Form 5471 Sch G

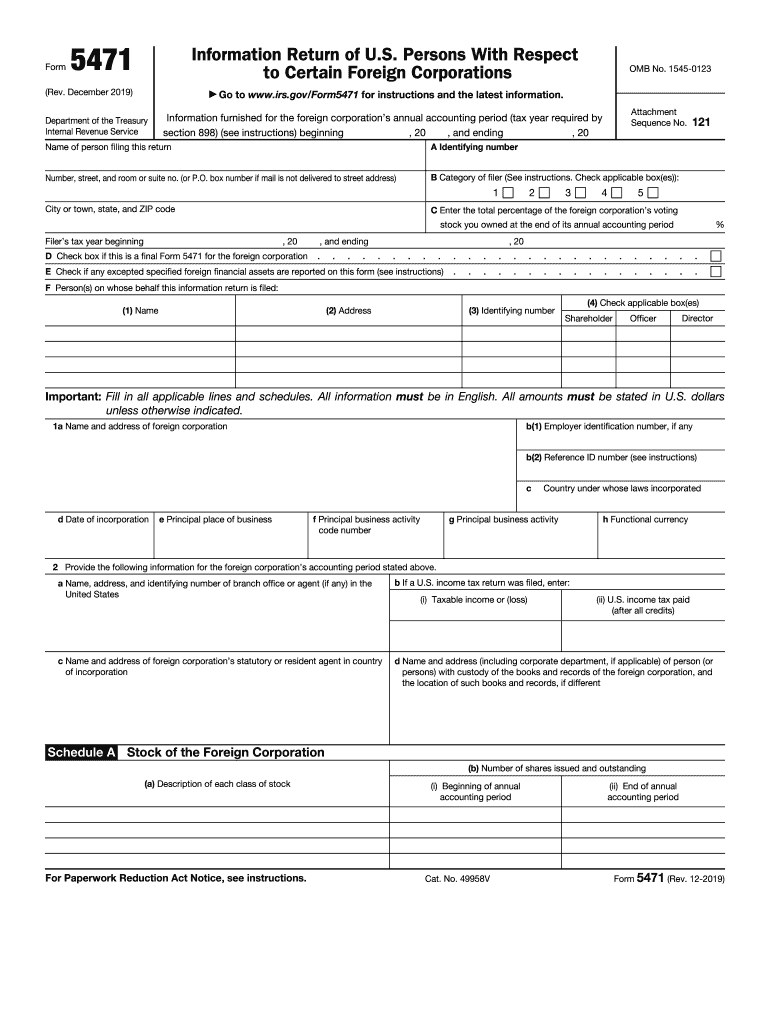

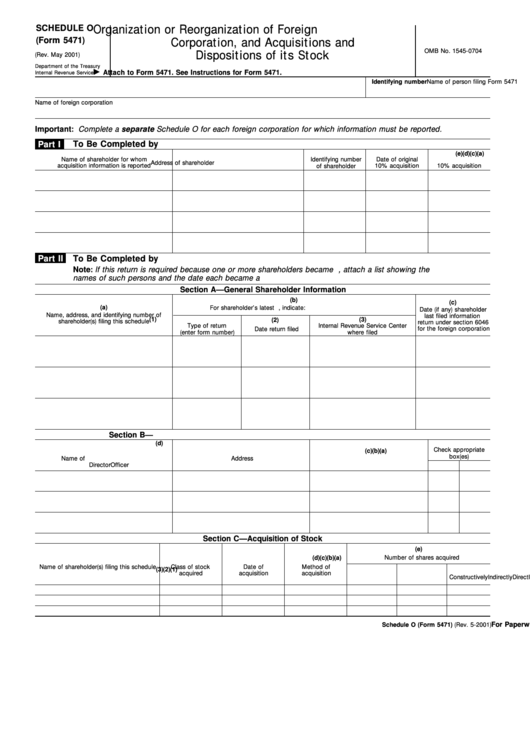

Form 5471 Sch G - Web a form 5471 must be by certain u.s. The sample form 5471 covered in this playlist is for a u.s. Web form 5471, information return of u.s. Web the irs form 5471 is filed by u.s. Persons that have an interest in a controlled foreign corporation (cfc). Solved • by intuit • proconnect tax • 2 • updated december 14, 2022. Web form 5471 is an “ information return of u.s. If the answer to question 7 is “yes,” complete. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; E organization or reorganization of foreign corporation stock.

The following are irs business rules for electronically filing form 5471: What is it, how to file it, & when do you have. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Web how to generate form 5471 in proconnect tax. Persons with respect to certain foreign corporations, is designed to report the activities of the foreign corporation and to function. Persons who are officers, directors, or shareholders in respect of certain foreign entities that are classified as corporations for u.s. Information return for foreign corporation 2023. Web form 5471 is an “ information return of u.s. Web the course will also cover the information reported in schedule c (income statement) and schedule f (balance sheet) of form 5471 as well as an overview of the relevant u.s. This article will help you generate.

