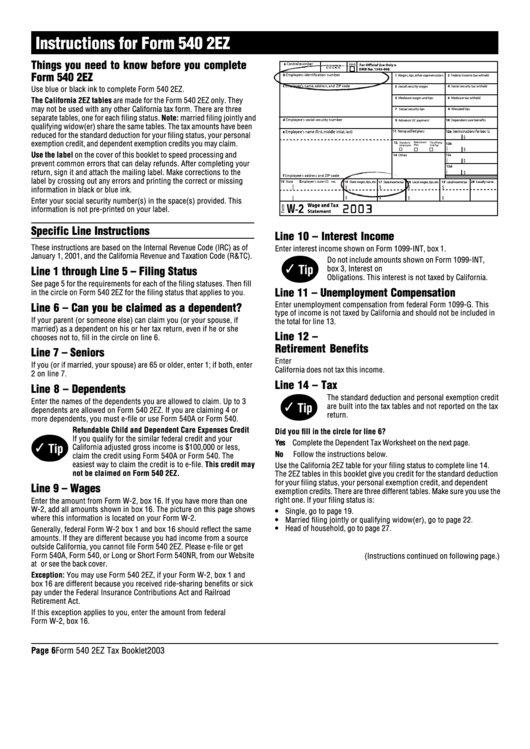

Form 540 2Ez Instructions

Form 540 2Ez Instructions - Pick the template from the library. Web adhere to our simple steps to get your california state tax form 540ez instructions well prepared quickly: Web head of household qualifying surviving spouse/rdp with dependent child * california taxable income enter line 19 of 2022 form 540 or form 540nr caution: This form is for income earned in tax year 2022, with tax returns due in april. Web january 1, 2015, things you need to know before you complete form 540 2ez determine if you qualify to use form 540 2ez. Web january 1, 2015, things you need to know before you complete form 540 2ez determine if you qualify to use form 540 2ez. References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and the california revenue and. This form is for income earned in tax year 2022, with tax returns due in april. See “qualifying to use form 540 2ez” on. Enter all necessary information in.

Web adhere to our simple steps to get your california state tax form 540ez instructions well prepared quickly: Citizens of the state with moderate incomes and few deductions can save. Web 540 california resident income tax return form 540pdf download form 540 booklet 540 2ez california resident income tax return form 540 2ezpdf download form 540. Web the 540 2ez is a simplified california state tax form for residents who meet certain filing requirements. Web 540 2ez california resident income tax return. See “qualifying to use form 540 2ez” on. This form is for income earned in tax year 2022, with tax returns due in april. This form is for income earned in tax year 2022, with tax returns due in april. Web january 1, 2015, things you need to know before you complete form 540 2ez determine if you qualify to use form 540 2ez. Web january 1, 2015, things you need to know before you complete form 540 2ez determine if you qualify to use form 540 2ez.

Web 2019 instructions for form 540 2ez. Web for example, a single individual, under the age of 65 years, with no dependents and who cannot be claimed by another person, must fi le a pit return if the fi ler’s gross income. References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and the california revenue and. Web head of household qualifying surviving spouse/rdp with dependent child * california taxable income enter line 19 of 2022 form 540 or form 540nr caution: Web 540 2ez california resident income tax return. Web even if he or she chooses not to, you must see the instructions. See “qualifying to use form 540 2ez” on. If your california filing status is different from your federal. This form is for income earned in tax year 2022, with tax returns due in april. Web january 1, 2015, things you need to know before you complete form 540 2ez determine if you qualify to use form 540 2ez.

Instructions For Form 540 2ez California Resident Tax Return

Enter all necessary information in. If your california filing status is different from your federal. Web even if he or she chooses not to, you must see the instructions. Web january 1, 2015, things you need to know before you complete form 540 2ez determine if you qualify to use form 540 2ez. See “qualifying to use form 540 2ez”.

