Form 5329 Exceptions

Form 5329 Exceptions - Web form 5329 exceptions and their codes for iras are: Qualified retirement plan distributions (doesn’t apply to iras) you receive. The table below explains exceptions to form 5329, additional tax on early distributions, to assist you with entering this information in proseries. Web what is form 5329? Web exceptions to the 10% additional tax apply to an early distribution from a traditional or roth ira that is: Made to a beneficiary or estate on account of the ira owner's death made because you're totally and permanently disabled Your life or life expectancy the joint lives or joint life expectancies of you and your designated beneficiary These distributions must be for: 1 early distributions includible in income (see instructions). Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas.

Web exceptions to the 10% additional tax apply to an early distribution from a traditional or roth ira that is: There are some exceptions to early withdrawal penalty codes on form 5329. Distributions made as part of a series of substantially equal periodic payments (made at. Qualified retirement plan distributions (doesn’t apply to iras) you receive. The table below explains exceptions to form 5329, additional tax on early distributions, to assist you with entering this information in proseries. Separation from service after age 55: Web what is form 5329? You may need this form in three situations: Web you may also have to complete this part to indicate that you qualify for an exception to the additional tax on early distributions or for certain roth ira distributions. Web solved•by intuit17•updated december 21, 2022.

Refer to the irs instructions for form 5329 for more information. Use the corresponding number to indicate which exception you are claiming: 1 early distributions includible in income (see instructions). These distributions must be for: For roth ira distributions, see instructions. Web solved•by intuit17•updated december 21, 2022. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. 02 — distributions made as part of a series of substantially equal periodic payments — made at least annually. There are some exceptions to early withdrawal penalty codes on form 5329. You may need this form in three situations:

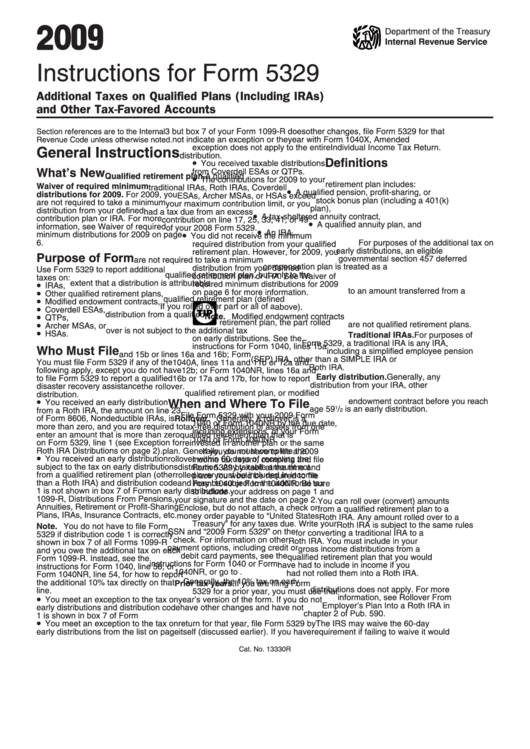

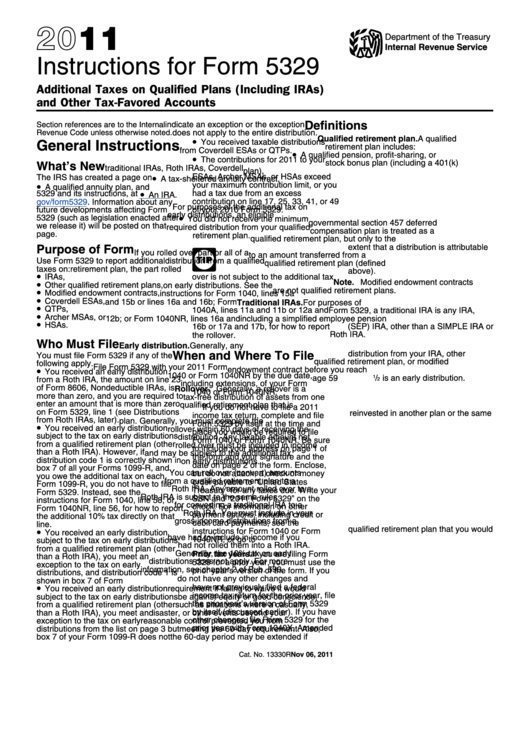

Instructions For Form 5329 Additional Taxes On Qualified Plans

Your life or life expectancy the joint lives or joint life expectancies of you and your designated beneficiary Made to a beneficiary or estate on account of the ira owner's death made because you're totally and permanently disabled Web what is form 5329? The table below explains exceptions to form 5329, additional tax on early distributions, to assist you with.