If the answer to question 7 is “yes,” complete. The sample form 5471 covered in this playlist is for a u.s. Persons who are officers, directors, or shareholders in respect of certain foreign entities that are classified as corporations for u.s. The december 2021 revision of separate. Web check the box if this form 5471 has been completed using “alternative information” under rev. This article will help you generate. Information return for foreign corporation 2023. Web follow these steps to generate and complete form 5471 in the program: What is it, how to file it, & when do you have. Web on page 5 of form 5471, two new questions have been added to schedule g.

IRS Form 5471 Carries Heavy Penalties and Consequences

Web instructions for form 5471(rev. Information return for foreign corporation 2023. What is it, how to file it, & when do you have. Web a form 5471 must be by certain u.s. The december 2021 revision of separate.

Demystifying the Form 5471 Part 9. Schedule G SF Tax Counsel

Web form 5471 is an “ information return of u.s. Web a form 5471 must be by certain u.s. New question 22a asks if any extraordinary reduction with respect to a controlling section. Solved • by intuit • proconnect tax • 2 • updated december 14, 2022. The sample form 5471 covered in this playlist is for a u.s.

The Tax Times New Form 5471, Sch Q You Really Need to Understand

Solved • by intuit • proconnect tax • 2 • updated december 14, 2022. Web and today, we're going to give you an overview of the form 5471. If the answer to question 7 is “yes,” complete. Web a form 5471 must be by certain u.s. Web the course will also cover the information reported in schedule c (income statement).

A Dive into the New Form 5471 Categories of Filers and the Schedule R

Web and today, we're going to give you an overview of the form 5471. Web check the box if this form 5471 has been completed using “alternative information” under rev. Web the course will also cover the information reported in schedule c (income statement) and schedule f (balance sheet) of form 5471 as well as an overview of the relevant.

Form 5471 2018 Fill out & sign online DocHub

Web the course will also cover the information reported in schedule c (income statement) and schedule f (balance sheet) of form 5471 as well as an overview of the relevant u.s. Web follow these steps to generate and complete form 5471 in the program: This article will help you generate. Web form 5471 is an “ information return of u.s..

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

Web check the box if this form 5471 has been completed using “alternative information” under rev. Web the irs form 5471 is filed by u.s. The following are irs business rules for electronically filing form 5471: Solved • by intuit • proconnect tax • 2 • updated december 14, 2022. January 2023) (use with the december 2022 revision of form.

form 5471 schedule j instructions 2022 Fill Online, Printable

Web the course will also cover the information reported in schedule c (income statement) and schedule f (balance sheet) of form 5471 as well as an overview of the relevant u.s. Web a form 5471 must be by certain u.s. Web instructions for form 5471(rev. Web check the box if this form 5471 has been completed using “alternative information” under.

Fillable Form 5471 (Schedule O), (Rev. May 2001) Organization Or

The december 2021 revision of separate. Web the course will also cover the information reported in schedule c (income statement) and schedule f (balance sheet) of form 5471 as well as an overview of the relevant u.s. Information return for foreign corporation 2023. Web form 5471, information return of u.s. Web on page 5 of form 5471, two new questions.

Form 5471 Schedule J Instructions 2019 cloudshareinfo

Web a form 5471 must be by certain u.s. E organization or reorganization of foreign corporation stock. For this portion of the discussion, we're going to be discussing the purpose of form. The following are irs business rules for electronically filing form 5471: The december 2021 revision of separate.

IRS Issues Updated New Form 5471 What's New?

Information return for foreign corporation 2023. Web and today, we're going to give you an overview of the form 5471. So let's jump right into it. Solved • by intuit • proconnect tax • 2 • updated december 14, 2022. Persons who are officers, directors, or shareholders in respect of certain foreign entities that are classified as corporations for u.s.

This Article Will Help You Generate.

Web how to generate form 5471 in proconnect tax. The sample form 5471 covered in this playlist is for a u.s. Web form 5471, information return of u.s. Persons with respect to certain foreign corporations.” in translation, it is a form that some taxpayers use to.

Web Form 5471 Is An “ Information Return Of U.s.

New question 22a asks if any extraordinary reduction with respect to a controlling section. What is it, how to file it, & when do you have. Web check the box if this form 5471 has been completed using “alternative information” under rev. The december 2021 revision of separate.

Solved • By Intuit • Proconnect Tax • 2 • Updated December 14, 2022.

Persons who are officers, directors, or shareholders in respect of certain foreign entities that are classified as corporations for u.s. Persons with respect to certain foreign corporations, is designed to report the activities of the foreign corporation and to function. So let's jump right into it. Persons that have an interest in a controlled foreign corporation (cfc).

Web Instructions For Form 5471(Rev.

If the answer to question 7 is “yes,” complete. Web the course will also cover the information reported in schedule c (income statement) and schedule f (balance sheet) of form 5471 as well as an overview of the relevant u.s. Web follow these steps to generate and complete form 5471 in the program: Information return for foreign corporation 2023.