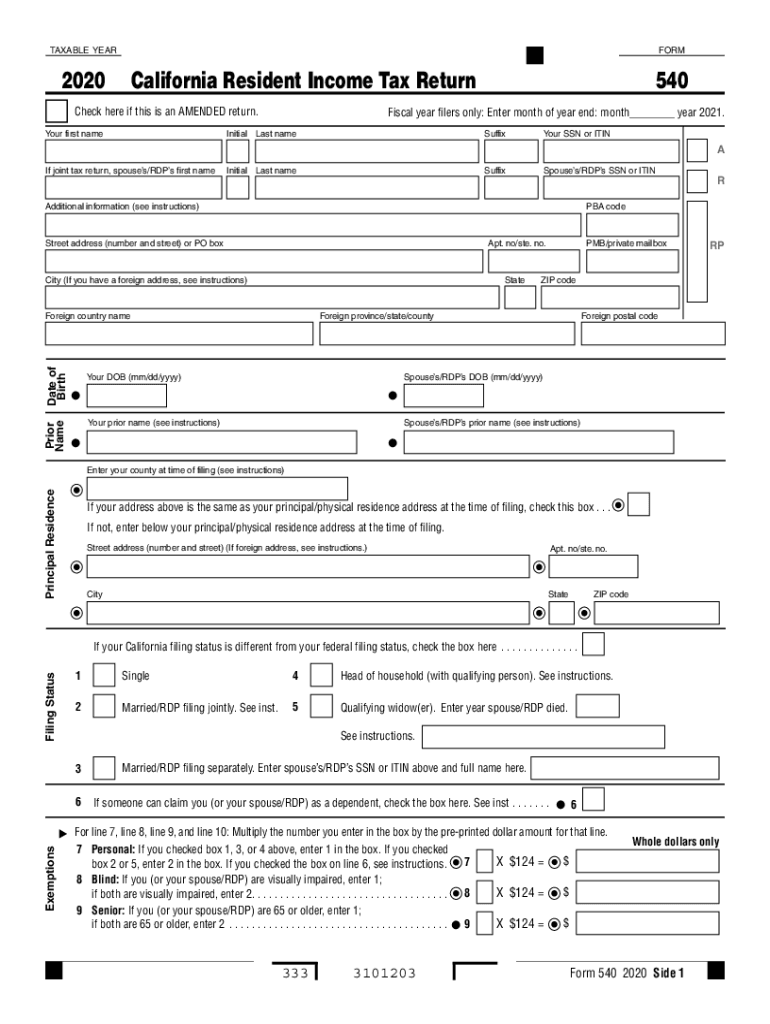

20202022 Form CA 540 2EZ Tax Booklet Fill Online, Printable, Fillable

Citizens of the state with moderate incomes and few deductions can save. Web adhere to our simple steps to get your california state tax form 540ez instructions well prepared quickly: If your california filing status is different from your federal. Things you need to know before you complete. See “qualifying to use form 540 2ez” on.