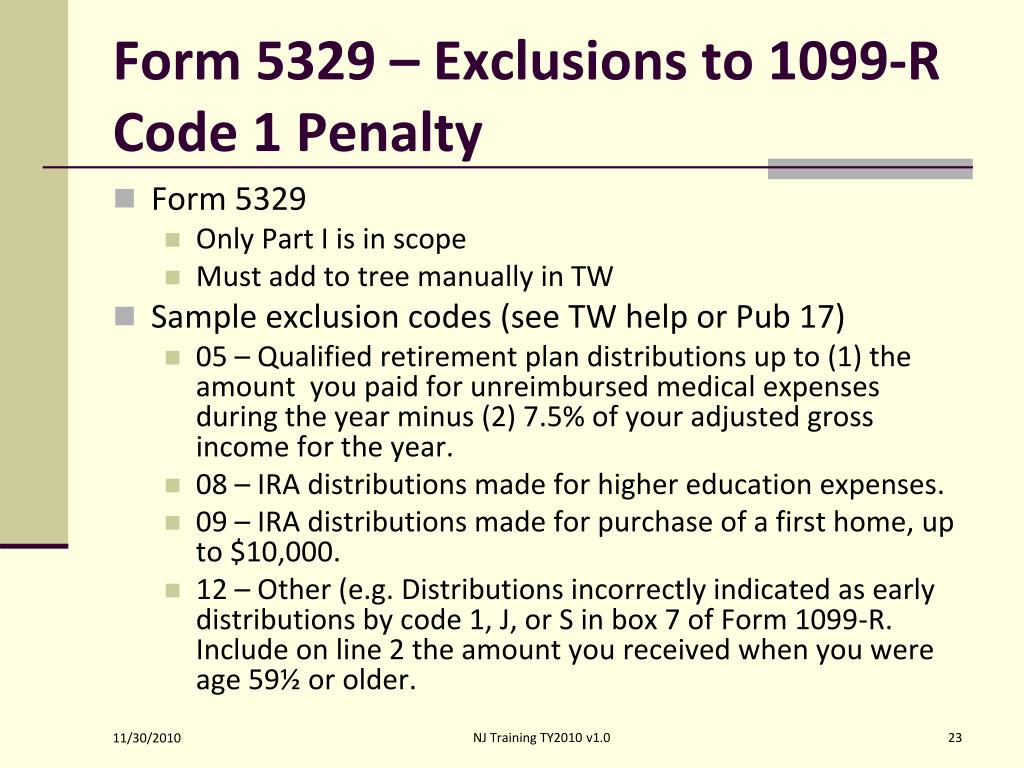

PPT Retirement PowerPoint Presentation, free download ID6769565

There are some exceptions to early withdrawal penalty codes on form 5329. The table below explains exceptions to form 5329, additional tax on early distributions, to assist you with entering this information in proseries. You may need this form in three situations: Web you may also have to complete this part to indicate that you qualify for an exception to.

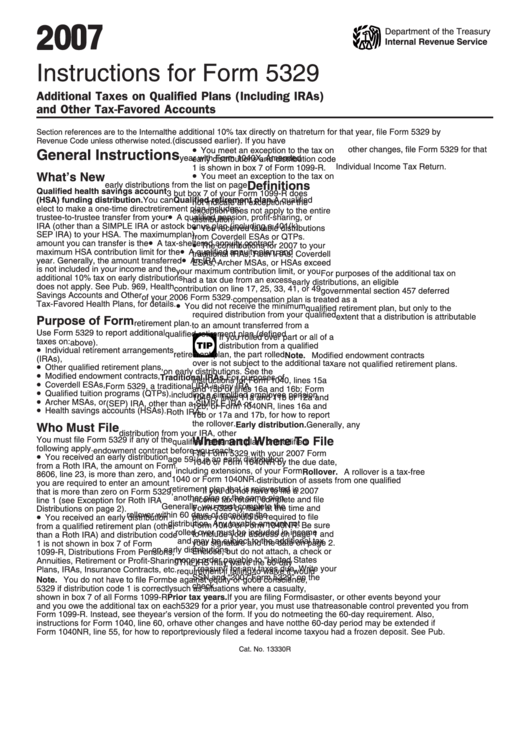

Instructions For Form 5329 Additional Taxes On Qualified Plans And

Web solved•by intuit17•updated december 21, 2022. Distributions made as part of a series of substantially equal periodic payments (made at. Qualified retirement plan distributions (doesn’t apply to iras) you receive. Web you may also have to complete this part to indicate that you qualify for an exception to the additional tax on early distributions or for certain roth ira distributions..

