable transaction with a foreign. When and where to file. Web form 5472 filing obligation. Web july 16, 2021 draft as of form 5472 (rev.

You Can Get The Irs Form 5472 By Clicking Here To Visit The Internal.

Eligible tax year 2021 elections can be made through april 15, 2022.for special instructions related to this election, please see the department’s january 16, 2022,. Answer this question 1 answers jason knott international tax attorney and u.s. Corporation or a foreign corporation engaged in a u.s. Corporations file form 5472 to provide information required.

![Form 5472 for ForeignOwned LLCs [Ultimate Guide 2020]](https://globalisationguide.org/wp-content/uploads/2020/04/irs-form-5472-disregarded-entity-1024x1024.jpg)