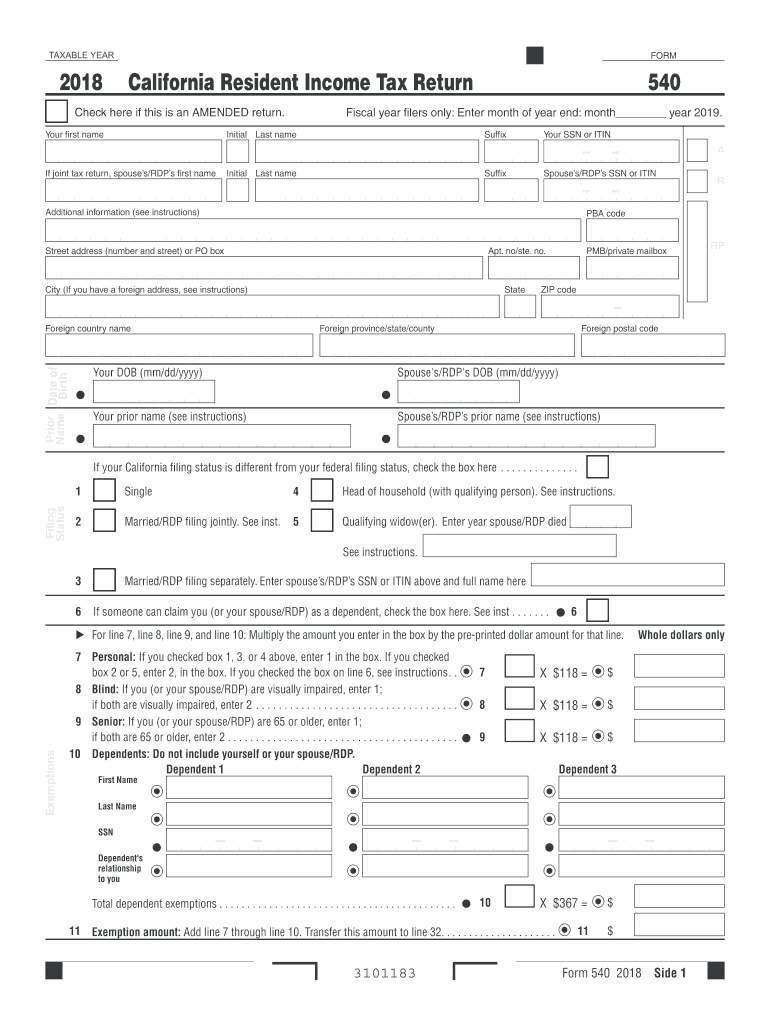

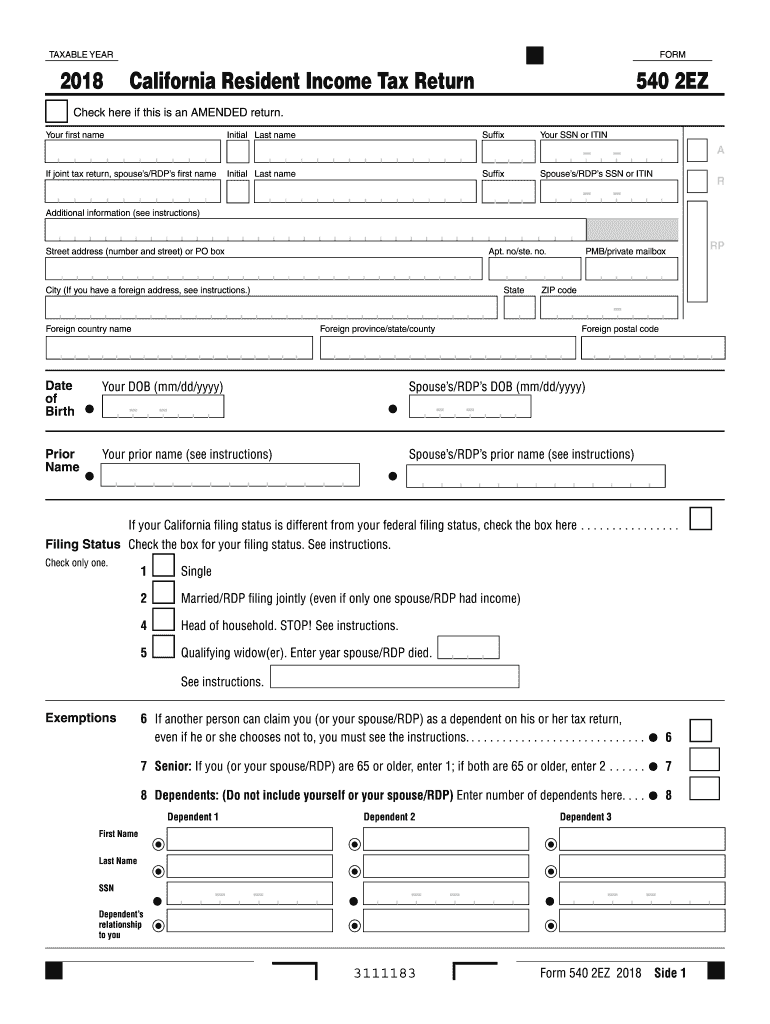

2018 Form CA FTB 540 Fill Online, Printable, Fillable, Blank pdfFiller

Web january 1, 2015, things you need to know before you complete form 540 2ez determine if you qualify to use form 540 2ez. This form is for income earned in tax year 2022, with tax returns due in april. 5 m qualifying widow(er) with dependent child. Web 2019 instructions for form 540 2ez. See “qualifying to use form 540.