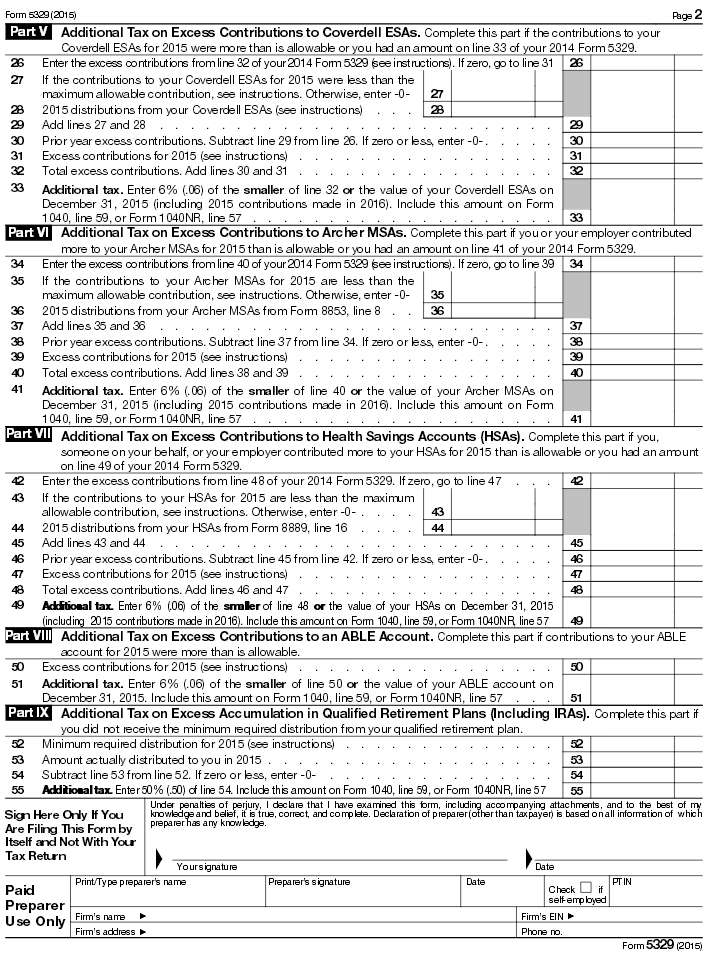

Who must file the 2015 Form 5329?

Refer to the irs instructions for form 5329 for more information. Made to a beneficiary or estate on account of the ira owner's death made because you're totally and permanently disabled Use the corresponding number to indicate which exception you are claiming: Qualified retirement plan distributions (doesn’t apply to iras) you receive. Web solved•by intuit17•updated december 21, 2022.

Form 5329 Edit, Fill, Sign Online Handypdf

Distributions made as part of a series of substantially equal periodic payments (made at. Qualified retirement plan distributions (doesn’t apply to iras) you receive. Separation from service after age 55: Made to a beneficiary or estate on account of the ira owner's death made because you're totally and permanently disabled 1 early distributions includible in income (see instructions).

Instructions For Form 5329 Additional Taxes On Qualified Plans And

For roth ira distributions, see instructions. Qualified retirement plan distributions (doesn’t apply to iras) you receive. Refer to the irs instructions for form 5329 for more information. Web solved•by intuit17•updated december 21, 2022. There are some exceptions to early withdrawal penalty codes on form 5329.

Instructions For Form 5329 Additional Taxes On Qualified Plans

Web you may also have to complete this part to indicate that you qualify for an exception to the additional tax on early distributions or for certain roth ira distributions. You may need this form in three situations: The table below explains exceptions to form 5329, additional tax on early distributions, to assist you with entering this information in proseries..

Form 5329 Instructions & Exception Information for IRS Form 5329

Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. For roth ira distributions, see instructions. Separation from service after age 55: Web you may also have to complete this part to indicate that you qualify for an exception to the additional tax on early distributions.

Download Instructions for IRS Form 5329 Additional Taxes on Qualified

There are some exceptions to early withdrawal penalty codes on form 5329. Your life or life expectancy the joint lives or joint life expectancies of you and your designated beneficiary Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. The table below explains exceptions to.

Instructions For Form 5329 Additional Taxes On Qualified Plans And

Qualified retirement plan distributions (doesn’t apply to iras) you receive. Your life or life expectancy the joint lives or joint life expectancies of you and your designated beneficiary Made to a beneficiary or estate on account of the ira owner's death made because you're totally and permanently disabled Separation from service after age 55: Web exceptions to the 10% additional.

Qualified Retirement Plan Distributions (Doesn’t Apply To Iras) You Receive.

Refer to the irs instructions for form 5329 for more information. 1 early distributions includible in income (see instructions). Distributions made as part of a series of substantially equal periodic payments (made at. Separation from service after age 55:

Web Exceptions To The 10% Additional Tax Apply To An Early Distribution From A Traditional Or Roth Ira That Is:

Made to a beneficiary or estate on account of the ira owner's death made because you're totally and permanently disabled 02 — distributions made as part of a series of substantially equal periodic payments — made at least annually. For roth ira distributions, see instructions. Your life or life expectancy the joint lives or joint life expectancies of you and your designated beneficiary

Web Form 5329 Exceptions And Their Codes For Iras Are:

Web you may also have to complete this part to indicate that you qualify for an exception to the additional tax on early distributions or for certain roth ira distributions. Web solved•by intuit17•updated december 21, 2022. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. These distributions must be for:

Use The Corresponding Number To Indicate Which Exception You Are Claiming:

The table below explains exceptions to form 5329, additional tax on early distributions, to assist you with entering this information in proseries. You may need this form in three situations: There are some exceptions to early withdrawal penalty codes on form 5329. Web what is form 5329?