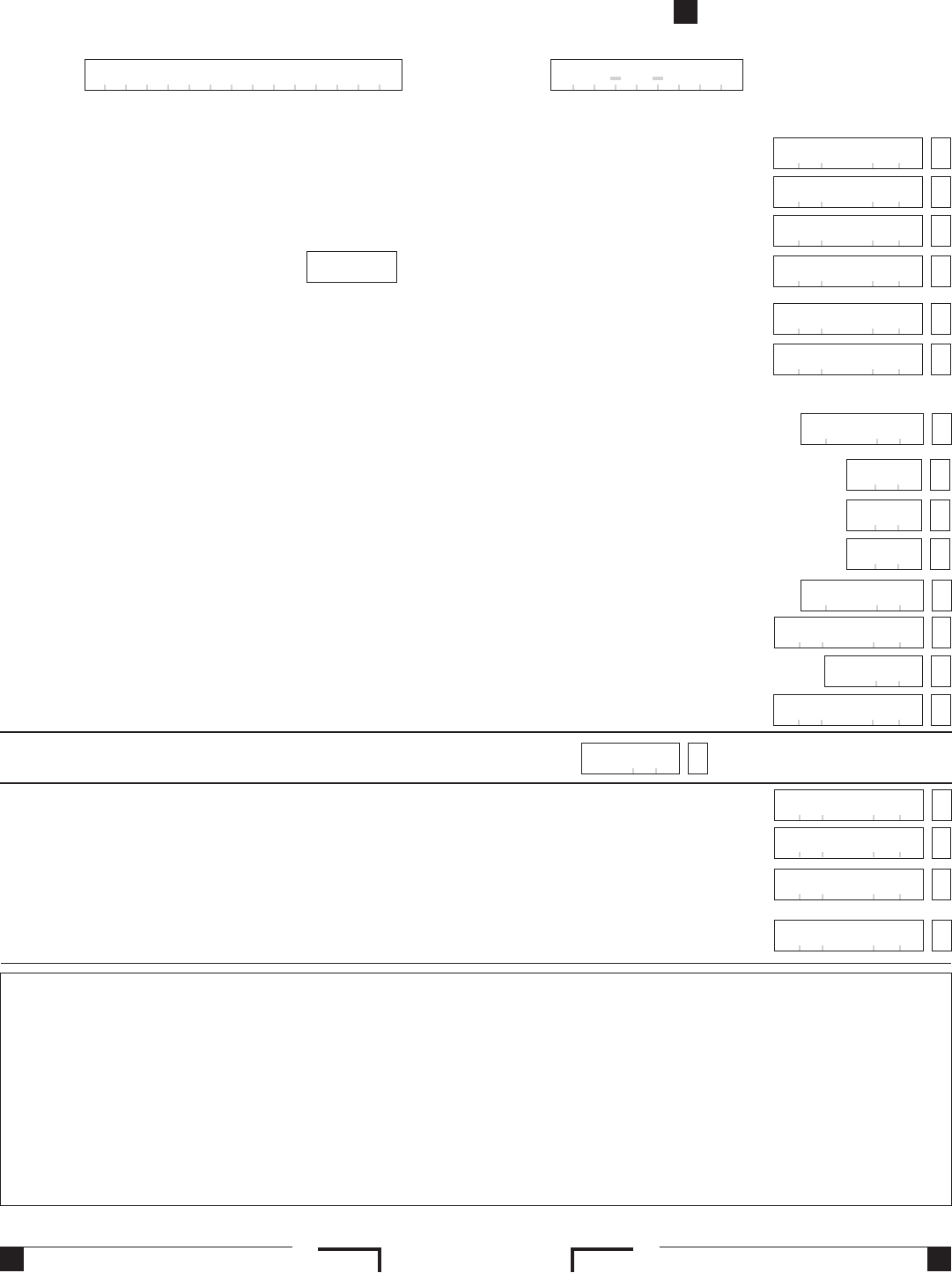

CA FTB 540 20202022 Fill out Tax Template Online US Legal Forms

Things you need to know before you complete. Web adhere to our simple steps to get your california state tax form 540ez instructions well prepared quickly: Web january 1, 2015, things you need to know before you complete form 540 2ez determine if you qualify to use form 540 2ez. See “qualifying to use form 540 2ez” on. This form.

2015 California Resident Tax Return Form 540 2Ez Edit, Fill

References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and the california revenue and. Web for example, a single individual, under the age of 65 years, with no dependents and who cannot be claimed by another person, must fi le a pit return if the fi ler’s gross income. See “qualifying to use.

Form 540 2ez Fill Out and Sign Printable PDF Template signNow

See “qualifying to use form 540 2ez” on. Things you need to know before you complete. This form is for income earned in tax year 2022, with tax returns due in april. Web january 1, 2015, things you need to know before you complete form 540 2ez determine if you qualify to use form 540 2ez. See “qualifying to use.

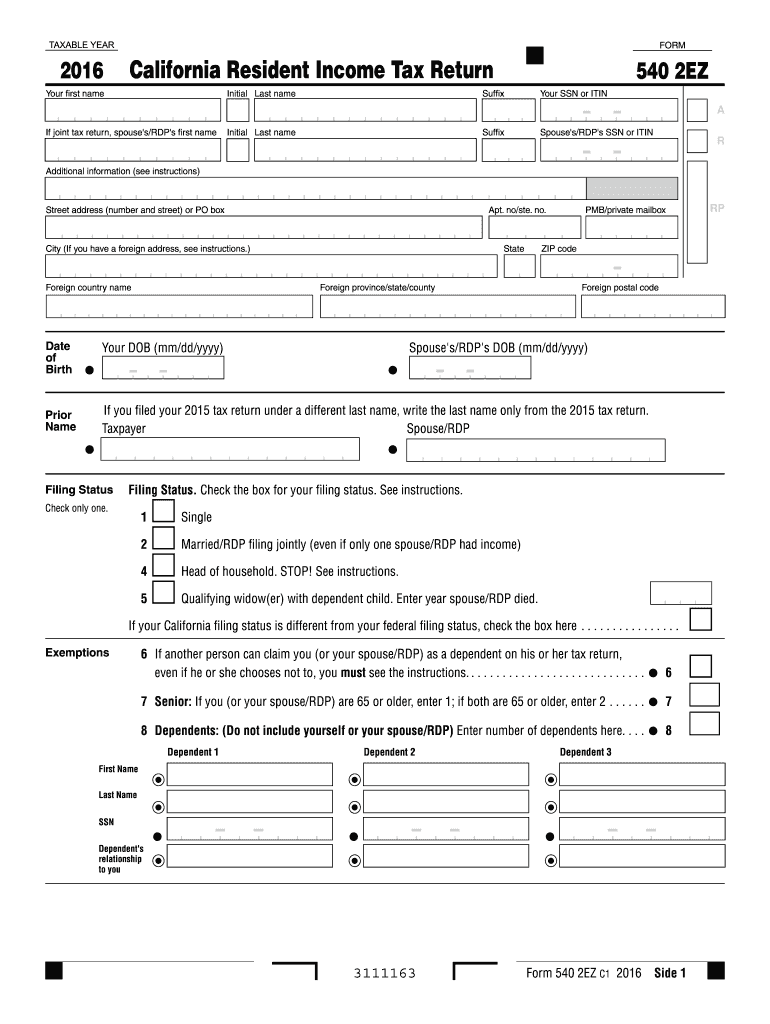

2018 Form CA FTB 540 2EZ Fill Online, Printable, Fillable, Blank

Pick the template from the library. If your california filing status is different from your federal. Web 540 2ez california resident income tax return. Single married/rdp filing jointly (even if only one spouse/rdp had income) filing status. See “qualifying to use form 540 2ez” on.

CA FTB 540NR Short 2018 Fill out Tax Template Online US Legal Forms

Web january 1, 2015, things you need to know before you complete form 540 2ez determine if you qualify to use form 540 2ez. Citizens of the state with moderate incomes and few deductions can save. Web head of household qualifying surviving spouse/rdp with dependent child * california taxable income enter line 19 of 2022 form 540 or form 540nr.

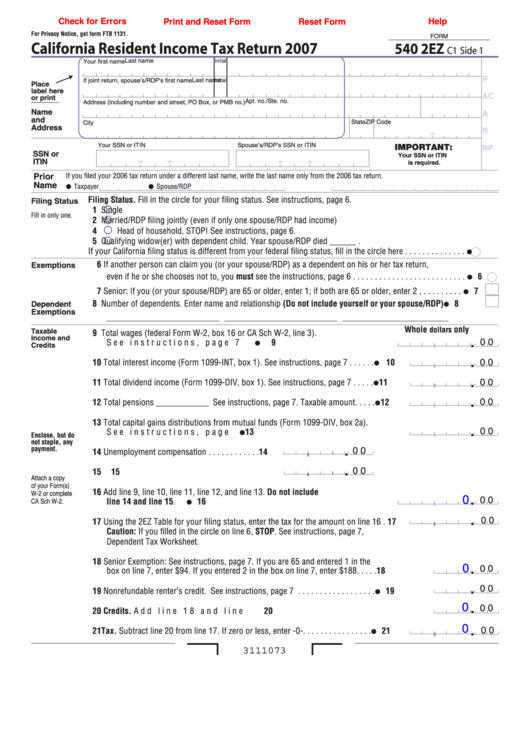

Fillable Form 540 2ez California Resident Tax Return 2007

Web adhere to our simple steps to get your california state tax form 540ez instructions well prepared quickly: Citizens of the state with moderate incomes and few deductions can save. This form is for income earned in tax year 2022, with tax returns due in april. References in these instructions are to the internal revenue code (irc) as of january.

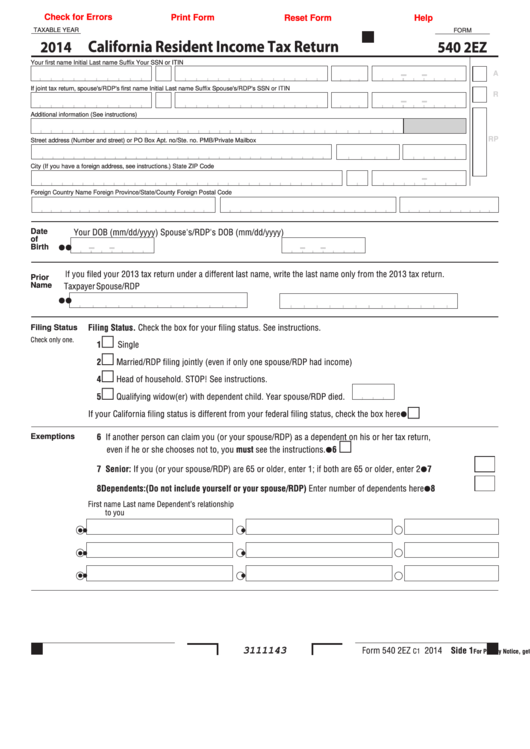

Fillable Form 540 2ez California Resident Tax Return 2014

References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and the california revenue and. Citizens of the state with moderate incomes and few deductions can save. Enter all necessary information in. Web january 1, 2015, things you need to know before you complete form 540 2ez determine if you qualify to use form.

Web 540 California Resident Income Tax Return Form 540Pdf Download Form 540 Booklet 540 2Ez California Resident Income Tax Return Form 540 2Ezpdf Download Form 540.

Single married/rdp filing jointly (even if only one spouse/rdp had income) filing status. Citizens of the state with moderate incomes and few deductions can save. Web 540 2ez california resident income tax return. Web january 1, 2015, things you need to know before you complete form 540 2ez determine if you qualify to use form 540 2ez.

Web January 1, 2015, Things You Need To Know Before You Complete Form 540 2Ez Determine If You Qualify To Use Form 540 2Ez.

If your california filing status is different from your federal. Web january 1, 2015, things you need to know before you complete form 540 2ez determine if you qualify to use form 540 2ez. Web adhere to our simple steps to get your california state tax form 540ez instructions well prepared quickly: Pick the template from the library.

Web Even If He Or She Chooses Not To, You Must See The Instructions.

See “qualifying to use form 540 2ez” on. Web 2019 instructions for form 540 2ez. Things you need to know before you complete. This form is for income earned in tax year 2022, with tax returns due in april.

Web Head Of Household Qualifying Surviving Spouse/Rdp With Dependent Child * California Taxable Income Enter Line 19 Of 2022 Form 540 Or Form 540Nr Caution:

References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and the california revenue and. Web for example, a single individual, under the age of 65 years, with no dependents and who cannot be claimed by another person, must fi le a pit return if the fi ler’s gross income. Web the 540 2ez is a simplified california state tax form for residents who meet certain filing requirements. This form is for income earned in tax year 2022, with tax returns due in april.